PayPal (NASDAQ: PYPL) and Block (NYSE: SQ) are two of the preferred fintech shares right this moment. Each have market caps of about $50 billion to $60 billion. Each have sturdy histories of progress. And each have loads of progress potential.

One inventory, nevertheless, is a significantly better purchase right this moment.

PayPal bets $5 billion on itself

PayPal the corporate doesn’t want a lot introduction. Spun off from mum or dad firm eBay in 2015, the corporate has amassed greater than 400 million international customers. From e-commerce transactions to paying again buddies, nearly everybody has both used PayPal personally or is aware of somebody who has.

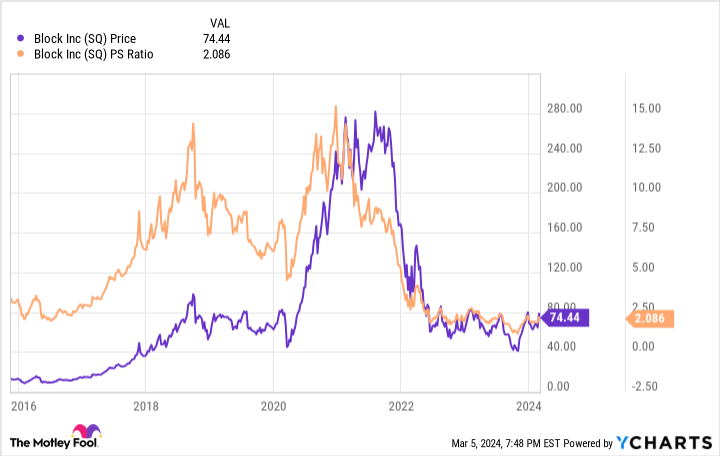

PayPal the inventory has a extra risky historical past.

After its cut up from eBay, PayPal inventory zoomed in worth, from $40 per share to $300 per share in simply three years. Since these all-time highs, nevertheless, the share worth has cratered. PayPal shares now commerce at 2017 costs.

PayPal inventory now trades at simply 2.2 instances gross sales — a preferred valuation metric for progress shares. That is the most affordable shares have ever been.

Administration has observed the decline in valuation, opting to make investments $5 billion in share repurchases. By shopping for again its personal inventory at discounted costs, the corporate hopes to double down on a turnaround.

There’s just one downside: PayPal has been right here earlier than. The corporate has already spent $15 billion in share repurchases since going public in 2015. These buybacks had been executed at costs a lot increased than right this moment, which means they destroyed shareholder worth.

PayPal is not going wherever as an organization, however do not be fooled into considering a budget valuation a number of is a transparent purchase sign. The rationale the shares are low-cost is that the corporate’s greatest days of progress in all probability are behind it. In truth, its person base has been shrinking the previous two years.

The shares may be a worthwhile worth at right this moment’s depressed costs, however there’s a more sensible choice for progress traders — a inventory with a turnaround story already in motion.

That is the fintech inventory price betting on

Block has confronted its personal struggles. The corporate — historically a fee processor, however extra lately an investor in different areas just like the peer-to-peer fee service Money App, music platform Tidal, and a bunch of blockchain-related ventures — has equally seen its inventory worth crater after a slowdown in progress and a drop in profitability.

On a price-to-sales foundation, Block inventory is definitely cheaper than PayPal, buying and selling at 2.1 instances gross sales. However as we’ll see, the underlying enterprise is way stronger.

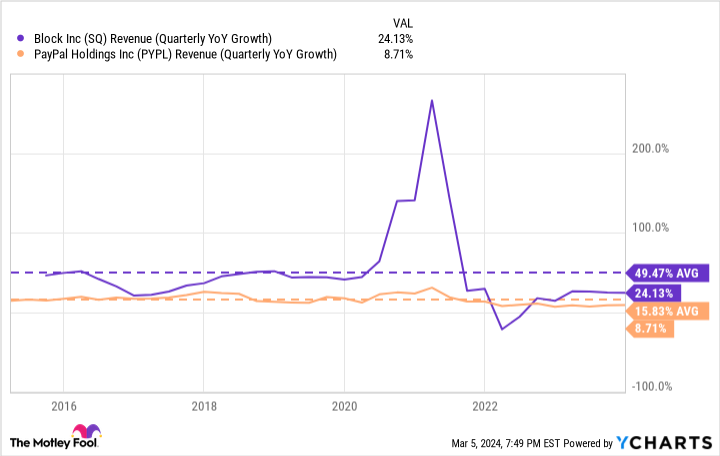

The primary benefit that Block has over PayPal is increased progress charges.

