Relating to synthetic intelligence (AI), the “Magnificent Seven” — Microsoft, Apple, Alphabet, Amazon, Meta Platforms, Tesla, and Nvidia (NASDAQ: NVDA) — garner essentially the most consideration from Wall Road.

Every of those corporations is taking part in a significant position in speedy modifications throughout e-commerce, cloud computing, client electronics, robotics, promoting, and extra. However among the many Magnificent Seven, Nvidia could also be taking part in a very powerful position. The corporate’s graphics processing models (GPU) are fueling purposes throughout the generative AI spectrum — from machine studying and quantum computing to information facilities.

Throughout its fiscal 2024 fourth-quarter earnings name on Feb. 21, Nvidia CEO Jensen Huang declared that “accelerated computing and generative AI have hit the tipping level.” With Nvidia refill over 230% within the final 12 months, some buyers could also be questioning what Huang meant, and if it is too late to purchase shares.

Let’s dig into Nvidia’s earnings report and assess the secular developments fueling demand for generative AI GPUs. Whereas Nvidia inventory is definitely having fun with the second, buyers should still come away impressed to purchase shares now.

Nvidia’s enterprise is hovering

Oftentimes when an organization is experiencing unprecedented demand, it should see hovering income — and that is it. In different phrases, corporations generally need to reinvest closely into manufacturing as a way to meet that larger demand. This may put a pressure on working margins and earnings, even throughout occasions of accelerated gross sales development.

However Nvidia is a uncommon breed, make no mistake about it.

The chart above illustrates Nvidia’s income, gross revenue, web earnings, and free money move on a quarterly foundation during the last 10 years. Simply take a look at how steep the slope of every line has change into. Not solely is the corporate producing strong top-line development, however its earnings and money flows are rising in lockstep.

Taking this a step additional, Nvidia shouldn’t be resting on its laurels. Whereas demand for its industry-leading A100 and H100 GPUs stays robust, the corporate is investing its earnings relentlessly into product innovation. The corporate is on observe to start shipments of next-generation chips, together with the H200 within the second quarter. Furthermore, experiences recommend that Nvidia plans to launch its strongest chip thus far, the B100, later in 2024.

The above developments underscore the truth that Nvidia’s chips are in excessive demand. And with newer, improved fashions anticipated to succeed in prospects quickly, Nvidia’s trip might simply be getting began.

The AI revolution is simply getting began

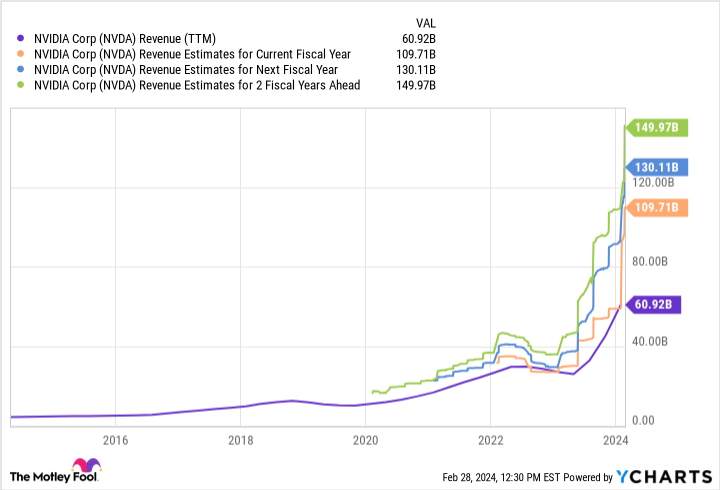

As use circumstances for AI proceed to evolve, so do estimates concerning the whole market dimension for the expertise. A prime Nvidia supervisor just lately forecast that the marketplace for AI-powered chips and software program would develop to be value $600 billion. The jury continues to be out on whether or not that prediction will show correct. Nevertheless, what analysts are calling for by way of development can shed some mild on Nvidia’s potential.

Whereas Nvidia’s trailing-12-month income of $61 billion is spectacular, maybe much more encouraging are its long-term development prospects as estimated by Wall Road analysts. Given Nvidia’s standing as a market chief in AI GPUs, many clearly imagine that the present demand developments could be sustained over the subsequent few years.

Is it too late to purchase Nvidia inventory?

To me, the most important danger related to Nvidia shouldn’t be its valuation. Slightly, I believe the aggressive panorama goes to change into more and more intense. Nvidia’s prime rival in the mean time is Superior Micro Gadgets (AMD). Nevertheless, each Amazon and Microsoft are already creating their very own inference and coaching chips for generative AI fashions. Whereas Nvidia could have a head begin, buyers shouldn’t flip their backs on its huge tech cohorts. Whereas I believe it will take a number of years for different chips to amass significant market share, Nvidia buyers must be contemplating what different development drivers the corporate has past AI GPUs.

One space that buyers could also be overlooking in the mean time is Nvidia’s alternative in software program. Whereas the corporate continues to be primarily a {hardware} developer, Nvidia’s software program and companies enterprise reached a $1 billion income run price throughout the fourth quarter.

It is a huge deal for a few causes. First, software program tends to come back with excessive margins. Ought to Nvidia start to finally lose share within the chip market, it is seemingly that its margins will take a success. Nevertheless, this may very well be greater than offset if Nvidia continues to see success in software program. Moreover, since software program companies are usually extra predictable by way of demand, I would not be stunned to see buyers apply much more of a premium to Nvidia inventory sooner or later.

At a price-to-sales ratio of 32, Nvidia inventory is buying and selling a lot larger than its historic ranges. Nevertheless, the corporate’s hovering income and earnings, coupled with its steadfast reinvestment into new merchandise and its budding software program enterprise, might warrant the premium. Given its differentiated enterprise mannequin, full-spectrum platform, and the secular tailwinds fueling AI, I believe now could be pretty much as good a time as ever to scoop up shares of Nvidia and maintain them for the long term.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Nvidia wasn’t one in all them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 26, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Nvidia’s CEO Says AI Is at a “Tipping Level.” Is the Inventory Nonetheless a Purchase? was initially revealed by The Motley Idiot