The inventory market has gotten off to a strong begin in 2024 with the S&P 500 index already up by shut to eight% and setting new highs, and the nice half is that the market may preserve rising because of a powerful U.S. economic system and receding inflation.

Expertise shares, specifically, may have one other strong yr on the again of catalysts similar to synthetic intelligence (AI). It’s value noting that the Nasdaq-100 Expertise Sector index has jumped by greater than 62% previously yr, so it might be tough to search out bargains on this sector. However when you’ve got $1,000 to spare after paying your payments, saving sufficient for a wet day, and paying off high-interest debt, it’s possible you’ll wish to use that investible money to purchase one share of every of those two tech corporations that appear like strong buys proper now primarily based on their long-term prospects.

1. Twilio

Cloud communications specialist Twilio (NYSE: TWLO) might appear like a shocking purchase advice contemplating that it has underperformed the inventory market previously yr, dropping 18% of its worth. There was extra dangerous information for Twilio buyers when the corporate launched its fourth-quarter outcomes final month.

Although it beat expectations for the quarter and its income for the yr rose 9% to $4.15 billion, administration failed to supply full-year steerage for 2024. The corporate is finishing up an operational evaluation of its buyer knowledge platform enterprise, often known as Phase, and says it plans to challenge the 2024 steerage this month as soon as that evaluation is full.

Nevertheless, a more in-depth take a look at Twilio’s steerage for the present quarter signifies that that is going to be a tough yr for the corporate. It expects simply 2% to three% income progress within the quarter to $1.03 billion. Twilio has additionally guided for adjusted earnings of $0.58 per share on the midpoint, which might be a 23% leap from the prior-year interval. For comparability, Twilio’s full-year earnings elevated to $2.45 per share in 2023 from simply $0.15 per share in 2022, pushed primarily by its cost-cutting strikes.

The comparatively slower progress forecast for 2024 explains why some buyers have been promoting Twilio inventory. In consequence, it could possibly now be purchased for simply 2.7 occasions gross sales, which is effectively beneath its five-year common gross sales a number of of 6.5. Moreover, Twilio is buying and selling at 24 occasions ahead earnings proper now, which makes it cheaper than the Nasdaq-100‘s ahead earnings a number of of 30 (utilizing the index as a proxy for the tech sector).

Shopping for Twilio at these multiples may turn into a wise long-term transfer. That is as a result of the corporate’s slowdown is more likely to be non permanent contemplating the communications-platform-as-a-service (CPaaS) business that it operates in. Twilio’s utility programming interfaces (APIs) enable corporations to construct voice, messaging, and video functions to stay related with their clients. This enables organizations to do with out old-school bodily name facilities, which require a variety of preliminary funding.

As of October 2023, Synergy Analysis Group describes Twilio because the main participant in CPaaS with a 37% market share. In the meantime, as of June 2023, market analysis agency IDC estimates that Twilio controls almost 1 / 4 of this market. IDC additional provides that “regardless of the setbacks of slowing gross sales cycles, restructuring, and downsizing, the business continues to be one of many strongest IT sectors with attainable double-digit and worthwhile progress in attain of many corporations.”

This explains why the CPaaS market is predicted to generate virtually $30 billion in income in 2026 in comparison with $14 billion in 2022. As such, it will not be shocking to see Twilio’s progress decide up as soon as once more within the subsequent couple of years. And, if the corporate continues to manage 1 / 4 of the CPaaS market in 2026, its income may enhance to $7.5 billion primarily based on IDC’s forecast.

That might translate right into a three-year income compound annual progress fee of almost 22% primarily based on Twilio’s 2023 income. If Twilio maintains its present price-to-sales ratio of two.7, its market cap may enhance to $20 billion within the subsequent three years. That might be a pleasant leap from the present stage of just about $11 billion.

2. Nvidia

Nvidia (NASDAQ: NVDA) might seem to be one other shocking decide for buyers on the hunt for discount shares. It trades at 33 occasions gross sales and 69 occasions trailing earnings following its 244% inventory surge previously yr. By these measures, it seems to be expensive. Nevertheless, Nvidia’s ahead multiples inform a distinct story.

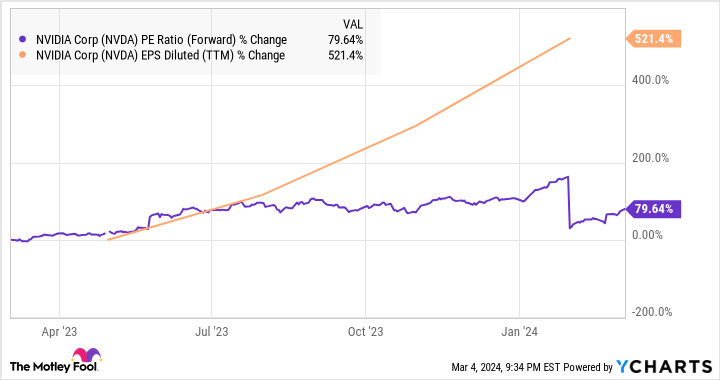

Because the chart above signifies, Nvidia’s ahead earnings and gross sales multiples have come down quickly of late. That is not shocking, as the corporate’s high and backside strains are predicted to rise sharply this yr. Analysts count on Nvidia’s earnings to leap to $24.43 per share in fiscal 2025 from $12.96 per share in fiscal 2024, which ended Jan. 28. Its high line is forecast to extend virtually 80% to $109.5 billion.

Extra importantly, Nvidia appears able to sustaining these spectacular progress charges past 2024. Analyst Vijay Rakesh of Japanese funding financial institution Mizuho estimates that Nvidia may generate $300 billion in income from AI chips by 2027. That might be a large enhance over the $47.5 billion income that it generated from its knowledge heart enterprise final yr by promoting AI chips, which was a good-looking 217% enhance from the prior yr.

There are a couple of the reason why it would not be absurd to see Nvidia’s income develop at such a panoramic tempo over the subsequent three years. First, Nvidia’s peer AMD has forecast that the worldwide AI chip market will generate $400 billion in annual income by 2027. Second, Nvidia is in a pleasant place to take advantage of this chance because it reportedly instructions a whopping 90% of this market.

Additionally, Nvidia’s efforts to maneuver into further niches of the AI chip market may ultimately assist it get near the bold income goal that Mizuho has set for it. All this means that Nvidia may turn into a high progress inventory in 2024 and past, and its low ahead multiples imply that buyers are getting a superb deal on it proper now.

One other factor value noting right here is that Nvidia has justified its valuation previously yr by clocking gorgeous earnings progress that has outpaced the expansion in its price-to-earnings ratio.

As such, Nvidia inventory seems to be like a discount contemplating the potential progress on supply, which is why savvy buyers ought to take into account shopping for it earlier than it strikes increased.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of March 11, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units, Nvidia, and Twilio. The Motley Idiot has a disclosure coverage.

Have $1,000? These 2 Shares May Be Discount Buys for 2024 and Past was initially printed by The Motley Idiot