From synthetic intelligence to renewed pleasure in cryptocurrencies, there are quite a lot of phenomenal progress tales driving markets proper now.

However as Warren Buffett simply wrote in his 2023 annual letter to shareholders — “For no matter causes, markets now exhibit much more casino-like conduct than they did once I was younger. The on line casino now resides in lots of properties and every day tempts the occupants.”

This phrase of warning doesn’t suggest that the components driving the market are all flawed. It is simply that with regards to investing, it is vital to keep away from hopping on a preferred commerce to make a fast buck. In the long term, a greater method is to give attention to proudly owning a bit of a top quality enterprise that can develop in worth over time.

Here is why Lululemon (NASDAQ: LULU), Moderna (NASDAQ: MRNA), Apple (NASDAQ: AAPL), Ford (NYSE: F), and Roku (NASDAQ: ROKU) have what it takes to compound, and why every inventory is value shopping for in March.

Stretch into the spring

Demitri Kalogeropoulos (Lululemon Athletica): Lululemon Athletica will announce its official fourth-quarter earnings replace someday in March, however buyers haven’t got to attend till then to purchase this stellar progress inventory. The athleisure big already provided some tantalizing hints about its progress developments to shut out fiscal 2023, saying in early January that each gross sales and income will land forward of administration’s earlier forecast. “We’re happy with our efficiency through the vacation season,” CFO Megan Frank stated in a press launch.

Executives are actually calling for This autumn gross sales to rise by about 14%, translating into a virtually 20% spike for the total yr. For context, most Wall Road execs are searching for Nike to develop by nearly 1% in 2024.

Lululemon can also be stretching increased with respect to revenue margins, that means buyers can anticipate to see a lot increased annual earnings over time. Gross revenue margin is close to 60% of gross sales, and working revenue has been holding above 20% of gross sales for the previous two years.

On the draw back, shares do not seem low cost heading into the March earnings replace. You will must pay practically 7 instances annual gross sales for Lululemon’s enterprise, whilst you may personal Nike for half that premium. There is a good probability Lululemon will earn its increased valuation by persevering with to report quick progress and rising income in 2024 and past. These gross sales positive factors ought to come from its push into worldwide markets and to demographics outdoors of its core feminine viewers. Search for a gradual move of progressive product releases to assist increased margins over time.

Should you’re risk-averse, you may need to simply watch the inventory for a doubtlessly lower cost to reach. But Lululemon nonetheless appears to be like engaging heading into the spring purchasing season.

It is time to give this biotech inventory one other shot

Keith Speights (Moderna): Let me acknowledge proper out of the gate that Moderna does not appear to be a promising decide at first look. Shares of the biotech firm have plunged 80% beneath the height set in mid-2021 and have fallen near 30% over the past 12 months. Moderna’s income continues to sink as a result of declining demand for its COVID-19 vaccines.

Nevertheless, I feel it is time to give this biotech inventory one other shot (pun totally meant). Why? Moderna seems to be on the edge of a serious comeback.

The U.S. Meals and Drug Administration (FDA) set a PDUFA date of Could 12, 2024, for an approval determination on Moderna’s respiratory syncytial virus (RSV) vaccine mRNA-1345. This RSV vaccine ought to be a industrial success if authorized, contemplating its strong efficacy and pre-filled syringes, which save docs and pharmacists time.

Moderna additionally hopes to launch mRNA-1345 in Australia and Germany later this yr. It plans to broaden into extra markets in 2025.

Thanks largely to the anticipated increase from its new RSV vaccine, Moderna thinks it’s going to return to gross sales progress subsequent yr. The corporate expects to succeed in breakeven in 2026. However mRNA-1345 is not the one potential progress driver on the way in which.

Moderna intends to file for regulatory approvals of its seasonal flu vaccine mRNA-1010 this yr as nicely. Its pipeline options a number of different late-stage applications, too, together with a mix flu/COVID-19 vaccine, a next-generation COVID-19 vaccine that is refrigerator-stable, cytomegalovirus (CMV) vaccine mRNA-1647, and most cancers vaccine mRNA-4157. Moderna is partnering with Merck to check mRNA-4157 with blockbuster immunotherapy Keytruda in treating melanoma and non-small-cell lung most cancers.

I predict Moderna will make rather more cash by the top of this decade than it does now and be extremely worthwhile. For long-term buyers searching for an important turnaround story, this biotech inventory may very well be proper up their alley.

