Supply: @NewsLambert on X

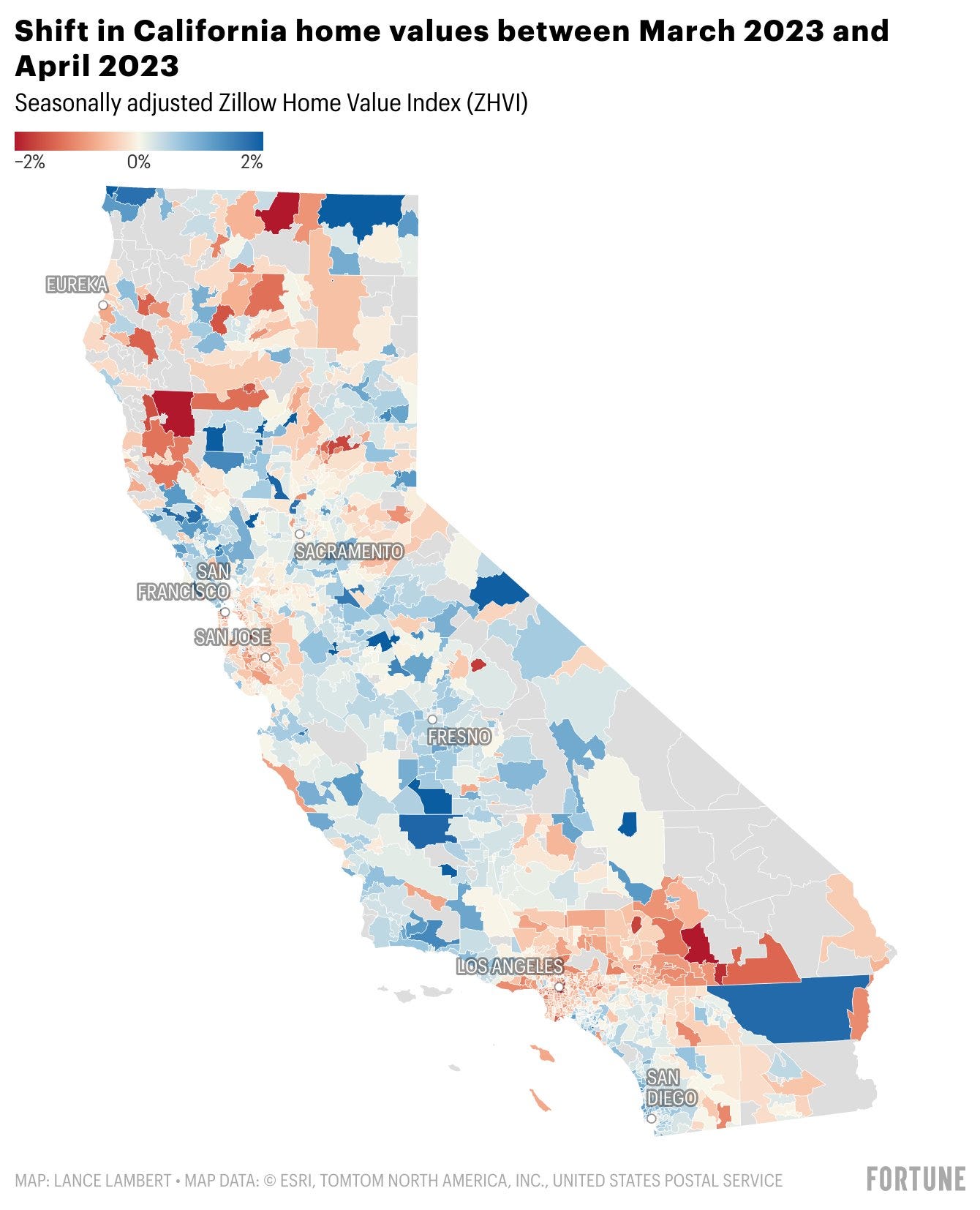

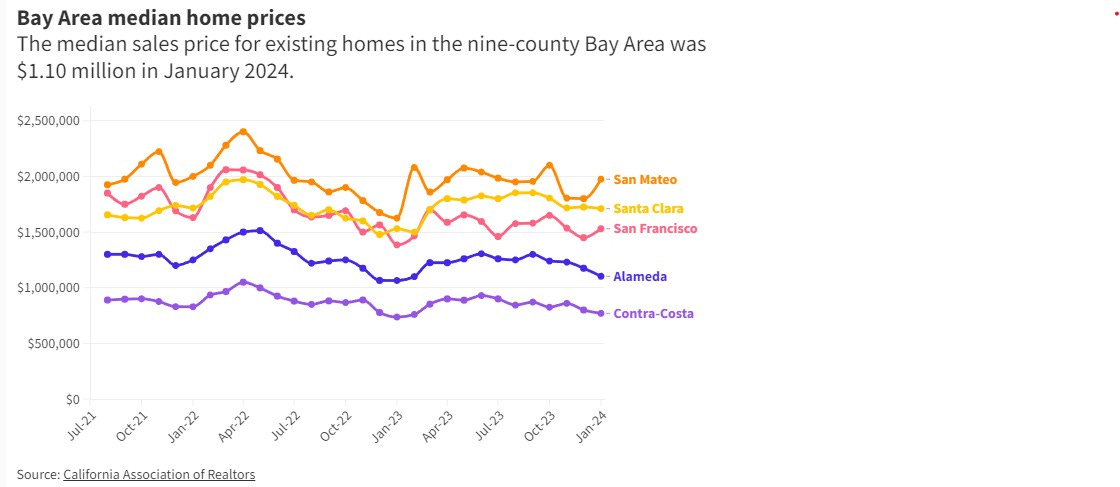

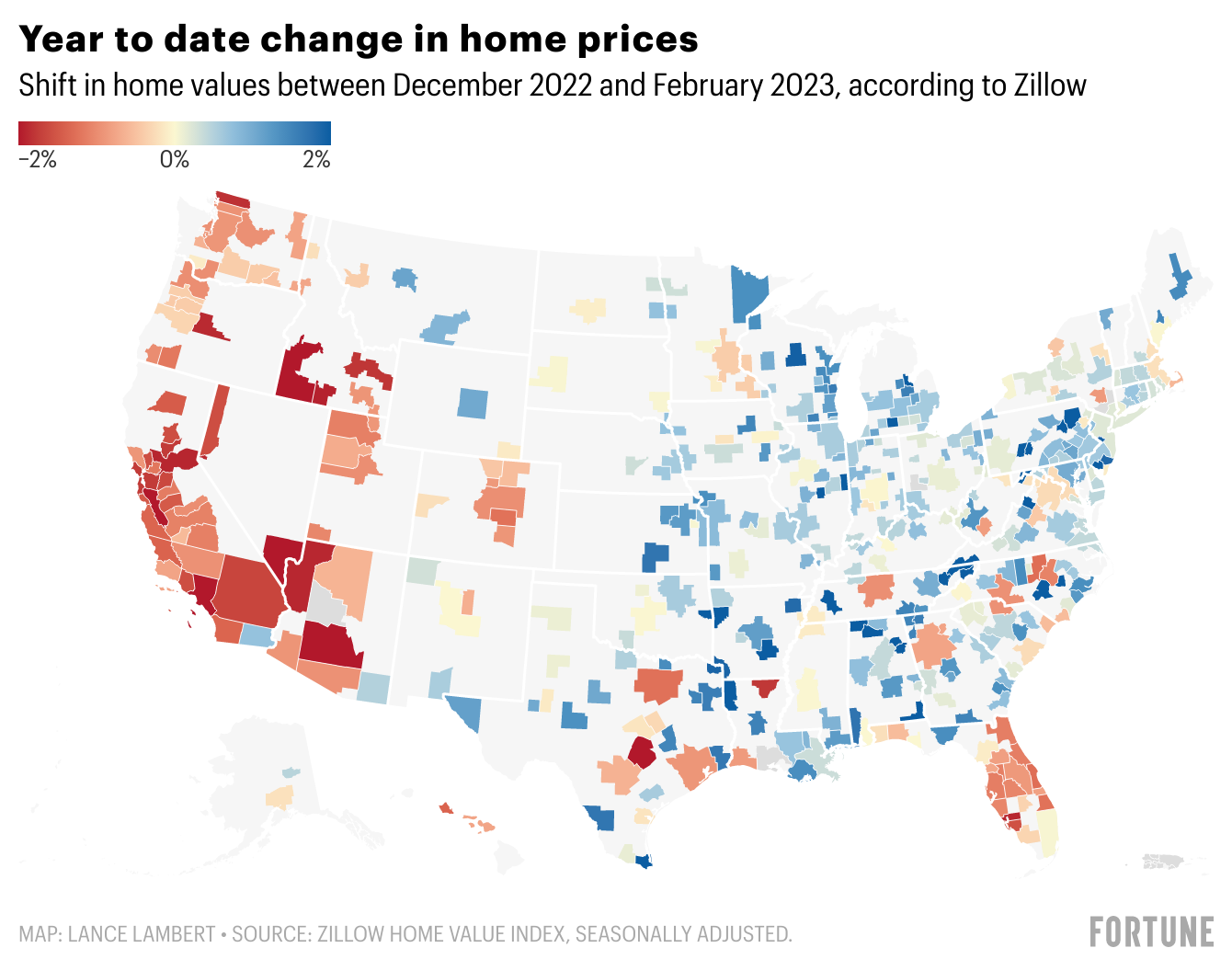

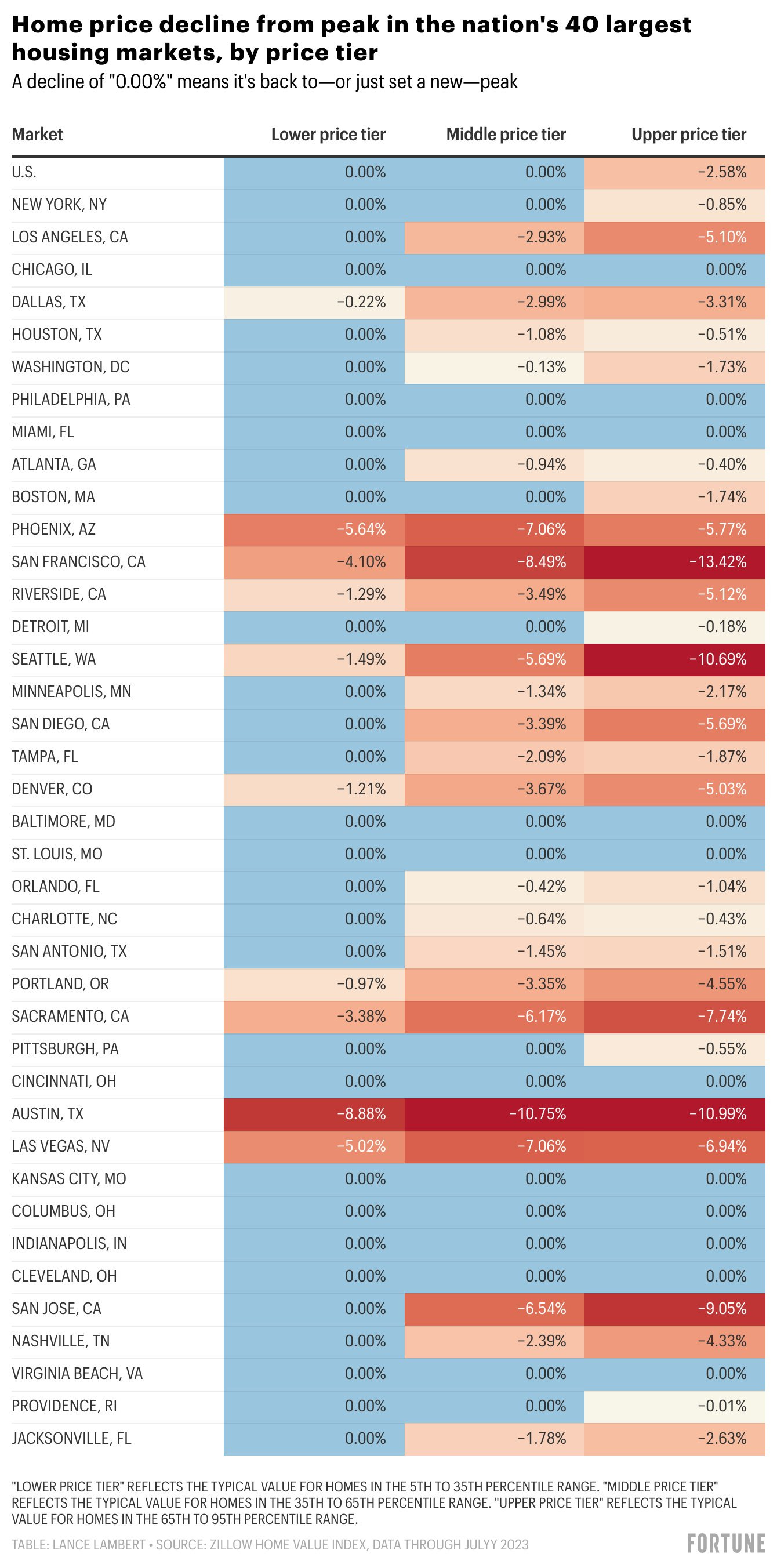

