Nvidia (NASDAQ: NVDA) has been something however an under-the-radar inventory over the past yr. After blowing out gross sales estimates for 3 straight quarters, shares of the expertise firm have soared 265% over the past 12 months.

Nvidia is at present the clear chief within the race for synthetic intelligence (AI) computing options; saying its highly effective semiconductors are in excessive demand is an understatement. And even after the surge within the inventory, there are nonetheless two good causes to purchase it now.

1. The period of generative AI

Nvidia affords a diversified portfolio of merchandise. It makes chips for gaming and affords a cloud-based gaming service. Its omniverse platform helps companies design and function manufacturing processes, and the corporate additionally provides the burgeoning autonomous driving business. However the information heart section is what has traders most excited.

Income from that section grew 409% yr over yr within the firm’s fiscal 2024 fourth quarter (ended Jan. 28). In that quarterly report, CEO Jensen Huang stated: “Accelerated computing and generative AI have hit the tipping level. Demand is surging worldwide throughout corporations, industries, and nations.” As Huang has beforehand famous, the period of generative AI is clearly taking off.

However there seems to be lots extra progress to come back. The market dimension for generative AI is projected to greater than quadruple from the 2023 degree by the tip of this decade. Nvidia will likely be a giant beneficiary of that progress.

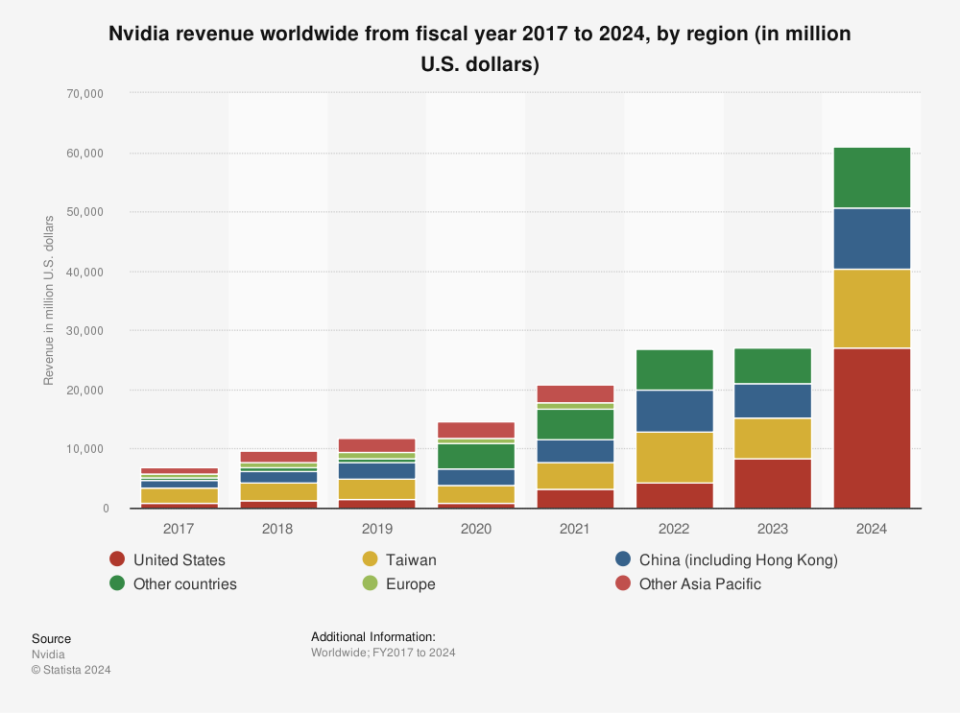

2. The geographical variety of its enterprise

Nvidia is not simply diversified with its services and products, it is also diversified geographically. Because the graph beneath exhibits, continued gross sales progress would not simply depend on the economic system of any single nation or area.

Regardless that a world recession (or a decline in simply considered one of its main markets) will have an effect on Nvidia’s efficiency, there may be much less danger for traders when gross sales are unfold out geographically.

That helps stem some danger, and there are many catalysts for extra progress, too. Machine studying has been the key focus of AI improvement. That’s more likely to proceed for at the least a number of extra years, however an growing variety of companies in a number of sectors are additionally utilizing AI expertise.

Nvidia’s automotive section might additionally develop shortly if self-driving automobiles turn out to be extra mainstream. Autonomous and sensor expertise is only one extra space past machine studying the place its gross sales might soar sooner or later. That potential is but one more reason to personal the inventory.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 finest shares for traders to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of March 18, 2024

Howard Smith has positions in Nvidia. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.

2 Causes to Purchase Nvidia Inventory Like There’s No Tomorrow was initially printed by The Motley Idiot