Apple’s finest qualities are underappreciated by the market proper now

Daniel Foelber (Apple): The only cause to purchase Apple inventory is that it’s an above-average firm buying and selling at practically the identical valuation because the S&P 500. That is a 27.5 price-to-earnings (P/E) ratio for the index and 28 for Apple.

There are a number of the reason why Apple is not getting the identical market premium as different tech shares. The only is its near-term progress prospects.

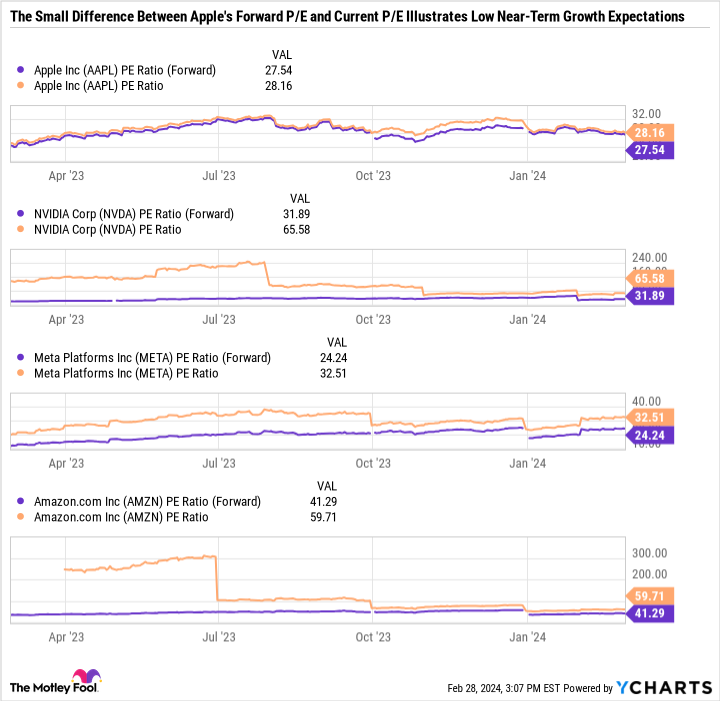

AAPL PE Ratio (Ahead) knowledge by YCharts

As you may see within the chart, the ahead P/E ratios of among the higher-flying big-tech-related shares are considerably decrease than the present P/E. In Nvidia‘s excessive case, earnings are anticipated to double in a single yr, which is why the ahead P/E is about half of the present P/E. With Apple, the 2 metrics are nearly equivalent.

Should you’re a short-term dealer, there is no cause to purchase Apple inventory now. And it is vital to keep in mind that inventory costs can take wild swings primarily based on sentiment and emotion.

However if you happen to’re a long-term investor, which is a much more profitable methodology for compounding wealth over time, there’s quite a bit to love about Apple that the market could also be discounting proper now.

Its current quarter featured slowing progress in China, which is regarding. However North America, rising markets like India and South Korea, and different elements of the world are doing nicely. Apple’s high-margin companies phase continues to be a key a part of the long-term progress story.

Apple additionally has little or no debt web of money relative to its measurement. And it generates loads extra money than it must run the enterprise. This can be a firm that purchased again over $20 billion of its personal inventory final quarter. On common, that is over $222 million spent on inventory buybacks per day!

There are only a few firms on the market with that degree of monetary muscle to deploy at will.

Apple is an exceptional enterprise with a robust model, streamlined vertical integration, a rock-solid steadiness sheet, and loads of capital it might probably use to speed up progress if it needs to. The valuation is smart relative to the market, and that is why Apple is value shopping for in March.

Ford is a no brainer inventory to purchase now

Neha Chamaria (Ford Motor): After a reasonably unstable 2023, Ford inventory has picked up some slack currently, rallying practically 18% previously three months, as of this writing. Labor strikes, rising prices, excessive rates of interest, and an electrical car (EV) enterprise dropping billions of {dollars} whilst fears of a world trade slowdown loom massive had been among the larger the reason why buyers stayed on the sidelines on Ford inventory final yr. Because it seems, the newest developments at Ford have renewed buyers’ religion within the legacy automaker, and I imagine this can be a nice time to purchase the inventory for the lengthy haul.

Regardless of all of the challenges, Ford grew its income by 11% in 2023 and turned a web revenue of $4.3 billion, versus a web lack of $2 billion in 2022. Ford additionally declared a supplemental dividend for the primary quarter as its adjusted free money move of $6.8 billion surpassed targets.

