SoundHound AI has been red-hot on the inventory market in 2024, with gorgeous features of 288% to this point. Buyers have been shopping for shares of this voice synthetic intelligence (AI) options supplier hand over fist based mostly on the idea that it may develop into the subsequent massive AI play.

The corporate’s income has been rising at a powerful tempo, and it additionally boasts of a strong pipeline that might assist it maintain its red-hot development sooner or later. What’s extra, SoundHound AI inventory has acquired a vote of confidence from AI pioneer Nvidia (NASDAQ: NVDA), which has a small stake within the firm. This can be a massive cause why shares of SoundHound have merely taken off prior to now month or so.

Nevertheless, buyers trying to purchase an AI inventory proper now is probably not snug paying 42 instances gross sales for SoundHound, which is method increased than the tech sector’s common of seven.1. In fact, it might develop into a key participant within the AI market in the long term, however SoundHound AI is at present fairly small, and is much from being worthwhile. As a substitute, buyers would do effectively to purchase shares of the next two established AI firms, which look like undervalued.

1. Nvidia

It’s possible you’ll be questioning how Nvidia is an undervalued AI inventory — it’s buying and selling at 36 instances gross sales, which is not very low cost when in comparison with SoundHound. However a better have a look at how briskly Nvidia has been rising will make it clear that buyers are certainly getting a great deal on the inventory proper now.

Nvidia’s income within the fourth quarter of fiscal 2024 (for the three months ended Jan. 28, 2024) jumped a whopping 265% 12 months over 12 months. Its adjusted earnings grew at a quicker tempo of 486% 12 months over 12 months to $5.16 per share. For comparability, SoundHound AI’s income was up 80% 12 months over 12 months within the earlier quarter to $17.1 million, whereas its adjusted loss halved on a year-over-year foundation to $0.07 per share.

What’s much more spectacular about Nvidia is that the chipmaker’s excellent development might be right here to remain. Its income steering of $24 billion for the primary quarter of fiscal 2025 implies that Nvidia’s income is on observe to greater than triple as soon as once more from the year-ago interval’s degree of $7.2 billion. Analysts have been fast to boost their development estimates. They anticipate Nvidia’s earnings to just about triple within the house of simply three fiscal years from fiscal 2024 ranges of $12.96 per share.

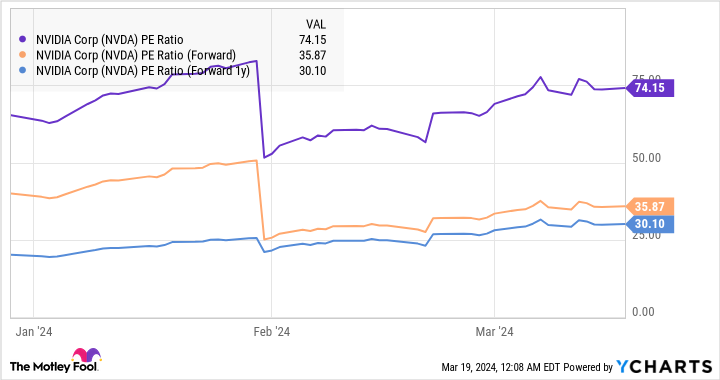

This prediction of speedy development in Nvidia’s earnings is exactly the rationale why the inventory is buying and selling at enticing ahead earnings multiples. That is evident from the chart beneath:

At 30 instances its fiscal 2027 earnings, shopping for Nvidia inventory is a no brainer proper now, as it’s buying and selling virtually in step with the Nasdaq-100’s ahead earnings a number of of 29 (utilizing the index as a proxy for tech shares). One other clear indicator of Nvidia’s undervaluation is its worth/earnings-to-growth ratio (PEG ratio) of simply 0.13; this can be a forward-looking valuation metric that helps perceive how low cost a inventory is relative to the expansion it’s anticipated to ship.

Historically, a inventory with a PEG ratio of lower than 1 is undervalued. Nvidia’s PEG ratio is effectively beneath that mark. All this means that buyers ought to think about shopping for Nvidia hand over fist, as it’s in a strong place to capitalize on the profitable long-term development alternative current in AI chips and ship wholesome features in the long term.

2. Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing (NYSE: TSM), popularly often called TSMC, is buying and selling at 10 instances gross sales and 26 instances trailing earnings. Meaning shares of the foundry large are method cheaper than shares of each Nvidia and SoundHound AI.

Contemplating the essential position that TSMC is enjoying in enabling the AI chip revolution, buyers would do effectively to get their arms on the inventory earlier than it turns into costly. In any case, Nvidia would not have been capable of run away with the AI semiconductor market with out TSMC’s assist. Nvidia is a fabless semiconductor firm, which implies that it merely designs the chips however does not manufacture them. TSMC, Nvidia’s foundry companion, does the precise manufacturing of the AI chips.

It’s value noting that TSMC is the world’s largest foundry firm, with a large share of 61%. That is effectively forward of second-place Samsung’s share of 11%. With the AI chip market predicted to clock 38% annual development by 2030, TSMC’s dominant place within the foundry house places it in an advantageous place to capitalize on the expansion alternative on provide.

That is very true contemplating that the main AI chip gamers are TSMC’s clients. From Nvidia to AMD to Intel, a number of chipmakers are lining as much as purchase chips made utilizing TSMC’s superior manufacturing processes. That is the rationale why TSMC is targeted on aggressively enhancing its month-to-month manufacturing capability of AI chips in order that it could meet the rising demand from a number of clients.

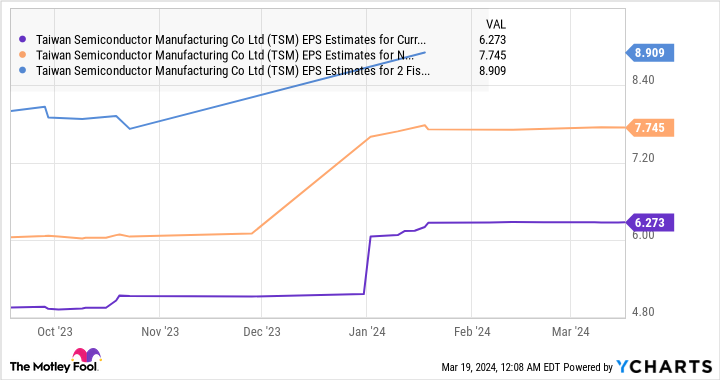

Consequently, it would not be shocking to see TSMC rising at a quicker tempo than the market’s expectations in 2024 and past. That is in all probability why TSMC’s consensus earnings estimates have been heading increased.

Assuming TSMC does handle to hit $9 per share in earnings in 2026 and trades at 29 instances earnings at the moment (in step with the Nasdaq-100’s ahead earnings a number of), its inventory worth may soar to $261. That might be a 91% soar from TSMC’s present inventory worth.

TSMC’s present earnings a number of is decrease than the Nasdaq-100’s common, which implies that buyers are getting a strong deal on this AI inventory proper now. They could not need to miss this chance given the spectacular features the inventory may ship over the subsequent three years.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of March 21, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2023 $57.50 calls on Intel, lengthy January 2025 $45 calls on Intel, and brief Might 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.

Neglect SoundHound AI: Right here Are 2 Synthetic Intelligence (AI) Shares That Are Undervalued was initially printed by The Motley Idiot