Again in 1992, political wonk James Carville informed Invoice Clinton, “It’s the financial system, silly,” and went on to steer his candidate towards a game-changing political win. A current notice from Goldman Sachs fairness strategist, David Kostin, reminds us of this – and factors out that this holds the important thing to understanding the bullish sentiment on shares.

Merely put, traders are betting that the financial system will present features this yr, and are enjoying shares accordingly. Though bond yields – which normally present a detrimental correlation to shares – are up, so are equities.

Describing the state of affairs, and its impression on the inventory market, Kostin writes: “An bettering financial progress outlook is one motive equities have just lately been resilient regardless of rising yields. Equities usually digest growth-driven will increase in yields much better than policy-driven will increase. Though Fedspeak seemingly contributed to the rise in yields this month, the outperformance of cyclical vs. defensive shares additionally signifies an enchancment within the fairness market pricing of the financial progress outlook to roughly 3%.”

“As traders fear much less concerning the potential for Fed tightening, progress expectations ought to grow to be a extra essential driver of yields, contributing to a much less detrimental correlation between shares and yields in 2024,” Kostin added.

Following this view, the analysts at Goldman are selecting potential winners for the months forward – and see at the very least a forty five% rally for 2 shares specifically. In truth, it’s not solely Goldman who favors these names. Utilizing the TipRanks database, we discovered that each are additionally rated as Sturdy Buys by the analyst consensus. Let’s take a better look.

Arvinas (ARVN)

We’ll begin with Arvinas, a biopharmaceutical analysis firm whose work is targeted on protein degradation. It is a comparatively new discipline within the total biopharma realm, involving the examine of the pure processes by which proteins are damaged down and faraway from residing cells, on the molecular stage. Proteins are important in all organic processes, and disruptions in protein degradation have been linked to varied ailments, as each causes and signs. Current research on this discipline have introduced new drug candidates to gentle as potential therapeutic brokers.

Arvinas boasts a analysis pipeline on the forefront of protein degradation analysis, with 12 lively tracks inspecting a number of drug candidates within the remedy of oncological circumstances like breast and prostate most cancers in addition to neurological issues like Parkinson’s and Huntington’s ailments. The protein degrading drug candidates are developed by way of the corporate’s proprietary platform, PROTAC, as a line of proteolysis concentrating on chimeras. These candidates have been developed to work with the physique’s personal pure processes for degrading and eradicating proteins – in impact, to wash out the particles from the physique, on the mobile stage.

In December of final yr Arvinas launched Section 1b knowledge on its main candidate, vepdegestrant. This candidate is a possible remedy for ER+/HER2 breast most cancers, and is underneath improvement in partnership with Pfizer. The Section 1b trial knowledge lined vepdegestrant as a mixture remedy with palbociclib, and confirmed an total response charge of 42% in ‘closely pre-treated sufferers.’ Vepdegestrant is at present the topic of two Section 3 trials, VERITAC-3, a combo trial with palbociclib, and VERITAC-2, a monotherapy examine. The drug additionally just lately obtained quick monitor designation from the FDA.

This drug candidate varieties the core of Goldman analyst Paul Choi’s outlook on the inventory. He believes that the late-stage trials will present optimistic outcomes, writing of the corporate and its late-stage pipeline, “We predict VERITAC-2 monotherapy examine is more likely to be optimistic, which together with a deliberate palbociclib mixture examine ought to result in vepdegestrant rising as the following customary of care in 2L+ ER+/HER2- breast most cancers, in-line with our KOL’s suggestions. Additional, vepdegestrant’s potential use in front-line sufferers supplies a large intermediate-to-long time period business alternative.”

Longer-term, Choi is bullish on the standard of each vepdegestrant and Arvinas’ improvement platform, and their means to develop remedy choices into different illness classes. As he says, “Additional, in opposition to the present biotech backdrop, we see the to-date scientific profile of vepdegestrant and ARVN’s PROTAC platform expertise (e.g., prostate, hematology, neurology) as putting the corporate as a possible candidate for acquirers in search of late stage oncology property, which might present extra upside over the intermediate-to-long time period.”

Quantifying his stance, Choi offers ARVN shares a Purchase ranking with a $70 value goal that implies a 47% share appreciation within the subsequent 12 months. (To look at Choi’s monitor report, click on right here)

This upbeat outlook resembles the Avenue’s total take. ARVN shares have a Sturdy Purchase consensus ranking, primarily based on 15 current critiques with a lopsided 14 to 1 cut up favoring Purchase over Maintain. The inventory’s buying and selling value of $45.97 and its common goal value of $61.67 collectively indicate a one-year upside potential of 30%. (See ARVN inventory forecast)

Fiverr Worldwide (FVRR)

We’re residing in a transitional interval, from a producing and industrial-based financial system to an info and digital-based financial system, and few areas present this variation greater than the rise of the gig work sector. It’s a type of freelance work, primarily based on particular person staff making offers instantly with prospects, utilizing the web because the medium – and the providers are infinite. Corporations like Fiverr have emerged to facilitate these gigs, connecting distributors with consumers, in addition to providing providers to enhance the character of gig work. Distributors can maintain on-line information of their work for tax functions, consumers and distributors can charge one another, and either side can seek for the opposite primarily based on kind of labor, supplied value, or geographical location.