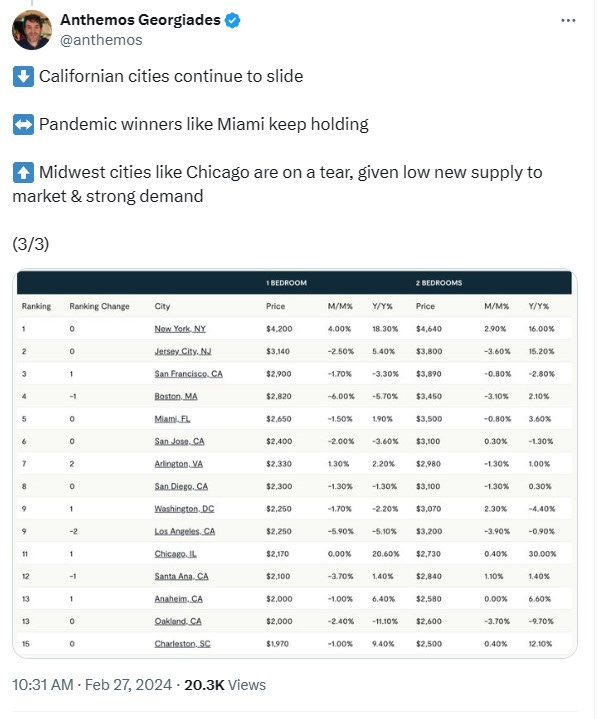

Final yr, there was a shift in actual property, with markets stronger within the Japanese US however a slowdown within the West. The West rose disproportionately throughout the tech increase and was hit more durable by going distant and tech crashing, in addition to Progressives ruining cities. Whereas the Bay Space escaped the worst of the housing crash in 08’, one other tech bubble crash on prime of an actual property bubble crash can be catastrophic. Regardless, Bay Space house costs ticked up this yr in hopes of a Fed pivot after high-interest charges prompted a slowdown final yr.

