The Axis of Resistance — that’s the Arab militaries with Iran and within the background, Russia – is aware of how one can wage financial warfare towards the US and its proxy, Israel. The Houthi sanctions on transport, for instance, are exhibiting extra effectiveness in stopping Israel-bound or Israel-linked vessels within the Crimson Sea than US sanctions have been to dam Russian oil shipments.

In attrition battle, on the financial entrance identical to the Gaza and different hearth fronts, the Axis of Resistance wins by sustaining its offensive capacities and operations for longer than the US and US-backed Israeli forces can defend. Like troops, tanks, and artillery items, the operational objective is to grind the enemy slowly however certainly into retreat, then capitulation.

measure if that is occurring now to the Israelis within the worldwide cash markets?

A global forex and bond dealer solutions by offering, first, a primer for every of the market indicators, and how one can learn them; after which a prepared reckoner for the harm being completed to Israel’s financial assets as those that function within the cash markets gauge their alternative.

For being profitable, you see, the chance of capitalizing on Israel’s defeat might quickly be extra worthwhile than investing in its success. When the markets see this opportunity at profit-making, normally lengthy earlier than the politicians and their captive media acknowledge it, there may be an inflection level within the circulate of cash. That does its harm, not by hitting the Israelis and Individuals of their bunkers with bullets and bombs, however by shifting the cash the US-backed Israeli entity wants out of attain, and chopping them off, each the US and Israel, from market confidence that they will win their battle, genocide or not.

The author of this primer and money-market evaluation has requested anonymity to guard towards retaliation from the US, Israel or their allies.

Primer for the cash markets

Understanding market indicators is essential throughout extended conflicts. To forecast the end result of the battle, you want a gauge for a way monetary markets reply to the evolving geopolitical scenario.

Opposite to the standard knowledge, the international change (foreign exchange, forex) markets are the primary markets to have a look at. There are the secure haven currencies: issuers from the strongest navy international locations – RUB (Russian Ruble), USD (United States Greenback), CNY (Chinese language Yuan), and the currencies of the buying and selling and monetary hubs, CHF (Swiss Franc), GBP (British Pound), AED (United Arab Emirates Dirham). You’ll be able to add others when they’re applicable within the circumstances of the battle you’re waging, defending, or betting on.

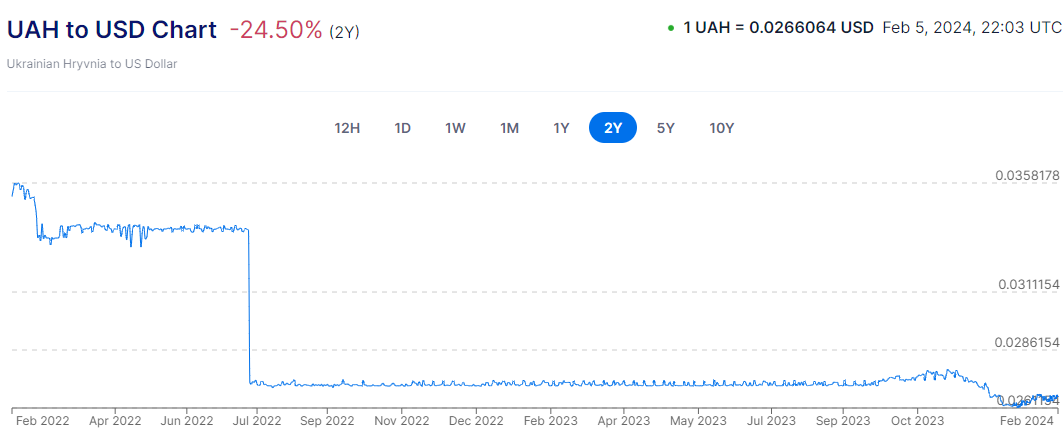

Then there are warzone or related currencies: you need to monitor the currencies of nations immediately concerned in or carefully tied to the battle. Foreign money depreciation may sign financial issues creating beneath the fog of battle – the EUR (European Union Euro), TRY (Turkish Lira), and ILS (Israeli Shekel). I don’t embrace the UAH (Ukrainian hryvnia) as it’s completely dependent now on life-support by the US and EU (with the chance of hyperinflation). The market bids up the currencies of nations that are successful their wars, and bids down the currencies of these that are shedding.

THE COLLAPSE OF UAH TO USD SINCE THE WAR BEGAN

Supply: https://www.xe.com/

Not everybody has entry to the Reuters or Bloomberg databases which merchants use. Do your personal analysis to pick out your knowledge feeds however this info has turn into extensively out there. The actual-time data-feed suppliers cost premium costs. For those who can reside with delayed quotes or secondary market makers, a lot of the longer pattern knowledge is out there at this time without cost on the web.

The intraday charts are extra for professionals or merchants having to maneuver giant positions. You must observe the time of day when the bid/ask unfold is the narrowest. That’s when most merchants are energetic on each side of the commerce. Weekends, after-business hours, or when decisive information from the battlefield is anticipated, the bid/ask unfold widens or there aren’t any costs being made. Let the customer beware when there isn’t a confidence in what is going to occur subsequent. Astute merchants exploit the arbitrage alternatives between the varied markets which view the battlefield from totally different factors of view and with totally different sources of data; on this sport you need to have huge cash and low transaction prices to play.

The longer time interval charts present underlying traits extra clearly, in addition to the forex help and resistance ranges.

The ahead market offers costs at mounted time intervals into the long run; these are certainly wagers on the long run. The spot market offers the events two enterprise days to settle the commerce. In style longer time durations are straight one week, one month, three months, six months, 9 months, and one 12 months.

Ahead contract pricing relies on rate of interest variations between the 2 markets. Because of this it is best to begin wanting on the foreign exchange spot market first.

Many cash market merchants favor to start out with authorities bond markets. Russia and China are internet creditor international locations so their bonds are comparatively skinny and even not out there because of sanctions. In an effort to transfer from one market to a different (even in bonds) merchants must transfer via the foreign exchange market, so I like to recommend beginning right here first. That is the place a lot of the liquidity is.

Non-deliverable forwards (NDFs) . are the helpful instrument operated offshore to get round buying and selling restrictions. NDFs are executed as swaps and are money settled for the variations as a substitute of the nominal quantities. In Europe most of those are settled in USD or EUR. For more information see this.

Subsequent up is the bond market.

Authorities bonds: observe the yield the unfold between quick and long run charges. Authorities bonds are purchased when different extra dangerous property are offered. That is to cut back third-party threat (if the cash is on a checking account, the financial institution owes you the cash — when you purchase a authorities bond, the federal government owes you). Governments are insensitive to modifications in market circumstances. They’ll borrow as and when they should, in addition to to roll over beforehand issued debt. New points, their quantities, and different particulars are normally printed properly upfront. Take observe if the federal government you’re following is borrowing in a international forex. That is acceptable in sure conditions however is usually an indication of weak spot.