The good incentive in gig work, for the client, is low price, an element that has additionally grow to be some extent of controversy. Critics say that gig work encourages an underclass, working for peanuts for the web wealthy. Boosters say that gig work gives anybody a fast technique to monetize a passion or a talent – and to make that cash on their very own time, in their very own method. In some methods, Fiverr’s personal existence encapsulates this debate. The corporate will get its title from the $5 price charged for each process on the platform – though now distributors on Fiverr can set their very own costs.

Fiverr obtained its begin in 2010, and has since grown from a small enterprise to a Fortune 500-level firm. At this time, Fiverr boasts greater than 400,000 lively vendor accounts, and almost 4.2 million lively consumers. There are greater than 700 service classes listed on the location, gig phrases are listed up entrance, and Fiverr gives 24/7 assist for its customers.

Fiver makes its cash primarily by way of transaction and repair charges, and within the final reported quarter, 3Q23, the corporate generated $92.5 million on the prime line. This was up greater than 12% year-over-year, and beat the forecast by $1.4 million. The corporate’s non-GAAP EPS of $0.55 beat the forecast by 9 cents. Fiverr will report 4Q23 earnings on February 22.

For Goldman’s 5-star analyst Eric Sheridan, the important thing factors listed here are Fiverr’s enterprise mannequin and the relative low cost of the shares. Sheridan writes, laying out the the reason why traders can buy in, “1) we see continued re-acceleration of income in 2024 pushed by a stabilizing macro setting (web provides bettering by way of the yr), spend per purchaser progress, worldwide progress and continued Promoted Itemizing & Vendor Plus adoption over time; 2) incremental enhancements in profitability with a deal with advertising and marketing effectivity & higher-value consumers (greater Day 1 spend, greater LTV pushed by frequency & retention, and so on.); & 3) product innovation & focus – the corporate continues to place its platform and merchandise for elevated ranges of personalization and matching capabilities, together with extra complicated tasks, with lots of these initiatives pushed by AI. Primarily based on this framework in opposition to present valuation/share value, we now see a optimistic threat/reward skew on the inventory…”

These feedback assist Sheridan’s Purchase ranking, whereas his $43 value goal factors towards a strong one-year achieve of 56.5%. (To look at Sheridan’s monitor report, click on right here)

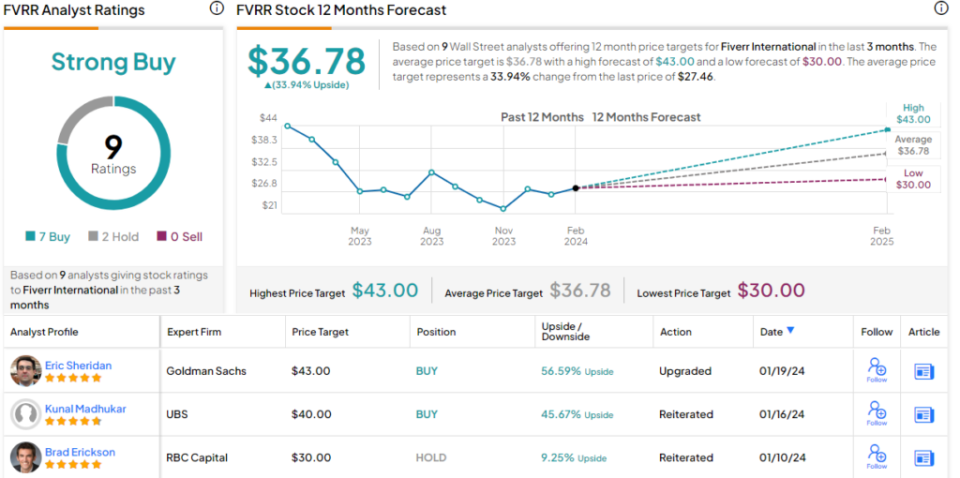

With 9 current analyst critiques, together with 7 to Purchase in opposition to 2 to Maintain, FVRR shares have earned a Sturdy Purchase consensus ranking from the Avenue. The inventory’s present buying and selling value is $27.46, and the common goal value is $36.78; collectively these indicate a achieve of 34% on the one-year horizon. (See Fiverr inventory forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Finest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely essential to do your personal evaluation earlier than making any funding.