Within the coming months, Europe’s power disaster could take a dramatic flip.

As Europe realizes the complete danger of counting on international oil and gasoline, it may quickly discover reduction coming from an surprising supply.

That’s as a result of, after years of leaning on low-cost Russian gasoline, geopolitical shifts have modified the equation.

Each the conflict in Ukraine and easy economics have pressured the EU to pivot from strict inexperienced power insurance policies.

The Wall Road Journal experiences, “Europe cuts habit to Russian oil.”

And The Washington Put up introduced lately, “Amid power disaster, EU says gasoline can typically be ‘inexperienced.'”

The message is evident: Europe is scrambling to diversify its power sources and obtain true power independence.

That’s unlocked a golden alternative with Europe’s best asset: its huge, untapped pure gasoline reserves.

For many years, prime targets for pure gasoline have gone fully neglected.

That’s why one Canadian power firm, MCF Vitality (TSXV:MCF; OTC:MCFNF), is on a mission to assist safe Europe’s power independence and discover these long-ignored belongings.

And with the acquisition of a confirmed goal in Germany, the panorama may shift dramatically within the coming months.

MCF Vitality Targets Ignored Pure Gasoline Reserves in Germany

MCF Vitality introduced a number of main new acquisitions in Germany. The corporate has secured rights to 4 key belongings up to now.

The corporate is particularly concentrating on its concession at Lech, which spans about 10 sq. kilometers in Bavaria.

That’s as a result of the property holds 3 wells already drilled many years in the past, with two confirming discoveries of pure gasoline.

Within the early Eighties, Mobil Oil started drilling in the hunt for oil on the property and found a major gasoline reservoir.

On the time, testing confirmed a most stream charge of 24 million cubic ft per day (MMCFD) of pure gasoline with related condensate.

Because of low pure gasoline costs on the time, nonetheless, these belongings have been left just about untouched for over 40 years.

As CEO James Hill said, “I believe from a danger perspective, you are not going to overlook this one. I believe there’s a 99% probability as a result of it’s there.”

Now, with 3D imaging and proprietary AI and machine studying expertise, MCF Vitality (TSXV:MCF; OTC:MCFNF), plans to pinpoint much more promising places on the property.

Particularly, they’ll use this knowledge to goal extra high-value prospects on their Lech East web site, which provides one other 100 sq. kilometers.

Based mostly on the imaging, the workforce has already keyed in on a number of places, with probably extra to return as soon as drilling commences in Q1.

By leveraging the hundreds of thousands of {dollars} that Mobil Oil spent on this 3D seismic imaging, MCF Vitality may quickly play a key function in serving to wean Europe off its habit to Russian gasoline.

Trade Trailblazers Primed to Capitalize on Europe’s Ignored Potential

MCF Vitality is led by CEO James Hill, a seasoned geologist with over 40 years of expertise exploring and growing belongings throughout North America and Europe.

Amongst Mr. Hill’s lengthy record of tasks is without doubt one of the largest onshore oi fields ever present in Europe, on the Patos Marinza Oil Area in Albania the place manufacturing was elevated over 2000%.

After a profitable profession, Hill had retired. However due to the scale of the chance at hand, his retirement was short-lived.

With Russia’s invasion and the EU’s pivot to categorise pure gasoline as “inexperienced power,” Hill and his workforce are uniquely positioned to faucet into Europe’s huge, neglected oil and gasoline reserves. In 2022, they started six months of due diligence, carried out on 20 belongings.

Since then, MCF Vitality has acquired rights to Europe’s most high-priority and high-conviction places.

That features the 4 belongings in Germany by means of the strategic acquisition of a personal German firm, Genexco.

The transfer offers MCF Vitality not simply the confirmed belongings drilled by Mobil many years in the past.

It additionally supplies a workforce of consultants with inside information of each the terrain and easy methods to navigate complicated zoning and licensing processes in Europe.

These early wins will now assist de-risk MCF Vitality’s portfolio whereas additionally accelerating its timeline.

With drilling set to begin in April at their Lech concession, pipelines are situated lower than 2 km away to carry power all through Europe.

That makes transportation considerably simpler and extra economical for MCF (TSXV:MCF; OTC:MCFNF) in the event that they uncover the volumes of pure gasoline that they count on, given the previous outcomes and 3D knowledge.

Higher nonetheless, the pipeline firm has even supplied to attach free of charge in the event that they dedicate provides, which might assist enhance money stream even additional.

A Trillion Cubic Toes of Pure Gasoline in Austria?

MCF Vitality’s management has been vocal about their confidence in a serious discovery in Germany as a result of Mobil’s previous work there.

However the firm’s most enjoyable prospect may come from MCF Vitality’s different current acquisition in Austria.

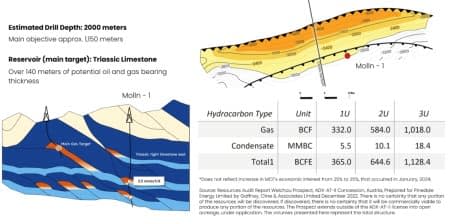

The corporate lately acquired rights to the Welchau prospect close to the Austrian Alps.

It covers 100 sq. kilometers and contains a big anticline construction, a big bump much like what’s discovered within the Kurdistan Area of Iraq or the Italian Apennines.

Within the Eighties, an Austrian oil and gasoline firm, OMV, drilled the Molln #1 on the aspect of this construction, 5 kilometers away from MCF Vitality’s properly location at Welchau and found the presence of gasoline and condensate.

LIVE DRILLING UPDATE: 03/11/2024 – MCF Vitality has simply confirmed an energetic petroleum construction on the Welchau-1 properly web site. The properly efficiently reached a depth of 1155 metres on March 10 and drilling to the primary goal is underway with completion anticipated by month finish. CEO of MCF Vitality James Hill stated, “The drilling outcomes up to now are very promising, and the indications of gasoline and heavier hydrocarbons are notably encouraging for us.” Learn the complete launch right here

In response to a current interview with Hill, Welchau holds all of the substances for a serious discovery:

– the confirmed hydrocarbons

– a lure massive sufficient to be seen from area

– the seal capability to seal the gasoline inside (which is often the primary danger).

Gaffney and Cline’s evaluation suggests that the property may produce as much as 584 billion cubic ft of gasoline on a best-case stage, with 10 million barrels of oil.

However Hill believes that, if the seal is pretty much as good because it seems, that quantity may almost double to the reported 1 TCF of gasoline and 18 million barrels of oil.

There’s nearly nowhere on the earth the place a trillion cubic ft rests untapped on land at such a low drilling value. If MCF Vitality (TSXV:MCF; OTC:MCFNF) if discovers wherever close to that quantity of gasoline, particularly simply 18 kilometers from a nationwide pipeline, it might be transformative for Europe’s power disaster.

Plus, it will be a serious boon to MCF Vitality.

A Main Shift in Europe’s Vitality Panorama Might Be Weeks Away

Europe’s shift away from low-cost Russian gasoline has created a once-in-a-generation alternative for pure gasoline exploration.

It’s all taking place as MCF Vitality prepares to start drilling at Welchau.

Within the coming weeks, an announcement from the corporate may sign a serious shift in how Europe supplies energy to properties throughout the continent.

With many years of expertise in Europe, plus a number of confirmed belongings and pipelines close by, MCF Vitality is now in a main place to capitalize on Europe’s untapped pure gasoline reserves.

Different firms to control:

Chevron Company (NYSE:CVX), a titan within the international power market, demonstrates an unwavering dedication to main the pure gasoline sector by means of vital investments in exploration, manufacturing, and distribution. Chevron’s strategic involvement in main LNG tasks throughout Australia and Africa is a testomony to its ambition to dominate this significant power sector. This forward-looking method not solely diversifies Chevron’s power portfolio but additionally aligns with the worldwide shift in direction of cleaner power sources, thereby enhancing its aggressive edge within the worldwide market.

In parallel, Chevron’s prowess within the oil sector stays foundational to its operations. The corporate boasts intensive reserves and a sturdy downstream presence, underpinned by a dedication to effectivity and sustainability. Chevron’s dedication to progressive applied sciences and sustainable practices in oil extraction and refining underscores its management in environmental stewardship throughout the trade.

Chevron represents a compelling funding alternative, combining expansive pure gasoline initiatives with a strong basis within the oil sector. This distinctive mix of progress potential in pure gasoline and stability in oil positions Chevron as a dynamic drive within the power trade, poised for continued success in an evolving international power panorama.

Exxon Mobil Company (NYSE:XOM)‘s affect on the worldwide power stage is profound, with strategic investments within the pure gasoline sector positioning it as a pacesetter on this quickly evolving market. The corporate’s engagement in LNG tasks and shale gasoline exploration highlights its dedication to assembly the world’s shifting power consumption patterns, with a transparent deal with offering cleaner, extra environment friendly power options.

Concurrently, Exxon Mobil’s legacy within the oil sector continues to be a major driver of its income, with international operations marked by an unyielding pursuit of operational excellence. The corporate’s efforts to reinforce extraction efficiencies and refining capabilities are indicative of its dedication to sustaining its standing as a premier oil firm, even because it expands its footprint within the pure gasoline area.

Exxon Mobil affords a harmonious mix of conventional power dominance and progressive progress methods. The corporate’s sturdy forays into pure gasoline, coupled with its enduring energy in oil operations, recommend a imaginative and prescient for the long run that guarantees regular returns and strategic progress alternatives within the evolving power market.

ConocoPhillips (NYSE:COP), with its expansive international operations, has adeptly balanced its power portfolio between pure gasoline and oil, reflecting a nuanced understanding of the world’s altering power consumption traits. The corporate’s strategic investments in pure gasoline, notably in North America and Asia, spotlight its dedication to securing a management place on this more and more vital sector. ConocoPhillips’ LNG operations and investments in shale reserves are emblematic of its ambition to harness the expansion potential of pure gasoline.

On the identical time, ConocoPhillips’ dedication to grease exploration and manufacturing stays unwavering. The corporate’s operations, which span a number of continents, are a testomony to its trade management and dedication to sustainable manufacturing strategies. This strategic twin focus ensures that ConocoPhillips is well-positioned to satisfy international power calls for with a various and environmentally accountable power portfolio.

Buyers contemplating ConocoPhillips are offered with an organization that gives a balanced and growth-oriented method to power manufacturing. Its mixture of pioneering pure gasoline initiatives and steadfast dedication to grease exploration and manufacturing positions ConocoPhillips as a flexible and sustainable selection within the international power market, providing each stability and vital progress potential.

Talos Vitality Inc. (NYSE:TALO) marks its presence within the exploration and manufacturing sector with a targeted method on the USA Gulf of Mexico and offshore Mexico, showcasing its prowess in tapping into the numerous oil and pure gasoline sources of those areas. As an organization that rapidly made its mark by means of strategic acquisitions and a sturdy exploration technique, Talos has distinguished itself with a portfolio that spans each operated and non-operated belongings, underlining its dedication to environmental stewardship and the adoption of progressive applied sciences. This dedication not solely enhances operational effectivity and security but additionally positions Talos as a pacesetter in sustainable power manufacturing.

Talos Vitality’s dedication to sustainability and decreasing its environmental affect is central to its operations. The corporate’s involvement in carbon seize initiatives and its steady exploration of technological developments to reduce its ecological footprint mirror a forward-thinking method to power manufacturing. For buyers, Talos represents an agile and progressive firm poised for progress in key energy-producing areas, making it a compelling selection for these excited by a sustainable future for the power sector.

Wanting ahead, Talos Vitality is about on increasing its footprint by means of exploration successes and strategic partnerships, sustaining a stability between progress and environmental duty. This imaginative and prescient, coupled with a eager eye on the evolving power panorama, makes Talos Vitality a notable prospect for buyers targeted on the power sector’s sustainable and progressive future.

Cheniere Vitality, Inc. (NYSE:LNG) is a pioneering drive within the liquefied pure gasoline (LNG) sector in the USA, boasting one of many nation’s inaugural LNG export amenities. With a enterprise mannequin that covers the whole LNG worth chain, Cheniere is strategically positioned to leverage the rising international demand for pure gasoline, acknowledged as a pivotal cleaner power supply. The operation of their Sabine Cross and Corpus Christi amenities underscores Cheniere’s capability to satisfy the burgeoning worldwide demand for LNG, highlighting its function within the international power transition in direction of lower-carbon sources.

The corporate’s dedication to sustainability, security, and neighborhood engagement is a testomony to its function as a accountable power supplier. Cheniere’s efforts to reinforce the environmental efficiency of its operations mirror a broader dedication to facilitating the transition to a lower-carbon future, aligning with international power traits and client expectations for extra sustainable power options.

Cheniere Vitality presents a novel funding alternative to have interaction with an trade chief within the LNG market, well-positioned to capitalize on the worldwide shift in direction of cleaner power sources. The corporate’s pioneering standing, mixed with steady growth and operational excellence, indicators sturdy progress potential and profitability within the transformative power panorama.

Brookfield Renewable Companions L.P. (NYSE: BEPC, TSX: BEPC) is on the forefront of the renewable power revolution, capitalizing on the rising demand for inexperienced power by means of strategic acquisitions and natural progress. The corporate’s formidable goal to extend its funds from operations (FFO) by over 10% this yr underscores its sturdy progress trajectory, supported by the progressive integration of Synthetic Intelligence (AI) as a catalyst for future expansions. This deal with AI highlights Brookfield Renewable’s adaptability and its potential to considerably affect the power sector.

The substantial electrical energy consumption related to AI expertise presents a novel alternative for Brookfield Renewable to satisfy the rising energy wants of main international expertise corporations. As AI’s demand for electrical energy surges, Brookfield’s strategic partnerships place it to turn out to be a major power provider, thereby enabling the corporate to play a pivotal function in powering the way forward for expertise and innovation.

Brookfield Renewable’s strategic foresight in embracing AI’s potential signifies its dedication to main the power transition. With CEO Connor Teskey’s insights on the exponential demand from expertise giants, the corporate is poised to assist the inexperienced power wants of among the world’s largest procurers of renewable energy. This method not solely enhances Brookfield Renewable’s progress prospects but additionally solidifies its place as a key participant within the sustainable power panorama, providing buyers an opportunity to be a part of a transformative journey in direction of a greener, extra technologically superior future.

Suncor Vitality (NYSE:SU, TSX:SU) stands as a beacon amongst Canada’s built-in power firms, with a pronounced presence within the pure gasoline sector alongside vital belongings in Western Canada. This strategic positioning permits Suncor to harness the area’s huge reserves, aiming to satisfy the escalating power calls for of North America. Furthermore, the core of Suncor’s operations lies throughout the oil sands, the place it ranks among the many world’s largest operators. The corporate’s dedication to leveraging cutting-edge applied sciences ensures environment friendly and sustainable extraction processes, setting a benchmark for operational excellence within the trade.

Suncor’s dedication to sustainability is obvious throughout all sides of its operations, from efforts to cut back carbon footprints to initiatives geared toward mitigating environmental impacts. This complete method to sustainability underscores Suncor’s dedication to environmental stewardship and positions it as a pacesetter within the transition in direction of extra sustainable power manufacturing practices.

Suncor’s stronghold within the oil sands sector guarantees regular revenues, whereas its ventures into the pure gasoline area mirror a strategic adaptability to the shifting dynamics of the worldwide power market. This mix of conventional power strengths with a forward-looking method to power manufacturing makes Suncor a horny funding possibility for these searching for to take part in the way forward for the power sector, marked by sustainability and innovation.

TC Vitality Company (TSX:TRP) performs a basic function in shaping North America’s power panorama by means of its intensive pipeline operations. Specializing within the transportation of pure gasoline, TC Vitality’s sprawling community ensures the environment friendly distribution of this crucial useful resource throughout the continent, embodying the corporate’s mission to facilitate power accessibility and reliability. This intensive infrastructure underscores TC Vitality’s strategic place on the nexus of North America’s gasoline distribution, reflecting a deep dedication to assembly the area’s evolving power calls for.

The corporate’s involvement in oil transportation additional amplifies its significance throughout the power sector. By connecting main oil sands areas to refineries and markets, TC Vitality’s oil pipelines are instrumental in sustaining a constant and environment friendly stream of oil, important for each financial stability and power safety.

Canadian Pure Assets Restricted (TSX:CNQ) showcases a various and sturdy portfolio that spans the breadth of the power sector, notably highlighted by its ventures within the pure gasoline area and its vital presence within the oil sands. The corporate’s strategic deal with the Montney and Duvernay areas exemplifies its dedication to harnessing Canada’s huge gasoline potential, positioning CNRL as a key participant within the nation’s power manufacturing.

Oil stays a cornerstone of CNRL’s success, with a various asset base that features oil sands, heavy crude, and light-weight oil, demonstrating the corporate’s operational versatility and managerial acumen in dealing with complicated power tasks. CNRL’s dedication to sustainable practices and price efficiencies not solely units it aside within the trade but additionally aligns with broader environmental targets, making it an interesting selection for buyers involved with sustainability.

Enerplus Company (TSX:ERF) is making vital strides as a diversified North American power producer, with a eager deal with natural manufacturing progress inside its principal areas. By emphasizing operational effectivity and price administration, Enerplus is ready to navigate the complexities of the power market, notably highlighting its prowess within the Bakken/Three Forks formations in North Dakota. These areas, recognized for his or her high-quality gentle oil belongings, considerably contribute to the corporate’s manufacturing quantity and income.

Enerplus’s dedication to sustainability and accountable useful resource improvement is obvious by means of its funding in applied sciences and practices designed to reduce environmental affect. This method not solely enhances the security and effectivity of its operations but additionally aligns with the rising international emphasis on environmental duty throughout the power sector.

Wanting forward, Enerplus is poised for continued progress and operational excellence. With a strong monetary basis and a strategic deal with its core operational areas, Enerplus is well-equipped to thrive within the dynamic power market. The corporate’s dedication to value-driven progress and sustainability positions it as a horny funding alternative for these trying to interact with an organization on the forefront of the power transition.

By. Charles Kennedy

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Ahead-Wanting Statements

This publication accommodates forward-looking info which is topic to a wide range of dangers and uncertainties and different elements that would trigger precise occasions or outcomes to vary from these projected within the forward-looking statements. Ahead trying statements on this publication embody that giant oil and gasoline firms will proceed to deal with offshore pure gasoline sources; that home onshore pure gasoline belongings in Europe will present a extra inexpensive power supply than offshore sources; that demand for pure gasoline will proceed to extend in Europe and Germany; that Russia is not going to provide the vast majority of pure gasoline in Germany and Europe; that pure gasoline will proceed to be utilized as a fundamental power supply in Germany and different European international locations and demand for pure gasoline, and specifically home pure gasoline, will proceed and enhance sooner or later; that MCF Vitality Ltd. (the “Firm”) can replicate the earlier success of its key buyers and administration in growing and promoting invaluable power belongings; that the pure gasoline tasks of the Firm can be efficiently examined and developed; that the Firm can develop and provide a protected, home supply of power to European international locations; that pure gasoline can be reclassified as sustainable power which can assist the event of the Firm’s belongings; that imports of liquified pure gasoline is not going to be sustainable for Europe and that European international locations might want to depend on home sources of pure gasoline; that the Firm expects to acquire vital consideration as a result of its upcoming drilling plans mixed with Europe determined for home pure gasoline provide; that the upcoming drilling on the Firm’s tasks can be profitable; that the Firm’s tasks will include industrial quantities of pure gasoline; that the Firm can finance ongoing operations and improvement; that the Firm can obtain its enterprise plans and aims as anticipated. These forward-looking statements are topic to a wide range of dangers and uncertainties and different elements that would trigger precise occasions or outcomes to vary materially from these projected within the forward-looking info. Dangers that would change or forestall these statements from coming to fruition embody that giant oil and gasoline firms will begin specializing in the event of home pure gasoline sources; that the pure gasoline sources of opponents can be extra profitable or receive a larger share of market provide; that offshore liquified pure gasoline belongings can be favored over home sources for numerous causes; that various applied sciences will exchange pure gasoline as a mainstream power supply in Europe and elsewhere; that demand for pure gasoline is not going to proceed to extend as anticipated for numerous causes, together with local weather change and rising applied sciences; that political adjustments will end in Russia or different international locations offering pure gasoline provides in future; that the Firm could fail to copy the earlier success of its key buyers and administration in growing and promoting invaluable power belongings; that the pure gasoline tasks of the Firm could fail to be efficiently examined and developed; that the Firm’s tasks could not include industrial quantities of pure gasoline; that the Firm could also be unable to develop and provide a protected, home supply of power to European international locations; that pure gasoline is probably not reclassified as sustainable power or could also be changed by different power sources; that the upcoming drilling on the Firm’s tasks could also be unsuccessful or could also be much less constructive than anticipated; that the Firm’s tasks could not include industrial quantities of pure gasoline; that the Firm could also be unable to finance its ongoing operations and improvement; that the Firm can obtain its enterprise plans and aims as anticipated; that the Firm could also be unable to finance its ongoing operations and improvement; that the enterprise of the Firm could also be unsuccessful for numerous causes. The forward-looking info contained herein is given as of the date hereof and we assume no duty to replace or revise such info to mirror new occasions or circumstances, besides as required by regulation.

DISCLAIMERS

This communication is for leisure functions solely. By no means make investments purely primarily based on our communication. We now have not been compensated by MCF Vitality Ltd. for this text. Whereas the opinions expressed on this article are primarily based on info believed to be correct and dependable, such info in our communications and on our web site has not been independently verified and isn’t assured to be appropriate. The content material of this text relies solely on our opinions that are primarily based on very restricted evaluation and we’re not skilled analysts or advisors.

SHARE OWNERSHIP. The proprietor of Oilprice.com owns shares of MCF Vitality Ltd. and subsequently has an incentive to see the featured firm’s inventory carry out properly. The proprietor of Oilprice.com is not going to notify the market when it decides to purchase extra or promote shares of MCF Vitality Ltd. out there. The proprietor of Oilprice.com can be shopping for and promoting shares of this issuer for its personal revenue. Accordingly, our views and opinions on this article are topic to bias, and why we stress that you must conduct your personal intensive due diligence concerning the Firm in addition to search the recommendation of your skilled monetary advisor or a registered broker-dealer earlier than you take into account investing in any securities of the Firm or in any other case.

NOT AN INVESTMENT ADVISOR. Oilprice.com will not be registered or licensed by any governing physique in any jurisdiction to offer investing recommendation or present funding suggestion. You shouldn’t deal with any opinion expressed herein as an inducement to make a specific funding or to comply with a specific technique, however solely as an expression of opinion. The opinions expressed herein don’t bear in mind the suitability of any funding along with your specific aims or danger tolerance. Investments or methods talked about on this article and on our web site is probably not appropriate for you and are usually not meant as suggestions.

ALWAYS DO YOUR OWN RESEARCH and seek the advice of with a licensed funding skilled earlier than making any funding. This communication shouldn’t be used as a foundation for making any funding in any securities. Previous efficiency will not be indicative of future outcomes.

RISK OF INVESTING. Investing is inherently dangerous. Don’t commerce with cash you can not afford to lose. There’s a actual danger of loss (together with whole lack of funding) in following any technique or funding mentioned on this article or on our web site. That is neither a proposal to buy, nor a solicitation of a proposal to promote, subscribe for or purchase any securities or the solicitation of any vote in any jurisdiction. No illustration is being made as to the long run value of securities talked about herein, or that any inventory acquisition will or is prone to obtain earnings.