-

Nvidia’s inventory might pull again as a lot as 11% after earnings, Financial institution of America’s Vivek Arya wrote.

-

However this volatility will probably be short-lived, primarily pushed by over-bullishness and never fundamentals.

-

The upcoming GPU Tech Convention in mid-March will present the inventory with a lift.

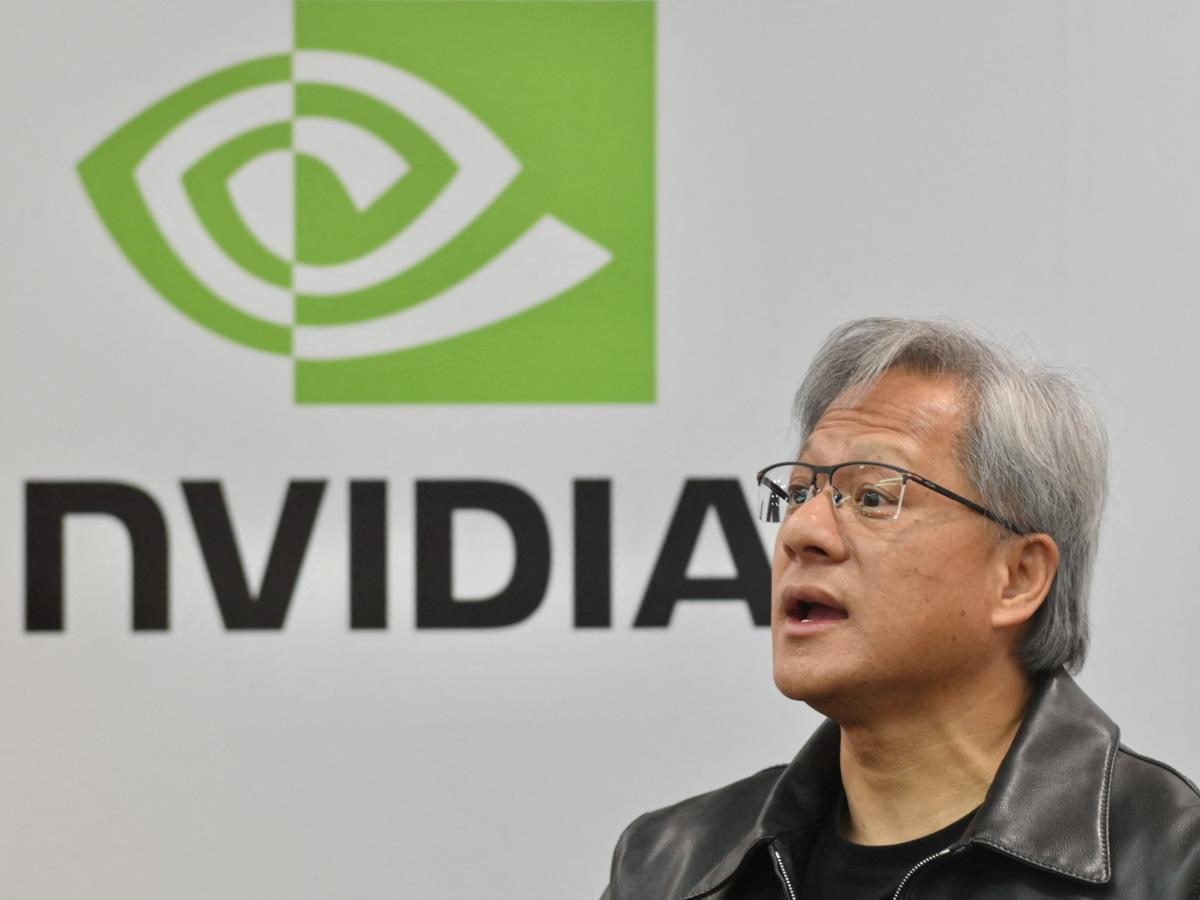

Nvidia’s speedy ascendance in mega-cap valuations retains it a prime choose for Financial institution of America analysis analyst Vivek Arya — however the inventory could possibly be in for a major pullback, he wrote on Thursday.

The chipmaker is ready to report its earnings on February 21, and traders haven’t held again on bullish expectations. Purchase-side estimates for Nvidia stand 9% above consensus, at $21.7 billion for the fourth quarter.

This dampens the potential for Nvidia to beat expectations, leaving the agency weak to an 11% implied post-earnings transfer, Arya wrote, citing Bloomberg choices. As of Friday afternoon, the inventory stands at about $740.

Although the decline could possibly be notable, it might even be transient, he wrote. Arya believes Nvidia’s failure to fulfill bullish estimates would come from supply-side elements, as a substitute of extra regarding shifts in demand and competitors.

In the meantime, volatility ought to resolve after Nvidia’s upcoming GPU Tech Convention, set for mid-March.

“As reference NVDA inventory was on common 6% larger (vs. SPX up 1%) T+1 days following the final six annual GTC occasions,” Arya mentioned.

Nvidia has remained a compelling inventory, with its valuation at 35x its price-to-earnings ratio, beneath its median.

Shares of the semiconductor producer have surged astronomically, serving to the corporate eclipse Amazon and Alphabet to develop into the third most valued agency on the S&P 500. By means of 2023 the inventory has jumped 250%, as its know-how has develop into a central part to the event of synthetic intelligence.

“We predict one interpretation of this NVDA transfer is a mixture of worry and greed and indiscriminate investor chase for all issues AI. We acknowledge these elements, however consider it understates the corporate’s strong execution and EPS revisions,” Arya wrote.

He additionally highlighted the agency’s alignment with US mandates to restrict chip shipments to China. When these mandates have been set in place in October, Nvidia redesigned a few of its semiconductors with decrease efficiency, making them permissible for Chinese language markets. The nation historically accounts for round a fifth of Nvidia’s income.

Whether or not a pullback is probably going or not, Wall Avenue has made its love for Nvidia obvious. Corporations run by billionaire traders have been growing their publicity to the chipmaker, together with these run by Ray Dalio, Paul Tudor Jones, and Stanley Druckenmiller.

Learn the unique article on Enterprise Insider