(Bloomberg) — Nvidia Corp.’s annual synthetic intelligence convention is simply days away and expectations are excessive for the semiconductor maker to ship information that can maintain the blistering rally in its inventory.

Most Learn from Bloomberg

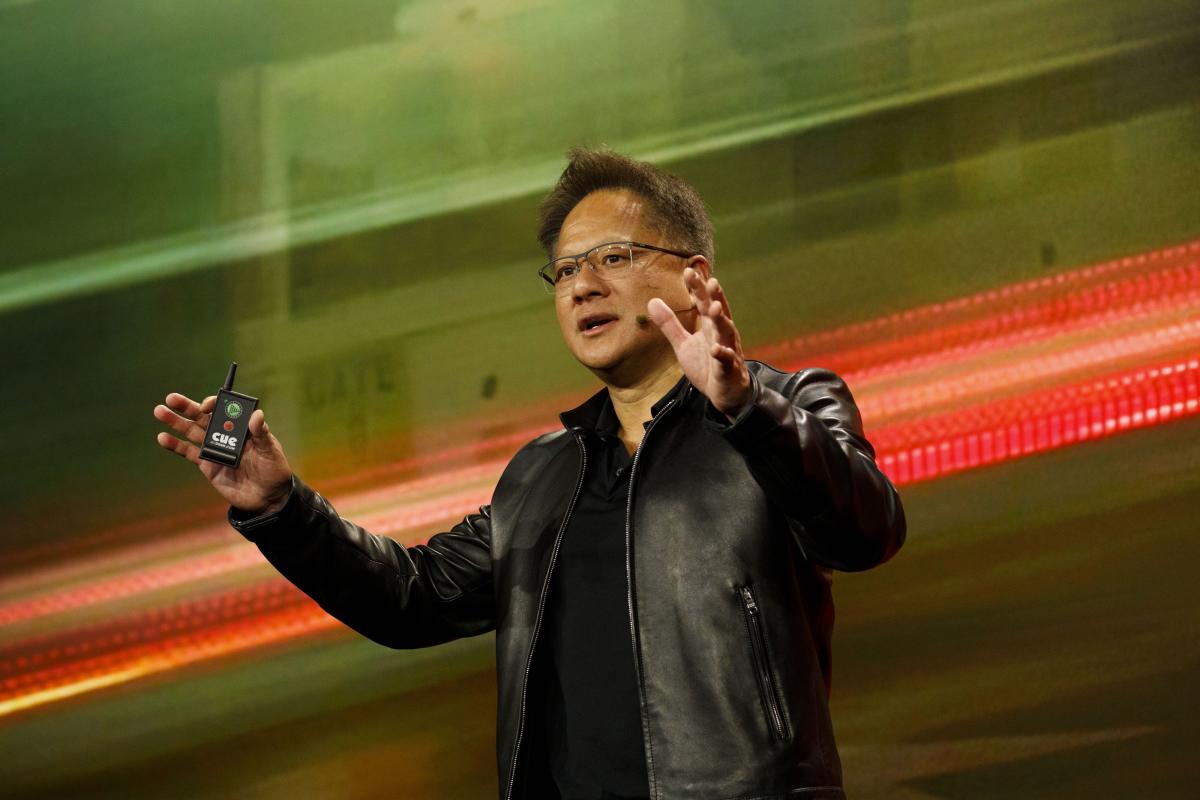

“Nvidia GTC,” the corporate’s graphics processing unit expertise occasion, has shortly grow to be a world AI convention for builders. It runs from March 18-21 in San Jose, California, with Chief Govt Officer Jensen Huang resulting from communicate on the opening day. His feedback might assist Nvidia inventory finish a bout of volatility and resume its surge of greater than 80% this yr.

“It’s an enormous catalyst as a result of they’ll in all probability give extra data, not solely on business penetration,” mentioned Ted Mortonson, expertise desk sector strategist at Robert W. Baird & Co. He in contrast the gathering to Apple Inc.’s yearly product launch.

Huang sometimes kicks off the occasion with an introduction of latest merchandise and a top level view of his newest imaginative and prescient for the place expertise is headed. He’ll be underneath stress to indicate off improvements that may replicate the wild success of the H100 chips for knowledge facilities and cement Nvidia’s main place on this profitable market.

