The merger and acquisition offers are coming within the shale patch, at a fee nearly too quick to doc. Final week information broke about Devon Vitality, (NYSE:DVN), and Canadian-based producer, Enerplus, (NYSE:ERF) opening merger talks. Enerplus has some alternative acreage within the Bakken play that might be very enticing to Devon because it fills in a number of gaps in its personal prime Bakken acreage. In addition they maintain some non-operated acreage within the Marcellus, that might probably be bought off as Devon has no different operation in that basin. The Bakken is house to among the longest shale laterals, and the ERF “jigsaw puzzle” items would help DVN tremendously in maximizing the manufacturing from the play.

Particulars are sketchy at this level, and I would not be shocked if ERF is not holding out for a money premium given the liquids-rich “grime”- 68%, they personal. That may be the good play for his or her shareholders. DVN has reached for its checkbook in its final couple of offers, for RimRock, and Validus. The shares of each firms are off from peaks set in Q-3 of final yr, DVN about 30% and ERF about 15%. That is the time to be merging with firms that may contribute instantly to the underside line, and synergistically make Newco doubtlessly a greater entity than the 2 had been individually. That’s what’s alleged to occur anyway.

The query arises, ought to Devon be the one shopping for? Right here’s the issue with the strikes Devon has made using this fill-in-the-gaps, “bolt-on” technique, from a shareholder perspective. They aren’t getting paid for it by the investing neighborhood! Maybe ERF must be shopping for Devon’s Bakken acreage. The economic logic works that method as properly. We’ll desk that thought for now, however return to it as we shut out the article.

Put apart different components, corresponding to declines in oil and gasoline costs, and focus solely on one factor. When Devon purchased the RimRock acreage in June of 2022, the share worth was $69. After they purchased Validus in August of 2022, the inventory worth was $65. Since these halcyon days of 2022 when folks talked glibly of $100 WTI going again to $120, DVN inventory has nose-dived, together with WTI, to be truthful, into the low $40’s. $2.7 bn in money later and buyers have misplaced 40% of their capital. That is the form of factor that draws activist buyers, and it wouldn’t shock me to see Engine #1 or Carl Icahn take a sizeable place to get board seats and begin swinging a meat axe.

On this article, we’ll evaluate a pair the Devon/ERF potential merger with one other M&A transaction now in course of. There are some obtrusive variations that ought to put the proposed deal between Devon and Enerplus within the correct body.

ExxonMobil and Pioneer Pure Assets

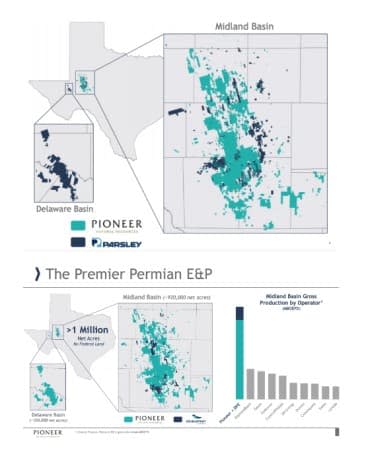

There’s a restrict to how far you may go evaluating a Tremendous Main like ExxonMobil, (NYSE:XOM) and even a big U.S.-focused shale producer like Devon Vitality. That mentioned, the “Industrial Logic” behind the XOM cope with Pioneer is obvious if you happen to take a look at the professional forma acreage footprint within the Midland basin, within the slide under. The distinction between what ExxonMobil is doing with its merger with Pioneer and what Devon is proposing to do with Enerplus is that the previous is enhancing its core acreage place in probably the most prolific shale basin within the nation. It stays to be seen if XOM shareholders will reap any bounty, not less than over the brief time period, from this deal. XOM inventory was $112 in October, of 2023 when it was introduced, and trades simply above $100 at present.

Devon, alternatively, has been increasing into different shale performs, to benefit from regional features of every. The issue with that method is Devon has not carried out within the high percentile in these different basins, nor have they delivered progress to their shareholders.

As famous, Devon’s share worth has collapsed with every extra deal, whereas the administration of Pioneer has delivered progress to its shareholders by specializing in increasing its empire within the Permian. In 2021 PXD’s $6.4 bn acquisition of Double Level Vitality raised some eyebrows approaching the heels of its $7.6 bn (money and debt assumption) acquisition of Parsley Vitality. Almost $14 bn in acquisitions in half a yr, for an organization Pioneer’s measurement was a daring transfer by administration.

Pioneer filings

Pioneer wasted no time in monetizing property from the Parsley Vitality pickup, promoting the Delaware basin acreage to Continental Assets for $3.25 bn in late 2021. Shareholders of Pioneer acquired $21.68 in common and particular dividends in 2022, and capital progress from $140 per share in early 2021 to the ultimate gross sales to XOM of $253 per share. By any measure, shareholders of Pioneer have benefited from the shrewd empire-building within the Midland basin.

