Based on Grand View Analysis, international cryptocurrency income hit $5 billion in 2022 and is projected to broaden at a compound annual development price (CAGR) of 12% via 2030. Whereas that development is important, it pales compared to the factitious intelligence (AI) market’s CAGR of 37% for the remainder of the last decade and its worth of $137 billion.

Pleasure over cryptocurrency faltered in recent times as volatility has brought about pullback from buyers. The chart above compares the three-year development between probably the most outstanding cryptocurrency and three firms energetic in AI. Every tech firm has carried out considerably higher than Bitcoin and probably has extra room to run within the coming years, due to AI.

Cryptocurrencies developed a repute for inconsistency. Nonetheless, it is simply the alternative with tech shares. The tech market is thought for rewarding modern firms with constant beneficial properties over the long run, with that unlikely to vary alongside a current growth in AI.

So, listed below are three AI shares with extra potential than any cryptocurrency.

1. Nvidia

All eyes have been on Nvidia (NASDAQ: NVDA) this yr as a result of its chips have change into the go-to for builders throughout the AI market. The corporate’s dominance in graphics processing items (GPUs) gave it a leg up on its opponents, permitting it to safe an estimated 80% to 95% market share in AI chips.

Hovering demand for AI GPUs brought about Nvidia’s income to skyrocket. Within the fourth quarter of 2024 (led to January), the corporate’s income elevated by 265% yr over yr to $22 billion. In the meantime, working revenue jumped 983% to almost $14 billion. The monster development was primarily owed to a 409% improve in information heart income, reflecting elevated chip gross sales.

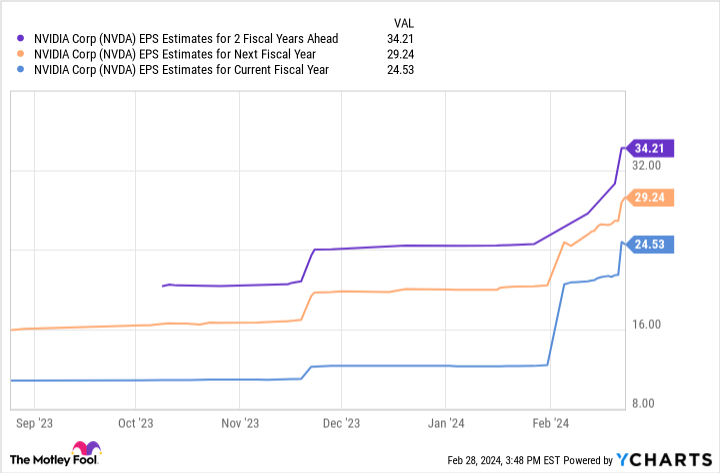

Nvidia’s earnings might hit $34 per share over the subsequent two fiscal years. Multiplying that determine by the corporate’s ahead price-to-earnings ratio (P/E) of 32 initiatives a inventory worth of $1,094.

Contemplating its present place, these projections would imply Nvidia’s inventory rising 39% by fiscal 2027. Along with a dominating place in a high-growth market like AI, Nvidia is a screaming purchase this month with extra potential than any cryptocurrency.

2. Microsoft

As the house of potent manufacturers like Home windows, Workplace, Xbox, and LinkedIn, Microsoft (NASDAQ: MSFT) is a tech behemoth and one of many greatest threats within the business. The corporate’s shares are up 65% within the final 12 months, and it lately surpassed Apple because the world’s Most worthy firm, with its market cap at present at simply over $3 trillion.

Moreover, Microsoft gained over buyers with an increasing position in AI. Heavy funding in ChatGPT developer OpenAI has led to a profitable partnership and entry to a few of the most superior AI fashions within the business.

The Home windows firm used OpenAI’s expertise to introduce AI options throughout its product lineup. In 2023, Microsoft added new AI instruments to its Azure cloud platform, built-in features of ChatGPT into its Bing search engine, and boosted productiveness in its Workplace software program suite by including AI options.

Microsoft achieved greater than $67 billion in free money circulation final yr, highlighting the enterprise’s reliability and worth as a long-term funding.

