After the S&P 500 (SNPINDEX: ^GSPC) fell by over 19% in 2022, the inventory market’s hottest index has been on a powerful run for the reason that starting of 2023. It completed 2023 up by over 24%, and the momentum in 2024 has it at an all-time excessive.

The S&P 500’s efficiency has been nice information, however it might additionally trigger some buyers to query if now’s the proper time to enter the market or add to their holdings. Regardless of the index being at an all-time excessive, listed below are two shares I will be including to my retirement account regardless. Every firm has long-term progress potential and stability that I haven’t got to second-guess.

1. Microsoft

Microsoft (NASDAQ: MSFT) is now the one firm within the coveted $3 trillion market cap membership, after Apple dropped beneath the mark (as of Jan. 29).

Arguably, no different tech firm has accomplished as spectacular a job as Microsoft in the case of constructing a well-diversified ecosystem of services and products. Not like Apple (which depends closely on the iPhone), Alphabet (which depends closely on Google promoting), or Amazon (which depends closely on e-commerce), Microsoft’s companies span a broad vary, with every holding its personal weight.

Microsoft’s diversified enterprise mannequin has labored wonders for its financials. Previously 5 years, its income and internet revenue have jumped, however the tempo at which its internet revenue has grown exhibits the effectivity of its operations.

What I recognize extra than simply the spectacular financials — and why I belief the corporate for the lengthy haul — is the place this cash comes from: different companies. Microsoft has accomplished an amazing job intertwining itself within the world enterprise work, to the purpose the place many companies would not operate as effectively with out Microsoft’s services and products.

Contemplate what number of companies depend on Microsoft Workplace for Excel, Azure for cloud companies, LinkedIn for recruiting, and Home windows for his or her working system. The checklist goes on, and this seemingly will not change anytime quickly. As Microsoft continues to innovate and entice company clients, I belief its place as a key a part of the worldwide enterprise world will stay sturdy.

2. Visa

A significant attribute I need in an organization that I am including to my retirement portfolio is an financial moat. In Visa‘s (NYSE: V) case, its financial moat is its world attain. With over 130 million service provider areas and 4.3 billion playing cards in circulation, Visa is the cost processing {industry} chief — and it isn’t even shut.

Within the cost processing {industry}, Visa’s attain is vital as a result of the community impact permits it to develop organically. When you’re a possible cardholder or service provider, you are extra incentivized to go along with Visa as a result of it is probably the most accepted and used card. This community impact has helped the corporate broaden globally at a powerful tempo. In its 2023 fiscal 12 months (ended Sept. 30), its cross-border quantity grew 20% 12 months over 12 months, and its whole processed transactions grew 10% 12 months over 12 months.

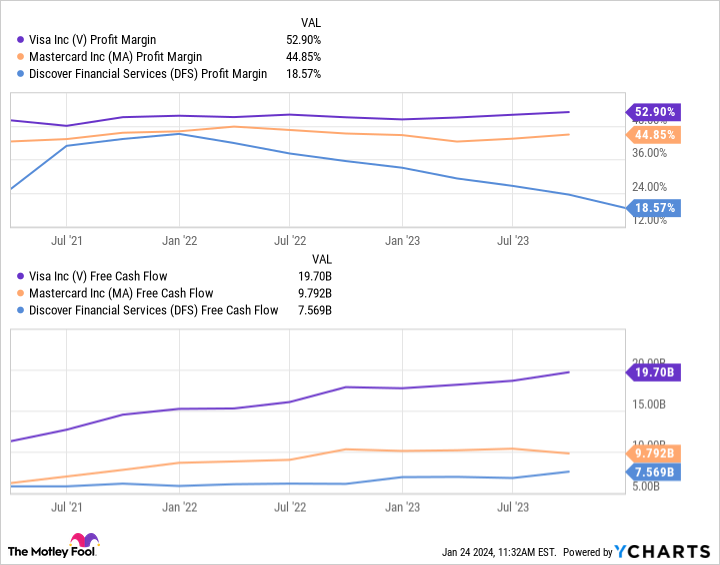

Visa’s market dominance is not going anyplace (if ever), and the emergence of digital funds offers it a lot of progress alternatives going ahead. With industry-leading revenue margins and free money move, Visa has the monetary energy to proceed increasing its world attain and innovating with the cost {industry}.

Each Microsoft and Visa supply one of the best of each worlds

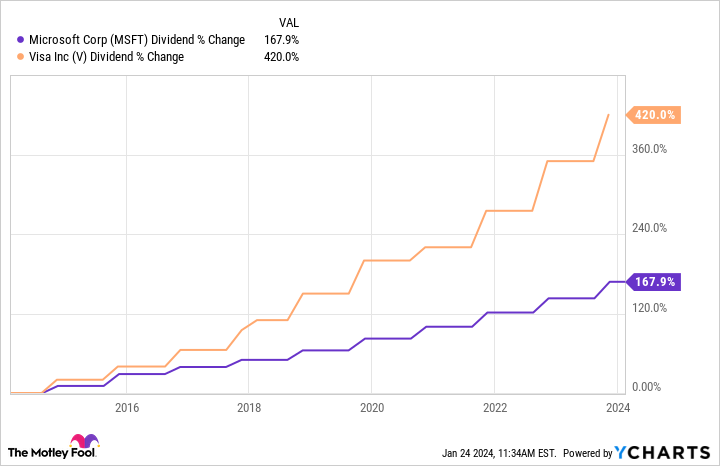

When most individuals consider dividend shares, their minds do not go to Microsoft and Visa. Nonetheless, each firms do, in truth, pay a dividend. Dividends reward buyers for his or her endurance (no matter inventory value actions) in addition to add to their whole returns.

Generally, a dividend is supposed to make up for an absence of inventory value progress. In Microsoft and Visa’s case, the dividend is a two-for-one reward to buyers. Each firms have excessive inventory value progress alternatives, so the dividend is a bonus.

Not at all are their dividend yields eye-popping, however any little bit can add up over time — particularly with the businesses rising the payouts yearly. Microsoft and Visa’s trailing-12-month dividend yields are each solely round 0.70%, however they’ve each elevated properly over the previous decade.

Whenever you’re investing for retirement, shares that pay dividends are nice, however shares that improve their dividends yearly are higher. The compounding impact can actually repay over time. Purchase Microsoft and Visa inventory, and let time work its magic.

The place to take a position $1,000 proper now

When our analyst workforce has a inventory tip, it might pay to hear. In any case, the publication they’ve run for 20 years, Motley Idiot Inventory Advisor, has greater than tripled the market.*

They simply revealed what they consider are the ten finest shares for buyers to purchase proper now… and Microsoft made the checklist — however there are 9 different shares chances are you’ll be overlooking.

*Inventory Advisor returns as of January 29, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Uncover Monetary Providers is an promoting associate of The Ascent, a Motley Idiot firm. Stefon Walters has positions in Apple and Microsoft. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Mastercard, Microsoft, and Visa. The Motley Idiot recommends Uncover Monetary Providers and recommends the next choices: lengthy January 2025 $370 calls on Mastercard and quick January 2025 $380 calls on Mastercard. The Motley Idiot has a disclosure coverage.

2 Shares I will Be Including to My Retirement Account — Even With the S&P 500 at an All-Time Excessive was initially revealed by The Motley Idiot