Over the previous 12 months, there have been few higher shares to personal than Nvidia (NASDAQ: NVDA), because it’s up 400% because the begin of 2023. And 12 months to this point, it is already up almost 50%.

Sadly, I missed these positive factors after promoting my shares final July. Nonetheless, it is by no means too late to confess you are flawed and contemplate shopping for again in. However at its present inventory worth, many individuals may query this resolution. So, why am I contemplating shopping for now? Learn on to search out out.

Nvidia’s progress has been unparalleled

Nvidia’s major merchandise are GPUs (graphics processing items). This piece of computing {hardware} is tailored to deal with advanced computing duties. Initially designed to course of gaming graphics, its makes use of have been expanded to duties like drug discovery, engineering simulations, mining cryptocurrency, and coaching AI fashions.

Synthetic intelligence has been the newest demand driver for Nvidia, and its outcomes are spectacular. Within the third quarter of fiscal 2024 (ended Oct. 30), income rose an unimaginable 206% 12 months over 12 months to $18.1 billion. However the firm is not performed as administration expects fourth-quarter income to greater than triple 12 months over 12 months to about $20 billion.

Progress of this magnitude at an organization as massive as Nvidia is sort of unparalleled, making the inventory such an unimaginable story. Just lately, Nvidia surpassed Amazon and Alphabet because the third-largest U.S. firm by market cap.

After lacking out on a lot of the inventory’s meteoric rise, I consider now’s the time to appropriate that mistake.

The inventory is pricey, however it’ll look cheaper quickly

Trying again on final 12 months, I understand I misjudged the market alternative for Nvidia’s merchandise. I figured that when the preliminary onslaught of AI-driven GPU demand was over, income would fall off a cliff. That is precisely what occurred in 2019 and 2022 when the cryptocurrency market crashed and demand for GPUs dropped.

I nonetheless consider this drop will occur, but it surely will not happen almost as shortly as I anticipated. The demand for Nvidia’s GPUs is unbelievable. Take Tesla, for instance. After they spent $300 million on its Dojo laptop crammed with 10,000 H100 GPUs, I figured that may be the one one they’d construct.

However Tesla introduced it will spend one other $500 million on a second Dojo laptop powered by Nvidia GPUs at its Buffalo, NY, plant. CEO Elon Musk additionally talked about on the corporate’s This autumn convention name that they’ve plans for extra Dojo computer systems past that.

Clearly, the demand is bigger than I anticipated, and I wish to get again in on that, particularly since it is going to be a multiyear pattern. Priority Analysis estimates the worldwide GPU market will attain about $773 billion in 2032, up from $42 billion in 2022. With Nvidia’s trailing-12-month income complete of $45 billion, it has a big foothold on this rising market.

However is now actually the most effective time? It is not as I ought to’ve performed this months in the past, but it surely’s by no means too late to flip your stance on a generational firm. Many traders neglected Amazon or Netflix within the early years however nonetheless made some huge cash off these shares regardless of being late to the social gathering.

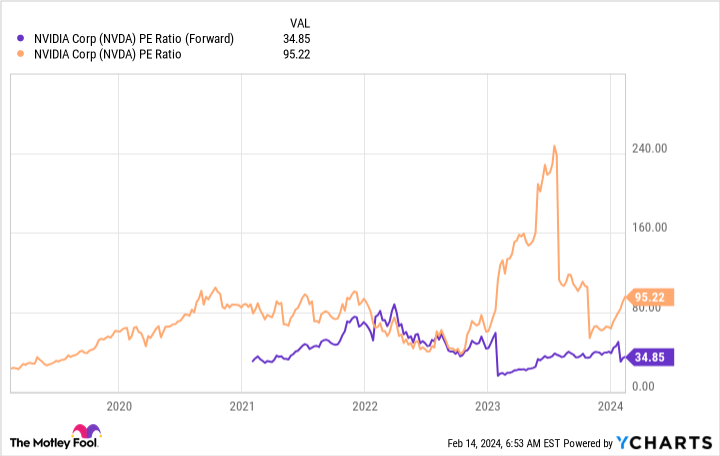

Nvidia is more likely to supply an identical alternative in the present day, assuming you’ll be able to abdomen the inventory’s price ticket, which trades for almost 100 instances earnings.

However when wanting ahead with analysts’ earnings projections over the following 12 months, the valuation is far more palatable. Microsoft trades at a comparable 35 instances ahead earnings estimates.

Whereas my place in Nvidia will seemingly be pretty small to begin, it is going to be sufficient pores and skin within the sport to observe the corporate and guarantee I am capturing the positive factors of what is seeking to be probably the most essential firms this decade. Whereas I’ve missed the primary massive transfer, there’s room for far more upside if the AI market is as huge as some predict.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Nvidia wasn’t one in every of them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 12, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Keithen Drury has positions in Alphabet, Amazon, and Tesla. The Motley Idiot has positions in and recommends Alphabet, Amazon, Microsoft, Netflix, Nvidia, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Here is Why I May Change My Thoughts and Purchase Nvidia Inventory was initially revealed by The Motley Idiot