Supply: Fortune.com

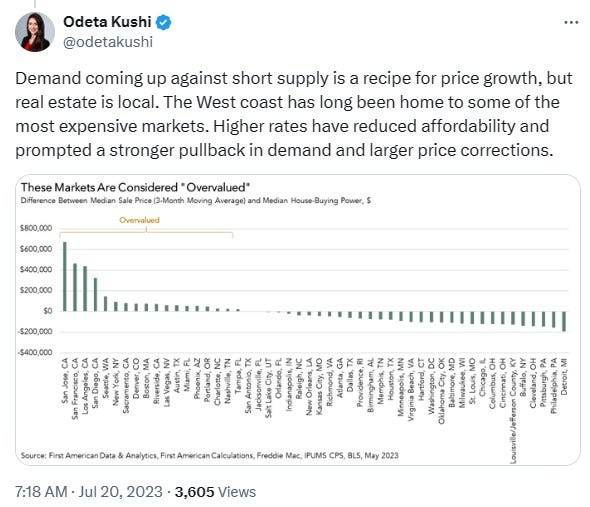

Bay Space actual property forecasts are extra bullish once more, together with for Silicon Valley residential actual property, regardless of tech layoffs. Whereas forecasts don’t essentially match up with actuality, plenty of demand is because of a scarcity of stock. Demand developing towards brief provide is a recipe for value progress. Nevertheless, so much relies upon upon rates of interest and the tech trade. To not point out hopes that AI, which is clearly in a bubble, can save the Bay Space’s financial system and actual property market.

Supply: Siliconvalley.com

California metros have a few of the most overvalued housing markets within the Nation (San Diego-Carlsbad – 70.0%, San Francisco-Oakland-Hayward – 69.8%, Los Angeles-Lengthy Seaside-Anaheim – 66.1%, Riverside-San Bernardino-Ontario– 66.0%). The metric for overvalued is contrasting house costs with wages. Locations just like the Bay Space’s jobs to housing ratio are so excessive, which implies that actual property is susceptible to mass layoffs.

Supply: Fortune.com

The locations the place housing costs plummeted probably the most in California in 2023 had been Dublin (-15.75%), Truckee (-13.50%), East Palo Alto (-13.47%), San Francisco (-13.04%), Palo Alto (-12.80%), Pleasanton (-12.14), Alameda (-12.12%), and Oakland (-11.94%). In distinction, the quickest rising house costs had been Hidden Hills (+6.7%), Newport Seaside ( (+10.6%), La Canada Flintridge (+14.5%), Rancho Santa Fe (+7.6%), Del Mar (+7.6%), and Coronado (+9.9%). SoCal actual property is stronger than the Bay Space, and prosperous Coastal San Diego and Orange County are particularly sturdy. These are locations the place tons of prosperous folks wish to reside and are fascinating for geographic attributes, reminiscent of being close to the Coast. Probably the most susceptible actual property is locations linked to jobs that may go distant or get terminated like Silicon Valley, city cores impacted by crime and concrete decay, in addition to locations folks moved to for cheaper housing just like the Inland Empire.

Supply: Fortune.com

Nationwide, homebuilder confidence has brightened because of hopes for a Fed pivot, which is now wanting much less possible. California metros carried out poorly for the prime metros for residential building permits. San Francisco ranked simply behind LA, at quantity 40, close to the underside of your complete Nation. The highest California metro for brand new permits was Sacramento (25th), adopted by Riverside-San Bernardino (twenty eighth), San Jose (thirtieth), and San Diego (thirty seventh). Nevertheless, NIMBYism is a significant motive why builder permits are so low for LA and SF metros in comparison with the remainder of the Nation.

Supply: Federal Reserve Financial Information

Supply: Federal Reserve Financial Information

California not too long ago turned extra YIMBY on housing, in good timing for the incoming actual property crash and recession. Count on to see fewer new skyscrapers and megaprojects underneath building, particularly workplace tasks. Whereas California going YIMBY might not be sufficient to offset the recession, I’m extra bullish on lacking center residential tasks, like midrise condominium complexes.