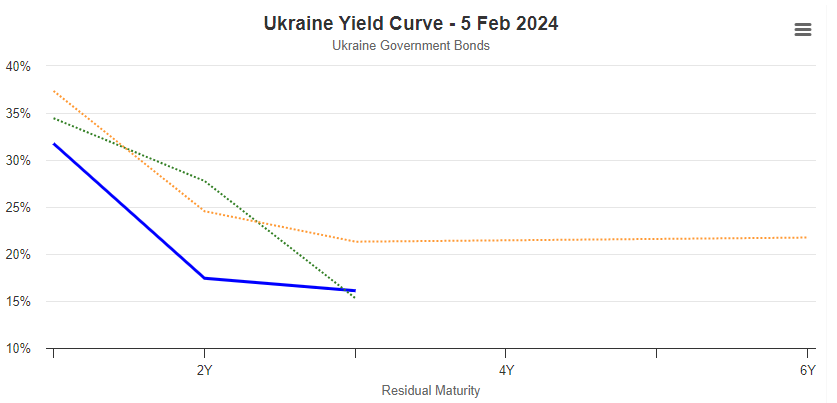

For a rustic in battle, the extra unsure the end result, the sharper the drop within the yield curve into the long run. Within the case of the Ukraine, because it loses its battle, the extra desperately it must borrow funds, and the shorter the time frame through which consumers of Ukrainian bonds will make investments with the intention to make their revenue. Observe when the yield will increase, the bond costs decline. UAH yields have needed to enhance sharply because the battle progressed. With out the sharp yield enhance the UAH bond would have been bathroom paper. It nonetheless may turn into that.

Supply: https://www.investing.com/

When there may be uncertainty within the markets, there’s a flight to security. Elevated demand for safe-haven property imply rising bond costs and decrease yields. A pointy drop in yields is a sign that cash is shifting out of the declining, riskier market. It might be shifting offshore into one other forex. Giant transactions are sometimes unfold out over time to maintain a low profile, and masks the calculations of the big-money gamers from the smalltime bettors.

Company bonds: by monitoring the spreads between company and authorities debt you might be able to observe the best way the market is calculating the chance between firms and between firms and governments. Defaults are an indication that companies are struggling to maintain their revenues and meet their prices and money owed. That is normally the sign for extra market intervention from central banks, later from governments performing with fiscal devices or regulatory and authorized measures. The bond markets ought to be adopted first as a result of they’re significantly larger than inventory markets, and tougher through which to hide expectations or rig values.

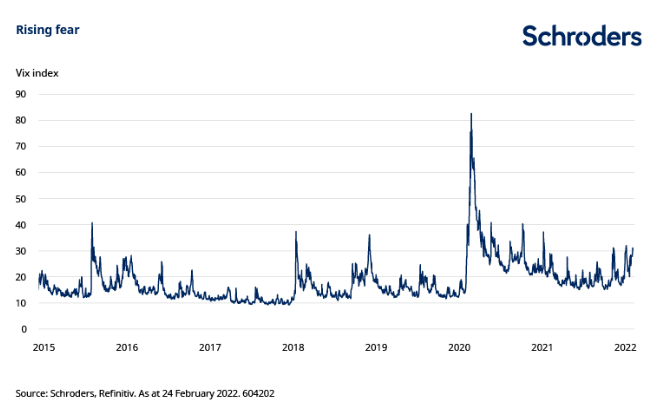

The inventory market is finest adopted by a volatility index (VIX). That is additionally known as the concern index — it measures the extent of volatility in inventory costs for the thirty-day interval forward. That is the inspiration of derivatives pricing. Growing volatility usually signifies that many merchants could have determined to depart the market. This then will increase the value unfold and reduces quantity and amount of bids/provides. Such markets could be “pushed” (manipulated) usually via spinoff contracts.

VIX REACTS TO THE START OF THE UKRAINE WAR

Evaluation at supply: https://www.schroders.com/

Battle shares are navy, weapon, and ammunition suppliers which see greater demand throughout a protracted battle. If there’s a scarcity of a specific services or products wanted by one of many belligerents and their suppliers refuse or can not broaden manufacturing /service, then you recognize the battle is misplaced. That is really the case for missile, tank, and artillery, in addition to for 155-mm artillery shell producers within the collective West. Following these shares will present you the market sentiment on how the battlefield goes for one aspect or the opposite. Chinese language and North Korean navy suppliers are nearly all state owned. They’re troublesome to observe and subsequent to unattainable to commerce.

SHARE PRICE TRAJECTORIES OF THE MAJOR US, EUROPEAN ARMS MAKERS OVER THE COURSE OF THE UKRAINE WAR

KEY: gray=Rheinmetall; inexperienced=BAE; orange=Northrup-Grumman; yellow=Raytheon (RTX). Supply: https://markets.ft.com/

Commodities: All economies rely on vitality. Geopolitical energy relies on who controls it. Provide disruptions (Houthis) or issues for international financial development (EU deindustrialization) can result in volatility in oil and fuel markets (after which purchaser’s markets).

