Esmeralda Bernal is the valedictorian of Downtown Magnets Excessive Faculty this yr, the daughter of Mexican immigrants who by no means went to school. She’s taken 18 college-level courses and aced them with a cumulative 4.5 GPA whereas taking over management roles in her faculty’s robotics and math golf equipment. She goals of changing into a civil engineer.

But the brainy senior couldn’t get previous glitches to submit her federal monetary help kind for greater than a month. A brand new kind designed to be less complicated was simply the other for her: impenetrable.

She had been making an attempt to achieve the U.S. Division of Schooling’s assist line since early January, to no avail. Lastly, after calling 13 occasions at some point final week, she obtained somebody on the road who may assist. She submitted her kind and is anxiously ready for the federal data to be despatched to schools, which use the all-important FAFSA kind, the Free Utility for Federal Scholar Help, to craft help packages that allow college students know whether or not they can afford their dream colleges. For Esmeralda, it’s MIT, Smith School and UC Berkeley.

“It was actually irritating,” mentioned Esmeralda. “It didn’t really feel less complicated to me.”

As tens of hundreds of California college students wrestle by means of one of the vital nerve-racking occasions of their highschool journeys — the wait for school acceptance letters — their anxiousness has been compounded this yr by a chaotic and glitch-filled rollout of newly designed FAFSA varieties. Panicked highschool seniors and their counselors describe the state of affairs as a fiasco, chaos and scary.

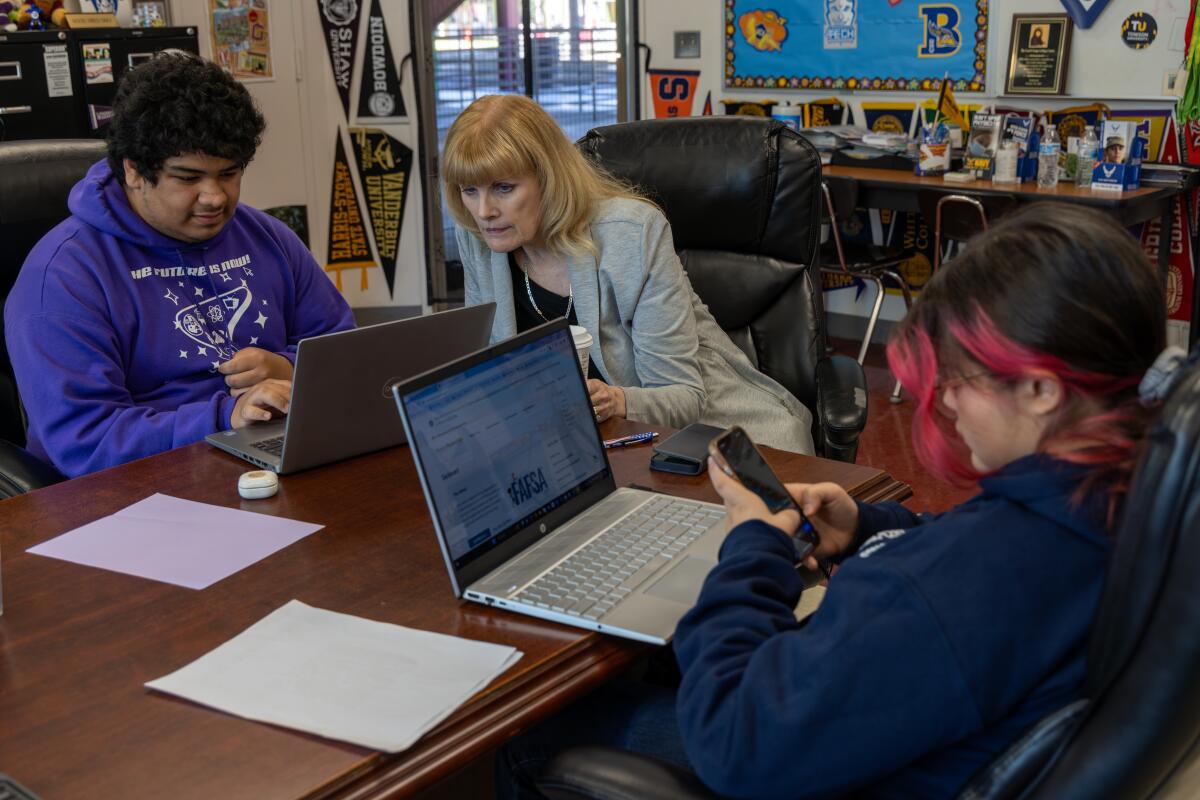

Esmeralda Bernal, heart, and different college students at Downtown Magnets Excessive Faculty in Los Angeles work with school counselor Lynda McGee, proper.

(Irfan Khan / Los Angeles Occasions)

The web kind, which was beforehand opened in late October, didn’t turn out to be totally accessible till mid-January. That delay and quite a few reported snags have resulted in a steep drop within the variety of monetary help varieties submitted. As of late January, about 700,000 seniors nationwide had submitted purposes, declining from about 1.5 million candidates the identical time final yr, in response to the Nationwide School Attainment Community, which analyzed information from the U.S. Division of Schooling.

