A model of this piece first appeared on TKer.co

Shares made new document highs, with the S&P 500 setting an intraday excessive of 5,261.10 and a closing excessive of 5,241.53 on Thursday. For the week, the S&P elevated 2.3% to shut at 5,234.18. The index is now up 9.7% yr so far and up 46.3% from its October 12, 2022 closing low of three,577.03.

Simply because one thing occurs a lot of the time doesn’t imply it occurs all the time. That is true for the inventory market, the economic system, and possibly all the pieces else in our lives.

In recent times, we’ve realized that is true of two of the preferred and traditionally constant recession indicators: the yield curve and the Convention Board’s Main Financial Index.

The inverted yield curve

The yield curve represents the form that varieties on a chart if you plot the rate of interest, or yield, for Treasury debt securities with numerous maturities. Usually, shorter-term charges just like the yield on the 2-year Treasury be aware shall be decrease than the yield on the 10-year Treasury be aware.

The yield curve inverts when a long run fee is decrease than a shorter time period fee (e.g., when the yield on the 10-year be aware is decrease than yield on the 2-year be aware).

Traditionally, when the yield on the 10-year be aware falls under the yield on the 2-year be aware (i.e., when the “2s10s” yield curve inverts), recessions have been considerably quickly to observe.

Two years in the past, the 2s10s yield curve inverted, which emboldened economists who had been warning of an impending recession.

We’re nonetheless ready for that recession.

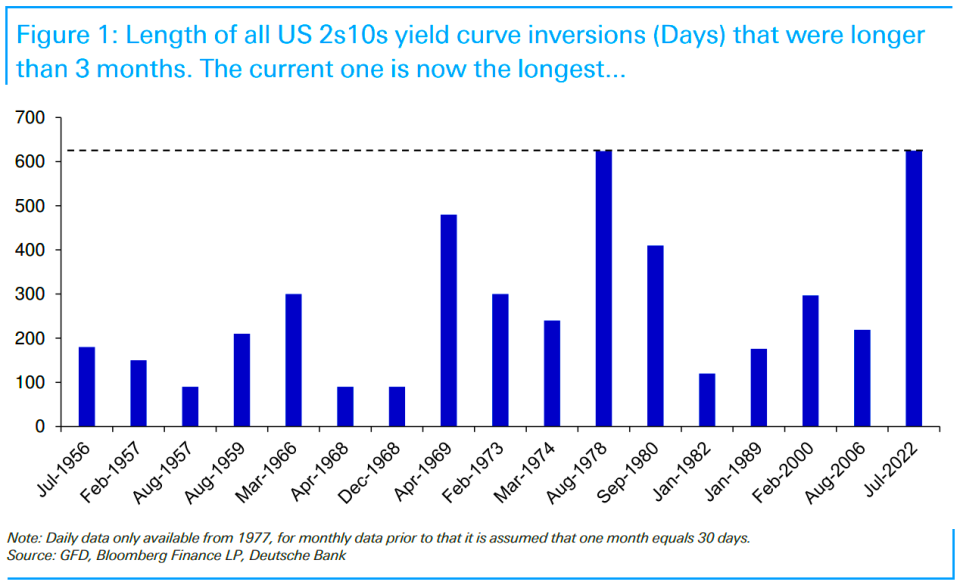

Deutsche Financial institution’s Jim Reid famous that on Wednesday “we handed the longest steady U.S. 2s10s inversion in historical past. Though the 2s10s first inverted on the finish of March 2022, it has now been repeatedly inverted for 625 days since July fifth 2022. That exceeds the 624 day inversion from August 1978, which beforehand held the document.”

Whereas the inverted yield curve could have a superb monitor document of predicting recessions, it’s not very exact in predicting when recessions will begin. Based on a Goldman Sachs evaluation of 2s10s inversions since 1965, seven to 49 months handed earlier than recessions occurred, with a median of 20 months.

So, the economic system might go into recession every week, a month, or a yr from now, which might arguably affirm the inverted yield curve’s sign.

That mentioned, one has to query the worth of an indicator that generally leads occasions by two to 4 years.

As Oaktree Capital’s Howard Marks says, “Being too far forward of your time is indistinguishable from being improper.”

The falling Main Financial Index

The Convention Board’s Main Financial Index (LEI) — a composite of market and financial metrics — has had a robust monitor document of predicting recessions, particularly when its six-month common change is detrimental.

Over the previous two years, it too had been signaling a recession that hasn’t come.

And final month, in its January replace, The Convention Board mentioned the LEI’s sign flipped constructive. From The Convention Board’s Justyna Zabinska-La Monica:

Whereas the declining LEI continues to sign headwinds to financial exercise, for the primary time prior to now two years, six out of its ten parts had been constructive contributors over the previous six-month interval (ending in January 2024). In consequence, the main index at present doesn’t sign recession forward. Whereas not forecasting a recession in 2024, we do anticipate actual GDP development to sluggish to close zero % over Q2 and Q3

On Wednesday, The Convention Board confirmed that the constructive developments continued into February.

“The U.S. LEI rose in February 2024 for the primary time since February 2022,” Zabinska-La Monica mentioned. “Power in weekly hours labored in manufacturing, inventory costs, the Main Credit score Index, and residential building drove the LEI’s first month-to-month improve in two years.”

Yardeni Analysis’s Ed Yardeni and Renaissance Macro’s Neil Dutta are amongst Wall Road knowledge nerds who’ve identified extra critical points with LEI.

The underside line: The LEI’s sign that folks have been citing has been off.

Zooming out

I feel it’s good to heed the warnings of the favored recession indicators. However simply because a metric is often proper doesn’t imply it is going to be proper the subsequent time round.

Moreover, it’s by no means good to rely too closely on the sign of a single metric. Whether or not it’s rates of interest, P/E ratios, or one in every of these recession indicators, any metric ought to be thought of within the context of different related metrics.

The recessionary indicators we’ve been studying about over the previous two years have come amid huge bullish tailwinds like document job openings and extra financial savings, which have confirmed to be extra dependable main indicators through the present financial cycle.

Possibly subsequent time the yield curve and the LEI shall be proper and well timed. However not this time.

SocGen raises its goal for the S&P 500

On Thursday, Societe Generale’s Manish Kabra raised his year-end goal for the S&P 500 to five,500 from 4,750. That is his first revision from her preliminary goal.

“U.S. exceptionalism goes from energy to energy,” Kabra wrote. “Regardless of widespread market optimism, we view this as rational slightly than extreme, as revenue development continues to extend and set new data for the S&P 500.”

Kabra just isn’t alone in tweaking his forecasts. His friends at BofA, Barclays, UBS, Goldman Sachs, RBC, and CFRA are amongst those that’ve additionally raised their targets.

Don’t be stunned to see extra of those revisions because the S&P 500’s efficiency, up to now, has exceeded many strategists’ expectations.

Reviewing the macro crosscurrents

There have been just a few notable knowledge factors and macroeconomic developments from final week to think about:

The Fed holds regular. The Federal Reserve introduced it will hold its benchmark rate of interest goal excessive at a spread of 5.25% to five.5%.

On the conclusion of its financial coverage assembly on Wednesday, the Fed additionally maintained its expectation for the equal of three 25-basis-point fee cuts in 2024. Nevertheless, the central financial institution’s new “dot plots” suggest fewer fee cuts in 2025 and 2026 than what it forecasted after the December assembly.

The Fed additionally boosted its forecast for GDP development, lowered its forecast for unemployment, and raised its forecast for inflation.

Regardless of this arguably hawkish replace, shares rallied. Maybe markets had been anticipating one thing much more hawkish.

Card knowledge suggests spending is holding up. From JPMorgan: “As of 13 Mar 2024, our Chase Client Card spending knowledge (unadjusted) was 2.4% above the identical day final yr. Based mostly on the Chase Client Card knowledge by means of 13 Mar 2024, our estimate of the U.S. Census March management measure of retail gross sales m/m is 0.58%.”

From Financial institution of America: “Whole card spending per HH was up 1.1% y/y within the week ending Mar 16, in keeping with BAC aggregated credit score & debit card knowledge. Retail ex auto spending per HH got here in at 0.5% y/y within the week ending Mar 16. After a delicate however steady Feb, Mar spending has improved, probably partially as a result of base impact from the Mar slowdown final yr.”

Unemployment claims tick decrease. Preliminary claims for unemployment advantages declined to 210,000 through the week ending March 16, down from 212,000 the week prior. Whereas that is above the September 2022 low of 182,000, it continues to pattern at ranges traditionally related to financial development.

Fuel costs rise. From AAA: “The nationwide common for a gallon of fuel rose 11 cents since final week to $3.52. Whereas home fuel demand has been lackluster, rising oil costs helped push pump costs greater.”