Gold and valuable metals: Usually seen as safe-haven property, the costs are sometimes manipulated by spinoff contracts. Statistics aren’t dependable (no audited statements from key gamers just like the Federal Reserve). Refineries remelt bullion into totally different measurement bars. In the event that they produce extra measured in ounces or in kilograms for good supply, you may guess whether or not the circulate is west (collective West) or east (Russia, China). Mining and refining corporations are sometimes very properly knowledgeable (it’s their enterprise).

Commerce Balances: Modifications in commerce balances point out relative strengths usually primarily based on navy muscle offering perception into how international commerce is affected by the battle. Metal, aluminum, and concrete high the battle indicator listing. Strategic metals are the Achilles Heel for a lot of purchasers. Delivery charges are additionally an excellent main indicator.

PMI (Buying Managers’ Index): A decline in PMI might point out financial contraction, influenced by the disruption brought on by the extended battle.

Sentiment surveys of those sorts will affirm whether or not the markets are calculating in a different way concerning the course of battle than the overall sentiment, fed because it all the time is by propaganda from all sides. Cash market merchants assume that worthwhile buying and selling concepts are normally the other of the overall sentiment. They guess towards conventions, however they don’t guess at the hours of darkness. So what you see the merchants doing is usually a glimpse of what the way forward for the battle will change into – who will win, who will lose, and at what price.

Prepared reckoner for Israel now and coming

Israel is a small place with simply over 9 million inhabitants.

The foreign exchange chart for the Israeli shekel (ILS) reveals a gradual however regular devaluation towards the greenback till the start of the Hamas offensive on October 7; that’s when the decline in worth accelerated sharply. This indicators that the Jewish diaspora was sending US {dollars} to help Israeli members of the family out of labor or out of money, and countrymen trying to go away the nation. The shekel could be very thinly traded and straightforward for the Israeli warfighters to control, masking the true market impacts of the battle.

DEVALUATION OF THE SHEKEL AGAINST THE DOLLAR

Supply: https://www.xe.com/

However watch out for shekel rigging by the Israeli authorities and the Jewish diaspora within the US! That is the way it was completed within the very first days, primarily by Israel’s Central Financial institution.

Observe that in October 2023, choices merchants noticed a near-70% chance that the shekel would weaken to 4 per greenback in a month — a degree unseen since 2015 — in contrast with solely an 18% likelihood the day earlier than the Hamas operation. Intervention has introduced the shekel down from a peak of simply over 4 to three.67 this week. The shekel is among the greatest losers this 12 months amongst a basket of 31 main currencies tracked by Bloomberg.

The Tel Aviv 35 Index (TA-35) closed on February 1 at 1817.83. This quantities to a restoration from the collapse of inventory worth within the first 4 weeks of the Hamas operation, when the index hit a low of 1605.20 on October 26. Whereas this market can be straightforward for the Israeli authorities and the diaspora to rig, the rise in worth signifies how a lot confidence has been generated by the Israel Defence Forces operations in Gaza, and by market sentiment that Israeli is successful its battle towards Hamas; genocide has been constructive for the shekel and for the TA-35.

TRAJECTORY OF ISRAELI STOCK MARKET PRICE INDEX, TA-35

Supply: https://www.google.com/

The Israeli bond market is closely depending on US state and native governments for 75% of their problem (about $150 million out of a complete problem of $200 million) as of final October. This isn’t a bond market as merchants perceive it, as a result of US authorities coverage, backed by the media, and enforced by the Israel foyer and Jewish communities across the US, guarantee there isn’t a lack of confidence within the worth to maturity of the bonds. That is market rigging with a distinction – it’s spiritual and ideological, in addition to political. Even within the comparatively quick historical past of the Vatican banks, there has by no means been a time or an instance of a global faith, mixed with state governments and their navy forces, to insist that the worth of their cash is backed by their god, or G-d as they report his spelling. By definition and religion, G-d can not default; however the Israeli state can.

