What’s the primary draw back to a brand new bull market? Valuations can grow to be frothy. The common S&P 500 inventory trades at almost 21.5 instances estimated earnings. Many shares have a lot steeper valuations.

However do not assume for a second that there aren’t bargains to be discovered. Listed here are 5 magnificent shares to purchase which might be filth low cost (listed in alphabetical order).

1. Ares Capital

You may not be conversant in Ares Capital (NASDAQ: ARCC). Nevertheless, it is the biggest publicly traded enterprise improvement firm (BDC) within the U.S. Its inventory can also be one which worth buyers may discover fairly engaging. Ares Capital’s ahead earnings a number of is a low 8.8x.

That low cost valuation is not the one factor to love about Ares Capital, although. The BDC’s dividend yield tops 9.4%. This dividend offers an enormous enhance to the corporate’s complete return. Since Ares Capital’s IPO in 2004, its complete return has trounced the S&P 500.

2. Power Switch LP

Power Switch LP‘s (NYSE: ET) items have greater than doubled in worth over the past three years. Regardless of the large good points, the midstream vitality supplier stays a discount with its ahead earnings a number of of solely 8.3x.

The restricted partnership additionally pays a hefty distribution that at the moment yields almost 8.8%. Power Switch expects to develop its distribution by 3% to five% per yr. Its pipelines and processing vegetation generate regular money stream that ought to enable the corporate to simply fund these distributions going ahead.

3. ExxonMobil

ExxonMobil (NYSE: XOM) stands out as one other vitality inventory that is obtainable at a reduction. Shares of the oil and fuel large commerce at roughly 10.7 instances anticipated earnings. That is effectively under the S&P 500’s stage and can also be decrease than the common vitality sector ahead earnings a number of of 11.2x.

The inventory has been a longtime favourite of earnings buyers. That is nonetheless the case with ExxonMobil’s dividend yielding 3.8%. The corporate may even have higher long-term progress prospects than many assume with its main investments in carbon seize and storage.

4. PayPal Holdings

PayPal Holdings (NASDAQ: PYPL) turned out to be a catastrophe for buyers lately. Since mid-2021, the fintech inventory has plunged by almost 80%. Nevertheless, this steep sell-off has made PayPal absurdly low cost. Its ahead earnings a number of is under 11.4x. PayPal’s price-to-earnings-to-growth (PEG) ratio, which components in projected progress over the subsequent 5 years, is a super-low 0.54. Any PEG ratio under 1.0 is taken into account to be a lovely valuation.

Though PayPal’s progress has slowed significantly, the corporate’s underlying enterprise stays fairly wholesome. Within the third quarter of 2023, PayPal’s complete cost quantity jumped 15% yr over yr. Its adjusted earnings per share soared 20%. The digital funds pioneer additionally generated a free money stream of $1.1 billion.

5. Pfizer

You may query my sanity with the inclusion of Pfizer (NYSE: PFE) as a “magnificent” inventory to purchase proper now. Shares of the large drugmaker sank almost 40% over the past 12 months. The inventory is down 55% from its peak set in late 2021.

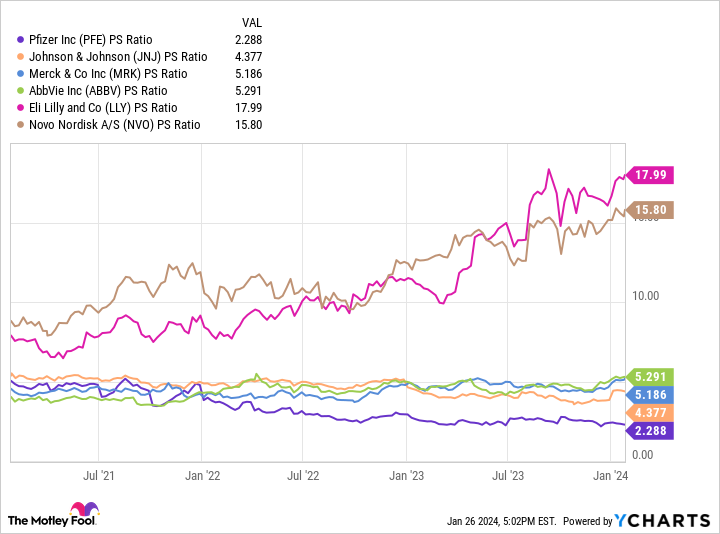

Pfizer seems like a discount, in my opinion, although. Its shares commerce at 12.6 instances anticipated earnings — a lot decrease than the S&P 500 healthcare sector common of 18.4. Pfizer’s price-to-sales ratio is simply a fraction of the multiples for its large pharma friends.

Certain, Pfizer deserves a decrease valuation due to its declining COVID-19 product gross sales and upcoming patent expirations for top-selling medication. Nevertheless, I believe the outlook for the pharmaceutical firm is significantly better than it appears to be at first look. As a bonus, Pfizer pays a juicy dividend with a yield of 6.1%.

Do you have to make investments $1,000 in Pfizer proper now?

Before you purchase inventory in Pfizer, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Pfizer wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of January 22, 2024

Keith Speights has positions in Ares Capital, PayPal, and Pfizer. The Motley Idiot has positions in and recommends PayPal and Pfizer. The Motley Idiot recommends the next choices: brief March 2024 $67.50 calls on PayPal. The Motley Idiot has a disclosure coverage.

5 Magnificent Shares to Purchase That Are Dust Low-cost was initially revealed by The Motley Idiot