Plenty of high-rise tasks had been canceled after the 2001 dotcom bubble crash and the 08 monetary crash. One of many best tragedies was the lack of potential Artwork Deco skyscrapers as a result of Nice Melancholy. The 70s stagflation period and early 80s recession had been a combined bag for high-rise building. On one hand, stagflation and the recession slowed down demand for actual property. Nevertheless, Japanese funding financed many skyscraper tasks, plus there have been some aggressive city renewal tasks in response to city decay. Plenty of the tallest high-rises in Downtown LA and SF had been constructed within the 70s or early 80s. Mockingly the booming 90s had been a low level for high-rise building, as there was an increase in NIMBYism, plus a shift in tastes to low or mid-rise workplace parks for Hollywood and Silicon Valley.

Supply: Odeta Kushi on X:

Building tendencies depend on whether or not inflation is allowed to surge to prop up actual property belongings or whether or not there’s a deflationary crash in asset bubbles and or a credit score crunch. The previous would wipe out the working class however may very well be good for actual property in additional prosperous areas and concrete cores, whereas the latter would halt most new building. There’s a sturdy correlation between whether or not the Fed pivots and new building.

Way back to twenty years in the past, James Howard Kunstler was making the purpose that the monetary infrastructure that sustains skyscrapers, megaprojects, and mass sprawl subdivisions was unsustainable. Skyscraper building displays speculative bubbles in addition to overseas funding, particularly Chinese language. China’s monetary and actual property disaster may have a ripple impact on California actual property, although the Chinese language may also nonetheless make investments as a hedge towards their crashing actual property.

Following improvement websites like UrbanizeLA and LAYIMBY for LA and SFYIMBY and Socketsite for the Bay Space, there are surprisingly nonetheless an honest quantity of latest high-rise proposals, although overwhelmingly residential and never a lot business. The query is whether or not these new proposals are an indication of the bubble or from natural demand. There’s a case that housing shortage is stopping the housing bubble from crashing, regardless of the Fed propping up actual property. To not point out that the migrant disaster is probably going getting used to prop up actual property, on the expense of rental inflation.

Builders Treatment is a clause that when cities fail to fulfill housing mandates they’re pressured by Sacramento to droop zoning and provides builders free rein. Whereas Builders Treatment and granting all zoning powers to the State Authorities has potential downsides, it should present how a lot unmet demand there may be that has been held again because of NIMBYism. Particularly on the Westside of LA and Silicon Valley, and the Peninsula within the Bay Space, all of which have plenty of low-slung housing stock. Beverly Hills and Palo Alto are already getting some formidable high-rise Builders Treatment proposals. Nevertheless, Builders Treatment may very well be extra of a bargaining chip to strain cities to make extra concessions on housing.

Supply: @jburnmurdoch on X

Downtown SF has had a significant slowdown in new high-rise proposals, and plenty of proposed high-rise tasks in SF are getting deserted. Nevertheless, there are nonetheless formidable high-rise proposals in different elements of SF and all through the Bay Space. For example, a proposed 50-story skyscraper by the Coast within the Sundown District, plus Berkeley and Santa Clara are present process booms in high-rise proposals after being NIMBY for thus lengthy.

Supply: Commercialobserver.com

The state of affairs is analogous for LA, the place Downtown LA can be seeing a slowdown with high-rise tasks canceled or under-construction tasks placed on maintain and coated with graffiti. Nevertheless, a 2 billion greenback megaproject was simply proposed on the periphery of Skid Row. This disconnect between tasks getting canceled but additionally formidable new proposals is an indication of the bubble and volatility. To not point out that LA’s new “Mansion Tax” is stifling new improvement, as landowners are much less more likely to promote. Regardless, residential demand appears sturdy in Miracle Mile and the Westside.

Supply: New York Submit by way of Ceaselessly California

Of proposed Bay Space Megaprojects, the Harmony Naval Weapons Station Redevelopment confronted some main setbacks however nonetheless has a greater probability of getting constructed than different megaprojects. Google’s proposed improvement of a mega campus and new city district close to Downtown San Jose has stalled, as has Oakland’s Brooklyn Foundation redevelopment. Probably the most formidable megaproject in California is Ceaselessly California in Solano County, which is financed by Silicon Valley billionaires. The undertaking is deliberate to be a medium-sized metropolis, accommodating as much as 400k residents.

I’m considerably skeptical of Ceaselessly California getting constructed, as it’s possible financed by debt, thus delicate to rates of interest and bubbles crashing. The builders additionally must safe possession of the land, and plenty of landowners are refusing to promote. To not point out the shortage of ample water rights and transportation connecting it to the Bay Space and Sacramento. Ceaselessly California jogs my memory of the failed, Quay Valley, a proposed new metropolis on the I-5 in the midst of nowhere, midway between LA and the Bay Space, which disbanded after the 08 recession. Each tasks had been shilled as eco-friendly and technologically superior. Nevertheless, Ceaselessly California’s builders are possible hedging on the long run previous the recession, with building most likely not beginning till not less than 2030.

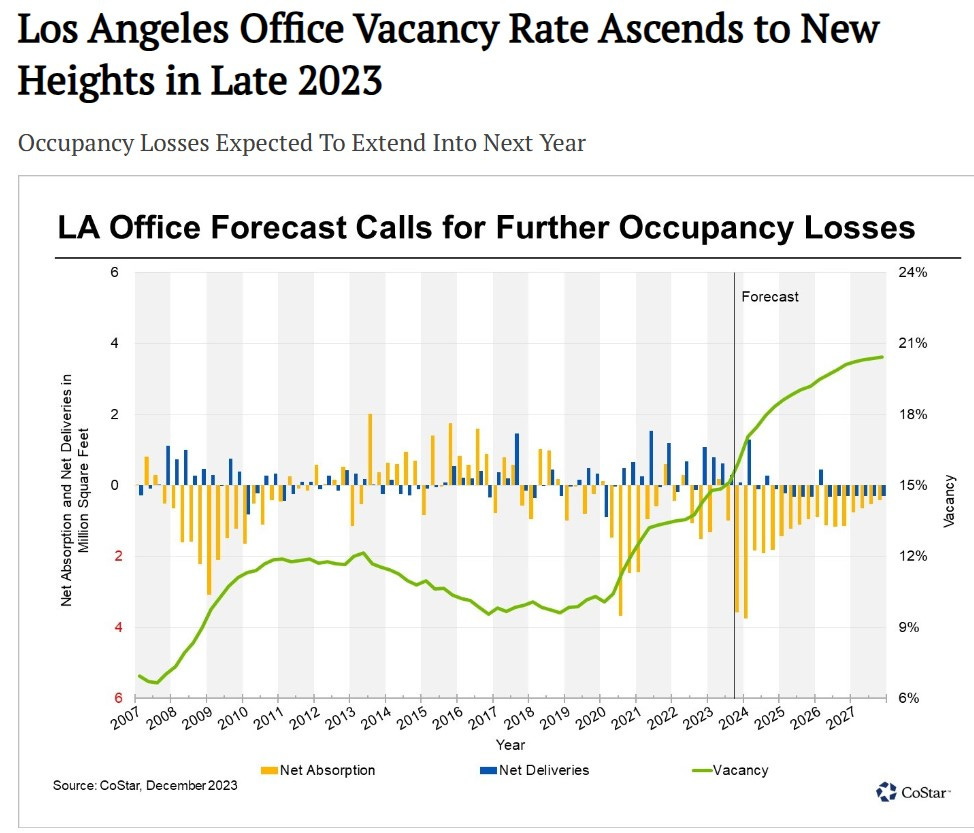

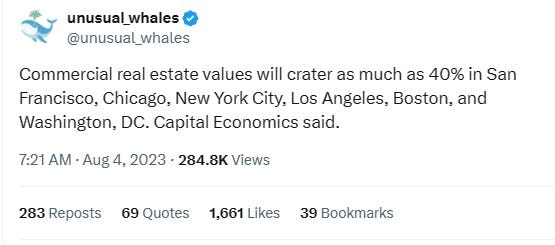

Industrial actual property is extraordinarily susceptible to crashing, with San Francisco workplace vacancies reaching a report excessive of 35.9% and 26.6% for Downtown LA, with vacancies solely projected to worsen. In distinction, the nationwide emptiness charge is nineteen.3%. Apart from natural demand and provide constraints holding off a crash in residential actual property, excessive rates of interest imply that owners are holding off on promoting. In contrast to the 08 monetary crash the place owners received foreclosed on, the price of low-fixed mortgages from earlier than charge hikes would possibly find yourself harming the banks moderately than the owners. Owners refusing to promote, inflicting a scarcity of housing stock, is bullish for rental markets and inflationary for renters. For that reason, I don’t foresee an enormous crash in residential though condominium and apartment complexes are linked to business actual property and the monetary system, and a few landlords are nonetheless within the crimson from the pandemic eviction moratoriums.

Supply: @unusual_whales on X

Whereas the recession may dramatically decelerate new improvement, foreclosures in business actual property may imply extra properties available on the market to be redeveloped, as landlords and banks are pressured to promote. Workplace towers would possibly get transformed into residential and foreclosed strip malls redeveloped into residential or mixed-use. Nevertheless, the excessive Fed charges that can trigger business landlords to refinance at larger charges, can even hinder new building. Whereas there may be plenty of demand for turning business to residential, the method of retrofitting workplace area is pretty costly and received’t be sufficient to avoid wasting business landlords and banks from defaulting. The advantages of workplace conversions easing housing provide and revitalizing city cores are long-term.

Downtown SF is on the snapping point and Downtown LA isn’t doing significantly better, it’s simply that LA is extra decentralized. The deterioration of city cores with decay, crime, and homelessness will possible worsen within the close to time period. Nevertheless, there are some city areas the place homeless encampments have been cleaned up that proceed to gentrify whereas different areas have gotten designated containment zones for homelessness. Whereas SF received away with dangerous insurance policies due to immense tax income from the tech trade, the loss in tax income may pressure radical change, however issues could must worsen earlier than they will get higher. If tech crashes, SF might be pressured to focus extra on tourism, which would require cleansing up city blight. Nevertheless, SF’s tourism trade isn’t doing nice both. Regardless, the current SF election reveals some pivot to the middle on homelessness and crime.

New York’s Decrease Manhattan efficiently reworked workplaces into residential in response to 9/11 and the 08 monetary crash. There was a proposal to transform workplace area in SF’s Monetary District to pupil housing for UC Berkeley college students. Additionally, a revival program for Downtown SF envisions pop-up bars, eating places, and artwork galleries. Monetary Districts may turn out to be arts and leisure districts and way more vigorous. Artwork scenes emerged from deindustrialization, so will high-rises have nightclubs, reside works areas, and artwork galleries, that host the subsequent era’s equal of the Hipster scene?

A considerably possible conspiracy idea is that oligarchs are destroying city cores with leftwing insurance policies in order that they will purchase up property cheaply and redevelop city cores. The ultra-wealthy are additionally more likely to exploit the recession to export plenty of the riffraff out of State. Despite the fact that I’m total bearish in regards to the financial system, I’m much less bearish than many on California actual property. Zoom cities in flyover nation, the place folks relocated to with distant work, are way more in danger than California when the mass layoffs hit.