Portfolio development can come from many alternative sources. Whereas areas together with synthetic intelligence (AI) or genomics are sizzling in the mean time, one space of investing that not often goes out of favor is dividend investing.

Dividends can present a profitable supply of passive earnings. And due to the ability of compounding, reinvesting dividends and holding on to your winners for the long term can particularly assist buyers construct generational wealth.

Let’s discover 10 shares which have ultra-high dividend yields, and assess why every is value an in depth look in 2024.

1. Hercules Capital: 10.6% dividend yield

Hercules Capital (NYSE: HTGC) is a enterprise improvement firm (BDC) that focuses on offering capital to venture-backed start-ups. Hercules is totally different from a typical financial institution because it tends to supply extra versatile financing choices. So whereas Hercules could also be assuming extra threat than a financial institution would usually underwrite, the corporate attaches excessive coupon charges onto its time period loans and in addition normally negotiates for warrants as a part of the deal construction. This supplies Hercules with an additional sweetener ought to considered one of its portfolio firms liquidate in an preliminary public providing (IPO) or acquisition.

Since Hercules is a BDC, it is required to pay out 90% of its taxable earnings to shareholders every year within the type of a dividend. Whereas this inherently makes Hercules interesting for dividend buyers, the corporate’s operational efficiency has confirmed robust. As such, shareholders have cheered the inventory for fairly a while. Over the past 10 years, Hercules inventory has a complete return of 230%.

Given its profitable long-term efficiency, coupled with a juicy dividend yield of 10.6%, passive earnings buyers might wish to scoop up shares in Hercules inventory.

2. Ares Capital: 9.5% dividend yield

One other BDC on my record is Ares Capital (NASDAQ: ARCC). What makes Ares a bit totally different than Hercules is that the corporate tends to concentrate on decrease middle-market companies throughout a wider array of industries. Given its dimension, Ares additionally has extra monetary flexibility than a typical BDC. The corporate makes a speciality of extra advanced transactions comparable to leveraged buyouts, for instance.

One factor that makes Ares particularly distinctive is its place as a Warren Buffett holding. Whereas Buffett is usually recognized for his Berkshire Hathaway portfolio, the Oracle of Omaha really has one other funding car. New England Asset Administration (NEAM) is a subsidiary of Berkshire, and considered one of its positions is none apart from Ares.

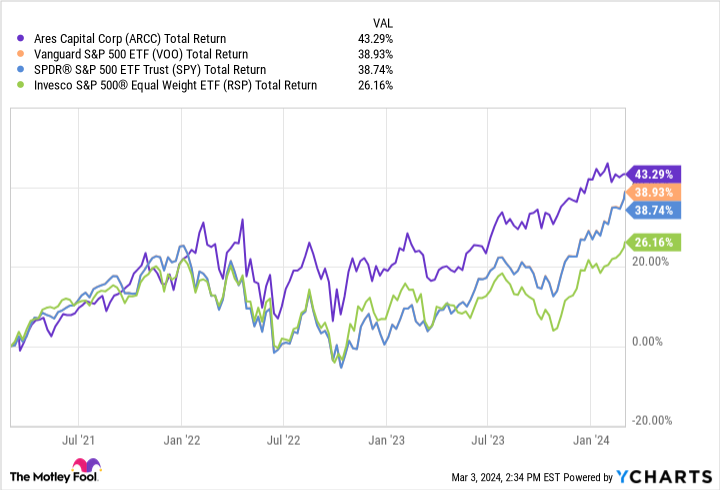

The chart beneath tracks the overall return of Ares inventory versus quite a lot of main S&P 500-themed exchange-traded funds (ETFs). Given its outperformance in comparison with the SPDR S&P 500 ETF Belief, Invesco S&P 500 Equal Weight ETF, and Vanguard S&P 500 ETF, buyers might observe Buffett’s lead and revel in market-beating returns on this little-known BDC.

3. Horizon Expertise: 11.1% dividend yield

Horizon Expertise (NASDAQ: HRZN) is considered one of Hercules’s largest rivals. The corporate additionally makes a speciality of enterprise debt for start-ups within the expertise, life sciences, and sustainable power industries.

With dividends reinvested, Horizon inventory has returned 131% throughout the previous decade. Whereas that lags Hercules’ efficiency, buyers should not look down on Horizon.

Since its price-to-book (P/B) ratio of 1.2 is modestly decrease than Hercules’s 1.6, I see Horizon as a pleasant hedge place to that of different BDCs. Now might be alternative to scoop up shares at an 11% yield and a pleasant low cost to its high rival.

4. Power Switch: 8.4% dividend yield

Power Switch (NYSE: ET) makes a speciality of pure gasoline transportation and storage. As a grasp restricted partnership (MLP), Power Switch acts as a pass-through entity — which means that each income and losses are handed by restricted companions (like buyers).

Power Switch at the moment trades at a price-to-earnings (P/E) ratio of 13.9 — about half of its long-term common. Given its current acquisition of Crestwood Power Companions, I believe buyers could also be discounting the impact on Power Switch’s future development.

With shares buying and selling at such a steep low cost to historic valuation ranges, now might be time to begin a place at an 8% yield.

5. Enterprise Merchandise Companions: 7.2% dividend yield

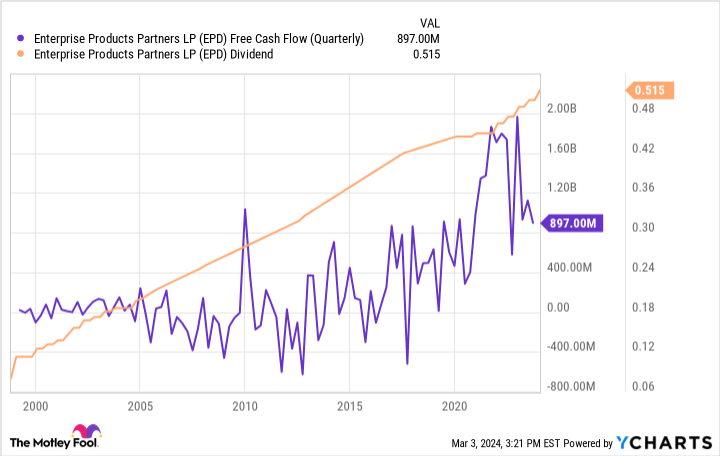

The chart beneath exhibits that, even with inconsistent free money circulate, midstream power firm Enterprise Merchandise Companions (NYSE: EPD) has managed to lift its dividend, which yields about 7.2%. I see this as a transparent signal of premium shareholder worth.

Proper now, Enterprise Merchandise Companions trades at a ahead P/E of simply 10.3. Because the S&P 500 is buying and selling at a ahead P/E of 23.4, Enterprise Merchandise Companions seems to be extremely undervalued in comparison with the broader market.

Given the corporate’s current acquisitions, I believe buyers might be discounting the long-run potential of Enterprise Merchandise Companions.

6. Enbridge: 7.8% dividend yield

Enbridge (NYSE: ENB) is a pure gasoline storage and pipeline administration operation. In the course of the previous 12 months, the shares fell 10% — vastly underperforming the broader market.

The power sector has confronted its share of headwinds throughout the previous 12 months as a result of a mix of lingering inflation and geopolitical tensions. However, Enbridge has remained targeted, and like its power friends above, it is resorting to acquisitions to jump-start new development.

In September 2023, the corporate acquired three gasoline utilities from Dominion Power. Enbridge’s chief government officer known as the deal a “once-in-a-generation alternative” as the corporate builds North America’s largest gasoline utility.

At a P/E of simply 16.5, Enbridge is buying and selling effectively beneath its five-year common of 26.4. Whereas the jury remains to be out concerning the long-term results of the Dominion deal, it is laborious to cross up shares at such a steep low cost and an almost 8% yield.

7. Kinder Morgan: 6.5% dividend yield

Final 12 months was difficult for Kinder Morgan (NYSE: KMI). Income, EBITDA (earnings earlier than curiosity, taxes, depreciation and amortization), and free money circulate noticed some dips that resulted in a modest sell-off of the inventory.

However like its power friends above, Kinder Morgan seems to be effectively positioned to return to development after its acquisition of STX Midstream. I am optimistic that 2024 can be a rebound 12 months for the corporate, which might end in additional distribution will increase for shareholders.

At a 6.5% yield, now might be an attention-grabbing time to purchase shares as Kinder Morgan seems to be to proper the ship and return to development.

8. Rithm Capital: 9.1% dividend yield

Rithm Capital (NYSE: RITM) is an actual property funding belief (REIT). Like BDCs, REITs are required to pay out 90% of their taxable earnings to shareholders within the type of a dividend.

At the moment, shares of Rithm are buying and selling over 40% beneath decade highs. My suspicion is that sentiment surrounding the true property trade has soured throughout the previous few years, given blended outlooks on the macroeconomy.

The factor to bear in mind is that REITs are available many alternative varieties. Rithm is a mortgage REIT, competing with firms like Arbor Realty Belief, Annaly Capital Administration, and AGNC Funding Corp. At a P/B of simply 0.92, Rithm is buying and selling on the lowest a number of amongst this peer set.