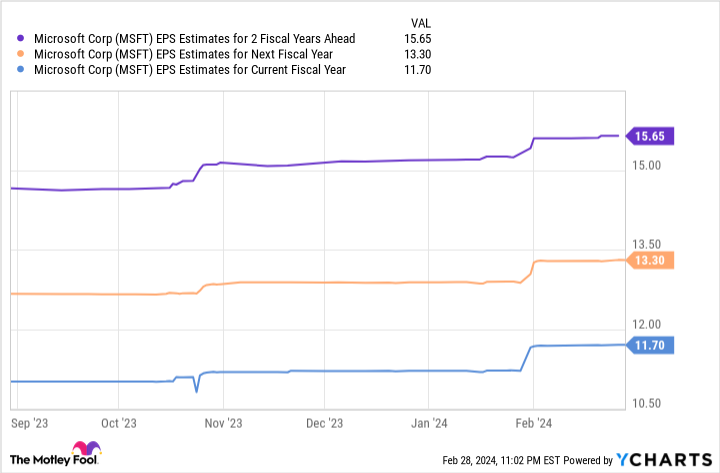

Microsoft’s earnings might attain almost $16 per share over the subsequent two fiscal years. In an analogous calculation to Nvidia, multiplying that determine by Microsoft’s ahead P/E of 35 yields a inventory worth of $550, projecting inventory development of 35% by fiscal 2026.

With its profitable OpenAI partnership, Microsoft is a much better funding than any cryptocurrency.

3. Superior Micro Units

Like Nvidia, Superior Micro Units (NASDAQ: AMD) has huge potential within the {hardware} aspect of AI. The corporate received a late begin within the business, outrun by Nvidia final yr. Nonetheless, AMD is transferring to problem Nvidia’s dominance quickly and take its slice of the profitable sector.

Final December, the tech large unveiled its MI300X AI GPU, designed to offer a substitute for Nvidia’s merchandise. The brand new chip already caught the eye of a few of tech’s most outstanding gamers, signing on Microsoft and Meta Platforms as purchasers.

Furthermore, AMD is not banking solely on stealing market share from Nvidia in GPUs. AMD seeks to steer its personal house inside AI by doubling down on AI-powered PCs. Based on analysis agency IDC, PC shipments are projected to obtain a serious increase this yr, with AI integration serving as a key catalyst. And a Canalys report predicts that 60% of all PCs shipped in 2027 shall be AI-enabled.

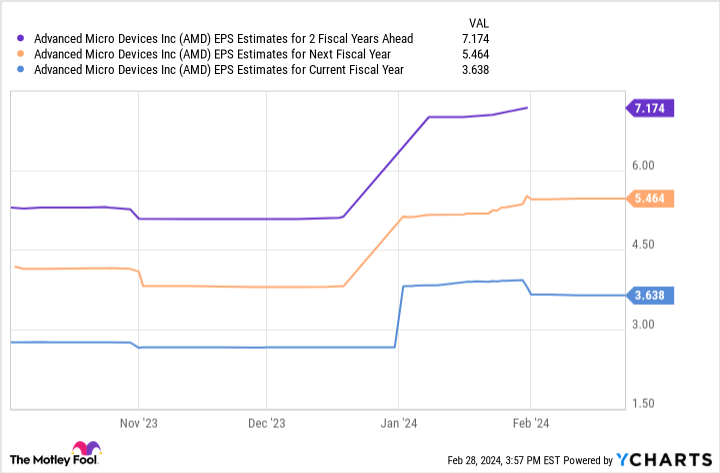

AMD has a stable outlook over the long run, and earnings-per-share estimates replicate this.

AMD’s earnings might hit simply above $7 per share over the subsequent two fiscal years. Multiplying this determine by the corporate’s ahead P/E of 49 yields a inventory worth of $352. If projections are appropriate, AMD’s inventory worth might double by fiscal 2026.

And with that, AMD has considerably extra potential than the crypto market.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Nvidia wasn’t one among them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 26, 2024

Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Dani Prepare dinner has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units, Bitcoin, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

3 Synthetic Intelligence (AI) Shares With Extra Potential Than Any Cryptocurrency was initially revealed by The Motley Idiot