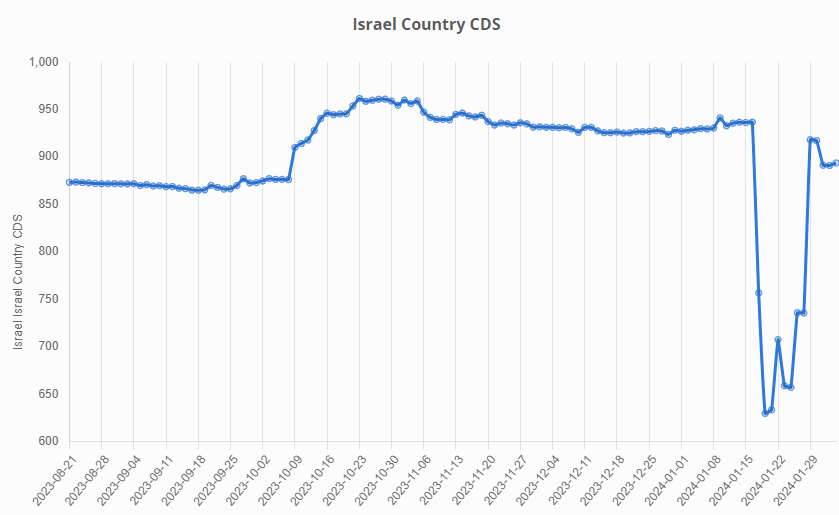

The Israel 5-year sovereign credit score default swaps (CDS) are measured and reported to point market sentiment on the chance of a default, and the premium required for upfront fee in case default happens. In current time this reached a most worth in early 2009. The instant affect of the beginning of battle final October was the small uptick seen within the chart and the flat line from then till mid-January. Since then, nevertheless, with the rising demonstration of the Ansarallah (Houthi) capability to blockade Israeli transport within the Crimson Sea and Gulf of Aden, the rise of operational strikes on the northern (Hezbollah) entrance, and the affect of recent Arab and Iranian offensive operations within the west (Syria, Iraq, Jordan), the notion of default threat has been returning to the October peak.

Supply: https://macrovar.com/

Response to those charts and values on the a part of the worldwide scores businesses has been, first to place Israel debt points on unfavourable outlook, after which, second, on downgrades. Unfavorable scores from the businesses increase the price of servicing Israel’s state and company bonds, and put stress on the state price range. A scores downgrade is a sign to the markets to go unfavourable towards the issuer – this normally follows a change in dealer sentiment.

In Israel’s case, nevertheless, there was an distinctive delay between unfavourable outlook and downgrade. The final Fitch report on Israel was dated October 17; Moody’s adopted on October 19; Normal & Poors (S&P) on October 24. There was no new scores report from Fitch, Moody’s, and Normal & Poor’s since then.

This means that giant stress is being utilized to the scores businesses and particular person analysts to not discover the regular deterioration of the IDF’s navy positions in Gaza and Lebanon; the collapse of transport into and out of the port of Eilat; and the escalation of the regional battle towards US bases supporting Israel, together with US and allied navy operations across the Arabian peninsula, bombing and missile assaults throughout Syria and Iraq.

Supply: https://www.fitchratings.com/

For evaluation of the score studies in October, click on to learn.

