China is the world’s largest EV market—and probably the most aggressive. Gross sales of “new vitality autos,” which incorporates each hybrids and battery EVs, expanded by 38% final 12 months to achieve 9.49 million items, in response to knowledge from the China Affiliation of Vehicle Producers. If the worldwide marketplace for EVs was 13.6 million final 12 months, as analysis agency Rho Movement estimates, then China is chargeable for virtually 70% of all EV gross sales final 12 months.

Because the world embraces electrical autos, China’s reasonably priced EVs might be poised for world dominance—a potential future that worries each legacy automakers and Tesla CEO Elon Musk.

Three Chinese language EV makers characteristic on the Asia Future 30, Fortune’s listing compiled in partnership with BCG that highlights 30 firms within the area finest positioned for future development. (You’ll be able to entry the complete listing right here, and the Future 50—which highlights 50 firms from all over the world—right here).

BYD, the EV big backed by Warren Buffett’s Berkshire Hathaway, is probably probably the most well-known of the three. The corporate, which received its begin as a battery maker, dethroned Tesla within the ultimate quarter of final 12 months because the world’s high vendor of battery EVs.

Two Chinese language EV startups—Nio and Li Auto—are additionally on the listing, each of which goal the premium finish of the market, competing with manufacturers like U.S.-headquartered Tesla.

But the three firms are only a few of the round 100 EV makers in China. Beijing inspired growth of the EV sector beginning within the early 2010s, handing out subsidies to each producers and customers.

The sheer quantity of producers makes China probably the most aggressive EV market on this planet: There have been as soon as as many as 500 EV firms in China, however competitors has pushed consolidation. Most EV makers are nonetheless loss-making, that means extra consolidation may come as firms exit the market.

To make issues worse, there might be a problem of oversupply simply because the tempo of development in China’s EV market exhibits indicators of slowing.

What units these firms aside from one another, and the way will they confront the problem of a extra aggressive EV market? Fortune dives into these three EV stars to say extra about what units them aside from the competitors.

BYD

Wang Chuanfu based BYD—or “Construct Your Desires—in 1995 not as a automotive firm, however as a battery maker, particularly for cellphones. The corporate expanded to the auto enterprise in 2003 after buying Xi’an Tsinchuan Vehicle, a small carmaker; it launched its first automobile, an inner combustion engine automotive known as the F3, two years later.

In 2008, BYD debuted its first plug-in hybrid electrical automobile, the F3DM. That very same 12 months, Berkshire Hathaway invested $230 million into the EV maker. Warren Buffett’s longtime enterprise accomplice, Charlie Munger, known as Wang a “mixture of Thomas Edison and Jack Welch” in a 2009 Fortune interview.

BYD is now a longtime and dominant participant in China’s EV market. The corporate, which sells each battery electrical and plug-in hybrids, is routinely among the many high month-to-month sellers of EVs within the nation.

BYD has efficiently vertically built-in operations which might enhance margins, to even having its personal ship to export its automobiles. Its historical past as a battery maker additionally provides it a bonus: BYD has an in-house battery expertise that it touts as a safer choice than the lithium-ion batteries utilized in most EVs.

“They used to have a market line about their batteries by no means catching hearth. It was fairly catchy” says Ding Yuqian, the pinnacle of China auto analysis at HSBC. She factors out that BYD is without doubt one of the few EV makers in China that makes its personal batteries, giving it a aggressive benefit over its friends.

After taking on the Chinese language market, BYD is now making an attempt to develop abroad. The EV maker has entered no less than 58 abroad markets together with Germany, Japan, Australia and Thailand. The corporate can also be constructing manufacturing services in Thailand and Brazil and has dedicated to constructing services in Hungary and Indonesia as nicely.

Its aggressive push for world growth has resulted in some regulatory blowback. BYD is one among a handful of Chinese language EV makers focused by the European Union in an anti-subsidy probe, which alleges the corporate receives an “unfair” degree of subsidies from the Chinese language authorities. (BYD, for its half, says it is simply higher managed than its European rivals)

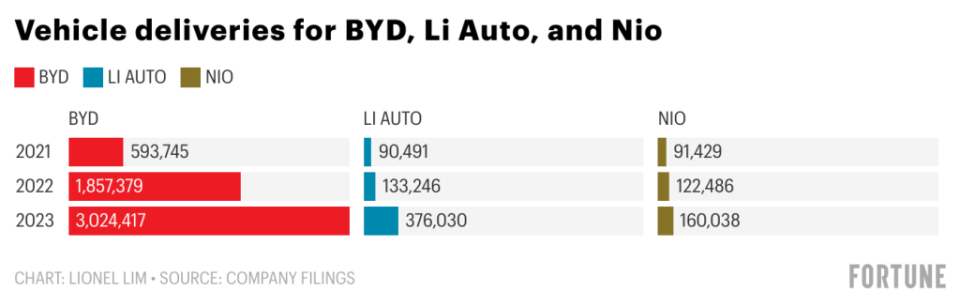

The corporate offered 3.02 million autos in 2023, beating its personal gross sales goal and surpassing Tesla in battery electrical automobile gross sales within the course of. (BYD overtook Tesla a lot earlier when together with the previous’s hybrid automobiles). An estimate launched by BYD in January stated the corporate expects 2023’s full-year internet revenue to be as excessive as 31 billion yuan ($4.3 billion), which might signify an 85% year-on-year leap.

