(Bloomberg) — Arm Holdings Plc climbed 25% in premarket buying and selling after the chip designer gave a surprisingly bullish forecast, exhibiting that its push past smartphones helps gas progress and profitability.

Most Learn from Bloomberg

Income within the three months ending in March will likely be $850 million to $900 million, Arm stated in an announcement Wednesday. That compares with a median analyst estimate of $778 million. Earnings will likely be roughly 30 cents, excluding some gadgets, properly forward of the 21-cent projection.

The upbeat outlook displays an enlargement by Chief Government Officer Rene Haas into contemporary areas, together with server chips. Executives stated that the smartphone business now accounts for a couple of third of the corporate’s gross sales, underlining how profitable he’s been at spreading its bets. And telephones now include extra Arm know-how per machine, serving to elevate royalty funds.

“We’re concerned in nearly each single finish market,” Haas stated on a convention name with analysts. “And nearly each single market is placing extra compute into their gadgets.”

The information despatched Arm shares on a startling rally, with the inventory leaping 25% in premarket buying and selling on Thursday earlier than New York exchanges opened. If the surge holds up in common buying and selling, it will simply vault Arm to a file value after the corporate’s preliminary public providing final 12 months. The shares closed earlier at $77.01, up 2.5% this 12 months.

Haas and Chief Monetary Officer Jason Youngster defined that the corporate’s prospects are shifting to new model of its know-how referred to as V9, which carries twice the royalty charge of its predecessors. They’re additionally utilizing extra Arm computing cores per machine — greater than 100 in Microsoft Corp.’s new server chips, for instance — which amplifies royalties. Arm can also be gaining market share from rival know-how within the data-center and automotive markets, they stated.

Arm’s three way partnership in China was a “good constructive shock” as properly, based on Youngster. It contributed 25% of whole income.

Arm now expects gross sales of $3.16 billion to $3.21 billion in fiscal 2024, which runs by way of March. That’s up from a earlier vary that topped out at $3.08 billion.

Income grew 14% to $824 million within the fiscal third quarter. Excluding some gadgets, revenue was 29 cents a share. Wall Avenue had predicted income of $760 million and earnings of 25 cents a share.

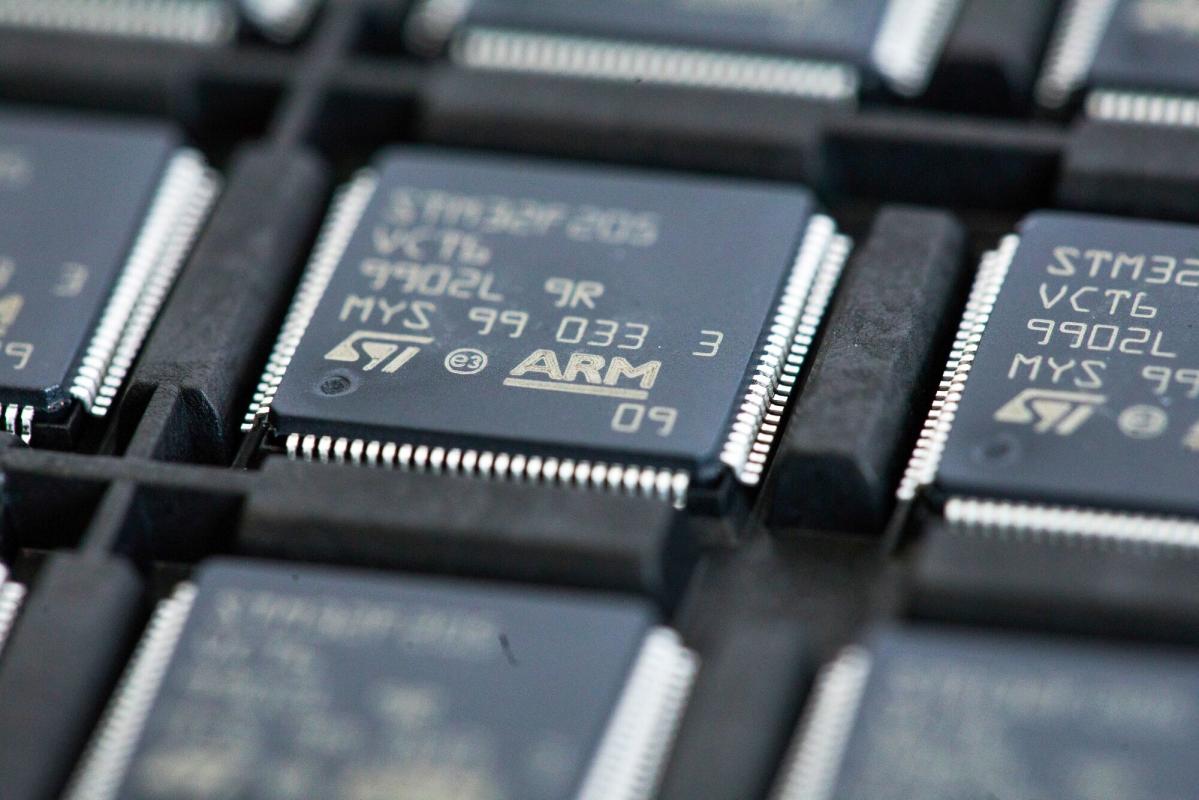

Arm has an uncommon position within the semiconductor business. It licenses the elemental set of directions that software program makes use of to speak with chips. The corporate additionally gives so-called design blocks that corporations resembling Qualcomm Inc. use to construct their merchandise.

Underneath Haas, Arm has been shifting towards offering extra full layouts that may be taken on to the manufacturing stage. That shift makes it extra helpful to some prospects, resembling cloud computing corporations like Amazon.com Inc., but in addition extra of a rival to some conventional shoppers, like Qualcomm.

Cambridge, England-based Arm remains to be 90%-owned by SoftBank Group Corp., which acquired the enterprise in 2016 for $32 billion. An IPO in 2023 raised $4.9 billion, marking the largest debut on a US change in 2023.

Arm’s licensing gross sales rose 18% to $354 million final quarter, and royalty income gained 11% to $470 million.

Arm’s buyer checklist spans the know-how business. Apple Inc. makes use of its instruction set for the processors that energy the iPhone and Mac computer systems. Amazon depends on Arm designs for its Graviton server processors for knowledge facilities. And Qualcomm and MediaTek Inc. are main customers of Arm’s blueprints for smartphone processors.

“What you’re seeing coming to life are the entire methods we’ve been engaged on for a variety of years,” Haas stated on the convention name. “Nearly as good because the final couple of quarters are, we’re simply in the beginning.”

(Updates with premarket buying and selling from first paragraph)

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.