Even so, CEO Jim Farley emphasised how Ford is “nowhere close to” its earnings potential but, and he believes the corporate is well-positioned for progress this yr. One of many key drivers ought to be Ford Professional, the corporate’s industrial automobiles division, which generates substantial recurring income from {hardware}, software program, and companies companies. In 2024, Ford expects Ford Professional to generate the best earnings earlier than curiosity and tax (EBIT) of round $8 billion to $9 billion amongst all its three divisions, with Ford Blue — its gas-and-hybrid automobiles phase — coming in a detailed second. Its EV enterprise, Mannequin e, may lose as a lot as $5.5 billion in EBIT in 2024.

Ford is aware of EVs are a difficult market, so it now needs to chop down capital spending on EVs till the time is correct and focus as an alternative on the higher-margin Professional and Blue companies. This transfer alone displays Ford’s agility, and it’s commendable that the corporate remains to be projecting flat to fifteen% progress in adjusted EBIT this yr regardless of the large anticipated losses in EVs. So Ford continues to develop regardless of challenges and is making the precise strikes to spice up its earnings, making it an important inventory to purchase now for 2024 and past.

Why Roku’s current inventory drop alerts shopping for the inventory in March

Anders Bylund (Roku): Roku’s current inventory drop is an inviting funding alternative in my eyes.

The media-streaming know-how skilled’s fourth-quarter earnings report impressed a 24% inventory value drop the subsequent day and a 33% decline three days later. Market reactions like these normally comply with a disappointing earnings report with weak outcomes and a dark near-term market view. However none of these bearish parts confirmed up in Roku’s report.

The headline outcomes had been roughly in keeping with Wall Road’s consensus estimates, with a 2% upside shock on the highest line. However the essential class of advert consumers within the media and leisure (A&E) trade is just not springing again to beneficiant advertising and marketing campaigns, limiting Roku’s progress prospects over the subsequent quarter or two.

Then Walmart threw extra chilly water on Roku’s inventory chart with the acquisition of good TV purchaser Vizio. If that deal is authorized and accomplished, it will take away an vital software program buyer from Roku’s roster and increase Vizio’s enterprise prospects with a deep-pocketed mother or father firm. So Roku’s inventory took one other dive as buyers absorbed the implications of a Walmart-Vizio mixture.

However Roku’s bears are leaping to the flawed conclusions.

You see, Roku’s modest income progress and unfavourable earnings in current quarters resulted from administration’s calculated decisions. Whereas different media-streaming {hardware} and software program suppliers battled the inflation disaster by elevating their costs, Roku held its value tags regular to draw extra customers as an alternative.

So the person rely grew from 60 million to 80 million lively prospects in two years, knee-deep within the inflation lavatory. Utilizing low cost {hardware} as a loss-leader advertising and marketing trick labored wonders, and I feel it is a good funding. Sustained earnings can wait, so long as Roku is concentrated on constructing the most important potential person base for a profitable long-term future.

Lengthy story brief, I discovered Roku’s fourth-quarter report inspiring, and the worth drop that adopted merely opened the shopping for window slightly bit wider. As for the Walmart plus Vizio risk, Roku is not any stranger to tackling bigger and richer rivals. In the meantime, related TV safety skilled Pixalate experiences that Roku’s share of the advert market on North American good TVs rose from 50% in February 2023 to 55% one yr later. It is not even a detailed race.

So I purchased extra Roku shares after the worth drops in February and may come again once more in March. Do your individual analysis and see the place you stand on this inventory’s bull-to-bear scale — however the time to behave is now if you happen to agree with my evaluation.

Do you have to make investments $1,000 in Lululemon Athletica proper now?

Before you purchase inventory in Lululemon Athletica, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Lululemon Athletica wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 26, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Anders Bylund has positions in Amazon, Nvidia, and Roku. Daniel Foelber has no place in any of the shares talked about. Demitri Kalogeropoulos has positions in Amazon, Apple, Meta Platforms, and Nike. Keith Speights has positions in Amazon, Apple, and Meta Platforms. Neha Chamaria has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, Apple, Lululemon Athletica, Merck, Meta Platforms, Nike, Nvidia, Roku, and Walmart. The Motley Idiot recommends Moderna and recommends the next choices: lengthy January 2025 $47.50 calls on Nike. The Motley Idiot has a disclosure coverage.

5 Prime Shares to Purchase in March was initially printed by The Motley Idiot