(Bloomberg) — Federal Reserve Chair Jerome Powell is anticipated to double down on his message that there’s no rush to chop rates of interest, particularly after recent inflation knowledge confirmed that worth pressures persist.

Most Learn from Bloomberg

Powell is headed to Capitol Hill, the place he’ll ship his semiannual financial coverage testimony to a Home committee on Wednesday and a Senate panel on Thursday. The US central financial institution chief and practically all of his colleagues have mentioned in latest weeks that they will afford to be affected person in deciding when to chop charges given underlying energy within the US economic system.

The “hazard of transferring too quickly is that the job’s not fairly completed, and that the actually good readings we’ve had for the final six months by some means prove to not be a real indicator of the place inflation’s heading,” Powell mentioned in an interview with CBS’s 60 Minutes on Feb. 5.

That cautious method has been validated in latest weeks by knowledge exhibiting inflation picked up final month. But it surely’s not more likely to fulfill Democrats, who’re anxious about how the trail of charges might have an effect on the November presidential election and down-ballot races. They’re anticipated to press the Fed chief on why officers are preserving borrowing prices so excessive, risking injury to the economic system, after they’ve made a lot progress on inflation.

The information spotlight for the week would be the month-to-month jobs report on Friday. Economists challenge payrolls development moderated in February to 200,000 following a 353,000 surge a month earlier that was the most important in a 12 months. The jobless charge is seen holding at 3.7%, whereas hourly earnings development in all probability cooled.

On Wednesday, the Fed will difficulty its Beige Guide survey of regional enterprise contacts from throughout the nation. Different knowledge within the coming week embrace separate February surveys of buying managers at service suppliers, in addition to figures on the January commerce stability and job openings.

What Bloomberg Economics Says…

Powell is anticipated to keep up a hawkish stance in his semiannual testimony to Congress, signaling to markets that the Fed is in no hurry to chop charges. If that results in tighter monetary situations, it is going to maintain the strain on the economic system and lift the possibility of further lagged impacts from financial coverage.”

— Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou. For full evaluation, click on right here

Elsewhere, different political set-piece occasions from China’s Nationwide Folks’s Congress to the UK price range will draw consideration, as will charge selections within the euro zone and Canada which can be anticipated to point out no change.

Click on right here for what occurred final week, and beneath is our wrap of what’s developing within the international economic system.

Asia

The Nationwide Folks’s Congress in China shall be on the focus in Asia as buyers, economists and policymakers look ahead to indicators that Beijing is ready to take extra important stimulus measures.

China’s development goal for the 12 months may additionally provide clues on how aggressively the nation’s management will pursue a restoration. The newest worth knowledge and cumulative commerce figures for January and February will point out how extreme China’s slide into deflation is turning into, in addition to the dearth of main assist for the economic system by way of exports.

February inflation figures for Tokyo are more likely to present a powerful uptick because the influence of subsidies a 12 months in the past fades, an end result that would gasoline bets on a March charge hike from the Financial institution of Japan at a time when the labor market has tightened.

Board member Junko Nakagawa will present the most recent signaling from the central financial institution on Thursday.

Economists in Australia will fine-tune their development forecasts on Tuesday after present account knowledge comes out. Gross home product is due the next day, with tepid development anticipated to proceed.

Development figures for South Korea are more likely to keep largely unchanged after a revision, however client costs are anticipated to warmth up once more in knowledge due on Wednesday.

Malaysia is anticipated to maintain charges unchanged at 3% on Thursday.

