(Bloomberg) — The US industrial actual property market has been in turmoil because the onset of the Covid-19 pandemic. However New York Neighborhood Bancorp delivered a reminder that some lenders are solely simply starting to see the ache.

Most Learn from Bloomberg

The financial institution’s choices to slash its dividend and stockpile reserves despatched its inventory down a report 38% and dragged the KBW Regional Banking Index to its worst day because the collapse of Silicon Valley Financial institution final March. Japanese lender Aozora Financial institution Ltd. added to the property jitters by warning of a loss tied to investments in US industrial actual property, sending shares plunging in Asia buying and selling.

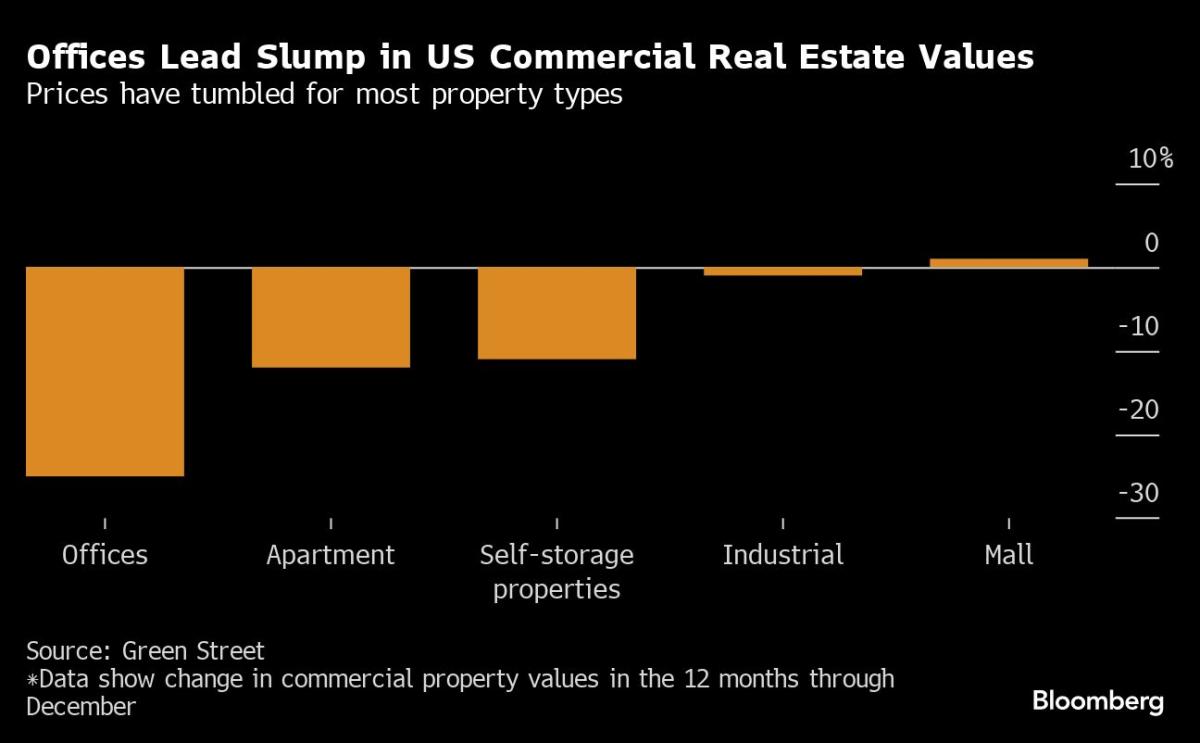

The priority displays the continued slide in industrial property values coupled with the problem predicting which particular loans would possibly unravel. Setting that stage is a pandemic-induced shift to distant work and a speedy runup in rates of interest, which have made it dearer for strained debtors to refinance. Billionaire investor Barry Sternlicht warned this week that the workplace market is headed for greater than $1 trillion in losses.

For lenders, which means the prospect of extra defaults as some landlords wrestle to pay loans or just stroll away from buildings.

“This can be a enormous challenge that the market has to reckon with,” mentioned Harold Bordwin, a principal at Eager-Summit Capital Companions LLC in New York, which focuses on renegotiating distressed properties. “Banks’ steadiness sheets aren’t accounting for the truth that there’s plenty of actual property on there that’s not going to repay at maturity.”

