“You solely want just a few good shares in your lifetime. I imply what number of instances do you want a inventory to go up tenfold to make some huge cash? Not loads.”-Peter Lynch

Investing is difficult; dropping shares are simpler to search out than successful ones. Nevertheless, as the nice Peter Lynch factors out, one or two nice shares can carry many different mediocre ones in a person portfolio.

At the moment, I wish to look at a inventory that has already made many traders wealthy — and stays a strong funding in the present day: Nvidia (NASDAQ: NVDA).

Nvidia is red-hot, because of the AI revolution

Let’s begin with the apparent: Nvidia’s inventory is on fireplace. Shares are up 38% yr to this point, and we’re solely six weeks into the brand new yr.

The explanation? Synthetic intelligence (AI), after all.

Because the designer of the world’s premier AI chips, graphics processing models (GPUs), Nvidia has seen demand for its merchandise skyrocket over the past two years.

Certainly, the demand for AI chips is rising so quick that the Worldwide Power Company (IEA) estimates that general power consumption by knowledge facilities could double by 2026.

And keep in mind knowledge facilities already devour a staggering quantity of energy. The IEA estimates that in 2022, knowledge facilities used roughly 460 terawatt-hours of electrical energy. That is roughly 1% of worldwide electrical energy demand, or sufficient to energy 32 million houses for a yr.

In different phrases, AI infrastructure is already huge, and it is rising even bigger. That is nice information for Nvidia, whose cutting-edge AI chips are prized by AI builders for his or her energy, pace, and effectivity.

Rising income, rising inventory

Now, let’s speak income. Nvidia’s gross sales have been climbing steadily as firms like Meta Platforms have ordered tons of of 1000’s of AI chips.

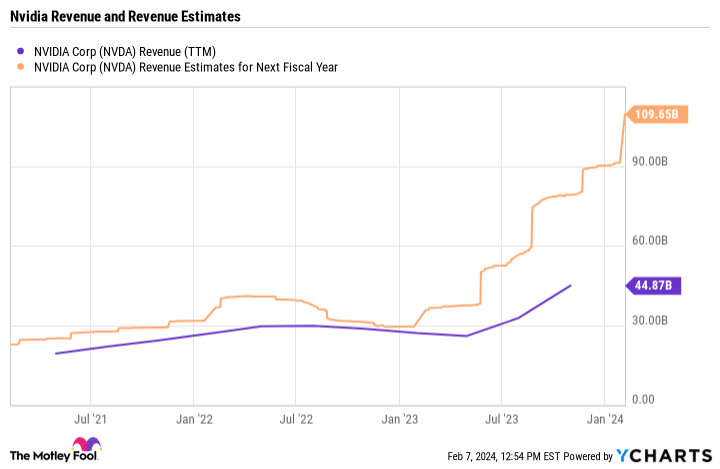

Certainly, Nvidia’s income over the past 12 months has jumped to $45 billion, up from $26 billion a yr in the past. Nevertheless, the corporate’s estimated gross sales figures are the place the eye-popping math seems.

As you may see, gross sales estimates for Nvidia’s subsequent fiscal yr proceed to climb. The consensus estimate (yellow line above) is roughly $110 billion, greater than double the corporate’s income over the past 12 months. What’s extra, the income estimates proceed to rise.

Consequently, analysts have been racing to revise their worth goal for the inventory. The best worth goal for Nvidia belongs to Rosenblatt Securities’ Hans Mosesmann, who, in August 2023, famous the inventory might go to $1,100. On the time, that represented 120% upside; in the present day, it is merely 59%.

What’s an investor to do?

First issues first: For traders who already personal Nvidia, congratulations! There is not any higher feeling than holding an enormous winner in your portfolio.

Now, combat the urge to promote. Certainly one of The Motley Idiot’s core funding ideas is to let winners run, tough because it could be to abdomen.

Granted, Nvidia’s inventory might flip decrease, maybe a lot decrease. However the cause for letting winners run is that it permits time to easy out these large peaks and valleys. Over time, that leads to substantial returns for these with the endurance to attend it out.

For individuals who do not personal Nvidia, now often is the time to contemplate it. Certain, shares have already soared over the past 15 months. However simply because a inventory is already up large does not imply it might probably’t transfer greater. The AI revolution is in full swing, and the corporate’s gross sales estimates proceed to extend as ever extra firms flip to AI to resolve issues and ship efficiencies.

To shut, let’s revisit Lynch’s recommendation that one or two good shares are sufficient for a lifetime of investing success. For a lot of traders, Nvidia is already a type of names. For others, it might develop into one.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 5, 2024

Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Jake Lerch has positions in Nvidia. The Motley Idiot has positions in and recommends Meta Platforms and Nvidia. The Motley Idiot has a disclosure coverage.

1 Outstanding AI Progress Inventory to Purchase Hand Over Fist Earlier than It Soars 59% was initially revealed by The Motley Idiot