Dwelling gross sales leap. Gross sales of beforehand owned properties elevated by 9.5% in February to an annualized fee of 4.38 million models. From NAR chief economist Lawrence Yun: “Extra housing provide helps to fulfill market demand. … Housing demand has been on a gentle rise as a consequence of inhabitants and job development, although the precise timing of purchases shall be decided by prevailing mortgage charges and wider stock decisions.”

Dwelling costs rise. Costs for beforehand owned properties elevated month over month and from year-ago ranges. From the NAR: “The median existing-home worth for all housing sorts in February was $384,500, a rise of 5.7% from the prior yr ($363,600).”

Homebuilder sentiment rises. From the NAHB’s Carl Harris: “Purchaser demand stays brisk and we anticipate extra shoppers to leap off the sidelines and into {the marketplace} if mortgage charges proceed to fall later this yr. … However though there’s sturdy pent-up demand, builders proceed to face a number of supply-side challenges, together with a shortage of buildable heaps and expert labor, and new restrictive codes that proceed to extend the price of constructing properties.”

New house building rises. Housing begins jumped 10.7% in February to an annualized fee of 1.52 million models, in keeping with the Census Bureau. Constructing permits rose 1.9% to an annualized fee of 1.52 million models.

Mortgage charges tick greater. Based on Freddie Mac, the common 30-year fixed-rate mortgage rose to six.87% from 6.74% the week prior. From Freddie Mac: “After reducing for a few weeks, mortgage charges are as soon as once more on the upswing. Because the spring homebuying season will get underway, current house stock has elevated barely and new house building has picked up. Regardless of elevated charges, homebuilders are displaying renewed confidence within the housing market, specializing in the actual fact that there’s a good quantity of pent-up demand, an ongoing provide scarcity and expectations that the Federal Reserve will reduce charges later within the yr.”

Individuals are nonetheless solely sorta returning to the workplace. From Kastle Programs: “Workplace occupancy dipped barely this previous week to 50.6%, in keeping with Kastle’s 10-city Again to Work Barometer. The height day was Tuesday at 58.9%. Cities in Texas noticed occupancy drop as faculties closed for spring break and extreme climate impacted the area. Austin dropped over 9 factors to 58.1% whereas Houston and Dallas each fell greater than 5 factors. Chicago, nonetheless rose to 56.4%, returning to its pandemic document excessive.”

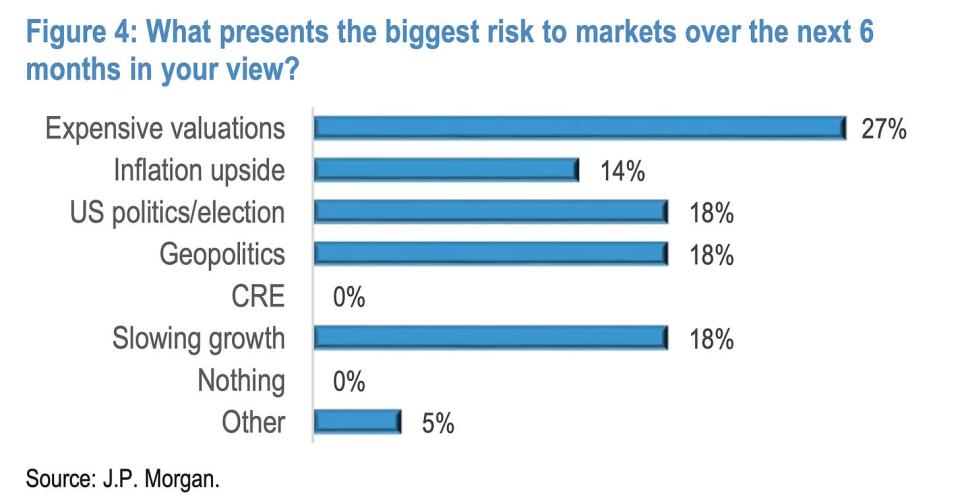

That is the stuff professionals are apprehensive about. Based on BofA’s February International Fund Supervisor Survey, fund managers recognized “greater inflation” because the “greatest tail danger.”

In a distinct survey, JPMorgan shoppers recognized costly valuations as the most important danger to markets.

The reality is we’re at all times apprehensive about one thing. That’s simply the character of investing.

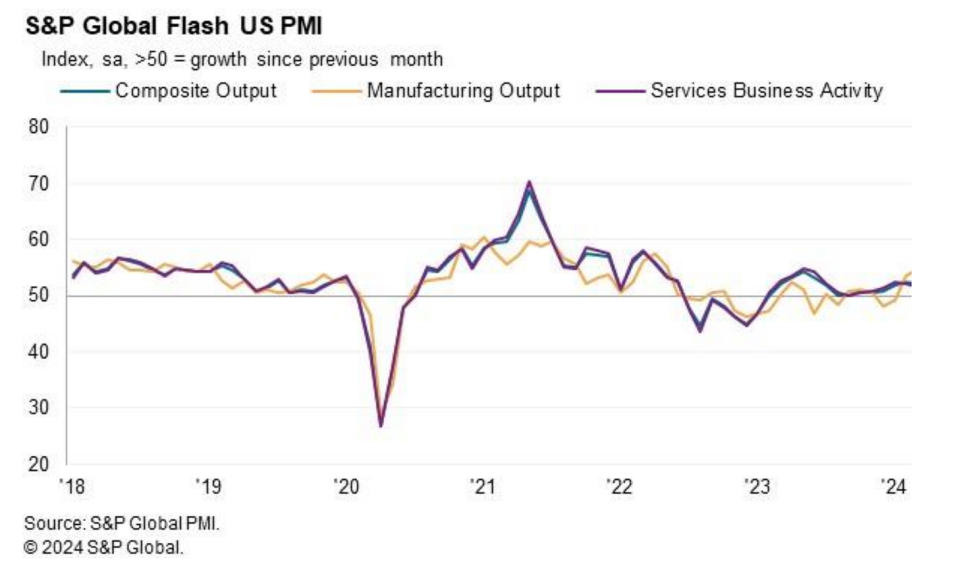

Exercise survey indicators development. From S&P International’s March Flash U.S. PMI:”“Additional expansions of each manufacturing and repair sector output in March helped shut off the U.S. economic system’s strongest quarter because the second quarter of final yr.

The survey knowledge level to a different quarter of sturdy GDP development accompanied by sustained hiring as firms proceed to report new order development. The brightest information got here from the manufacturing sector, the place manufacturing is now rising on the quickest fee since Could 2022. Manufacturing positive aspects are linked to bettering demand for items each at house and overseas, driving an additional upturn in enterprise confidence within the outlook.”

It’s price remembering that delicate knowledge just like the PMI surveys don’t essentially replicate what’s truly occurring within the economic system, particularly throughout occasions of stress.

Close to-term GDP development estimates look good. The Atlanta Fed’s GDPNow mannequin sees actual GDP development climbing at a 2.1% fee in Q1.

Placing all of it collectively

We proceed to get proof that we’re experiencing a bullish “Goldilocks” delicate touchdown situation the place inflation cools to manageable ranges with out the economic system having to sink into recession.

This comes because the Federal Reserve continues to make use of very tight financial coverage in its ongoing effort to get inflation beneath management. Whereas it’s true that the Fed has taken a much less hawkish tone in 2023 and 2024 than in 2022, and that the majority economists agree that the ultimate rate of interest hike of the cycle has both already occurred, inflation nonetheless has to keep cool for a short time earlier than the central financial institution is snug with worth stability.

So we must always anticipate the central financial institution to maintain financial coverage tight, which suggests we ought to be ready for comparatively tight monetary situations (e.g., greater rates of interest, tighter lending requirements, and decrease inventory valuations) to linger. All this implies financial coverage shall be unfriendly to markets in the interim, and the danger the economic system slips right into a recession shall be comparatively elevated.

On the similar time, we additionally know that shares are discounting mechanisms — which means that costs can have bottomed earlier than the Fed indicators a serious dovish flip in financial coverage.

Additionally, it’s necessary to keep in mind that whereas recession dangers could also be elevated, shoppers are coming from a really sturdy monetary place. Unemployed persons are getting jobs, and people with jobs are getting raises.

Equally, enterprise funds are wholesome as many firms locked in low rates of interest on their debt lately. At the same time as the specter of greater debt servicing prices looms, elevated revenue margins give firms room to soak up greater prices.

At this level, any downturn is unlikely to show into financial calamity provided that the monetary well being of shoppers and companies stays very sturdy.

And as at all times, long-term buyers ought to keep in mind that recessions and bear markets are simply a part of the deal if you enter the inventory market with the purpose of producing long-term returns. Whereas markets have had a fairly tough couple of years, the long-run outlook for shares stays constructive.