Scott Sheffield, Pioneer’s long-time CEO, and the architect of the empire within the Midland basin that drew ExxonMobil’s eye, is retiring this yr on the high of his recreation. Capping his profession with the corporate sale to XOM, he’s set to obtain a payout of money and inventory of $151 mm, in line with this Bloomberg article. I count on few PXD shareholders will begrudge him this magnificent payday.

Let’s now look nearer at what Devon hopes to attain with the multi-billion greenback acquisition of Enerplus.

The DVN and ERF Industrial Logic

Here’s what Devon administration informed us in regards to the RimRock acreage pickup. The slide instantly under discusses its “industrial logic.” As you may see, the rationale was apparent because the RimRock acreage facilitated a number of features of shale improvement laterals, optimized properly spacing, vital mass-higher output, in theory-lower manufacturing prices, and enhanced logistics.

They ticked each field, and shareholders had been promised that elevated free money circulate era would end result and elevated quantities of money could be returned to them. As beforehand famous, Devon Vitality’s inventory went from $69 to $65 per share in only a few months. What truly occurred? Free money declined from 60% of operational money flow-OCF in 2021 to 40% of OCF in 2022. What about shareholder returns?

Dividends paid out to shareholders went from $1.97 in 2021 to $5.17 in 2022 however declined to $2.87 in 2023. In the event you add the worth of share buybacks-$4.65, over this era, it will get higher, however at a complete of $12.67 all-in, Devon shareholders have fared way more poorly than PXD shareholders, with no capital appreciation to sweeten the drugs!

Now we come to the fundamentals of what ERF would possibly imply to DVN. Or what DVN’s Bakken acreage would possibly imply to Enerplus.

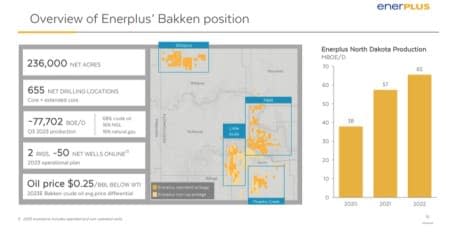

The match between ERF’s footprint in Dunn, and McKenzie counties turns into obvious whenever you transpose it in opposition to DVN’s present footprint within the slide above. The Industrial Logic solely will get higher with the 2 mixed, whenever you take a look at the blocky acreage in Willams County. The three counties talked about listed here are within the high ten and high twenty shale-producing counties nationally, in line with my business sources.

There’s one other side to DVN’s curiosity in ERF. Enerplus is killing it in productiveness. In the event you take a look at the slide above the YoY progress fee from 2021 to 2022 is 13%. DVN’s Williston output by comparability has been pretty flat throughout this era. Trade sources affirm to me that ERF is among the high producers on this basin, touchdown within the high 15 nationally. Of their final convention name, DVN administration famous a decline within the Bakken and a shift of capital focus to the Delaware basin.

Lastly, on LOE-lease working prices. Firm filings reveal that ERF is gentle years forward of DVN, coming in at $10.75-11.00 in Q-3, vs $13.04 for DVN. DVN studies a money margin within the Williston of $32.14 on realized pricing of $52.64. If that they had ERF’s numbers it will correlate to an 8% bump increased.

DVN final paid $23K per acreage to RimRock, so I count on that will probably be a place to begin for ERF’s consideration. An equal supply for his or her 236K acres would complete within the neighborhood of $5.4 bn, making fairly a windfall for ERF shareholders with the corporate’s present capitalization of $3.15 bn.

I count on the money facet of this deal is the arduous half. After shelling out ~$900 mm for RimRock and $1.8 bn for Validus within the final couple of years, DVN solely has $1.3 bn in money on the books. Simply hypothesizing, in the event that they had been to place $1 bn in money and use debt for 40% of it, leaving a share alternate for the opposite ~45%-say ~$2.0 BN, the money circulate would pay out the acquisition fairly shortly. Figuring worth realizations at $55, and a money margin of $35, with ~160K BOEPD of mixed manufacturing would pay out in a yr. However that’s been true of the opposite acquisitions properly, and up to now, there’s nothing to point out for it.

At that sale worth, ERF would convey $5.4 bn in new capitalization, ~$1 bn in EBITDA and ~100K BOEPD to DVN, and nearly no debt, shifting DVN’s EV/EBITDA metric incrementally just a little increased (considering the brand new $2.0 bn in debt to shut the deal) to round 3.4X from 3.0X. On a flowing barrel foundation, it additionally strikes up a bit to $52K from $46K per barrel. So the chance that shareholders will profit from a deal the place their primary monetary metrics worsen defies logic.

The previous just isn’t essentially a prologue. This deal could possibly be the one which justifies itself with rewards to shareholders. Nothing in our overview suggests this, fairly the reverse, truly, however we’ve to permit for the chance. The date for Devon’s 2024 annual assembly hasn’t been set but. Sometimes it’s in early June. If sufficient disgruntled shareholders present up, it could possibly be a raucous affair. They’ve ample purpose to be sad.

By David Messler for Oilprice.com

Extra Prime Reads From Oilprice.com: