Tremendous Micro Pc (NASDAQ: SMCI) has been one in all 2024’s greatest winners, because the inventory is up an unbelievable 209% this yr. However, in the event you observed this firm sooner, you are an excellent greater winner.

What would a $10,000 funding at first of 2020 be value now?

Supermicro is benefiting from the rise of AI

Tremendous Micro Pc has been an unbelievable success story currently, as its extremely customizable servers are beginning to see huge demand. Corporations of all sizes and styles deploy these servers, and so they can be utilized for duties like drug discovery, engineering simulation, knowledge storage, and synthetic intelligence (AI) mannequin coaching.

The latter sparked unbelievable curiosity within the inventory currently, however the pattern towards large knowledge has been occurring for fairly a while. This has been the driving pressure behind Supermicro’s inventory for even longer, and with many firms behind within the computing arms race, Supermicro stands to learn from the buildout.

However simply how profitable has the inventory been? For those who had invested $10,000 about 4 years in the past, it could be value a jaw-dropping $322,000.

Put a special approach, a $31,500 funding at first of 2020 would have made you a millionaire. A big chunk of this achieve has come since 2023 began, with much more coming in 2024 alone.

That is as a result of Supermicro is seeing unprecedented demand and expects this pattern to proceed.

Within the second quarter of fiscal yr 2024 (ended Dec. 31, 2023), Supermicro’s income rose 103% to $3.67 billion. That is fairly good, however its steering indicated 205% for the subsequent quarter.

Tremendous Micro Pc’s enterprise is robust, and the long-term outlook appears to be like nice. In Q1, administration mentioned its roadmap to $20 billion in annual gross sales. In Q2, that purpose has elevated to $25 billion.

That is nonetheless an enormous runway from what it expects to supply in fiscal yr 2024 (ending June 30), with its full-year steering coming in at $14.5 billion (elevated from Q1’s steering of $10.5 billion).

Clearly, there’s loads of upside forward for Supermicro, however is it time to take the features and deploy them elsewhere?

Tremendous Micro Pc trades on the identical ranges as Nvidia

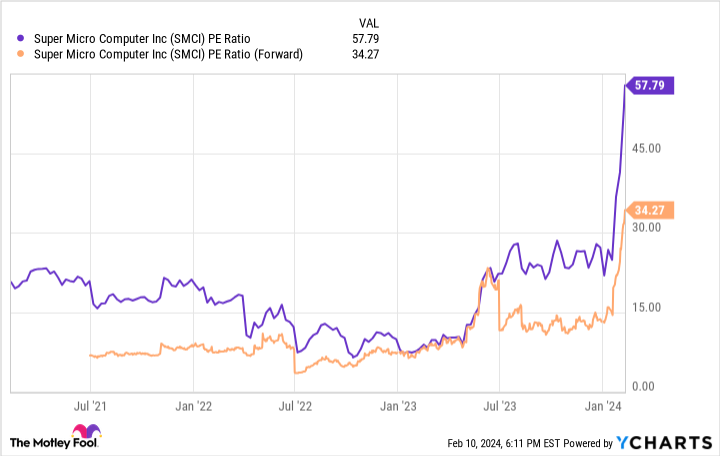

The market is properly conscious that Supermicro will put up phenomenal development over the subsequent yr, so the inventory has quickly elevated in response. This valuation spike is spectacular however ought to stage out as improved outcomes catch as much as investor sentiment.

But when it stumbles alongside the way in which, Supermicro will doubtless lose its premium price ticket in a short time.

Nonetheless, the query stays: Is 34 occasions ahead earnings too costly of a price ticket to pay for Tremendous Micro Pc? One of many different beneficiaries of AI proliferation is Nvidia, which trades at 95 occasions trailing and 35 occasions ahead earnings.

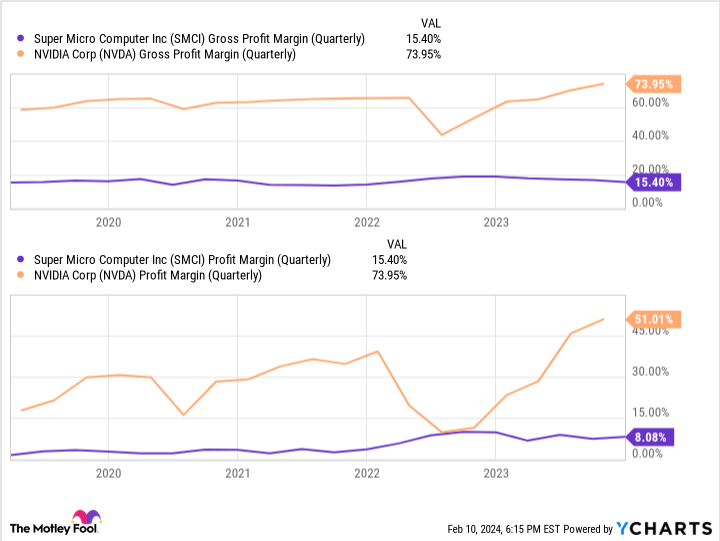

So, trying on the ahead price-to-earnings (P/E) ratio, the 2 are basically valued on the identical stage. For my cash, I would a lot relatively personal Nvidia, as Supermicro relies on Nvidia to produce its GPUs, not the opposite approach round. Moreover, Nvidia’s margin profile is way superior to Tremendous Micro Pc’s.

This isn’t to say that Tremendous Micro Pc is a nasty firm, but it surely should not be valued the identical as Nvidia, which has a far superior enterprise mannequin.

Supermicro is a superb firm that may see robust features, however I would a lot relatively personal Nvidia at its present price ticket.

Must you make investments $1,000 in Tremendous Micro Pc proper now?

Before you purchase inventory in Tremendous Micro Pc, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Tremendous Micro Pc wasn’t one in all them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 12, 2024

Keithen Drury has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot recommends Tremendous Micro Pc. The Motley Idiot has a disclosure coverage.

If You Invested $10,000 in Tremendous Micro Pc in 2020, This Is How A lot You Would Have At present was initially printed by The Motley Idiot