The power sector is coming off a extra turbulent 12 months. Oil and fuel costs had been down whereas rates of interest rose. In consequence, most power shares slumped in 2023.

Final 12 months’s challenges have many power shares buying and selling at compelling ranges. Chevron (NYSE: CVX), Vitality Switch (NYSE: ET), and NextEra Vitality (NYSE: NEE) stand out from the pack as nice buys this February. This is why they may energize your portfolio in 2024 and past.

This top-notch oil inventory is on sale

Shares of Chevron have slumped about 15% over the previous 12 months. Whereas decrease oil costs have weighed on the oil big’s inventory value, it has additionally been underneath stress resulting from its daring deal to purchase rival Hess. Chevron is paying about $60 billion to accumulate Hess, which is able to improve its progress whereas including some dangers.

Hess will add two new areas to Chevron’s portfolio (Bakken and offshore Guyana). The Bakken will present it with one other money circulation engine, whereas Guyana ought to be a serious progress driver. Nonetheless, there are integration dangers with each areas. On prime of that, Guyana is in a border dispute with neighboring Venezuela over its profitable off shore oilfields.

Chevron is not any stranger to working in areas with geopolitical threat. It additionally has a protracted observe report of integrating acquisitions. In consequence, the Hess deal seems like an awesome transfer by the oil big. It might assist the corporate greater than double its free money circulation by 2027, assuming oil costs stay within the $70s whereas extending its manufacturing progress outlook into the 2030s. That will give Chevron more money to extend its already enticing dividend (presently yielding 4.1%) and repurchase its beaten-down shares.

A dust low cost, high-yielding midstream big

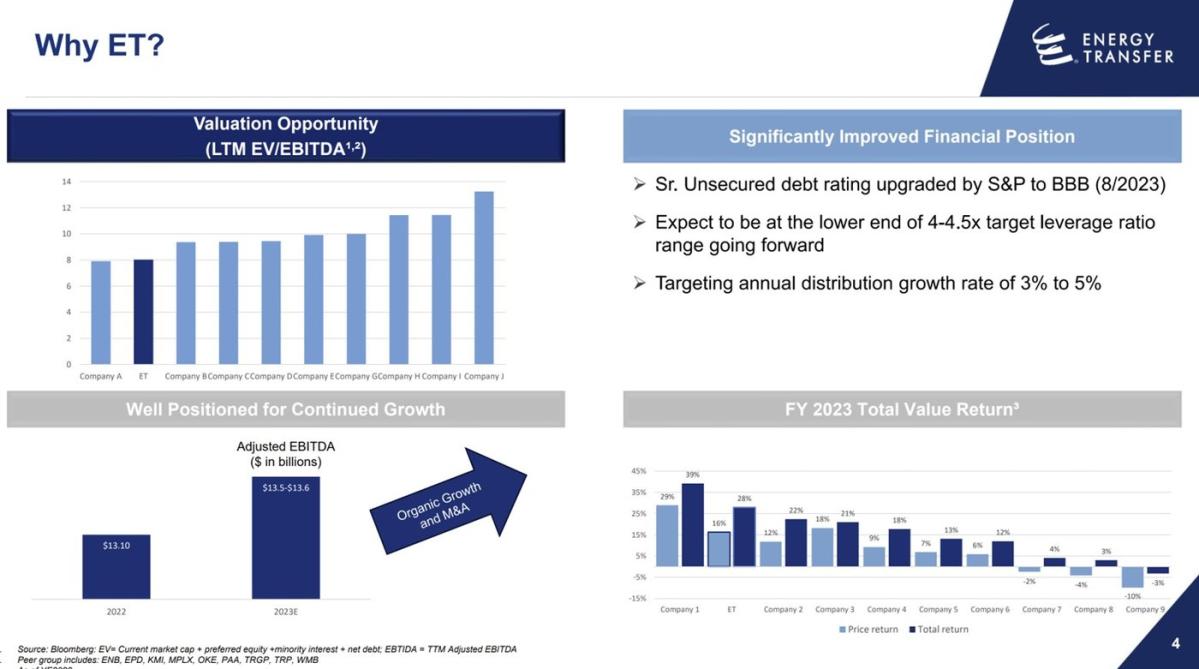

Items of Vitality Switch have truly rallied about 10% over the previous 12 months. Nonetheless, the grasp restricted partnership (MLP) nonetheless has plenty of room to run. One issue driving that view is its bottom-of-the-barrel valuation:

As that slide exhibits, Vitality Switch has the second-lowest valuation in its peer group. That is an enormous purpose why it has such a excessive distribution yield (presently 8.7%).

The MLP trades as if it is not rising, which is not the case. As that slide additionally signifies, its earnings are rising, which is giving it the gas to proceed boosting its big-time distribution. The corporate lately gave buyers one other increase and has bumped up its payout by 3.3% over the previous 12 months.

Vitality Switch generates ample extra money after overlaying that payout. That provides it the funds to spend money on growth initiatives whereas sustaining a robust stability sheet. The corporate’s monetary energy has enabled it to be a consolidator within the midstream sector (it made two offers final 12 months). Acquisitions and natural growth ought to proceed rising the MLP’s earnings and money circulation, giving it the gas to steadily enhance its high-yielding distribution.

A supercharged utility inventory

NextEra Vitality inventory has misplaced about 20% of its worth over the previous 12 months. That was largely resulting from points at its affiliate, NextEra Vitality Companions. NextEra Vitality had one other robust 12 months in 2023, rising its adjusted earnings by greater than 9%, which exceeded the excessive finish of its steerage vary. With its earnings rising whereas its inventory slumped, the utility now trades at a way more enticing valuation. It additionally affords a better dividend yield (3.2%).

NextEra Vitality continues to run circles round its friends within the utility sector. It expects to extend its earnings at or above the excessive finish of its 6% to eight% annual goal vary via 2026. That is a lot sooner than the roughly 5% to 7% annual progress price a lot of its friends hope to realize.

Two notable catalysts are powering NextEra Vitality’s sooner progress: geography and renewable power. The corporate’s Florida-based electrical utility advantages from the state’s above-average inhabitants progress and ample sunshine. In the meantime, NextEra’s power sources section is capitalizing on accelerating demand for renewable power. These elements ought to allow the utility to proceed increasing briskly within the coming years.

Prime-notch power shares

Chevron, Vitality Switch, and NextEra Vitality are compelling funding alternatives this February. The trio trades at decrease valuations, giving them enticing dividend yields. In the meantime, they’ve plenty of gas to proceed rising their earnings and higher-yielding payouts sooner or later. That makes them stand out as prime power shares to purchase this month.

Do you have to make investments $1,000 in Chevron proper now?

Before you purchase inventory in Chevron, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Chevron wasn’t one among them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of January 29, 2024

Matthew DiLallo has positions in Chevron, Vitality Switch, NextEra Vitality, and NextEra Vitality Companions. The Motley Idiot has positions in and recommends Chevron and NextEra Vitality. The Motley Idiot has a disclosure coverage.

3 Prime Vitality Shares to Purchase in February was initially revealed by The Motley Idiot