(Bloomberg) — In a cavernous manufacturing corridor in Düsseldorf final fall, the somber tones of a horn participant accompanied the ultimate act of a century-old manufacturing unit.

Most Learn from Bloomberg

For a German model, click on right here. Subscribe to our German each day publication.

Amid the flickering of flares and torches, lots of the 1,600 individuals dropping their jobs stood stone-faced because the glowing steel of the plant’s final product — a metal pipe — was smoothed to an ideal cylinder on a rolling mill. The ceremony ended a 124-year run that started within the heyday of German industrialization and weathered two world wars, however couldn’t survive the aftermath of the vitality disaster.

There have been quite a few iterations of such finales over the previous 12 months, underscoring the painful actuality dealing with Germany: its days as an industrial superpower could also be coming to an finish. Manufacturing output in Europe’s greatest financial system has been trending downward since 2017, and the decline is accelerating as competitiveness erodes.

“There’s not a variety of hope, if I’m sincere,” mentioned Stefan Klebert, chief government officer of GEA Group AG — a provider of producing equipment that traces its roots to the late 1800s. “I’m actually unsure that we will halt this development. Many issues must change in a short time.”

The underpinnings of Germany’s industrial machine have fallen like dominoes. The US is drifting away from Europe and is looking for to compete with its transatlantic allies for local weather funding. China is changing into a much bigger rival and is not an insatiable purchaser of German items. The ultimate blow for some heavy producers was the tip of big volumes of low-cost Russian pure gasoline.

Alongside world volatility, political paralysis in Berlin is intensifying long-standing home points akin to creaking infrastructure, an getting old workforce and the snarl of pink tape. The training system, as soon as a energy, is emblematic of a long-term lack of funding in public companies. The Ifo analysis institute estimates that declining math abilities will value the financial system about €14 trillion ($15 trillion) in output by the tip of the century.

Learn Extra: Germany Frets Volkswagen Is Heading Down the Street to Nowhere

In some instances, the commercial downshift is going down in small steps like scaling again growth and funding plans. Others are extra evident like shifting manufacturing traces and trimming employees. In excessive situations — like Vallourec SACA’s pipe plant, as soon as a part of fallen industrial large Mannesmann — the consequence is everlasting closure.

“The shock was enormous,” mentioned Wolfgang Freitag, who labored on the plant since he was an adolescent. The 59-year-old’s job now could be to disassemble tools on the market and assist his outdated colleagues discover new work.

Germany nonetheless has an enviable roster of small, agile producers, and the Bundesbank and others reject the notion that full-blown deindustrialization is wherever shut. However with reforms stalled, it’s unclear what’s going to gradual the decline.

“We’re not aggressive,” Finance Minister Christian Lindner mentioned at a Bloomberg occasion earlier this month. “We’re getting poorer as a result of we now have no progress. We’re falling behind.”

Chancellor Olaf Scholz’s fractious coalition was thrown into additional disarray in mid-November by a funds disaster sparked by a court docket ruling over borrowing measures, leaving the federal government with little leeway to take a position.

“You don’t must be a pessimist to say that what we’re doing in the mean time received’t be sufficient,” mentioned Volker Treier, overseas commerce chief at Germany’s Chambers of Commerce and Trade. “The velocity of structural change is dizzying.”

Frustration is widespread. Though a whole bunch of hundreds of individuals have hit the streets in current weeks to protest in opposition to far-right extremism, the anti-immigration Various für Deutschland, or AfD, is forward of all three ruling events within the polls — trailing solely the conservative bloc. Scholz’s Social Democrat-led alliance has help from 34% of voters, in keeping with a Spiegel evaluation of current surveys.

Learn Extra: The Far Proper Is on the Rise in Germany and Scholz Is at a Loss

Fading industrial competitiveness threatens to plunge Germany right into a downward spiral, in keeping with Maria Röttger, head of northern Europe for Michelin. The French tiremaker is shutting two of its German crops and downsizing a 3rd by the tip of 2025 in a transfer that can have an effect on greater than 1,500 employees. US rival Goodyear has comparable plans for 2 amenities.

“Regardless of the motivation of our workers, we now have arrived at some extent the place we will’t export truck tires from Germany at aggressive costs,” she mentioned in an interview. “If Germany can’t export competitively within the worldwide context, the nation loses certainly one of its greatest strengths.”

Different examples of decline floor recurrently. GEA is closing a pump manufacturing unit close to Mainz in favor of a more recent web site in Poland. Auto-parts maker Continental AG introduced plans in July to desert a plant that makes parts for security and brake methods. Rival Robert Bosch GmbH is within the strategy of slashing hundreds of employees.