Li Auto

The EV startup Li Auto, based in 2015, is backed by a few of China’s largest tech giants, like Meituan and ByteDance. The corporate debuted on the Nasdaq in 2020. Its founder Li Xiang launched the corporate after 20 years within the web sector, and had beforehand arrange Autohome, a web-based platform for Chinese language customers to purchase automobiles.

Li took a special route from different Chinese language EV startups by specializing in plug-in hybrids fairly than pure electrical autos. Hybrids may be powered by both petrol or electrical energy, and are sometimes positioned as a transitional expertise to encourage skeptics nervous about vary. The choice could have labored: Li Auto surpassed 10,000 fashions offered simply six months after launching its first automobile mannequin in December 2019.

Li Auto, sometimes called a Tesla competitor, targets the premium market in China. Not like BYD’s extra mass-market fashions, Li Auto’s choices are extra area of interest, akin to sport utility autos or bigger multi-purpose autos concentrating on wealthier Chinese language customers with larger households.

The corporate has solely lately entered the battery electrical automobile area with its Li Mega, the startup’s lately introduced minivan. Li Auto has launched 4 new fashions this 12 months because it embarks on a a number of product technique.

Ding, from HSBC, thinks Li Auto’s transfer to battery electrical autos will work for the corporate within the long-term as the price of batteries comes down. Customers may also respect Li Auto’s funding in quick charging capabilities. The brand new Li Mega has a vary of 500 kilometres on a 12-minute cost.

In 2023, Li Auto offered 376,030 autos, a rise of over 180% from the 12 months prior. Not like its friends, Li Auto has no plans to chop costs, pledging to launch automobiles above the 200,000 yuan worth level ($27,800) threshold, which is historically the cut-off between mass market and premium fashions.

The corporate can also be investing closely in autonomous driving, with firm president Donghui Ma predicting that self-driving automobiles shall be prepared for mass acceptance in only a few years.

Nio

Nio received its begin in 2014, after its founding by Chinese language businessman William Li. The corporate attracted backing from main Chinese language and world traders, together with Tencent, Temasek, and Lenovo. The corporate debuted on the New York Inventory Trade in 2018.

The EV startup has attracted state-backed traders as nicely. In 2020, Nio offered a 17% stake to the municipal authorities of the japanese Chinese language metropolis of Hefei. (The federal government cashed out a 12 months later, incomes an over 500% return). Then, final 12 months, Nio received a $2.2 billion funding from CYVN, an funding fund managed by the Abu Dhabi authorities.

Nio, like Li Auto, positions itself as a premium model. However the firm is putting a better give attention to R&D, design, and the consumer expertise. For instance, it has talked up its ambitions with AI-assisted driving, and has launched a Nio telephone for use with its automobiles. The telephone can be utilized to get the automotive to drive itself to the consumer’s location, or provoke self-parking.

However in addition to a premium consumer expertise and glossy design, Nio is trialling a special enterprise mannequin: Battery swapping and leasing. The corporate has invested in a battery swapping community that enables drivers to rapidly energy up their automotive by altering the facility cell, fairly than ready for the automobile to cost.

Nio can also be pushing a battery leasing choice, the place prospects can as a substitute lease the facility cell and cut back the price of their automotive by round 70,000 yuan ($9,858). A large chunk of a automobile’s price—roughly as much as 40%—is taken up by the battery.

It’s a novel, and maybe dangerous, method, says Ding. “This enterprise mannequin will not be seeing a lot duplication inside different EV firms,” she says. “A swap station might be a bit bit extra CapEx heavy within the early stage.”

Even when Nio is making an attempt to set itself aside technologically, the corporate must persuade traders that its funds are trending in the fitting path.

Nio reported a 20.72 billion yuan ($2.88 billion) internet loss in 2023, 43.5% bigger than the earlier 12 months. The corporate delivered 160,038 autos in 2023, a 30.7% enhance from a 12 months earlier. The corporate plans to launch a mass market model in Could.

The Asia Future 30, created in a partnership between Fortune and BCG, highlights 30 firms throughout Asia which might be finest poised for the long run development. You could find the listing right here.

Fortune is internet hosting the inaugural Fortune Innovation Discussion board in Hong Kong on March 27–28. Consultants, traders, and leaders of the world’s largest firms will come collectively to debate “New Methods for Progress,” or how firms can finest seize alternatives in a fast-changing world.

This story was initially featured on Fortune.com