In California, solely 16.1% of seniors had submitted a FAFSA by means of Feb. 2, a drop of greater than 57% from that very same date the earlier yr, in response to the community’s information.

The numbers at native colleges present alarming drops in completions.

At Downtown Magnets, which regularly wins honors from L.A. Unified for top charges of FAFSA completion, solely one-third as many seniors had accomplished the shape as of Jan. 26 in contrast with final yr, in response to federal information. And fewer than 5 varieties had been efficiently processed, leaving nearly all of that faculty’s college students in monetary help limbo.

As of late final week, Pasadena Excessive would usually have about 75% of FAFSA purposes submitted for seniors. As a substitute, the quantity is about 17%, counselors mentioned. Different Pasadena Unified colleges reported related numbers. For Muir Excessive, it was 14% as a substitute of 80%. For Marshall Basic Excessive, it was 28% as a substitute of 75%.

The delays prompted the College of California and California State College to announce final week they might lengthen their Might 1 deadline for first-year college students to just accept their admission gives for fall 2024. Each techniques introduced extensions till at the very least Might 15. The California Scholar Help Fee, which distributes state Cal Grants, additionally prolonged the precedence deadline to submit monetary help purposes by one month, to April 2.

U.S. Secretary of Schooling Miguel Cardona has acknowledged the issues, saying officers are “decided to get this proper.” His division final week pledged to supply extra personnel, funding, expertise and different sources to college students, excessive colleges and faculties.

However on the bottom, in excessive colleges throughout the state, confusion reigns.

“That is simply the most important fiasco,” mentioned Lynda McGee, a counselor at Downtown Magnets for twenty-four years. “I’ve by no means seen something in all of the years I’ve been a counselor that even begins to match to this stage of dysfunction.”

At their month-to-month assembly final Thursday, counselors in Pasadena Unified described a cascade of issues.

Generally dad and mom and college students obtained to the tip of the shape, however the system wouldn’t allow them to create the account, saying there was an error however not explaining what it was. Some who didn’t end the shape on the primary attempt or wanted to appropriate a mistake have been locked out.

After ready 4 weeks, one household was lastly capable of get a “case quantity,” which means they have been in line for assist with FAFSA issues. However the pupil’s dad or mum didn’t communicate English — and federal FAFSA advisors communicate nearly solely English. In her confusion, the coed made an inadvertent mistake and the system canceled her case quantity. She needed to fill out one other kind to get a brand new case quantity — and wait one other month consequently, mentioned Renee Cruz, a university counselor at Muir Excessive Faculty.

College students even have been caught in suggestions loops, with the system telling them they’ve a FAFSA account once they don’t. Once they attempt to entry it by altering the password, they’re advised to create an account. For one Muir Excessive household, the pc system mixed the knowledge for twins into one account as one individual — and the mom couldn’t create two accounts it doesn’t matter what she tried.

Annoyed counselors report turning to Fb counselor teams and even Reddit — which don’t have any connection to the FAFSA system — for ideas.

Krystal Rodas, a university and profession advisor at Pasadena Excessive, may discover no resolution to mysterious error messages on the web site. When she obtained by means of on the telephone, “they saved saying that there was no resolution. It was an ongoing challenge.”

