“Just a few good concepts is all you want. And while you discover the few, you need to act aggressively. That is the Munger system.”-Charlie Munger

Growth! $150,000 lands in your pocket out of nowhere.

What would you do? Purchase a brand new automotive? Embark on the holiday of a lifetime? Renovate your own home?

If I have been to search out myself in such a hypothetical situation, I do know what I’d do: I would observe Charlie Munger’s recommendation and make investments it — maybe $50,000 every into three shares. Perhaps it might go one thing like this:

1. Visa

First up is Visa (NYSE: V), the world’s largest payment-processing firm.

Discover that I referred to as Visa a payment-processing firm quite than a bank card firm. That is as a result of Visa would not challenge credit score or debit playing cards. Certainly, opposite to standard perception, Visa would not supply prospects credit score, set charges, or cost charges. As a substitute, Visa companions with monetary establishments like banks and credit score unions by providing entry to the Visa-branded cost community (for a price).

That is a key distinction, as Visa has no credit score danger. It additionally means the corporate’s income is basically tied to the quantity of funds and transactions on its community.

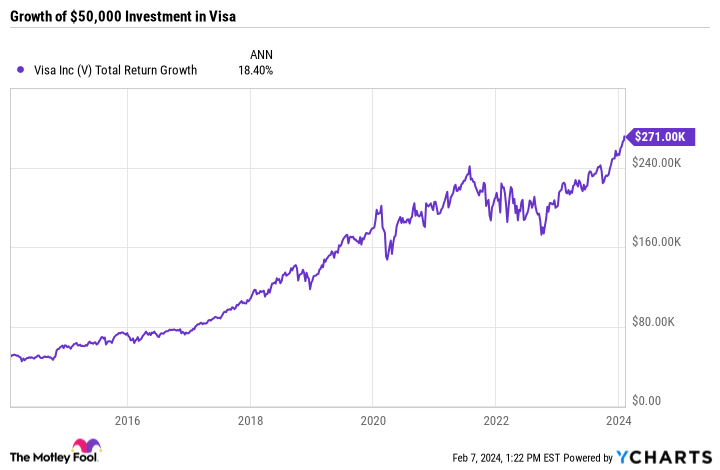

At any fee, Visa’s no-nonsense enterprise mannequin has delivered distinctive shareholder beneficial properties. Over the past decade, Visa’s inventory has generated an annualized whole return (worth appreciation plus dividend funds) of 18.4%.

Meaning $50,000 invested in Visa 10 years in the past could be price $271,000 right this moment — not too shabby. Nevertheless, I even have my eye on some spicier picks.

2. CrowdStrike

Subsequent up is a youthful, faster-growing firm. It is CrowdStrike (NASDAQ: CRWD), a pacesetter in AI-driven cybersecurity options. Whereas I worth Visa for its regular development, CrowdStrike is all about potential.

The corporate is rising income at a 35% year-over-year fee as of its most up-to-date quarter (the three months ending on Oct. 31, 2023). Furthermore, the general cybersecurity market that CrowdStrike goals to fulfill is rising by leaps and bounds.

Briefly, that is as a result of cybercrime is booming. Hackers — searching for cash, political retribution, or chaos — are operating amok proper now. Massive organizations, starting from large-cap firms to governments and non-profits, are all scrambling to guard their networks, harden their defenses, and safeguard their information.

Extra to the purpose, some analysts count on the cybersecurity market to develop by 50% to $274 billion by 2028 — presenting a major alternative for cybersecurity corporations like CrowdStrike.

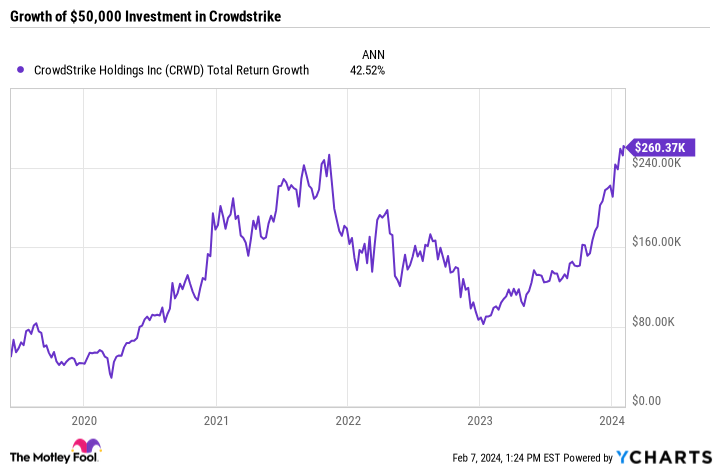

At any fee, CrowdStrike’s inventory has rewarded buyers since its debut in 2019. Its whole return since then is greater than 423% or nearly 43% yearly.

In different phrases, $50,000 invested in CrowdStrike’s Preliminary Public Providing (IPO) on June 12, 2019, could be price $260,000 as of the time of this writing.

That is a formidable return, and if CrowdStrike shares develop at that fee over the following decade, my hypothetical portfolio could be effectively on its strategy to $1 million.

Nevertheless, I nonetheless have one last decide to make.

3. Nvidia

Final, we arrive at Nvidia (NASDAQ: NVDA). For my part, no different inventory can match Nvidia’s mixture of precise outcomes and potential.

As for the outcomes, they’re plain to see. Meta Platforms, Microsoft, Amazon, Tesla, and lots of others are shopping for all of the Nvidia AI chips they will get their fingers on. And but, the demand appears insatiable as a result of the world cannot get sufficient of synthetic intelligence (AI).

For his half, Nvidia Chief Govt Officer (CEO) Jensen Huang put it this fashion: “For the very first time, due to generative AI, laptop know-how goes to affect actually each single business and each single nation.”

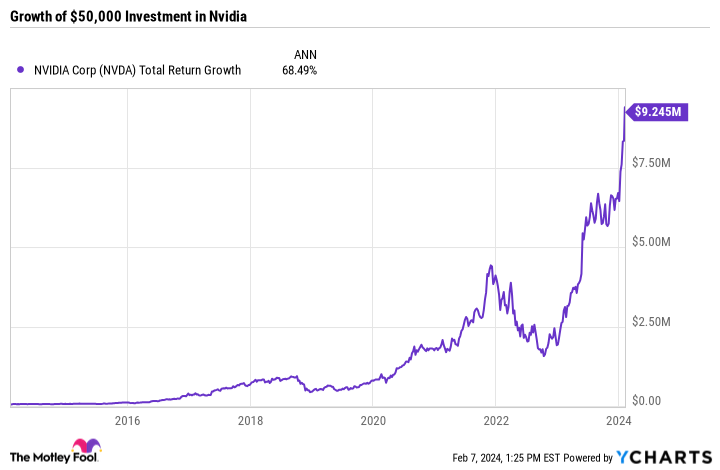

So, given the large demand for AI chips, it ought to come as no shock that Nvidia has been probably the greatest shares to personal over the past 10 years.

Certainly, a $50,000 funding made in Nvidia shares 10 years in the past would now be price an astronomical $9.2 million as of this writing.

It is laborious to imagine {that a} comparable return is feasible for Nvidia shares over the following 10 years, however nobody actually is aware of.

One factor is definite: The world is determined for extra AI merchandise, which suggests extra AI chips. Nvidia is presently the market chief, however others, like AMD and Intel, wish to catch up. Furthermore, some massive tech names like Alphabet and Apple are growing their very own AI chips, given the profitable nature of the market.

Nonetheless, Nvidia is effectively positioned to learn from the surge in AI demand for a few years. And that is why it beneficial properties the ultimate place in my hypothetical portfolio.

Must you make investments $1,000 in Visa proper now?

Before you purchase inventory in Visa, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Visa wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 5, 2024

Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Jake Lerch has positions in Alphabet, Amazon, CrowdStrike, Nvidia, Tesla, and Visa. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Alphabet, Amazon, Apple, CrowdStrike, Meta Platforms, Microsoft, Nvidia, Tesla, and Visa. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2023 $57.50 calls on Intel, lengthy January 2025 $45 calls on Intel, and quick February 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.

Need $1 Million in Retirement? Make investments $50,000 in These 3 Shares and Wait a Decade was initially revealed by The Motley Idiot