When examined with a large lens, the inventory market represents a pathway to long-term wealth creation. However when that lens is narrowed, the predictability of directional strikes within the iconic Dow Jones Industrial Common (DJINDICES: ^DJI), benchmark S&P 500 (SNPINDEX: ^GSPC), and growth-powered Nasdaq Composite (NASDAQINDEX: ^IXIC) will get tossed out the window.

Though traders are reveling within the new bull market, the Dow Jones, S&P 500, and Nasdaq Composite have traded off bear and bull markets in successive years since 2020. There’s an actual risk this sample persists in 2024, with shares plunging, as soon as once more.

Whereas there is not any such factor as a predictive indicator or financial knowledge level that may, with 100% accuracy, forecast directional short-term strikes within the Dow, S&P 500, and Nasdaq Composite, there are a number of indicators and metrics which have strongly correlated with strikes within the inventory market all through historical past. One such indicator, which has by no means been improper, given a choose set of circumstances, gives an ominous warning for traders in 2024.

This recession-forecasting instrument has an impeccable observe file courting again greater than 60 years

Although “impeccable” is a phrase not often thrown round on Wall Road, the Convention Board Main Financial Index (LEI) has a very impeccable observe file of forecasting U.S. recessions.

The LEI is reported month-to-month (normally throughout the third week of a month) and accommodates 10 inputs. Whereas three of those inputs are monetary in nature, such because the efficiency of the S&P 500, the opposite seven are nonfinancial and embody the likes of the ISM Manufacturing New Orders Index, common weekly manufacturing hours, and common weekly preliminary unemployment claims, to call a number of.

The aim of those variables is to foretell modifications within the U.S. enterprise cycle. The Convention Board particularly states that the LEI is aiming to forecast “turning factors within the enterprise cycle by round seven months.” In different phrases, it is making an attempt to foretell recessions earlier than they’re formally introduced by the Nationwide Bureau of Financial Analysis.

In January, the LEI declined by 0.4%, which marked the twenty second consecutive month it is contracted. That ties a interval between 1973 and 1975 for the second-longest consecutive month-to-month downturn within the LEI, when back-tested to 1959. Solely the 24-month contraction noticed throughout the Nice Recession (2007-2009) has lasted longer.

However it’s not the month-to-month declines which might be most regarding. Traditionally, one-year comparisons have proved way more telling for the U.S. economic system.

With regard to year-over-year modifications within the LEI, the index has seen quite a few declines which have ranged between 0.1% and three.9% since 1959. Whereas these drops should not be ignored, they’ve merely served as cautionary moments for traders and have not been indicative of a U.S. recession.

This is the place issues get fascinating: Any time the LEI has declined by at the least 4% on a year-over-year foundation, a U.S. recession has ultimately taken form. There is not a single occasion previously 60 years when the LEI fell by at the least 4% and the U.S. did not dip right into a recession. As of January 2024, the LEI is down 7% from the prior-year interval.

To be honest, shares do not essentially mirror the efficiency of the U.S. economic system. Wall Road tends to be forward-looking, which is why you typically see the Dow, S&P 500, and Nasdaq Composite backside out earlier than the U.S. economic system reaches its trough. Nonetheless, company earnings normally ebb and move with the well being of the U.S. economic system. If the Convention Board LEI maintains its pristine streak of portending U.S. recessions, the broad expectation could be for shares to plunge right into a bear market.

Wall Road is priced for perfection (and that is traditionally dangerous information, too)

The priority for traders is that the Convention Board LEI represents simply one in every of a rising variety of indicators and metrics cautioning of potential uneven waters for Wall Road within the not-too-distant future. Along with declining M2 cash provide, tighter bank-lending practices, and a heightened chance of a recession, primarily based on the steepening of the Treasury yield curve, shares are traditionally expensive.

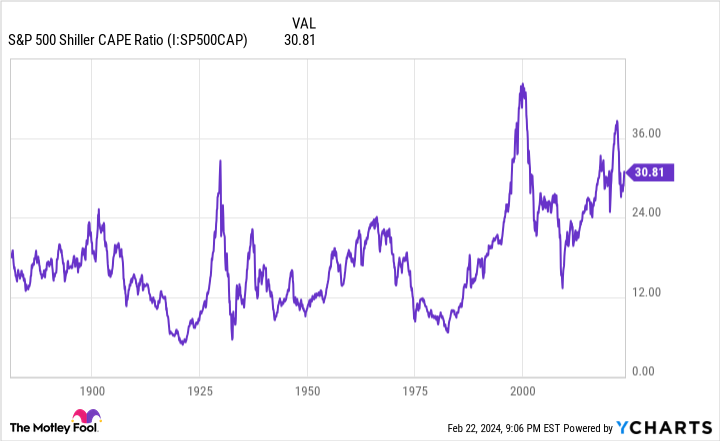

The valuation index that ought to be elevating eyebrows in the intervening time is the S&P 500’s Shiller price-to-earnings (P/E) ratio, which is also referred to as the cyclically adjusted price-to-earnings ratio (CAPE ratio).

