The bogus intelligence (AI) market exploded final 12 months and have become one of many largest progress drivers of the Nasdaq Composite‘s restoration. The market confronted an financial downturn the earlier 12 months, which despatched numerous shares plunging. Nonetheless, the Nasdaq Composite is up 44% 12 months over 12 months and climbing, primarily because of pleasure over AI.

Based on knowledge from Grand View Analysis, the AI market is projected to have a compound annual progress fee of 37% by 2030. The trade hit practically $200 billion final 12 months, however this trajectory would see it obtain near $2 trillion by the last decade’s finish. So, regardless of the market’s meteoric rise over the past 12 months, new traders nonetheless have a lot to achieve from AI.

The “Magnificent Seven” shares of the tech world — Apple, Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), Amazon, Meta Platforms, Microsoft, Nvidia (NASDAQ: NVDA), and Tesla — are an incredible place to start out. These firms are investing closely in AI and have the model energy to go far within the trade. It is not too late to put money into AI, so listed here are two Magnificent Seven shares to purchase and maintain eternally.

1. Nvidia

Nvidia’s enterprise was introduced entrance and middle final 12 months when it snapped up an estimated 90% market share in AI graphics processing items (GPUs), the chips vital for coaching and working AI fashions. In the meantime, rivals like Superior Micro Units and Intel scrambled to catch up.

Hovering demand for AI companies led to an analogous demand for high-powered chips, with Nvidia completely positioned to produce its {hardware} to many of the market. Consequently, earnings hit file heights over the past 12 months.

Within the fourth quarter of fiscal 2024 (led to January), Nvidia’s income elevated by 265% 12 months over 12 months to $22 billion. In the meantime, working revenue jumped 983% to just about $14 billion. The monster progress was primarily from a 409% rise in knowledge middle income, reflecting elevated chip gross sales.

The chipmaker’s large success in AI has additionally seen its free money movement soar 430% in 12 months to $27 billion. Comparatively, AMD’s is at simply over $1 billion, whereas Intel’s is damaging $14 billion.

So, regardless of new GPU releases from each rivals, Nvidia’s head begin in AI probably pushed it additional forward with larger money reserves to proceed investing in its know-how and retain its market supremacy.

After a monster progress 12 months, some analysts are questioning whether or not Nvidia has rather more to supply. Nonetheless, the numerous potential of AI and the corporate’s highly effective market place means it stays a pretty long-term play.

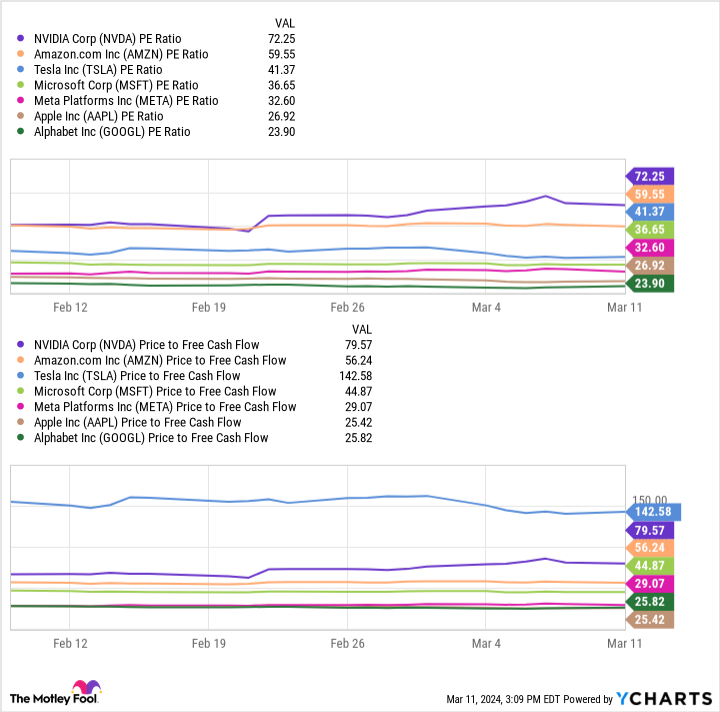

Furthermore, this chart reveals Nvidia’s price-to-earnings (P/E) ratio and price-to-free-cash-flow plunged 45% and 48% over the past 12 months, that means the corporate’s inventory is buying and selling at its finest worth in months.

Alongside a strong function in AI, Nvidia is a Magnificent Seven inventory that’s too good to cross up.

2. Alphabet

It is unimaginable to disclaim Alphabet’s prime spot in tech, with manufacturers like Android, YouTube, and Google attracting billions of customers worldwide. The recognition of those merchandise enabled Alphabet to realize a number one 25% market share in digital promoting and turn out to be the world’s sixth Most worthy firm by market cap.

Nonetheless, all eyes have been on its increasing AI efforts over the past 12 months. On the finish of 2023, the corporate debuted Gemini, a big language mannequin that appeared more likely to make Alphabet aggressive in opposition to cloud rivals Microsoft and Amazon.

But the Google dad or mum’s inventory was down 7% within the final month after a disappointing launch for Gemini. Alphabet lately held a presentation for the brand new AI mannequin, and Gemini gave inaccurate depictions of historic figures and failed to acknowledge key variations between different outstanding figures. The blunders pressured Alphabet to take its AI picture companies offline for now.

Regardless of current failures, Alphabet stays a pretty approach to put money into AI over the lengthy haul. Final 12 months, the corporate hit $70 billion in free money movement, greater than Microsoft or Amazon. The corporate has the monetary sources to maintain investing in its enterprise and the model energy to draw customers to its companies.

Moreover, the desk above reveals that Alphabet has the bottom P/E and second-to-lowest price-to-free-cash-flow of all the Magnificent Seven. Consequently, Alphabet’s inventory is a discount in comparison with its rivals, making it a lower-risk approach to put money into AI.

Along with a spread of immensely widespread manufacturers, Alphabet is likely one of the finest Magnificent Seven shares to purchase now and maintain eternally.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Nvidia wasn’t one in every of them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of March 11, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Dani Cook dinner has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2023 $57.50 calls on Intel, lengthy January 2025 $45 calls on Intel, lengthy January 2026 $395 calls on Microsoft, quick January 2026 $405 calls on Microsoft, and quick Might 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.

It is Not Too Late to Put money into Synthetic Intelligence: 2 “Magnificent Seven” Shares to Purchase and Maintain Eternally was initially printed by The Motley Idiot