(Bloomberg) — Micron Know-how Inc., the most important US maker of pc reminiscence chips, is heading in the right direction for its largest acquire in additional than 12 years after giving a surprisingly robust income forecast for the present quarter, buoyed by demand for synthetic intelligence {hardware}.

Most Learn from Bloomberg

Fiscal third-quarter income will likely be $6.4 billion to $6.8 billion, the corporate stated in a press release Wednesday. That compares with a mean analyst estimate of $5.99 billion. Micron could have earnings of about 45 cents a share, minus sure gadgets. Analysts projected 24 cents.

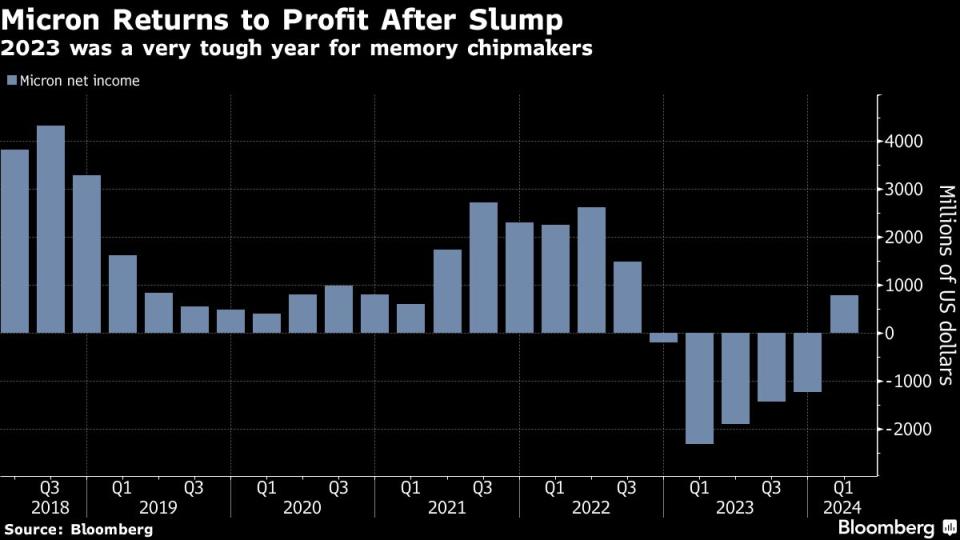

Micron and its rivals are rising from one of many worst slumps the reminiscence chip trade has suffered, triggered by weak demand for private computer systems and smartphones. However executives are optimistic in regards to the future because the booming marketplace for AI gear helps chipmakers return to development and profitability.

“We imagine Micron is likely one of the largest beneficiaries within the semiconductor trade of the multiyear alternative enabled by AI,” Chief Government Officer Sanjay Mehrotra stated within the assertion.

The shares rose 18% to $113.30 in premarket buying and selling on Thursday. If the beneficial properties maintain, Micron will likely be set for its largest leap since Dec. 22, 2011 and hit its highest stage on report. That they had climbed 13% to $96.25 this yr via the shut on Wednesday.

Mehrotra has promised buyers that 2024 will mark a rebound for the trade and 2025 will see report gross sales ranges. However Micron might want to make sufficient ultrafast reminiscence, which works with Nvidia Corp. chips to assist knowledge heart operators develop AI software program.

AI-related programs use one thing referred to as high-bandwidth reminiscence, or HBM. That kind of chip is new and fewer of a commodity. Meaning firms like Micron can cost a a lot larger worth for it.

Micron obtained its first income from a type of this reminiscence referred to as HBM3E in its most up-to-date quarter. The semiconductors are a part of Nvidia graphics chip-based AI accelerators, Micron stated. And Micron expects “a number of hundred million” {dollars} of income from HBM merchandise in fiscal 2024. Nearly all of its manufacturing of such chips is bought out for 2025, it stated.

AI software program is created by bombarding software program with info. The method can contain trillions of parameters and is extremely reliant on reminiscence. To be able to keep away from bottlenecks and hold costly processors working flat-out, Micron and its opponents have developed chips that talk with different parts a lot sooner than conventional reminiscence chips.

Nvidia CEO Jensen Huang stated earlier this week that HBM was greater than only a reminiscence improve — it’s a technical marvel that’s very important to AI programs. He talked about Micron as a frontrunner in bringing the brand new know-how to market.

Within the second quarter, which ended Feb. 29, Micron’s income rose 58% to $5.82 billion. The Boise, Idaho-based firm had earnings of 42 cents a share, excluding sure gadgets. That compares with estimated gross sales of $5.35 billion and a projected lack of 24 cents a share.

“Micron has returned to profitability and delivered optimistic working margin 1 / 4 forward of expectation,” Mehrotra stated on a convention name with analysts.

Micron competes with South Korea’s Samsung Electronics Co. and SK Hynix Inc. in promoting chips that present short-term reminiscence in computer systems and telephones. Micron additionally makes flash reminiscence, which supplies longer-term storage in these units.

Each varieties of reminiscence comply with trade requirements, which means that components from totally different firms are interchangeable and might be traded like commodities. The draw back is that costs might be risky, and clients can change from one provider to a different.

Reminiscence-chipmakers have been making an attempt to push into new markets, resembling knowledge facilities, automobiles and an growing array of devices — making them much less depending on telephones and PCs. However they haven’t change into diversified sufficient to offset the swings in demand inside their core markets, as they skilled in 2023.

Micron is trying to makers of private computer systems and smartphones to return to regular ordering. Lots of them had scaled again demand to attract down the stock they’d readily available. Weak ordering from these clients pushed chip costs down beneath the price of manufacturing final yr.

Earlier Wednesday, the US Division of Commerce introduced it should award Intel Corp. $8.5 billion in grants and as a lot as $11 billion in loans to assist fund an growth of its semiconductor factories within the US. The announcement was the most important disbursement so removed from the Biden administration’s Chips and Science Act. No different huge chipmakers have to date been publicly promised assist.

Micron stated it’s sustaining its price range for brand new crops and tools for fiscal 2024 at $7.5 billion to $8 billion. It is going to proceed with tasks in China, Japan and India. Proposed US expansions — in New York State and Boise — “require Micron to obtain the mix of enough Chips grants, funding tax credit, and native incentives to handle the associated fee distinction in comparison with abroad growth,” Mehrotra stated.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.