Famed investor Warren Buffett is understood for locating high quality companies at a great worth and holding them over time. When his conglomerate Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) first started investing in Apple (NASDAQ: AAPL) in 2016, that inventory traded at a steep low cost to the market — with a price-to-earnings (P/E) ratio within the vary of 10 to 14.5 that yr. Again then, sentiment was adverse — there was a widespread view that Apple’s progress was plateauing, its market growth had performed out, and its merchandise have been restricted — to not point out it did not have the high-margin companies section it has immediately.

Lots has modified since then. However Apple has as soon as once more misplaced its market premium. During the last six months, the S&P 500 is up 14.6%, whereas Apple inventory is down 4.9%. On March 1, Apple offered off, and the S&P 500 rose. At one level, Apple’s P/E ratio fell under the S&P 500’s, however it ended up ending the day at 27.9, which was, coincidentally, the identical because the S&P 500.

Berkshire Hathaway’s different high public fairness holdings — Financial institution of America (NYSE: BAC), American Specific (NYSE: AXP), Coca-Cola (NYSE: KO), Chevron (NYSE: CVX), and Occidental Petroleum (NYSE: OXY) — are all buying and selling at reductions to the S&P 500. Mixed with Apple, these six firms make up 78.4% of Berkshire’s portfolio.

Let’s take into account why Buffett and his crew like these firms, and the qualities that make them good long-term holdings.

Model energy

In Berkshire Hathaway’s most up-to-date letter to shareholders, Buffett praised his longtime accomplice Charlie Munger for a lot of issues, together with a key lesson he taught Buffett.

Charlie, in 1965, promptly suggested me: “Warren, neglect about ever shopping for one other firm like Berkshire. However now that you just management Berkshire, add to it great companies bought at truthful costs and quit shopping for truthful companies at great costs. In different phrases, abandon every part you realized out of your hero, Ben Graham. It really works however solely when practiced at small scale.”

Again then, Buffett was recognized for getting first rate or dangerous companies as a result of their e book values have been increased than their market values. Munger taught Buffett that if he was going to be an important investor managing a bigger sum of money, he must pivot away from that scrappy technique towards one thing extra sustainable.

Berkshire’s high inventory holdings immediately mirror this shift. Apple is the undisputed chief in smartphones, client electronics, and wearable gadgets, and provides a variety of companies, many with excessive margins.

Financial institution of America is the second-largest diversified financial institution behind JPMorgan Chase.

American Specific is a high bank card firm, together with Mastercard and Visa (which Berkshire additionally owns shares in).

Coca-Cola is probably the most useful U.S.-based beverage firm.

Chevron is the second-biggest U.S.-based oil main, behind ExxonMobil. And Occidental Petroleum, generally often known as Oxy, is without doubt one of the Most worthy exploration and manufacturing firms and, assuming its take care of CrownRock L.P. goes via, will change into one of many high producers within the Permian Basin — the most important onshore oilfield within the U.S.

In sum, Berkshire’s largest inventory holdings are all among the many high canines of their respective industries. Lots of them have one other attribute that Buffett loves — capital return packages.

Rewarding shareholders

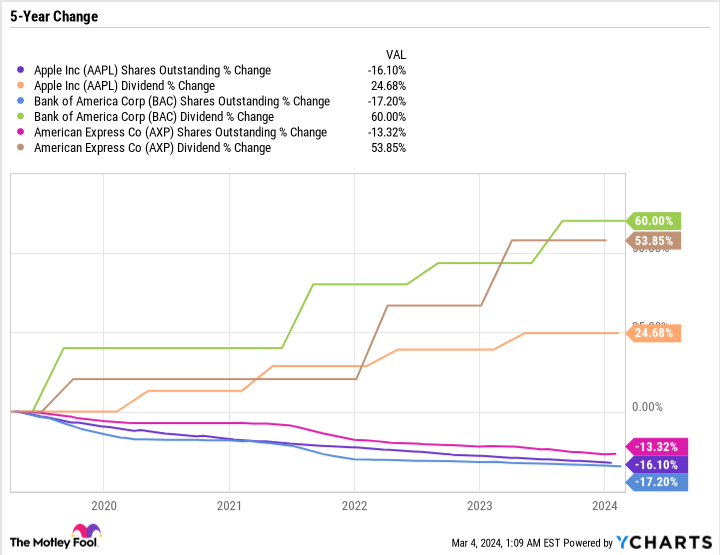

During the last 5 years, Apple, Financial institution of America, and American Specific have all boosted their dividends and acquired again inventory at spectacular charges.