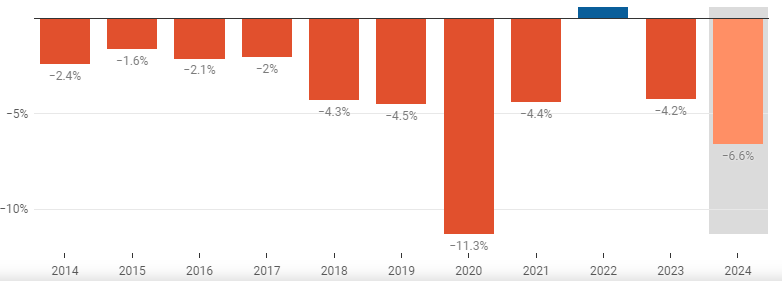

Reuters and the Israeli press have reported that Israel acknowledged a price range deficit of twenty-two.9 billion shekels in October, a leap from 4.6 billion in September; this pushed up the price range deficit over the prior 12 months to 2.6% of the nation’s Gross Home Product (GDP). The deficit ought to enhance as battle harm accumulates. Based on Reuters reporting in December, Israeli officers had been admitting then it was “not doable to plan for the chance that the battle towards Gaza’s Palestinian Hamas Islamists would stretch into March or past.”

By the tip of December, the price range deficit had risen to 4.2% of GDP. By the tip of January, the projection for this 12 months had risen to six.6%.

Bezalel Smotrich, left, is Israel’s finance minister. Supply: https://en.globes.co.il/

ISRAEL’S BUDGET DEFICIT AS PERCENTAGE OF GDP

The all-time unfavourable price range deficit/GDP ratio was recorded at 16.1% in 1981. Supply: https://tradingeconomics.com

As actual property and different tax collections collapse, Israel must make a big money name on the US. That is going to return within the close to future, simply as the federal government in Kiev has been compelled into calling on Congress because the Ukraine battle is being misplaced. The longer each wars are protracted, the extra clearly the lack of confidence expresses itself within the US Congress.

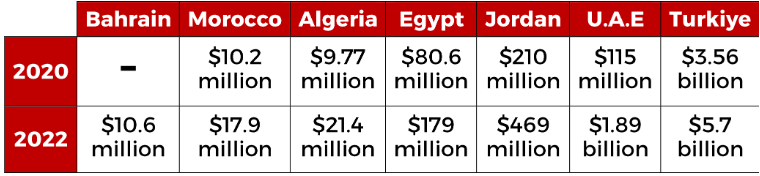

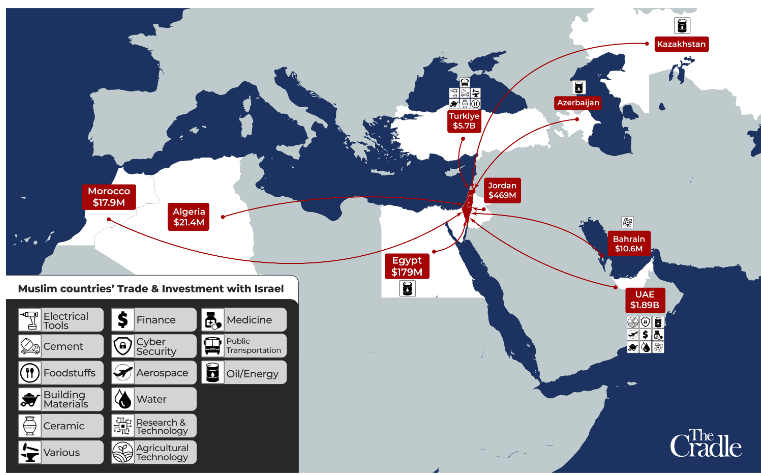

The Axis of Resistance retains its navy capacities for escalation on all fronts. However in the intervening time, the Arab states and Turkey have but to introduce a blockade of their export shipments to Israel, and again a worldwide boycott alongside the strains of the anti-apartheid marketing campaign towards South Africa from 1959 till 1994.

ARAB STATE AND TURKISH GROWTH OF TRADE WITH ISRAEL SINCE 2020

Supply: https://thecradle.co/

Supply: https://thecradle.co/

And so it involves cross that the battle of attrition isn’t just between Israel and the Palestinians, however between Israel and the US and the Arab states, Iran and the Islamic states. The extent of the battlefield is just now taking form.