Up a whopping 1,720% over the previous 5 years, semiconductor firm Nvidia (NASDAQ: NVDA) has produced life-changing returns for traders. Nevertheless it’s not a brand new act. The inventory is up an much more spectacular 87,000% over its lifetime.

A real millionaire maker.

Immediately, at a humungous $1.5 trillion market cap, it in all probability will not proceed multiplying in dimension. In spite of everything, America’s whole annual financial output is value $28 trillion. However that does not imply Nvidia nonetheless cannot aid you retire a millionaire.

Buyers can confidently purchase and maintain Nvidia in a diversified portfolio and benefit from the compounding returns which can be probably on the best way.

I will talk about how Nvidia can nonetheless change your monetary fortunes beneath.

AI is right here to remain, however maintain expectations lifelike

Nvidia constructed an incredible firm by specializing in devoted graphics processing items (GPUs). These are laptop chips designed for intense workloads like high-end gaming. As know-how superior over time and demanded higher-performing {hardware}, Nvidia’s chips started spreading to new finish markets like cryptocurrency mining, autonomous driving, and, sure, synthetic intelligence (AI).

The corporate has develop into the dominant AI chip provider briefly order. Nvidia constructed a software program ecosystem that made it simple for patrons to implement and develop AI fashions on Nvidia chips. Immediately, Nvidia has an estimated 90% market share, and it is believed the AI chip market may develop to sizes starting from $120 billion to $400 billion by 2027 (and will continue to grow past that).

No matter the place the numbers in the end land, AI is clearly an incredible alternative. Because the dominant chip firm, Nvidia may technically seize a lot of that development, however traders could need to pump the brakes. There isn’t any doubt Nvidia will stay a big consider AI, however competitors will aggressively chase it. Moreover, some extra outstanding AI chip customers may design in-house {hardware}; some are already engaged on it.

The underside line is that Nvidia will proceed rising, nevertheless it’s unlikely that Nvidia will keep its latest tempo.

A money cow is born

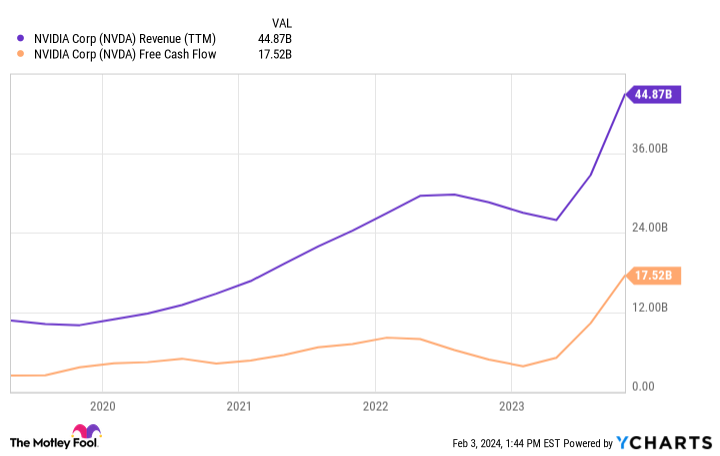

The excellent news is that is OK. Nvidia does not must develop into some $10 trillion firm to make you extraordinarily rich over the long run. It is simply going to occur in a different way than traders are used to. You see, Nvidia is already extremely worthwhile, and its large income development is making it a money cow.

Nvidia has transformed 39% of its income to free money circulation over the previous 4 quarters, totaling $17.5 billion. Analysts presently estimate $109 billion for the fiscal yr ending January 2026. Money circulation margins may enhance as Nvidia grows, however that is nonetheless about $40 billion in money circulation even when they do not.

Placing that money to work will make millionaires

The place am I going with this? There is a good probability that Nvidia’s large money circulation and what it does with that cash will drive funding returns over the subsequent decade and past. Shareholders may see Nvidia’s income trickle right down to them as dividends and share repurchases. The corporate already pays a dividend, although its yield is hilariously low at 0.03% due to how a lot shares have risen.

Shareholders will probably be too giddy to snort if administration raises the dividend quicker. The dividend solely prices Nvidia about $394 million, a rounding error to the corporate at this time. I am extra optimistic that Nvidia will flip right into a cannibal, repurchasing staggeringly massive quantities of inventory to spice up its earnings-per-share (EPS) as income development finally slows.

You’ll be able to see that administration just lately started urgent this button, so traders could possibly be at first of an extended stretch the place repurchases decrease the share rely, making yours value extra.

Nvidia is just too huge to be the lottery ticket it as soon as was. However is Nvidia able to serving to you retire a millionaire? Completely.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Nvidia wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 5, 2024

Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.

May Nvidia Inventory Assist You Retire a Millionaire? was initially revealed by The Motley Idiot