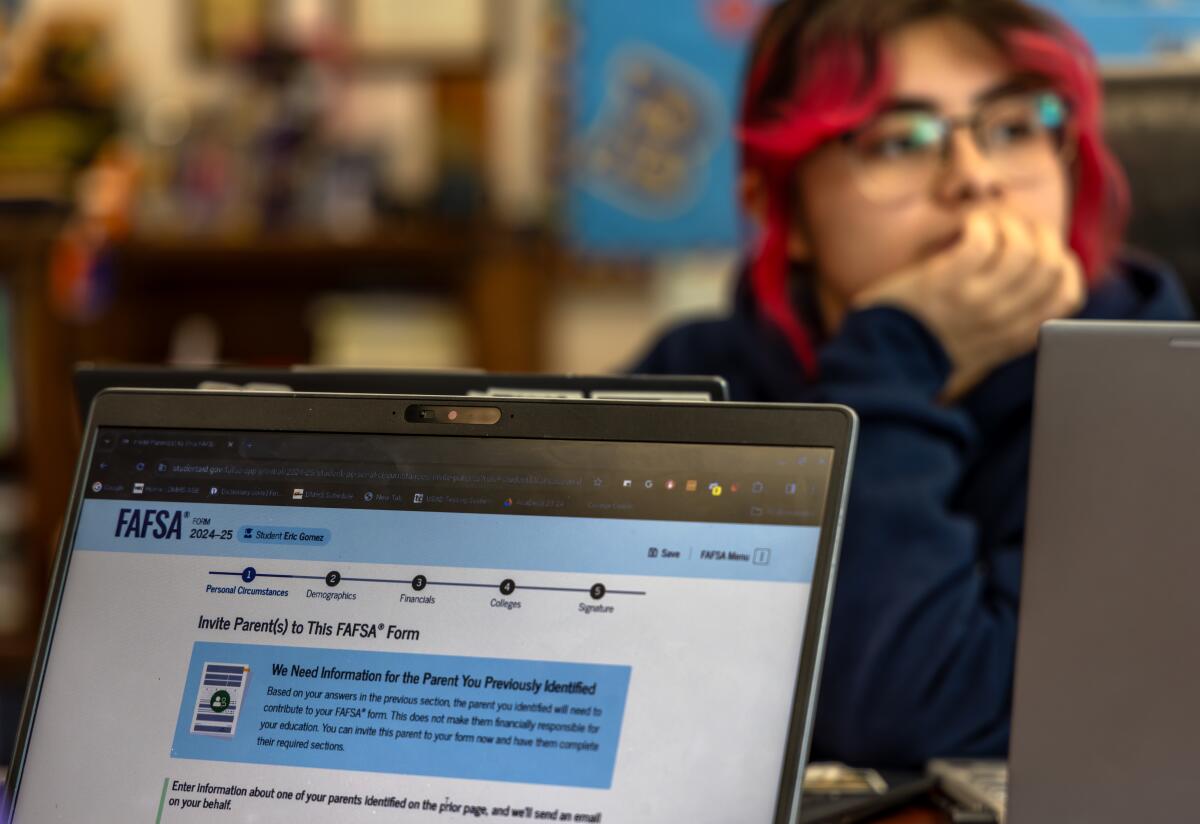

A pc display screen reveals the FAFSA utility at Downtown Magnets Excessive Faculty.

(Irfan Khan / Los Angeles Occasions)

Notably damaging to college students with immigrant dad and mom, the system seems to be particularly troublesome when dad and mom shouldn’t have a Social Safety quantity. Maria Torres, a Marshall Basic Excessive counselor, realized that leaving clean the handle part for folks with out Social Safety numbers would possibly work. It did for 2 folks however not one of the others, she mentioned.

Monetary help submissions that the federal authorities usually processed in 5 to seven days are being pushed off until March, the advisors reported. Meaning faculties might be jammed as effectively — even when they push again their very own deadlines.

Filling out the FAFSA has turn out to be one thing of a common expertise for highschool seniors and their households. Solely essentially the most affluent households can afford to forgo all monetary help — with the common complete price of attending a four-year school, together with mortgage reimbursement and misplaced wages, usually surpassing half one million {dollars}.

At Calabasas Excessive, senior Ella Shapiro has no expectation of qualifying for a federal Pell Grant for low-income college students, as her father is a doctor and her mom works in vogue. However she understands that schools usually require the FAFSA for their very own institutional grants and supplemental help, together with federally sponsored loans and work alternatives.

She mentioned the software program was “onerous to get on and keep on the web site. ” For about two weeks, she additionally saved getting messages saying the system was down and to attempt once more later. Counselors held conferences and tried to troubleshoot points.

After two weeks of issues, she thinks she has efficiently submitted her kind: “I’m crossing my fingers at this level.”

At Downtown Magnets Excessive Faculty, Hero Khun is the son of Cambodian immigrants with out school levels who opened a doughnut store in 2019. When the pandemic hit and campuses closed, he would get up at 4 a.m. and assist them till on-line courses began at about 8 a.m. He nonetheless works on weekends whereas juggling a rigorous course load of Superior Placement courses; he presently has a 4.0 GPA and goals of changing into a bodily therapist.

Hero mentioned he misunderstood one query and wrongly reported that his dad and mom have been unwilling to share monetary data. However he can’t get again into his account to repair the error till mid-March, when the FAFSA portal will settle for corrections. He worries that could be too late to place him for a powerful monetary help bundle ought to he be admitted to his prime decisions — USC and Occidental.

Lynda McGee, heart, a university counselor, helps college students Eric Gomez, left, and Alyen Gutierrez fill out the FAFSA utility at Downtown Magnets Excessive Faculty.

(Irfan Khan / Los Angeles Occasions)

“It’s type of worrying as a result of a whole lot of colleges needed the FAFSA data early on, and I can’t do something about it now; I simply have to attend,” he mentioned.

For Zoe Jeronimo, a senior at Blair Excessive in Pasadena, monetary help might be essential to attending school in any respect. Her father is a gardener; her mom a homemaker who raises three kids and finds some work as a housekeeper.

Neither of her immigrant dad and mom attended school or speaks fluent English, leaving Zoe to navigate the college-application course of on her personal, with assist from counselors.

She’s spent components of about 15 days trying to finish the shape, however the system nonetheless received’t let her full the shape on behalf of her father. A high-achieving pupil with a ardour for biology — and an internship at Huntington Hospital Medical Analysis Institutes beneath her belt — Zoe worries that the delay may crush her school goals.

“Filling out the FAFSA has been like a extremely scary factor and worrisome as a result of my father and my mom and I preserve pondering: What if I obtained accepted to a faculty I actually needed, like UCLA, however can’t afford it?”