In a speech that delivered China’s evaluation of world commerce circumstances in 2024, commerce minister Wang Wentao final week warned the “setting is poor”.

“Rising commerce protectionism” and “intensified geopolitical conflicts” had been among the many important challenges, he advised reporters in Beijing on Friday.

However in China’s favour, he reassured his viewers, had been document exports from its “new three” industries: electrical autos, photo voltaic vitality merchandise and lithium batteries.

The fast development of China’s new breed of inexperienced exports — which rose 30 per cent year-on-year to Rmb1tn ($139.3bn) in 2023, in keeping with Wang — has boosted the world’s second-largest financial system because it struggles with a deep property stoop, deflationary strain and low investor confidence.

However for its developed nation buying and selling companions, the prospect of China’s low-cost imports flooding their markets and wiping out jobs in vital industries such because the automotive sector and photo voltaic and wind energy is prompting rising alarm.

Later this yr, the European Fee is about to conclude an anti-subsidy investigation into Chinese language EV manufacturing that would result in greater tariffs for Chinese language imports. Brussels can be contemplating emergency assist measures for its photo voltaic panel manufacturing trade, together with an anti-dumping investigation. The US, in the meantime, has slapped export controls on high-technology shipments to China.

The EU and US are, to make use of officers’ most popular time period, “de-risking” — in impact diversifying their sources of key merchandise — and tightening funding screening for Chinese language firms, basically scrutinising transactions for nationwide safety issues.

Beijing has attacked the EU anti-subsidy investigation into EVs as “bare protectionism” and has criticised “de-risking”. However western critics argue China’s policymaking has been mercantilist for many years, with the methodical setting of targets to extend home provide chain self-reliance. Overseas firms complain they’re going through rising obstacles to accessing the Chinese language market.

“I’m nervous about this challenge, that it might flip into one other commerce battle between two of crucial buying and selling companions,” says Wang Yong, professor on the Faculty of Worldwide Research in Peking College, referring to the EV dispute between China and the EU. “If that occurs no person will profit,” he says, including that China and its important buying and selling companions want to consider “artistic options” to keep away from escalation.

However George Magnus, an affiliate at Oxford college’s China Centre, says commerce negotiators will wrestle to stop additional fallout this yr.

The emergence of China’s “new three” and different industries that had been developed with heavy state subsidies is bringing to a head a conflict between the Chinese language financial system, which carefully marries state coverage and monetary assist with an aggressive personal sector, and the market-orientated capitalism of developed nations.

“What each events need is simply probably not acceptable to both aspect,” Magnus says.

Developed nations, and people within the EU specifically, need China to dilute its industrial insurance policies and concentrate on the home financial system. Chinese language leaders, in the meantime, “clearly like the concept of open buying and selling relationships nevertheless it’s open buying and selling relationships which can be according to the way in which that they need to do industrial coverage”, he provides.

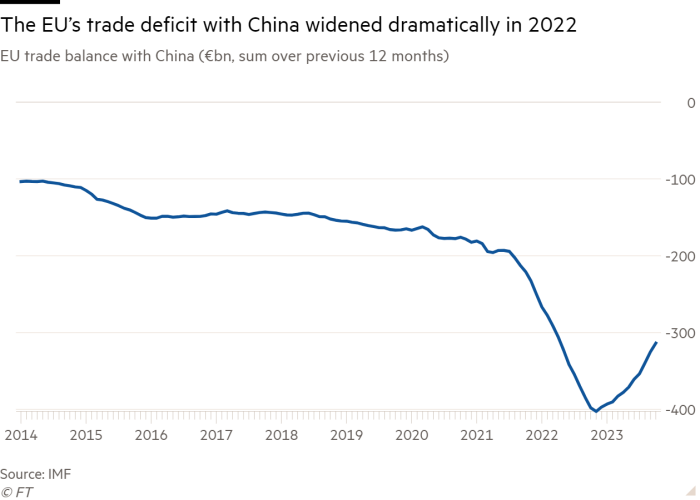

Developed nations have lengthy grizzled about Beijing’s industrial coverage however for the EU the discrepancies gained urgency in 2022, when China booked a “historic” commerce surplus with the bloc of practically €400bn.

Brussels introduced the anti-subsidy investigation when Chinese language EVs started gaining market share final yr. On the similar time, the Ukraine warfare and the pandemic satisfied European leaders they wanted to diversify their sources of some key merchandise of their provide chains, such because the uncommon earths, that are dominated by China.

Their actions got here alongside measures within the US. In addition to proscribing Chinese language entry to superior semiconductors and stepping up the screening of inward and outbound investments to and from China, in 2022 President Joe Biden signed the Inflation Discount Act, which goals to strengthen America’s renewable vitality manufacturing provide chain.

“We don’t need to see decoupling from China,” European Fee President Ursula von der Leyen advised reporters on a go to to Beijing to see President Xi Jinping in December. “What we need to see is de-risking.”

This was about “addressing extreme dependencies by the diversification of our provide chain . . . and thus rising our resilience”, she mentioned.

Chinese language officers responded by criticising Europe’s “restrictive financial and commerce insurance policies”. China’s international ministry director-general for European affairs, Wang Lutong, who participated within the conferences with the EU delegation, attributed China’s industrial growth to mere “innovation”.

But for Beijing, bold insurance policies squarely aimed toward lowering the financial system’s reliance on international nations have been underneath means for many years.

This was initially motivated by China’s need to meet up with its western counterparts after a long time through which the financial system was largely closed to world commerce throughout Mao Zedong’s management. However underneath Xi, who has sought to grow to be extra assertive on the international stage, it has grow to be a nationwide safety crucial.

“China was the unique ‘de-risker’,” says Jens Eskelund, president of the European Union Chamber of Commerce in China. “It’s no secret that China has been speaking about self-reliance for a really very long time.”

Within the early 2000s, Beijing launched a number of industrial plans which aimed to cut back the nation’s dependence on imported expertise to 30 per cent or much less by 2020.

However the plan that basically nervous western governments, together with that of former US president Donald Trump, was “Made in China 2025”, which sought to raise China’s technological prowess to the best ranges.

Tao Wang, chief China economist with UBS and writer of Making Sense of China’s Financial system, says policymakers on the time had been nervous about rising labour prices, a quickly ageing inhabitants and the expansion of digital applied sciences abroad.

“The thought was that China was going through this middle-income entice problem,” Wang says. “And so we actually wanted to maneuver up the worth chain and improve our trade to have the ability to compete.”

The worrying a part of Made in China from developed nations’ perspective was that accompanying paperwork listed bold market share targets throughout 10 strategic industries, from IT and digital machine instruments to robotics, aerospace and new vitality autos.

As an illustration, Chinese language producers of 5G cell community tools and handsets ought to have 80 per cent home market share and 40-45 per cent worldwide market share by 2025, in keeping with evaluation from the US Chamber of Commerce. To realize comparable targets, electrical battery makers had been provided subsidies that would account for greater than 50 per cent of the price of the product.

Overseas enterprise teams attacked the plan as mercantilist, with the US Chamber saying it raised the “chance of rising inefficiencies and overcapacity in China in addition to spillover distortions on a worldwide scale”.

After outcry from western governments, culminating in Trump launching a commerce warfare on China, Beijing steadily dropped Made in China 2025 from official discourse. Xi started as a substitute speaking about “twin circulation”, basically making an attempt to steadiness exports and home consumption — an equilibrium Beijing has but to handle, economists say.

Nevertheless, beneficiant subsidies have continued to circulation into lots of the goal sectors, from semiconductors to EVs.

The 2018 prospectus of main EV maker Nio, for example, mentions not solely subsidies focusing on customers, that are additionally widespread within the US and EU, however authorities handouts for constructing and working public charging stations, in addition to for product growth, manufacturing services, analysis and growth, asset acquisitions and low-interest authorities loans. In 2020, Nio obtained a virtually $1bn bailout from state-backed buyers.

China ended an 11-year shopper subsidy scheme for EV purchases in 2022. However native governments nonetheless supply subsidies and tax rebates and the central authorities has extended a tax discount on EV purchases to 2027. CSIS, the US think-tank, has put Beijing’s cumulative state spending on the EV sector at greater than $125bn between 2009 to 2021.

Importantly for China’s state planners, the sector has met its targets. Chinese language model EVs held 79.9 per cent of the home market in 2022, in keeping with state media.

What has actually alarmed the west about Chinese language clear tech firms is that their expertise is commonly superior to that of the US and different superior economies.

Nationwide Safety Advisor Jake Sullivan mentioned in a speech final April that the US “needed to take care of the fact that a big non-market financial system had been built-in into the worldwide financial order in a means that posed appreciable challenges”.

He accused China of subsidising “at an enormous scale each conventional industrial sectors, like metal, in addition to key industries of the long run”.

However Wang of Peking College says it will be flawed to dismiss the vital position of China’s enormous and dynamic personal sector within the success of many industries, together with EVs.

“In fact, they profit from . . . subsidies from the totally different ranges of presidency,” he says, of China’s personal firms. However their innovation and entrepreneurship shouldn’t be underestimated: “They’ve benefited rather a lot from the fierce competitors in China and on this planet.”

One draw back to such heavy-handed state intervention is that China’s industrial insurance policies can produce unpredictable outcomes and be prohibitively pricey, analysts say.

In China’s western province of Sichuan, the Chongqing Shenhua Skinny Movie Photo voltaic Know-how Co is one instance of centralised coverage misfiring.

Presiding over the photo voltaic plant’s launch ceremony in 2017, the deputy mayor of Chongqing proudly declared the Rmb2.55bn undertaking would “usher in a brand new period” of unpolluted vitality industries within the western Chinese language megapolis.

At the moment, nonetheless, the manufacturing facility is a forlorn sight — deserted by its state-backed shareholders after they determined its expertise couldn’t compete in China’s cut-throat photo voltaic cell market. The doorway turnstiles are wired shut and the German engineers who arrange its superior manufacturing traces have lengthy gone.

“There aren’t any new buyers to kick-start the manufacturing facility,” laments the lone guard on the gate.

Though China’s photo voltaic trade has grown to dominate the worldwide market, it has additionally had excessive ups and downs — because the Shenhua buyers discovered. Firms went bankrupt, for example, after export markets contracted following the eurozone debt disaster that started in 2008.

It’s a growth and bust sample repeated in different sectors. China has struggled to develop a leading edge semiconductor trade regardless of 40 years of state assist.

Even the automotive trade, which was dominated by foreign-Chinese language joint ventures till the EV race, was not notably internationally aggressive earlier than the event of recent vitality autos, UBS’s Wang says.

She believes the distinction with the EV sector is that the federal government “didn’t choose winners and shield sure incumbents and so forth, however as a substitute created incentives for folks to get into the trade after which compete”. Whoever had one of the best technique and one of the best expertise received, she provides.

Regardless of its technological prowess, China’s EV trade has adopted a trajectory much like different sectors favoured by Beijing, says Jörg Wuttke, former president of the European Union Chamber of Commerce in China and now president emeritus.

“Everyone has an infinite provide of loans and assist from the native authorities and that’s why usually, at any time when China scales up, on the finish, it turns into very low cost after which it has just one rescue mechanism. That security valve known as exports,” he says, including it was the Chinese language taxpayer who finally ends up footing the invoice.

Traditionally, the preliminary rollout of an industrial coverage has been accompanied by guidelines that make it laborious for foreigners to take part, in keeping with Wuttke.

“You’ll be able to’t compete towards an financial system which in essence is all the time solely opening up when really the prepare’s already left the station,” he says.

Chinese language policymakers and businessmen typically see international complaints as bitter grapes. One western government recollects how, at a gathering of Chinese language and European businesspeople in Brussels final yr, an official from one in all Beijing’s state-owned enterprises began lecturing the gathering on how Europe had misplaced its “Protestant work ethic”.

“There actually gave the impression to be the notion proper there that Europe is being lazy,” the western government says. This was even supposing Europe’s productiveness ranges stay greater than China’s, he provides.

Chinese language policymakers additionally level to rising US and EU subsidies for inexperienced trade. The price of the US Inflation Discount Act, for example, was initially estimated at $385bn however might ultimately rise to $3tn.

“In Europe 10 or 20 years in the past, and within the US, they thought if we’re coping with China, China will grow to be extra like us. However China managed to truly make us grow to be extra like them,” says Wuttke.

What’s totally different with China’s newest spherical of insurance policies, nonetheless, is the rising emphasis on nationwide safety, analysts say.

Below Xi, the Chinese language authorities has expanded its definition of safety to embrace most areas of expertise, from vitality and the setting to knowledge and manufacturing, with a concentrate on self-reliance.

With China’s property market downturn and customers reluctant to spend, Chinese language banks are lending extra to producers, elevating fears in Europe particularly that one other wave of low cost items is about to go its means.

If the EU concludes its EV anti-subsidy probe by penalising Chinese language vehicles, Beijing would in all probability retaliate, analysts say. Final yr Beijing responded to US export restrictions by inserting limits on shipments of two metals utilized in chipmaking, gallium and germanium, over which it has a chokehold. China additionally this month fired a warning salvo at France, which it sees as one of many protagonists of the EV dispute, by launching an anti-dumping probe into French cognac.

Henry Gao, Professor of Legislation at Singapore Administration College, says China will do its finest to keep away from a breakdown within the relationship with the EU, as occurred with the US underneath Trump. With its financial system struggling and authorities debt rising, it can not afford anyway to maintain subsidising its EVs.

Gao says that Xi possible realises it’s not sensible to quarrel with too many huge buying and selling companions concurrently. “Xi in all probability sees the present world by the lens of the ‘three kingdoms’,” says Gao, referring to a interval of historical past when three states fought for supremacy in China. “You can’t struggle the 2 different kingdoms on the similar time. If you struggle one you have to attempt to be buddies with the opposite. That’s the technique.”

For superior economies, China’s low-cost exports and manufacturing might assist governments steadiness inflationary pressures whereas transitioning to cleaner applied sciences. This might present one motivation for defusing looming commerce variations.

“If globally folks need to undertake a inexperienced transition quickly, it is smart to make use of cheaper, extra price environment friendly merchandise,” says Robin Xing, chief China economist with Morgan Stanley. “So it’s additionally a fragile steadiness. How a lot do you need to convey the transition ahead? How a lot do you need to be extra self-sufficient within the provide chain?”

Eskelund of the EU’s Chamber believes there’s a “sweetspot” through which the 2 sides can profit from the opposite’s aggressive strengths.

“It’s in one of the best long-term curiosity of each China and Europe that we discover that steadiness to permit either side to play to their benefits in a means that helps the opposite social gathering. However that’s not the place we’re right now,” he says.

Extra reporting from Andy Bounds in Brussels and Edward White in Shanghai