Investing in synthetic intelligence (AI) has turn into profitable and dangerous. Shares reminiscent of Nvidia and Palantir may revolutionize AI, however in addition they promote at valuations that make them more and more dangerous selections.

Nevertheless, not all AI shares have turn into costly previously 12 months. These three corporations play vital roles in AI, however commerce at valuations that can permit risk-averse traders to purchase in now with out overpaying.

IBM

Now that Worldwide Enterprise Machines (NYSE: IBM) has turn into a pacesetter within the cloud, it’s in all probability time to think about including it to your portfolio. The corporate’s transfer into the hybrid cloud and the spinoff of its underperforming managed infrastructure enterprise as a brand new firm, Kyndryl, have modified the outlook for this tech inventory.

IBM has additionally developed AI options. Amongst its merchandise is Watsonx, which helps customers construct basis fashions, scale AI workloads from its knowledge retailer, and monitor AI lifecycles of their entirety. Furthermore, IBM Analysis and the corporate’s group of consultants also can assist shoppers deploy AI throughout their organizations.

Earnings traders will like IBM’s payout. With a dividend of $6.64 per share yearly, at present share costs, it presents a yield of three.6%, and the corporate has a 27-year streak of annual payout hikes. This makes it the dividend inventory within the cloud area, since its friends both present extra modest payouts or do not pay dividends in any respect.

Additionally, after years of decline and stagnation, the inventory has begun to come back again. Over the past 12 months, it’s up greater than 35% and will quickly return to the all-time excessive it touched in 2013. But even after these good points, it trades at a P/E ratio of 23, a discount valuation in comparison with many AI shares right now. Given these elements, traders might need to purchase shares of IBM earlier than they turn into considerably costlier.

Taiwan Semiconductor Manufacturing

Admittedly, Taiwan Semiconductor Manufacturing (NYSE: TSM) — aka, TSMC — might not seem to be a low-risk choose. Lately, all shares tied to China, on some stage, have struggled with progress. Traders like Warren Buffett have exited their positions in TSMC out of concern of the chance that China would possibly invade Taiwan, which is residence to many of the firm’s chip fabrication services.

Nevertheless, virtually each chip design firm depends upon TSMC for its manufacturing. Thus, corporations reminiscent of Nvidia and AMD face this identical danger, regardless that it’s doubtless not priced into their shares. Secondly, China additionally depends upon TSMC’s chips, making it much less doubtless it will put its economic system in danger with an invasion.

Traders might have began to note as TSMC inventory has risen greater than 40% over the previous 12 months. That has taken its P/E ratio to 26. Whereas its earnings a number of has considerably elevated over the previous couple of months, TSMC routinely traded at greater than 30 instances earnings through the 2021 bull market.

Additionally, analysts forecast a ten% surge in earnings for this 12 months and a 23% enhance in 2025. These elements ought to put upward strain on the semiconductor inventory as TSMC produces extra of the chips that can energy the AI revolution.

T-Cell

T-Cell US (NASDAQ: TMUS) is certainly one of solely three nationwide 5G wi-fi suppliers within the U.S. This positions it as one of many few wi-fi telecoms that may present a vital hyperlink for quite a few AI purposes.

Furthermore, it was based in 1994, and in contrast to Verizon Communications and AT&T, it began as a wi-fi supplier. As such, T-Cell doesn’t have legacy prices reminiscent of pensions, nor does it face intensive environmental cleanup prices from outdated lead-lined cables — simply two of the issues which are presently plaguing these rivals.

For these causes, it has lengthy been free to spend its capital on its wi-fi networks and acquisitions, and to supply value cuts which have squeezed the revenue margins of its friends. All of this has allowed T-Cell to develop its market share to round 24%.

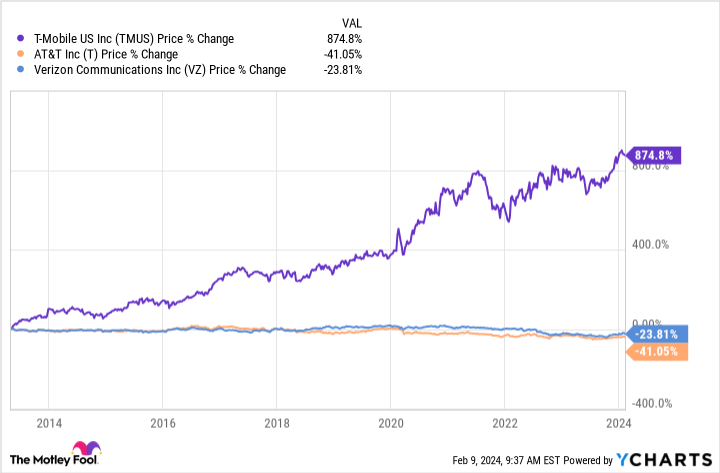

Though T-Cell’s share value rose solely 12% final 12 months, the telecom inventory outperformed its friends. It has additionally risen by practically 875% since its inception, making it extra of a progress inventory.

Nevertheless, its P/E ratio of 23 is low by historic requirements. Additionally, because it initiated a dividend in December, extra conservative traders would possibly take an curiosity. At $2.60 per share yearly, its 1.6% money return is dwarfed by the larger than 6% dividend yields of AT&T and Verizon.

Nonetheless, its payout may act as a stabilizing drive for T-Cell over time, and with inventory value progress supplementing returns, it ought to proceed to outpace its friends.

Must you make investments $1,000 in Worldwide Enterprise Machines proper now?

Before you purchase inventory in Worldwide Enterprise Machines, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Worldwide Enterprise Machines wasn’t certainly one of them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 12, 2024

Will Healy has positions in Superior Micro Units and Palantir Applied sciences. The Motley Idiot has positions in and recommends Superior Micro Units, Nvidia, Palantir Applied sciences, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Worldwide Enterprise Machines, T-Cell US, and Verizon Communications. The Motley Idiot has a disclosure coverage.

3 Compelling Synthetic Intelligence (AI) Shares That Danger-Averse Traders Can Really feel Secure Shopping for was initially revealed by The Motley Idiot