Coke and Chevron have centered totally on rising their dividends. Each have elevated their payouts by greater than 50% within the final 10 years. And Chevron has purchased again a boatload of inventory over the past two years. In 2023 alone, it spent a document $26 billion on dividends and buybacks.

Occidental Petroleum is a little bit of an outlier. In 2020, Oxy reduce its dividend from $0.79 per share per quarter to only $0.01 per share per quarter. It has since raised its quarterly payout a number of occasions, bringing it as much as $0.22 per share, however it hasn’t been precisely the kind of constant dividend payer Berkshire often targets.

Oxy can also be recognized for utilizing debt and leveraging up its stability sheet, which it can do to pay for its pending CrownRock acquisition.

In Berkshire’s 2023 letter to shareholders, Buffett praised Oxy’s management and wrote of his confidence within the U.S. oil and pure gasoline business. Oxy stands out as a particular play on a particular theme. It quantities to 4.1% of the general public fairness portfolio, indicating that Berkshire is taking care to handle the place to ensure it does not change into too giant.

Glorious values price contemplating now

You might be questioning, if these firms all have qualities that make them appropriate investments, then why would they commerce at a reduction to the market? A part of the reason being merely the industries that these firms are in.

Monetary shares are inclined to commerce at reductions to the market. So do client staples firms like Coca-Cola. The oil and pure gasoline sector is cyclical, so its P/E ratios are typically low throughout progress durations and excessive throughout downturns. Buyers are inclined to pay a premium for progress firms relative to slower-growing firms, and so they are inclined to favor stability versus cyclicality.

As for Apple, it has been largely unaffected by the unreal intelligence-induced tech bull market, and is dealing with slowing progress out of China and competitors from Huawei. So its valuation has come underneath stress as traders seek for firms which can be rising within the close to time period.

Sticking to a course of

Berkshire’s largest inventory holdings showcase its highest-conviction names. Berkshire has owned a few of these shares for many years. Others, like Apple, Chevron, and Oxy, are newer additions to the portfolio.

The important thing takeaway is that Berkshire is aware of what it’s on the lookout for, and targets firms that match its standards — not merely these which can be tied to whichever sizzling development is sweeping Wall Road. Berkshire invests in firms which can be good values and have engaging capital return packages via dividends and buybacks.

As a person investor, it is vital to search out the sorts of firms and sectors you want. It is also very important to be sure you align your investments together with your threat tolerance. Buffett has usually stated that Berkshire purposely retains an enormous money place and is conservative with its investments, however that is as a result of capital preservation and limiting draw back threat are integral elements of his philosophy.

In case you have a excessive threat tolerance or are a number of a long time away from retirement, taking up extra threat might make sense for you. However solely in case you are comfy with threat and have the persistence to carry onto shares via durations of volatility.

Must you make investments $1,000 in Apple proper now?

Before you purchase inventory in Apple, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Apple wasn’t one in every of them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of March 8, 2024

Financial institution of America is an promoting accomplice of The Ascent, a Motley Idiot firm. JPMorgan Chase is an promoting accomplice of The Ascent, a Motley Idiot firm. American Specific is an promoting accomplice of The Ascent, a Motley Idiot firm. Daniel Foelber has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple, Financial institution of America, Berkshire Hathaway, Chevron, JPMorgan Chase, Mastercard, and Visa. The Motley Idiot recommends Occidental Petroleum and recommends the next choices: lengthy January 2025 $370 calls on Mastercard and brief January 2025 $380 calls on Mastercard. The Motley Idiot has a disclosure coverage.

6 Dividend Shares Make Up 78.4% of Warren Buffett’s $370 Billion Portfolio, and They Are All Cheaper Than the S&P 500 was initially revealed by The Motley Idiot