Synthetic intelligence (AI) is fascinating the funding neighborhood proper now. Other than the “Magnificent Seven” shares, buyers are in search of different alternatives that will present equally profitable returns. Nevertheless, with so many tech sector executives touting the time period “AI” on their earnings calls or throughout media interviews, it may be difficult to discern which firms may very well be rising as leaders within the house.

ServiceNow (NYSE: NOW) is a lesser-known identify amongst AI companies. The corporate makes a speciality of automation options for info expertise (IT) companies and is quietly constructing a number one AI infrastructure. An evaluation of the inventory relative to its friends means that now can be a terrific time to scoop up shares.

Main the digital transformation revolution

ServiceNow is led by Invoice McDermott, who was previously the CEO of enterprise software program supplier SAP. Since taking the reins at ServiceNow in 2019, McDermott has persistently used a particular phrase to explain the corporate’s disruptive agenda: digital transformation. However what precisely does that imply?

Companies are relying greater than ever on information — tons and plenty of information — to make knowledgeable, environment friendly choices. Moreover, bigger enterprises have a tendency to make use of combos of various software program instruments and platforms to accommodate their information. Usually, these programs don’t simply talk with each other — leaving decision-makers in a troublesome spot.

ServiceNow helps companies digitize operations and join their information.

ServiceNow is placing on a grasp class in gross sales

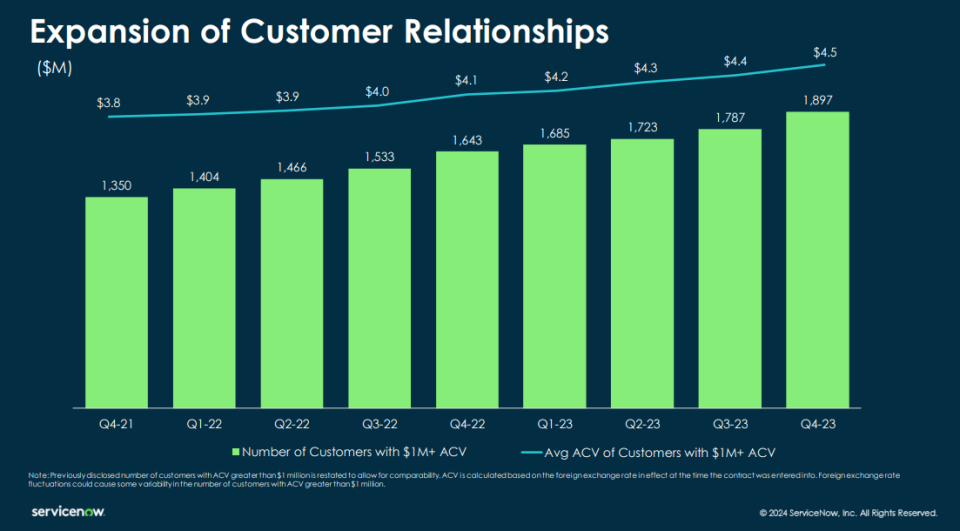

The chart beneath illustrates how ServiceNow has persistently grown the variety of prospects paying a minimum of $1 million in annual contract worth. These identical prospects are additionally spending extra with ServiceNow annually, indicating prospects like its suite of merchandise.

One of many ways in which ServiceNow has been in a position to generate this progress is thru newly developed AI-powered options. For instance, throughout the fourth quarter, ServiceNow’s generative AI merchandise drove the most important web new annual contract worth contribution of any new product. The corporate boasts world accounting agency EY and funds chief Visa as notable prospects of its AI instruments.

Is ServiceNow inventory a purchase now?

AI has many alternative purposes. Because it pertains to ServiceNow, traits in IT spending are vital to investigate. On the corporate’s fourth-quarter earnings name in late January, McDermott mentioned:

Gartner estimates $5 trillion in tech spending in 2024, rising to $6.5 trillion by 2027. That implies that spending will develop one other $1 trillion in solely two years, accelerating from the decade-plus it took for us to get to $5 trillion. For the primary time in a decade, IT companies will turn out to be larger than communication companies in 2024. Gartner estimates that by 2027, almost all the progress in worldwide IT spending will come from software program and IT companies.

What McDermott is emphasizing is that whereas tech spending at giant is anticipated to develop, software program and IT companies particularly are forecast to be main beneficiaries sooner slightly than later. Checked out a unique approach, whereas ServiceNow is rising its enterprise prospects at a wholesome clip, its finest days could also be forward.

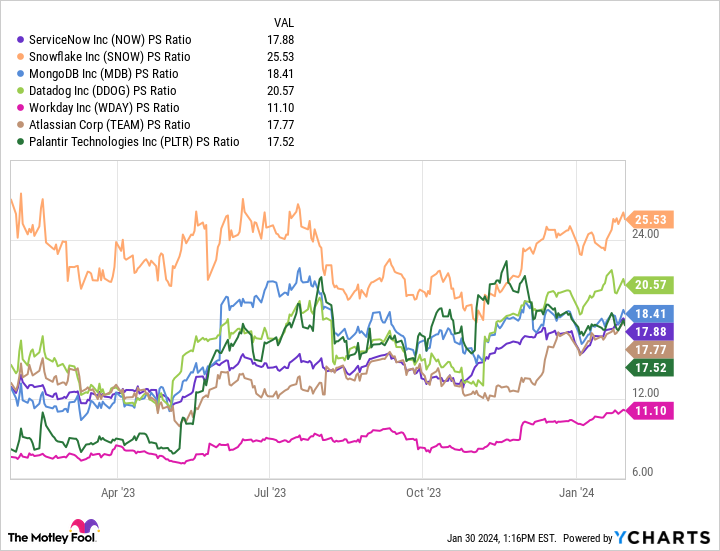

With a price-to-sales ratio of 18, ServiceNow inventory trades in the course of the pack amongst main enterprise software program builders specializing in office automation companies.

ServiceNow might very properly be an undervalued progress inventory, overshadowed by its bigger rivals. Make no mistake, McDermott and his workforce are laying the foundations on the intersection of generative AI and IT software program as we speak in order that ServiceNow can benefit from the tailwinds of elevated IT spending over the following a number of years.

To me, ServiceNow represents a singular alternative within the AI panorama. Whereas the corporate might not entice the identical quantity of consideration as different main software program suppliers, the traits in its buyer base mixed with the general evolution of its complete addressable market create a compelling funding alternative.

The place to take a position $1,000 proper now

When our analyst workforce has a inventory tip, it will possibly pay to hear. In spite of everything, the e-newsletter they’ve run for 20 years, Motley Idiot Inventory Advisor, has greater than tripled the market.*

They only revealed what they imagine are the ten finest shares for buyers to purchase proper now… and ServiceNow made the listing — however there are 9 different shares chances are you’ll be overlooking.

*Inventory Advisor returns as of January 29, 2024

Adam Spatacco has positions in Palantir Applied sciences. The Motley Idiot has positions in and recommends Atlassian, Datadog, MongoDB, Palantir Applied sciences, ServiceNow, Snowflake, Visa, and Workday. The Motley Idiot recommends Gartner. The Motley Idiot has a disclosure coverage.

1 Unstoppable Synthetic Intelligence (AI) Inventory to Purchase Hand Over Fist in 2024 was initially revealed by The Motley Idiot