Pleasure round synthetic intelligence (AI) dominated the tech sector final 12 months. Particularly, megacap enterprises such because the “Magnificent Seven” produced outsize positive aspects and helped push the Nasdaq Composite over 40%. Certainly, AI tailwinds appear to have carried over into 2024 and are one of many core causes the S&P 500 is buying and selling at file excessive ranges.

Beneath the AI umbrella, one of many greatest themes surrounding the expertise is semiconductors. Particularly, Nvidia‘s main place amongst chip producers helped gas the inventory over 200% final 12 months.

Nonetheless, savvy traders perceive that there are different alternatives alongside semiconductor companies. With a market cap of simply $28 billion, Tremendous Micro Pc (NASDAQ: SMCI) will not be in your radar but. The corporate designs server and storage options and notably leverages Nvidia’s and Superior Micro Units‘ GPU methods.

As traders proceed to pour into semiconductor shares, a radical evaluation of Tremendous Micro’s enterprise could make clear tangential alternatives within the area.

What does Tremendous Micro really do?

Tremendous Micro manufactures IT structure comparable to server rack options and storage clusters. As functions for generative AI proceed to develop, demand for top finish compute and storage options also needs to rise.

On the floor, this pattern appears to be helpful for chip companies. Nonetheless, corporations like Tremendous Micro are additionally a beneficiary given their position in design options. This is the reason George Tsilis of TD Ameritrade referred to Tremendous Micro as a “stealth Nvidia” alternative. Whereas the corporate doesn’t immediately compete with chip makers, its relationship with the business’s main gamers has served as a bellwether for enterprise.

How is Supermicro performing?

During the last 12 months, Tremendous Micro has witnessed extra pronounced development as demand for AI options elevated. In actual fact, in mid-January the corporate revised steering for its second quarter of fiscal 2024, ended Dec. 31.

Initially, administration guided for gross sales between $2.7 billion and $2.9 billion for the quarter and earnings per share (EPS) between $3.75 and $4.24. Nonetheless, the corporate’s new steering referred to as for income of $3.6 billion and earnings of practically $5 per share.

Jus this week Tremendous Micro reported outcomes for its second fiscal quarter, exceeding its personal expectations. The corporate reported income of $3.7 billion, representing 103% development 12 months over 12 months and 73% development quarter over quarter. On the profitability facet, EPS grew 62% yearly to $5.10.

Whereas the monetary profile is spectacular and the corporate’s development prospects seem sturdy, an in depth evaluation of Tremendous Micro’s valuation can be prudent earlier than pouring into the inventory.

Must you put money into Supermicro inventory?

In a means, Tremendous Micro trades in tandem with its chip manufacturing cohorts. In different phrases, when Nvidia, AMD, and others tout the track of AI, Tremendous Micro inventory enjoys some elevated shopping for exercise as nicely. Whereas this will make some sense, traders ought to notice that Tremendous Micro inventory is up virtually 600% since January 2023. Furthermore, a more in-depth have a look at some valuation multiples under could shed some gentle on the corporate’s place relative to its precise competitors.

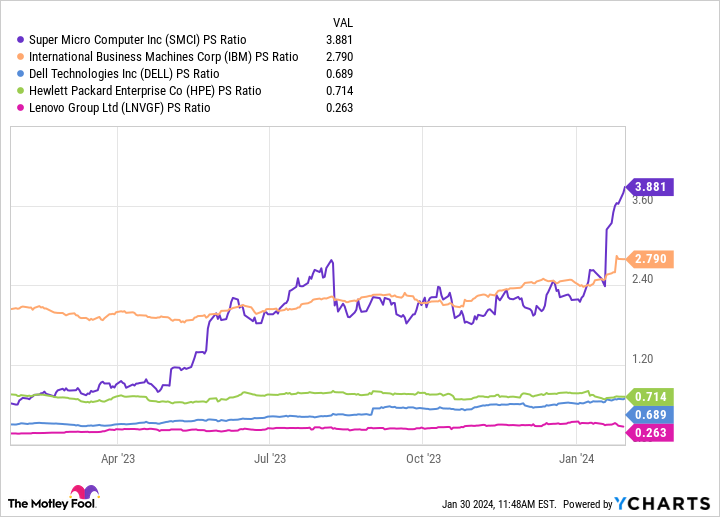

Tremendous Micro competes with different built-in methods suppliers comparable to IBM, Hewlett Packard Enterprise, Dell, and Lenovo. At a price-to-sales (P/S) ratio of three.9, Tremendous Micro inventory is the costliest amongst its cohorts based mostly on this metric — and it isn’t even shut. Moreover, the chart above clearly illustrates the extra pronounced uptick in its P/S a number of for the reason that begin of the 12 months.

Tremendous Micro might symbolize a singular alternative for traders trying to diversify their AI holdings. Nonetheless, whereas the inventory’s premium valuation appears warranted, it is also argued that it’s overbought proper now. Buyers ought to take into account that Tremendous Micro’s opponents are diversified companies with sturdy capital positions. So despite the fact that the corporate has executed a good job navigating the aggressive panorama, it’s nonetheless a comparatively nascent enterprise working amongst a lot bigger tech behemoths.

Given Tremendous Micro’s stellar development and its shut ties to main chip producers, I’m bullish on its long-term prospects however would warning traders from probably getting caught up in a momentum play. Furthermore, ought to Tremendous Micro proceed to distinguish amongst its bigger opponents, the corporate could also be price a place in your portfolio. For now, probably the most prudent motion could also be to regulate the corporate’s updates and its capability to execute on its development forecasts.

Must you make investments $1,000 in Tremendous Micro Pc proper now?

Before you purchase inventory in Tremendous Micro Pc, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Tremendous Micro Pc wasn’t one in every of them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of January 22, 2024

Adam Spatacco has positions in Nvidia. The Motley Idiot has positions in and recommends Superior Micro Units and Nvidia. The Motley Idiot recommends Worldwide Enterprise Machines and Tremendous Micro Pc. The Motley Idiot has a disclosure coverage.

Right here Is 1 Synthetic Intelligence (AI) Inventory I Have My Eyes On in 2024. Trace: It is Not Nvidia or AMD. was initially revealed by The Motley Idiot