Shares of Nvidia (NASDAQ: NVDA) have soared large time for the reason that starting of 2023, clocking astronomic good points of 441% because the inventory market has handsomely rewarded the corporate’s excellent top- and bottom-line progress, however that great rally has made the inventory extraordinarily costly.

Nvidia inventory is at the moment buying and selling at 41 occasions gross sales, considerably larger than its five-year common gross sales a number of of 17.7. In the meantime, the S&P 500 index has a median price-to-sales ratio of two.7. Nvidia’s price-to-earnings (P/E) ratio can also be fairly costly at 97. The tech-heavy Nasdaq-100 index, of which Nvidia is a component, has a median P/E ratio of 34.

These valuation multiples point out that Nvidia is not precisely a worth choose proper now. Nevertheless, that is half the story, as a more in-depth have a look at Nvidia’s ahead multiples and its potential progress prospects suggests one thing else.

Suppose Nvidia inventory is dear? Suppose once more

Whereas Nvidia does appear costly so far as its trailing multiples are involved, the image modifications utterly with regards to the corporate’s forward-looking multiples. The inventory sports activities a ahead P/E a number of of 33. That is nearly in keeping with the Nasdaq-100 index’s ahead earnings a number of of 30, utilizing the index as a proxy for tech shares.

Given Nvidia’s main place out there for chips used for coaching synthetic intelligence (AI) fashions — the driving power behind the corporate’s excellent efficiency within the just lately concluded fiscal 12 months 2024 — it’s straightforward to see why its ahead earnings a number of is considerably decrease. The chipmaker’s income jumped a powerful 126% in fiscal 2024 (which ended on Jan. 28) to nearly $61 billion. Non-GAAP (usually accepted accounting rules) earnings shot as much as $12.96 per share from $3.34 per share within the earlier 12 months, nearly quadrupling in worth.

Value noting is that Nvidia’s progress within the remaining two quarters of fiscal 2024 was majestic. In Q3, as an example, its income was up 206% 12 months over 12 months to $18 billion. That was adopted by a 265% year-over-year enhance in income within the earlier quarter to $22.1 billion. The chipmaker anticipates its income within the ongoing quarter to return in at $24 billion on the midpoint, which might be a 234% year-over-year enhance.

However that is not the place the nice half ends, as analysts are anticipating Nvidia’s income to extend considerably within the new fiscal 12 months, and past.

Because the chart above signifies, Nvidia’s income is predicted to leap 2.5x within the subsequent three fiscal years from fiscal 2024’s studying. That is not stunning, contemplating the potential progress alternative within the AI chip market and Nvidia’s pole place on this area.

Nvidia administration identified on the most recent earnings convention name that its knowledge heart income shot up a whopping 409% 12 months over 12 months to $18.4 billion and produced 83% of its whole income because of strong demand for “each coaching and inference of generative AI and huge language fashions throughout a broad set of industries, use circumstances, and areas.”

The corporate additionally added that it’s witnessing an enchancment within the provide of its knowledge heart chips. However regardless of that, it sees demand for its next-generation AI chips to be stronger than provide. That is not stunning, as Nvidia reportedly controls greater than 80% of the marketplace for AI chips, and clients have been lining as much as get their arms on its choices for AI coaching and inference.

Extra importantly, the corporate is concentrated on sustaining its management place on this profitable market with its upcoming H200 AI graphics processing unit (GPU). Nvidia will begin the preliminary shipments of this processor within the subsequent quarter and claims that it’s already witnessing stable demand for this product.

With the AI chip market set to clock annual progress of just about 38% by the top of the last decade, producing an annual income of $207 billion in 2030, Nvidia is all set to capitalize on this great alternative because of its aggressive product plan. Consequently, it will not be stunning to see Nvidia’s inventory head larger sooner or later, particularly contemplating the terrific earnings progress it’s predicted to ship.

Anticipate Nvidia’s inventory to maintain delivering stable good points

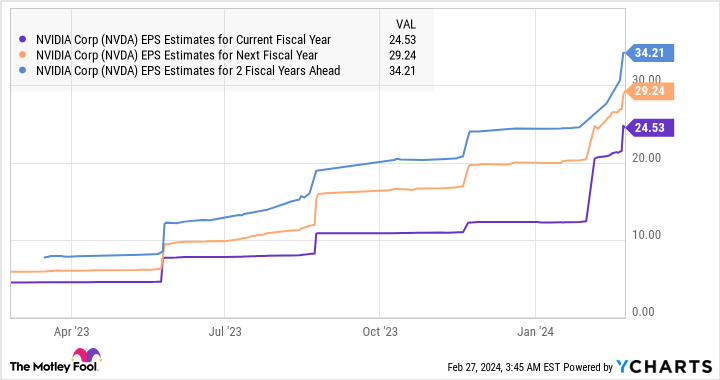

Nvidia delivered $12.96 per share in earnings in fiscal 2024. Because the chart under tells us, analysts have considerably raised their earnings progress expectations.

If Nvidia does hit $34.21 per share in earnings in fiscal 2027, as seen within the chart, and maintains its five-year common ahead earnings a number of of 39.2 at the moment, its inventory worth might enhance to $1,341. That may be a 70% enhance from present ranges.

On condition that Nvidia is buying and selling at a decrease ahead earnings a number of at current, traders are getting a superb deal on this AI inventory proper now, which they need to think about grabbing with each arms, as its red-hot rally appears right here to remain.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Nvidia wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 26, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.

Is It Too Late to Purchase Nvidia Inventory? was initially printed by The Motley Idiot