This yr’s look carries extra weight after Nvidia’s 2024 positive aspects alone added $1 trillion in market worth for the corporate, catapulting it right into a place because the top-performing inventory within the S&P 500 Index. It’s been a bumpy trip for traders for the reason that March 7 report shut: on Tuesday, the shares snapped the worst two-day drop in 5 months, solely to slip once more on Wednesday. In early buying and selling Thursday, shares had been down greater than 1%.

A few of that volatility is probably going resulting from merchants positioning forward of subsequent week’s occasion. Choices knowledge present that traders are paying an rising premium for calls to revenue from an increase in costs because the assembly approaches, particularly for short-term contracts.

“It’s sort of just like the Apple product introductions — all people tries to get in entrance of it,” mentioned Mortonson. “The million-dollar query is for those who get promoting on the information after Jensen’s keynote presentation.”

The occasion is so essential to the shares that Financial institution of America analysts led by Vivek Arya have dubbed it the “AI Woodstock.” They’ve raised their Nvidia worth goal to $1,100 from $925 forward of the convention.

Even after virtually quadrupling up to now 12 months, Nvidia’s valuation means that there’s nonetheless room for additional positive aspects, in keeping with BofA. The inventory now trades at a decrease a number of than when ChatGPT was launched in November 2022, Arya wrote.

And Wall Road is overwhelmingly bullish on Nvidia heading into the occasion. The corporate has 60 purchase rankings, seven holds and 0 sells amongst analysts tracked by Bloomberg.

“I really feel very comfy and assured the place the extent of demand is and upside to just about each estimate I’ve seen on the market, in all probability together with our personal for the following 12 to 18 months,” TD Cowen analyst Matthew Ramsay mentioned in an interview. He has an outperform score and $900 worth goal on Nvidia.

Whereas expectations are optimistic main into the San Jose occasion, analysts and traders alike are conscious that Nvidia inventory is buying and selling close to technically overbought ranges that might spark one other pullback. Due to its measurement — it rocketed into the ranks of the three largest S&P 500 shares this yr — sharp strikes in any path might swing the complete market.

Nvidia “is a reputation that’s being held to very excessive expectations and they also have the stress to proceed to carry out,” mentioned Chris Carey, a portfolio supervisor at Carnegie Funding Council. “In the event that they don’t, it’s going to be a shock within the brief time period, after which a chance as effectively.”

Blended in with issues that hype round Nvidia’s management in AI is baked into the inventory, there’s additionally the chance for extra optimistic momentum, relying on what comes out of an occasion that has traditionally given shares a lift.

“There’s a lot hypothesis and a lot over-exuberance on this identify that it doesn’t actually commerce on valuation anymore,” mentioned Mortonson. “It’s consider within the dream, so to talk, and the dream is occurring.”

High Tech Tales

-

Hon Hai Precision Business Co. reported its second straight quarter of sturdy revenue development after profitable AI {hardware} gross sales helped offset weak point in iPhone and electronics demand.

-

ByteDance Ltd.’s human sources chief has taken the helm of the corporate’s sharply decreased gaming division and can refocus the enterprise on extra private content material, avoiding a head-on conflict with Tencent Holdings Ltd.

-

SoftBank Group Corp. is exploring a possible funding in Mistral AI, the French firm rising as Europe’s hottest synthetic intelligence startup, folks with data of the matter mentioned.

-

Reddit Inc. is telling potential traders in its preliminary public providing that it expects income in 2024 to develop by greater than 20% versus the earlier yr, in keeping with an individual acquainted with the state of affairs.

-

The destiny of an app utilized by 170 million People is now within the palms of 100 senators. Even earlier than the Home handed a measure, 352 to 65, on Wednesday to ban TikTok except its Chinese language proprietor divests it, the short-video app had turned its lobbying efforts to the Senate, the place many a earlier legislative juggernaut has gone to die.

Earnings Due Thursday

-

Premarket

-

Postmarket

-

Adobe

-

Smartsheet

-

PagerDuty

-

Mix Labs

-

Kodak

-

–With help from David Marino and Ian King.

(Updates inventory strikes at market open)

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.