Whereas PayPal’s enterprise is shrinking in accordance with some metrics, most of Block’s segments are experiencing sturdy progress. Block, for instance, has 56 million month-to-month customers on its Money App. Whereas progress has slowed considerably in latest quarters, the corporate continues to extend this person base.

Continued person progress has allowed Block to take care of income positive factors which might be a lot larger than what PayPal has achieved, even throughout its days as a sizzling inventory after changing into an unbiased firm.

Block can also be higher positioned for future progress.

As the corporate’s title suggests, Block has made massive bets on rising blockchain applied sciences like Bitcoin. Customers of its Money App can already purchase, promote, and transact in Bitcoin. Its Sq. fee processing platform, in the meantime, is poised to deliver cryptocurrency transactions to the lots. Whereas PayPal is defending a plateauing enterprise mannequin, Block is positioned to capitalize on progress tendencies just like the adoption of cryptocurrencies.

Why then is Block inventory cheaper than PayPal?

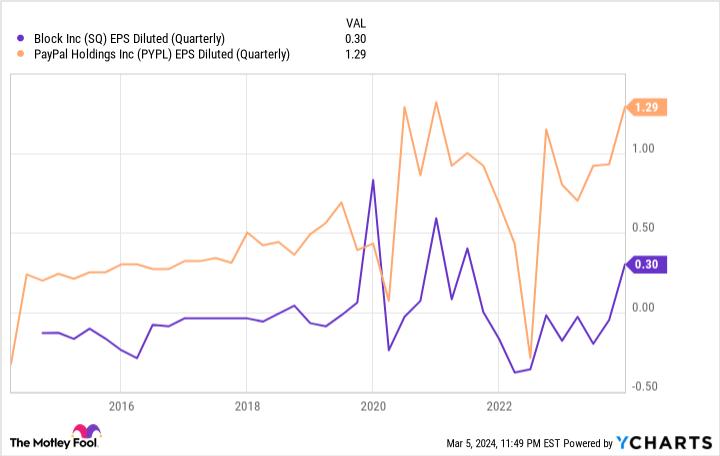

For many of PayPal’s public historical past, the corporate has been worthwhile, racking up billions in free money move — the explanation it has been capable of fund its historic share buyback applications.

Block, in the meantime, has been unprofitable lately. When the shares spiked in 2020, nevertheless, the corporate had posted a number of quarters of profitability. That is what the market got here to count on, till a string of quarterly losses despatched the inventory worth tumbling.

As an entire, Block is much less worthwhile than PayPal, however that is palatable so long as progress charges stay excessive. The market, in spite of everything, is keen to fund a quickly rising firm. When progress charges gradual, nevertheless, the market all of the sudden turns into much less keen to cowl losses.

Final September, Block co-founder Jack Dorsey rejoined Block because the chief govt officer with one mission: return the corporate to profitability. It did not take lengthy for this imaginative and prescient to be realized. In February, the corporate posted its first web revenue in two years, albeit a small one.

With a return to profitability, count on Block’s valuation multiples to select up, particularly if this feat is repeated in subsequent quarters. A high-growth inventory that is worthwhile, irrespective of how small, deserves a better a number of than 2.1 instances gross sales on this market.

Between PayPal and Block, Block inventory is the clear winner for traders proper now.

Must you make investments $1,000 in Block proper now?

Before you purchase inventory in Block, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Block wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of March 8, 2024

Ryan Vanzo has positions in Bitcoin. The Motley Idiot has positions in and recommends Bitcoin, Block, and PayPal. The Motley Idiot recommends eBay and recommends the next choices: brief April 2024 $45 calls on eBay and brief March 2024 $67.50 calls on PayPal. The Motley Idiot has a disclosure coverage.

1 Fintech Inventory to Purchase Hand Over Fist and 1 to Keep away from was initially printed by The Motley Idiot