Buyers usually look to metrics like P/E to evaluate valuation, which is completely nice. However dividend yield can be used on this approach. In truth, given the variability of earnings and the relative consistency of dividend funds, you might argue that yield is a greater measure of investor sentiment. That is why high-yield Enterprise Merchandise Companions (NYSE: EPD) and TotalEnergies (NYSE: TTE) appear to be low-cost vitality shares you may wish to purchase at the moment.

Enterprise’s yield is traditionally excessive

Enterprise’s 7.6% distribution yield is on the excessive finish of its historic yield vary. That implies the grasp restricted partnership (MLP) is comparatively low-cost at the moment. After all this alone would not make it value shopping for.

The excellent news is that backing the excessive yield is a distribution that has been elevated for 25 consecutive years. The MLP’s steadiness sheet can also be funding grade-rated. And distributable money stream lined the distribution 1.7 instances over in 2023. In different phrases, the excessive yield seems properly supported.

Enterprise’s enterprise, in the meantime, is constructed for consistency. It owns the vitality infrastructure that is used to move oil, pure fuel, and the merchandise into which they get turned all over the world. Clients pay charges for using the property, so risky commodity costs aren’t almost as necessary as demand for vitality. Vitality demand tends to be resilient even when oil costs are low. The adverse right here is that the yield will in all probability make up the lion’s share of the return traders see as a result of enterprise progress is more likely to be modest. Nevertheless, if you happen to’re trying to maximize the earnings your portfolio generates, Enterprise ought to undoubtedly be in your quick checklist proper now.

TotalEnergies’ yield is comparatively excessive

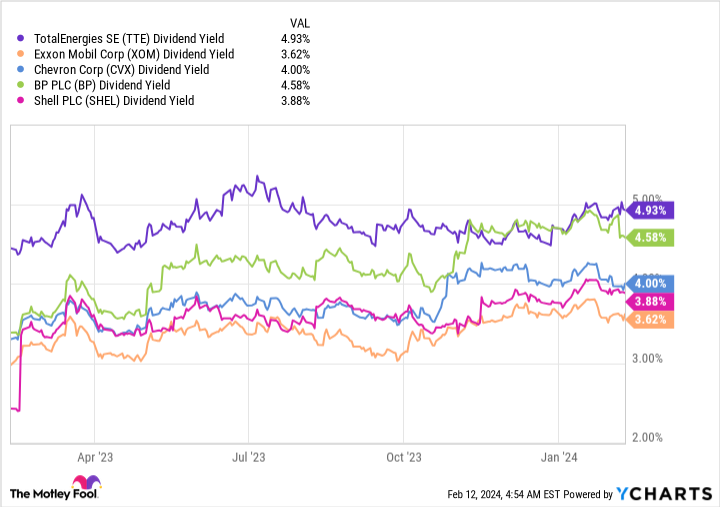

Built-in vitality large TotalEnergies’ closest friends are ExxonMobil (NYSE: XOM), Chevron (NYSE: CVX), BP (NYSE: BP), and Shell (NYSE: SHEL). Of this group, it has the best dividend yield at roughly 5%. That hints that traders are discounting the inventory relative to its friends.

What’s fascinating right here is that TotalEnergies is providing a mixture of issues that none of its friends has. U.S. giants Exxon and Chevron are largely sticking to their oil and pure fuel focus. TotalEnergies is investing in its carbon fuels enterprise, however it’s additionally constructing a clean-energy enterprise. Thus, it’s adjusting with the world round it. Whereas BP and Shell are investing in clear vitality, too, each of those European friends lower their dividends at across the identical time they introduced clean-energy shifts. TotalEnergies hasn’t wanted to chop its dividend and, in truth, has continued to extend it.

In all, if you happen to’re searching for a diversified, high-yield vitality inventory, TotalEnergies may very well be simply what you want. That mentioned, U.S. traders should pay overseas taxes on TotalEnergies’ dividend. However these taxes will be claimed again when submitting U.S. taxes. That is further work, however it may very well be properly well worth the effort for traders attracted by TotalEnergies’ extra measured method to the vitality sector.

Two excessive yields value a deep dive

Neither Enterprise nor TotalEnergies is ideal, however then no inventory is. In the event you’re trying to maximize the earnings your portfolio generates, then ultra-high-yield Enterprise is value a deep dive. In the event you’re merely wanting so as to add some diversified vitality publicity to your portfolio with an built-in vitality firm, then the comparatively excessive yield TotalEnergies gives over its friends needs to be enticing to you.

Must you make investments $1,000 in Enterprise Merchandise Companions proper now?

Before you purchase inventory in Enterprise Merchandise Companions, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Enterprise Merchandise Companions wasn’t one in every of them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 12, 2024

Reuben Gregg Brewer has positions in TotalEnergies. The Motley Idiot has positions in and recommends BP and Chevron. The Motley Idiot recommends Enterprise Merchandise Companions. The Motley Idiot has a disclosure coverage.

2 Extremely Low cost Vitality Shares to Purchase Now was initially revealed by The Motley Idiot