Now might be a singular alternative to purchase shares in Rithm because it trades at a reduction to its friends and presents buyers a scorching 9.1% yield.

9. Altria: 9.6% dividend yield

Altria (NYSE: MO) is house to a few of the world’s most acknowledged tobacco manufacturers. The corporate sells cigarettes beneath the Marlboro and Black & Gentle monikers, in addition to smokeless tobacco merchandise on! and NJOY.

The previous few years have been powerful for the tobacco market. Lingering inflation and excessive borrowing prices have put a pressure on client purchases. Wellness is usually on the rise as effectively — making it more difficult for Altria to market its merchandise to health-conscious shoppers.

Whereas development is a priority for Altria in the mean time, there’s one huge purpose to personal this inventory.

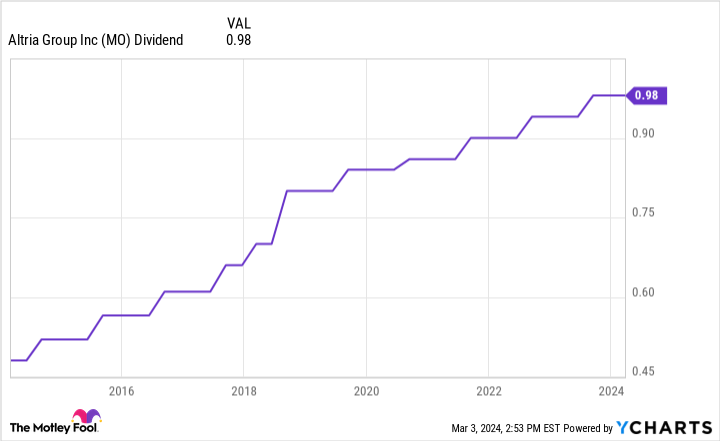

Altria has earned a place on the unique record of Dividend Kings — firms which have raised their dividends for at the very least 50 consecutive years. It doesn’t matter what challenges the corporate has confronted, the corporate at all times finds a solution to put shareholders first and never solely proceed paying a dividend, however growing it.

10. Verizon Communications: 6.6% dividend yield

To be blunt, telecommunications supplier Verizon (NYSE: VZ) is not precisely synonymous with monster development. The telecom trade is changing into more and more commoditized, with main gamers like AT&T, T-Cellular, and Comcast usually providing the identical merchandise and competing on value.

However like Altria, one factor that makes Verizon extra compelling than its friends is its traditionally rising dividend.

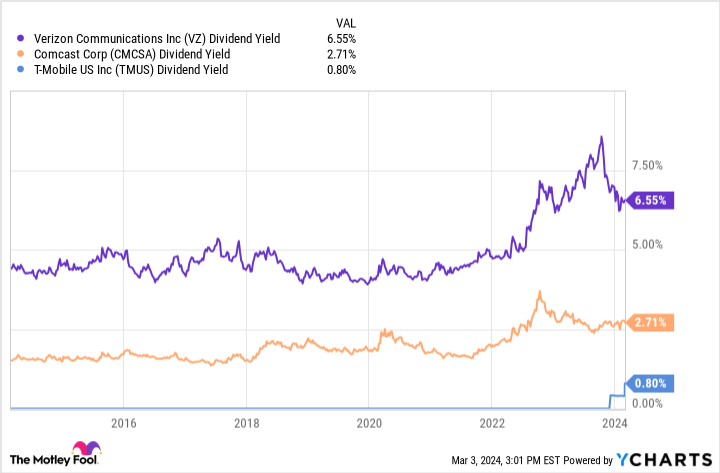

In September 2023, Verizon raised its dividend for the seventeenth consecutive 12 months. In distinction, AT&T slashed its dividend a few years in the past, and has not raised it since. In the meantime, the dividend yields of T-Cellular and Comcast each pale compared to that of Verizon.

Whereas Verizon might not provide the tempting development prospects of sizzling tech shares, the corporate is best-in-breed with regards to telecom suppliers. I see its dividend as protected, given the corporate’s dedication to elevating it yearly for nearly twenty years.

Do you have to make investments $1,000 in Hercules Capital proper now?

Before you purchase inventory in Hercules Capital, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Hercules Capital wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 26, 2024

Adam Spatacco has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Berkshire Hathaway, Enbridge, Kinder Morgan, and Vanguard S&P 500 ETF. The Motley Idiot recommends Comcast, Dominion Power, Enterprise Merchandise Companions, T-Cellular US, and Verizon Communications. The Motley Idiot has a disclosure coverage.

Right here Are My Prime 10 Extremely-Excessive-Yield Dividend Shares to Purchase in 2024 was initially revealed by The Motley Idiot