Berkshire Hathaway CEO Warren Buffett has scored unimaginable investing wins over time by selecting nice companies with highly effective aggressive benefits. To place the Oracle of Omaha’s observe document in perspective, in case you purchased $1,000 price of Berkshire shares when Buffett bought a controlling stake within the enterprise and have become its CEO in Could 1965, you’d in the present day personal inventory price roughly $34.3 million.

In fact, Berkshire’s present large dimension makes it unlikely that its inventory will ship a efficiency like that once more any time this century. With a market capitalization of $889 billion, it ranks because the world’s eighth-most-valuable firm. Delivering exponential development turns into far tougher at that stage.

However taking some pages out of Buffett’s investing playbook can nonetheless be an effective way to attain market-beating returns, and two Motley Idiot contributors suppose following the Oracle of Omaha’s lead on these two shares under could be an effective way to strengthen your portfolio.

The AI revolution will energy massive wins for Amazon

Keith Noonan: Amazon (NASDAQ: AMZN) is the world’s largest on-line retail firm. It is also the main supplier of cloud infrastructure companies.

Although it accounts for the big majority of the corporate’s revenues, Amazon’s e-commerce enterprise really doesn’t account for many of its earnings. Due to its excessive working prices, the web retail unit generates comparatively low revenue margins. Its Amazon Net Companies (AWS) cloud enterprise is way extra worthwhile, bringing in roughly 67% of the corporate’s $36.9 billion in working revenue final 12 months.

However as Amazon continues to leverage economies of scale and takes benefit of latest applied sciences, it ought to be capable of obtain much better margins from its e-commerce enterprise. Notably, wider use of synthetic intelligence (AI) ought to present an unimaginable efficiency catalyst for the already massively profitable firm.

AI will probably pave the best way for elevated automation on the firm’s warehouses. It may additionally open the door for self-driving autos and autonomous-delivery applied sciences. Because of this, Amazon’s e-commerce working prices may fall dramatically — and its earnings may skyrocket.

In the meantime, the rising demand for AI is already powering robust efficiency for AWS. AI functions are being constructed, launched, and scaled on the corporate’s cloud infrastructure. As extra functions are created and used, demand for that cloud infrastructure will proceed to rise.

For long-term traders searching for AI development shares that supply a pretty risk-reward profile, Amazon has the makings of an incredible purchase proper now.

Coca-Cola has developed robust buyer relationships

Parkev Tatevosian: To me, to ensure that a inventory to be a no brainer funding, I need to really feel assured that the corporate might be round for not less than one other 20 years. Coca-Cola (NYSE: KO) definitely matches that invoice. The beverage big has been delighting clients for roughly a century, and it is affordable to imagine will probably be round for a number of many years extra, not less than. Importantly, Coca-Cola serves clients in a method that generates profitable earnings for shareholders.

In 2023, its income totaled $45.7 billion whereas its working revenue totaled $13 billion. Which means that after protecting all of the bills concerned in serving clients these tasty drinks they’ve come to like, Coca-Cola’s working revenue margin was a refreshing 28.4%.

The confirmed functionality to generate billions in gross sales at profitable revenue margins can go a good distance towards relieving traders’ considerations concerning the dangers of investing. Definitely, billions in annual earnings attracted Buffett to Coca-Cola inventory. The underlying causes that these earnings preserve flowing are administration’s talent in working the enterprise successfully, mixed with shoppers’ model loyalty and their regular consumption habits.

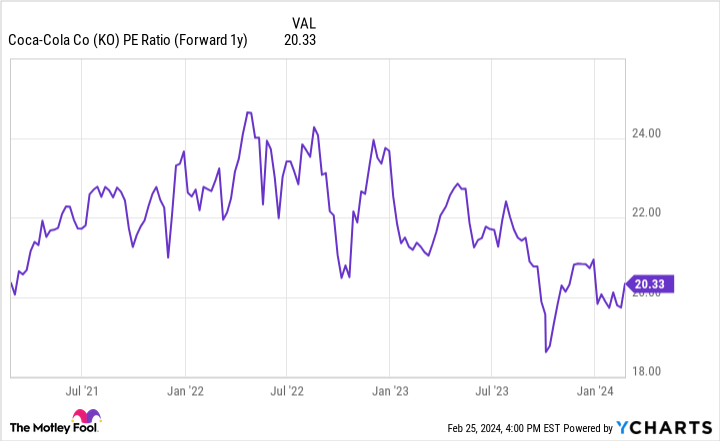

I’m often keen to pay a better worth to spend money on corporations like Coca-Cola due to the excessive probability they are going to be round for the long run. Happily, Coca-Cola’s valuation shouldn’t be too costly. Presently buying and selling at a ahead price-to-earnings ratio of 20, Coca-Cola’s inventory has recently been on the decrease finish of the vary it has occupied for the final a number of years. Traders who purchase Coca-Cola inventory in the present day moderately anticipate their funding to be price extra 20 or 30 years from now.

Do you have to make investments $1,000 in Amazon proper now?

Before you purchase inventory in Amazon, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Amazon wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 26, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Keith Noonan has no place in any of the shares talked about. Parkev Tatevosian, CFA has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon and Berkshire Hathaway. The Motley Idiot has a disclosure coverage.

2 Spectacular Warren Buffett Shares Which can be No-Brainer Buys for 2024 (and Past) was initially printed by The Motley Idiot