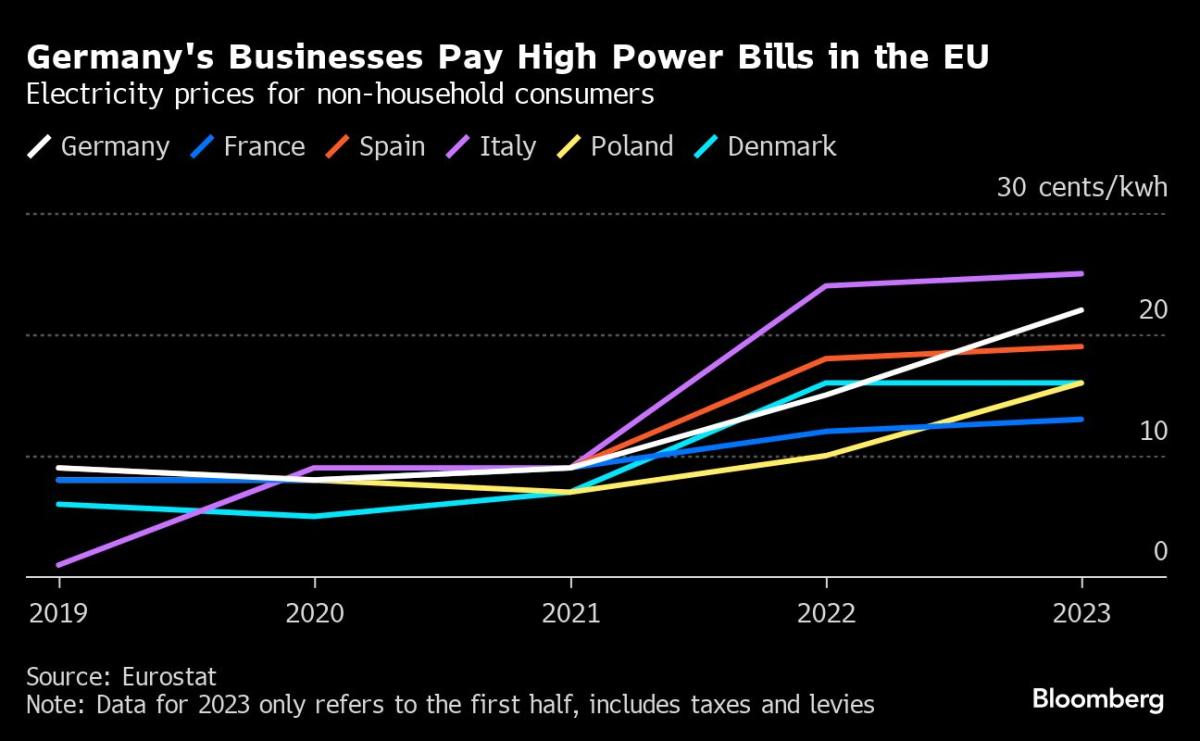

The vitality disaster in the summertime of 2022 was a serious catalyst. Whereas worst-case situations like freezing properties and rationing had been averted, costs stay larger than in different economies, which provides to prices from larger wages and regulatory complexity.

One of many hardest-hit sectors has been chemical substances — a direct results of Germany’s lack of low-cost Russian gasoline. With the transition to wash hydrogen nonetheless unsure, practically one in 10 firms are planning to completely halt manufacturing processes, in keeping with a current survey by the VCI business affiliation. BASF SE, Europe’s greatest chemical producer, is reducing 2,600 jobs and Lanxess AG is decreasing employees by 7%.

Germany’s sluggish paperwork additionally isn’t retaining tempo, even when firms are ready to take a position. GEA put in photo voltaic capability at a manufacturing unit within the western German city of Oelde, the place it makes tools that may separate cream from milk. It utilized for permits to feed within the energy final January, two months earlier than beginning development and continues to be ready for approval — practically two years after initiating the venture.

The vitality squeeze got here rapidly on the heels of disruptions from the pandemic that led to stalled meeting traces as German automakers waited months for chips and different parts, underscoring the dangers of counting on a far-flung community of suppliers, particularly in Asia.Learn Extra: Europe’s Financial Engine Is Breaking Down

China is now inflicting hassle for Germany in quite a few methods. On high of its strategic shift into superior manufacturing, a slowdown of the Asian superpower’s financial system is sapping demand for German items even additional. On the similar time, low-cost competitors from China is worrying industries key for Germany’s local weather transition — and never simply electrical vehicles.

Producers of photo voltaic panels are shuttering operations and reducing employees as they wrestle to compete with state-supported Chinese language rivals. Dresden-based Solarwatt GmbH has already minimize 10% of its workforce and should relocate manufacturing overseas if the state of affairs doesn’t enhance this 12 months, in keeping with CEO Detlef Neuhaus.

Germany’s headwinds require adaptation. For EBM-Papst, a producer of followers and ventilators, the commercial disaster meant buying a struggling provider. And to remain nimble, the corporate shifted manufacturing to parts for warmth pumps and information facilities and away from the auto sector. It’s additionally seeking to transfer some administrative duties to japanese Europe or India.

“It’s not simply vitality,” CEO Klaus Geißdörfer mentioned in an interview. “It’s additionally employees availability in Germany, which is now very tense.” Inside a decade, the working-age inhabitants will probably be too small to maintain the financial system functioning because it does immediately, he added.

The Bundesbank concluded in a September report {that a} decline in manufacturing — which accounts for just below 20% of the financial system, practically twice the US’s degree — isn’t worrying if it’s gradual.

Such a development may imply the tip of the highway for extra fundamental producers just like the pipe plant in Düsseldorf. Freitag, a member of the manufacturing unit’s works council, is now serving to put together the 90-hectare web site on the market. A lot of the tools will find yourself in a scrapyard, which “makes my coronary heart and eyes weep,” he mentioned.

–With help from Kamil Kowalcze.

(Particulars added of voter help in paragraph 14.)

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.