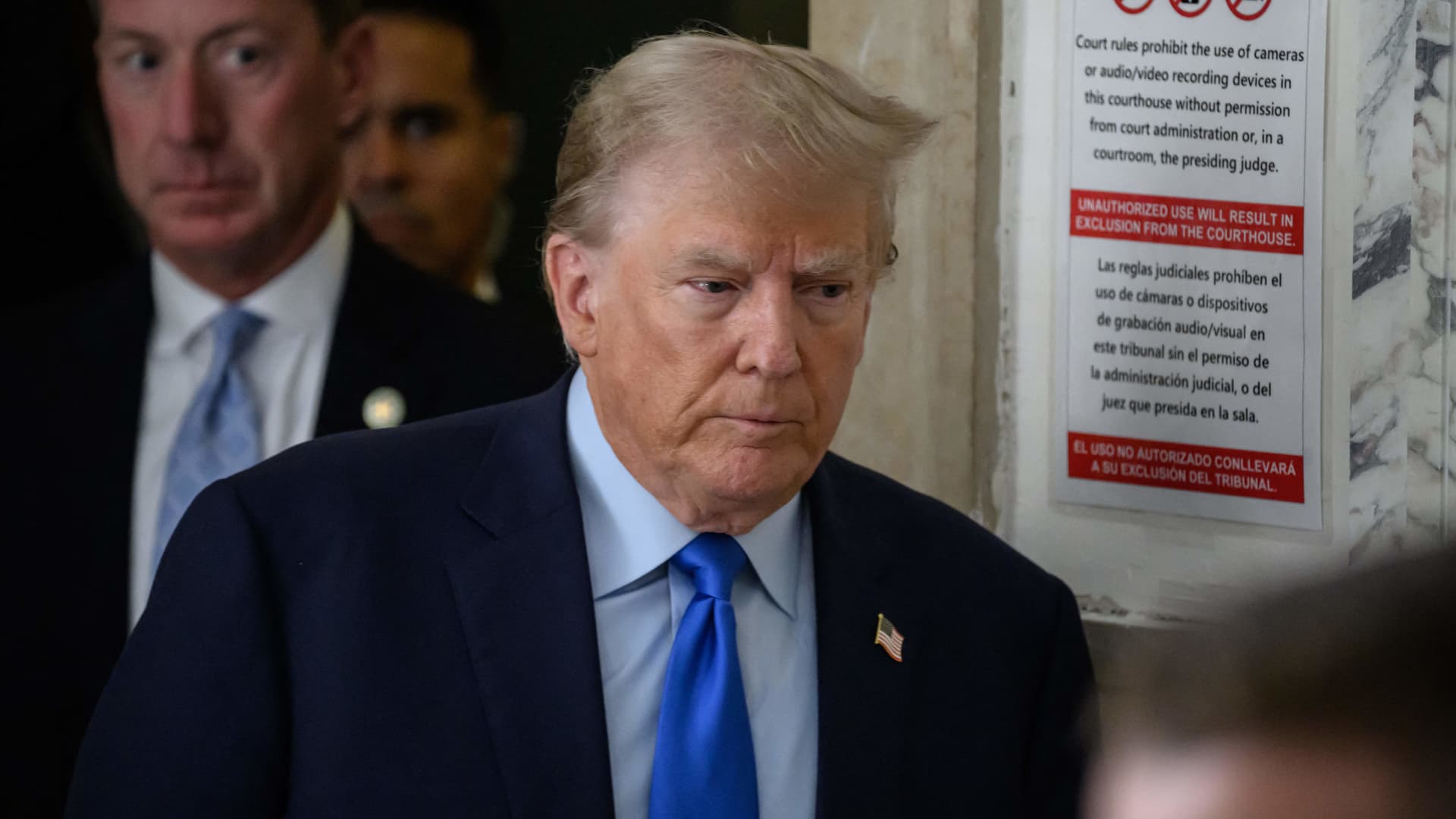

Former U.S. president Donald Trump arrives to the court docket room following a break on the New York State Supreme Court docket on the primary day of his civil fraud trial, in New York Metropolis on Oct. 2, 2023.

Ed Jones | AFP | Getty Photos

Attorneys for Donald Trump on Wednesday stated the previous president and his co-defendants plan to publish a $100 million bond to pause enforcement of their civil fraud judgment — although that’s only a fraction of the full quantity they’ve been ordered to pay.

To safe a “full” attraction bond, which may price greater than $550 million, could be “not possible,” the protection attorneys wrote in a court docket submitting to the Appellate Division of Manhattan Supreme Court docket.

If Trump had been pressured to place up a bond for the whole quantity, his attorneys wrote, “properties would probably must be offered to lift capital below exigent circumstances” to lift the cash.

New York Legal professional Common Letitia James, who introduced the fraud case, responded saying that concession exhibits Trump “has inadequate liquid belongings to fulfill the judgment.”

“There isn’t any advantage” to Trump’s declare that “a full bond is pointless” in the event that they publish a partial quantity of “lower than 1 / 4 of the judgment,” James stated as she urged the appeals court docket to deny Trump’s request.

An appellate choose is anticipated to challenge a choice later Wednesday.

The filings got here two days after Trump appealed Choose Arthur Engoron’s ruling discovering him, his two grownup sons, his firm and its executives responsible for submitting fraudulent data on key monetary statements.

Engoron ordered the defendants to pay a complete of $464.6 million in fines and curiosity. Trump’s complete was greater than $454 million, which incorporates greater than $98 million in prejudgment curiosity. This curiosity continues to accrue at a 9% annual price, including practically $112,000 a day to Trump’s invoice alone.

Engoron’s judgment additionally bars Trump from working a enterprise in New York for 3 years, or making use of for loans from monetary establishments registered with the state throughout that interval.

Trump’s attorneys famous in Wednesday’s submitting {that a} surety bond company will usually set the bond quantity at 120% of the judgment to account for curiosity and attraction prices. On this case, the bond might be value upward of $550 million.

“The exorbitant and punitive quantity of the Judgment coupled with an illegal and unconstitutional blanket prohibition on lending transactions would make it not possible to safe and publish a whole bond,” they wrote.

“Appellants nonetheless plan to safe and publish a bond within the quantity of $100 million.”

That quantity could be sufficient to “adequately” safe a keep of the judgment, they wrote, as a result of it could be coupled with the oversight measures relied on by James’ workplace.

The protection attorneys additionally famous that their purchasers’ huge actual property holdings in New York are being overseen by a court-appointed monetary monitor to “preclude any dissipation or switch of belongings.”

That oversight alone could be “enough to adequately safe any judgment affirmed,” they wrote. “Appellants’ bond would merely function additional safety.”

However James’ submitting shot again, saying, “These are exactly the circumstances for which a full bond or deposit is important.”

“Defendants have by no means demonstrated that Mr. Trump’s liquid belongings may fulfill the complete quantity of the judgment,” the lawyer normal wrote.

She added, “there may be substantial danger that defendants will try and evade enforcement of the judgment (or make enforcement harder) following attraction.”

Engoron’s judgment isn’t the one large authorized invoice dogging Trump as he seeks the Republican presidential nomination. Trump in late January was ordered to pay $83.3 million after a federal jury in New York discovered him responsible for defaming author E. Jean Carroll.

Trump has vowed to attraction that judgment.

That is growing information. Please test again for updates.

Do not miss these tales from CNBC PRO: