Since 1957, there have been 14 occasions when it took the S&P 500 index greater than a 12 months to return to a brand new all-time excessive. This stat is fascinating as a result of the index continued increased on 13 of these events over the next 12 months.

With this in thoughts — and with the S&P 500 setting new highs as we moved from 2023 to 2024 — it appears like the proper time so as to add to some latest winners. One such inventory shifting increased these days is specialty grocer Sprouts Farmers Market (NASDAQ: SFM), which has risen over 280% since 2020.

Regardless of this unbelievable run, there are a number of causes to imagine the very best is but to come back for the lifestyle-friendly grocery chain. Here is what units the corporate aside, making it an ideal dollar-cost-averaging candidate right this moment for a $100 funding.

Rethinking conventional grocery shops

Dwelling to 407 better-for-you grocery shops, Sprouts Farmers Market brings specialty meals merchandise to the lots. No matter what grocery “attribute” a client wants, Sprouts probably has it, sourcing a lot of its gadgets from over 250 native farmers. That includes natural, keto, plant-based, gluten-free, vegan, and dairy-free choices (amongst others), the corporate’s health-conscious area of interest is extremely differentiated from conventional grocers.

Sustaining this big range of groceries, Sprouts holds a Web Promoter Rating (NPS) of +57 amongst its clients, which is phenomenal. Rated on a scale of unfavourable 100 to 100, NPS measures how possible a buyer is to suggest an organization’s merchandise to a pal, with a rating of +57 exhibiting the overwhelming majority of consumers would.

Between this excessive buyer satisfaction and a singular number of gadgets, Sprouts drives constant repeat visits from consumers who cannot discover related merchandise elsewhere — at the very least in a single cease.

Development choices abound

Whereas the corporate has a rapidly rising base of loyal clients, 76% of its shops reside in 5 states: California, Arizona, Colorado, Texas, and Florida. Moreover, the corporate solely operates in 23 U.S. states, leaving loads of enlargement alternatives. With administration concentrating on a ten% retailer rely progress charge over the long term, listed below are 4 particular areas that ought to assist gas Sprouts’ progress:

1. Saturating current markets

At the moment constructing a brand new distribution middle in Pennsylvania, the corporate plans so as to add to its 12 shops within the area. With the brand new facility anticipated to assist shops inside a 250-mile radius, Sprouts intends so as to add shops in Pennsylvania, Virginia, New Jersey, Delaware, and Maryland. Between these new areas and continued progress throughout the firm’s core markets of California, Texas, and Florida, administration believes it could add over 300 shops in these eight states alone.

2. Increasing into new states

With three shops in Washington and Missouri every, all indicators level to Sprouts shifting north in due time — however which may be additional down the highway because of its present ambitions within the Northeast.

3. Rising personal label gross sales

Sprouts model personal label gross sales have risen from 14% of income in 2018 to twenty% in 2023. This private-label model is significant to the corporate because it generates increased margins, leaving Sprouts much less dependent upon suppliers.

4. Beginning a loyalty program

Sprouts plans to check a loyalty program in choose markets in 2024. If profitable, the corporate might glean beneficial data from its members, probably discovering new personal label alternatives and boosting shopper engagement.

Buoyed by these progress drivers, Sprouts ought to nonetheless be within the early chapters of its progress story.

Distinctive profitability

Finest but for buyers, the corporate’s excessive and rising return on invested capital (ROIC) makes these enlargement plans much more promising.

ROIC measures an organization’s capability to generate web revenue from its debt and fairness. Sprouts’ spectacular mark of 20% signifies that administration has executed an distinctive job making capital expenditures because it grew. Due to this outsize profitability, the corporate is armed with ample funds it could use to reward shareholders.

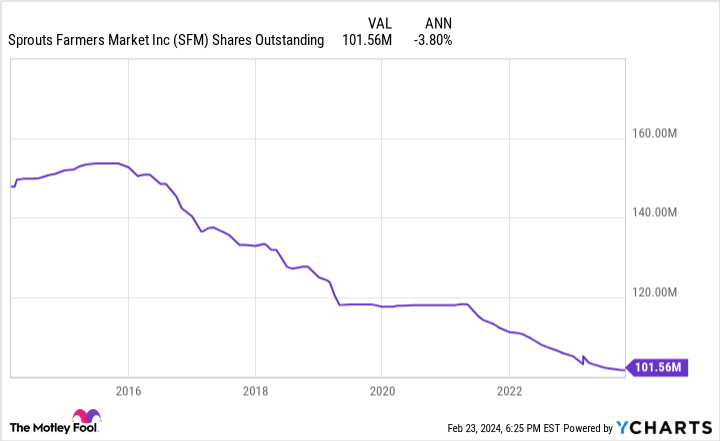

Shopping for again 4% of its shares yearly during the last decade, the corporate juices its earnings per share (EPS) figures by decreasing its complete shares excellent. Thanks to those buybacks, Sprouts’ EPS has spiked 414% since 2014, surpassing its web revenue progress of 279%.

Why dollar-cost averaging is the way in which to go

As promising as Sprouts’ operations are with its loyal clients, along with its immense progress potential and strong profitability, its price-to-earnings (P/E) ratio has tripled from 8 in 2021 to 24 right this moment. Rising gross sales and EPS by 8% and 17% within the fourth quarter of 2023, the corporate watched its share value rocket to new all-time highs final week.

Nonetheless, regardless of rising 24% in 2024, Sprouts’ P/E ratio of 24 could be very close to the S&P 500’s common of 23. Due to this distinction between Sprouts’ booming share value and fairly honest valuation, the corporate appears excellent for dollar-cost-averaging buys.

By constructing a place in small parts of $100 or much less at numerous value factors, you’ll be able to take away a number of the volatility surrounding the corporate’s skyrocketing share value whereas nonetheless getting some pores and skin within the sport.

Finally, Sprouts Farmers Market’s future appears brighter than ever, making it a successful funding that I’m more than pleased to maintain including to — even at right this moment’s barely dearer valuation.

Must you make investments $1,000 in Sprouts Farmers Market proper now?

Before you purchase inventory in Sprouts Farmers Market, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Sprouts Farmers Market wasn’t one in all them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 26, 2024

Josh Kohn-Lindquist has positions in Sprouts Farmers Market. The Motley Idiot recommends Sprouts Farmers Market. The Motley Idiot has a disclosure coverage.

The Bull Market Is Formally Right here: 1 No-Brainer Inventory Up 280% Since 2020 to Purchase With $100 Proper Now was initially revealed by The Motley Idiot