Moody’s Buyers Service mentioned it’s reviewing whether or not to decrease New York Neighborhood Bancorp’s credit standing to junk after Wednesday’s developments.

Learn Extra: NY Neighborhood Bancorp Plunges as Actual Property Dangers Jolt Market

Banks are going through roughly $560 billion in industrial actual property maturities by the tip of 2025, in response to Trepp, representing greater than half of the entire property debt coming due over that interval. Regional lenders particularly are extra uncovered to the business, and stand to be damage tougher than their bigger friends as a result of they lack the big bank card portfolios or funding banking companies that may insulate them.

Business actual property loans account for 28.7% of belongings at small banks, in contrast with simply 6.5% at greater lenders, in response to a JPMorgan Chase & Co. report revealed in April. That publicity has prompted extra scrutiny from regulators, already on excessive alert following final yr’s regional banking tumult.

Whereas actual property troubles, significantly for workplaces, have been obvious within the almost 4 years because the pandemic, the property market has in some methods been in limbo: Transactions have plunged due to uncertainty amongst each patrons and sellers over how a lot buildings are value. Now, the necessity to handle looming debt maturities — and the prospect of Federal Reserve rate of interest cuts — are anticipated to spark extra offers that can convey readability to only how a lot values have fallen.

These declines might be stark. The Aon Middle, the third-tallest workplace tower in Los Angeles, lately offered for $147.8 million, about 45% lower than its earlier buy value in 2014.

“Banks — neighborhood banks, regional banks — have been actually sluggish to mark issues to market as a result of they didn’t must, they had been holding them to maturity,” mentioned Bordwin. “They’re enjoying video games with what’s the actual worth of those belongings.”

Multifamily Loans

Exacerbating the nervousness surrounding smaller lenders is the unpredictability of when and the place soured actual property loans can happen, with only a few defaults having the potential to wreak havoc. New York Neighborhood Bancorp mentioned its enhance in charge-offs had been associated to a co-op constructing and an workplace property.

Whereas workplaces are a specific space of concern for actual property buyers, the corporate’s largest actual property publicity comes from multifamily buildings, with the financial institution carrying about $37 billion in condominium loans. Almost half of these loans are backed by rent-regulated buildings, making them susceptible to New York state laws handed in 2019 that strictly restrict landlords’ capacity to lift rents.

On the finish of final yr, the Federal Deposit Insurance coverage Corp. took a 39% low cost when it offered about $15 billion in loans backed by rent-regulated buildings. In one other indication of the challenges going through these buildings, roughly 4.9% of New York Metropolis rent-stabilized buildings with securitized loans had been in delinquency as of December, triple the speed for different condominium buildings, in response to a Trepp evaluation primarily based on when the properties had been constructed.

‘Conservative Lender’

New York Neighborhood Bancorp, which acquired a part of Signature Financial institution final yr, mentioned Wednesday that 8.3% of its condominium loans had been thought of criticized, which means they’ve an elevated threat of default.

“NYCB was a way more conservative lender when in comparison with Signature Financial institution,” mentioned David Aviram, principal at Maverick Actual Property Companions. “But as a result of loans secured by rent-stabilized multifamily properties makes up a bigger proportion of NYCB’s CRE e-book compared to its friends, the change within the 2019 lease legal guidelines might have a extra important impression.”

Stress is rising on banks to scale back their publicity to industrial actual property. Whereas some banks have held off on massive mortgage gross sales resulting from uncertainty over the previous yr, they’re anticipated to market extra debt now because the market thaws.

Canadian Imperial Financial institution of Commerce lately began advertising loans on struggling US workplace properties. Whereas US workplace loans make up simply 1% of their complete asset portfolio, CIBC’s earnings had been dragged down by greater provisions for credit score losses within the phase.

“The proportion of loans that banks have to this point been reported as delinquent are a drop within the bucket in comparison with the defaults that can happen all through 2024 and 2025,” mentioned Aviram. “Banks stay uncovered to those important dangers, and the potential decline in rates of interest within the subsequent yr received’t resolve financial institution issues.”

–With help from Sally Bakewell.

(Updates with Aozora Financial institution actual property warning in second paragraph)

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.