Europe, Center East, Africa

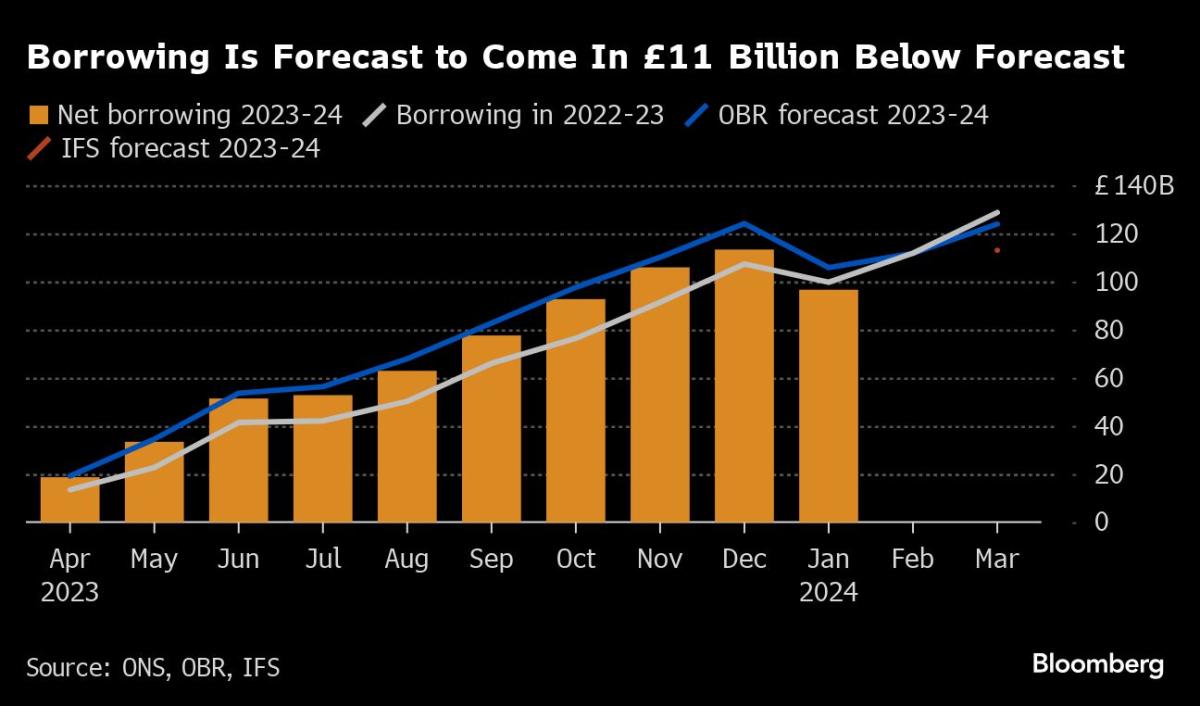

Within the UK, Chancellor of the Exchequer Jeremy Hunt will unveil his price range on Wednesday in what could possibly be the ultimate such announcement earlier than a common election that’s possible this 12 months.

Hypothesis in latest days has centered on potential giveaways for voters, and an finish to the “non dom” standing utilized by rich foreigners. Hunt might have restricted room for maneuver on tax cuts.

Within the euro zone, the European Central Financial institution choice on Thursday would be the most important occasion. Policymakers will unveil their first quarterly forecasts of the 12 months, which can present that they’re transferring nearer towards delivering a charge minimize in coming months.

Sooner-than-expected inflation in numbers launched on Friday might nonetheless give officers cause for warning, they usually’re additionally awaiting knowledge on wage offers to make sure that the complete tempo of consumer-price good points isn’t getting mirrored in pay.

Knowledge within the euro area will give a studying on the energy of producing in key economies. Industrial numbers from Germany, France and Spain are all due.

Switzerland, whose central-bank chief simply introduced his departure for later this 12 months, will launch inflation on Monday that’s anticipated by economists to have slowed to 1.2%, the weakest since 2021.

Turning east, Polish financial officers are anticipated to maintain their charge unchanged at 5.75% on Wednesday, whereas their Serbian friends the following day will reveal in the event that they’re opting to carry borrowing prices at 6.5% once more.

In Turkey, analysts predict knowledge on Monday will present inflation accelerated to 66% in February, an end result that’s roughly consistent with forecasts from the central financial institution.

And the following day in South Africa, a report is more likely to present that the nation skirted a recession, helped by an enlargement in its mining and manufacturing industries. The economic system is forecast to have grown 0.3% within the fourth quarter of 2023.

Latin America

Brazil’s January industrial manufacturing knowledge might present 2024 getting off to a powerful begin.

In Luiz Inacio Lula da Silva’s first 12 months again in workplace, output averaged 0.1%, far beneath the three.4% common seen throughout his first stint as president. Output averaged -1.2% over the following 12 years.

Brazil may even serve up the central financial institution’s weekly survey of economists, present account, overseas direct funding, month-to-month commerce figures, financial institution lending and authorities debt knowledge.

In Peru, most analysts have been wanting fo the central financial institution to ship a seventh straight quarter-point interest-rate minimize to six% at its assembly on Thursday. February inflation knowledge posted Friday exhibiting an surprising bounce in client costs possible complicates the choice.

On the ever-critical inflation entrance, the early consensus expects that client worth knowledge will present inflation slowed in Colombia and Mexico whereas rising barely in Chile.

Mexico’s double-barreled posting Thursday of mid-month and February client worth readings will possible present sufficient cooling to inexperienced gentle Banxico to ship a a lot awaited charge minimize at its March assembly.

In Colombia, each the headline and core readings will gradual to maintain BanRep easing on March 22, whereas Chile’s central financial institution — which sees inflation hitting the goal within the first half — gained’t be postpone by the slight uptick reported right here.

–With help from Paul Jackson, Vince Golle, Laura Dhillon Kane, Piotr Skolimowski, Paul Wallace, Monique Vanek and Robert Jameson.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.