Whereas the standard P/E ratio takes into consideration an organization’s or index’s trailing-12-month earnings per share, the Shiller P/E for the S&P 500 is predicated on common inflation-adjusted earnings from the prior 10 years. Taking a look at 10 years’ value of earnings historical past can clean out the impression of one-time occasions, such because the COVID-19 pandemic, which briefly skewed company earnings.

When back-tested to 1871, the Shiller P/E has averaged a studying of 17.09. Nonetheless, it is spent a lot of the previous 30 years nicely above this mark. The democratization of data and entry to buying and selling, because of the arrival of the web, coupled with decrease rates of interest, has bid up valuation multiples for shares as a complete.

However just like the LEI, the Shiller P/E ratio has an arbitrary line-in-the-sand determine that is traditionally represented hassle for traders. Particularly, it is when the Shiller P/E ratio surpasses and sustains 30 throughout a bull market rally.

Trying again greater than 150 years, there have solely been six cases the place the S&P 500’s Shiller P/E lifted above 30 and held this mark for an affordable interval. Following the 5 earlier cases, the S&P 500 and/or Dow Jones Industrial Common went on to lose between 20% and 89% of their worth. In different phrases, when valuations get prolonged to the upside, bear markets have traditionally adopted. As of the closing bell on Thursday, Feb. 22, the Shiller P/E had surpassed 34.

To be clear, the S&P 500’s Shiller P/E ratio is not a timing instrument. That is to say that valuations can keep prolonged for a very long time, simply as they did for 4 years between 1997 and 2001. However the lesson historical past teaches is that prolonged valuations have led to eventual sizable pullbacks within the Dow, S&P 500, and Nasdaq Composite.

Now for the excellent news

Contemplating how robust the inventory market has been over the previous 14 months, the prospect of a plunge in shares in all probability is not one thing traders need to take into consideration. However I’ve excellent news on a number of fronts.

On one hand, U.S. recessions are a traditional and inevitable a part of the financial cycle. Since World Struggle II resulted in September 1945, the U.S. economic system has labored its method via a dozen contractions. However here is the factor: 9 of those 12 recessions lasted lower than a 12 months, and the remaining three didn’t surpass 18 months in size. Financial downturns are usually blips within the grand scheme of issues.

By comparability, durations of financial enlargement can stick round for a very long time. Twice since September 1945, the U.S. economic system has loved a interval of development that hit the one-decade mark. Over prolonged durations, the American economic system goes to develop — and it is a related story with the inventory market.

Since 1950, the S&P 500 has endured 40 double-digit declines, which works out to a correction about as soon as each 1.85 years. Regardless of by no means realizing forward of time when these drops will happen, how lengthy they’re going to final, or the place the trough will finally be, historical past has proven that every one in every of these double-digit declines was ultimately absolutely recouped by a bull market rally.

An information set launched by analysts at Bespoke Funding Group final 12 months confirmed simply how disproportionate bear markets and bull markets may be on Wall Road. For the reason that begin of the Nice Despair in September 1929, the typical S&P 500 bear market has lasted 286 calendar days, or about 9.5 months. That compares to 1,011 calendar days for the typical S&P 500 bull market over the identical timeline.

Trying even additional again yields extra compelling knowledge on the facility of time and persistence as an investor.

Yearly, analysts at Crestmont Analysis replace a knowledge set that examines the rolling 20-year whole returns, together with dividends paid, of the S&P 500. Regardless that the S&P did not come into existence till 1923, its elements might be situated in different main indexes previous to its creation. This allowed Crestmont to back-test the S&P’s whole returns to 1900, which led to 105 rolling 20-year durations of knowledge (1919-2023).

The important thing discovering is that not one of the 105 rolling 20-year durations produced a unfavourable whole return. Hypothetically talking, so long as an investor held their stake within the S&P 500 or an S&P 500 monitoring index for 20 years, they might have made cash each single time.

Due to this fact, persistence and perspective are highly effective instruments when placing your cash to work on Wall Road.

The place to speculate $1,000 proper now

When our analyst group has a inventory tip, it may well pay to pay attention. In spite of everything, the e-newsletter they have run for over a decade, Motley Idiot Inventory Advisor, has almost tripled the market.*

They simply revealed what they consider are the 10 finest shares for traders to purchase proper now…

*Inventory Advisor returns as of February 20, 2024

Sean Williams has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.

Are Shares About to Plunge? A Recession Indicator That is By no means Been Fallacious Weighs In. was initially revealed by The Motley Idiot