After trouncing the market averages in 2023, the inventory costs of Superior Micro Gadgets (NASDAQ: AMD) and Nvidia (NASDAQ: NVDA) are persevering with their momentum in 2024. AMD shares are already up 23%, whereas Nvidia inventory is up 26% yr so far — each leaving the S&P 500 index within the mud.

Traders ought to at all times watch out of paying an excessive amount of for a inventory, however there are good causes to anticipate these prime synthetic intelligence (AI) shares to maneuver larger over the following few years.

Superior Micro Gadgets

AMD is a number one provider of central processing models (CPUs) for PCs and servers, the place it’s gaining market share in opposition to Intel. The corporate’s push into high-performance computing chips has paid off in recent times, however a brand new yr brings new alternatives for this tech innovator.

AMD will attempt to convert its latest success in CPUs to the info heart graphics processing unit (GPU) market to seize the booming marketplace for AI.

A worldwide slowdown within the semiconductor {industry} pressured AMD’s income progress during the last yr. However main chip foundry Taiwan Semiconductor Manufacturing issued a optimistic outlook in its newest earnings report that bodes effectively for one among its key prospects. TSMC producers chips for different corporations, together with AMD, and mentioned it expects 2024 to be a “wholesome” yr of progress.

AMD has guided for $2 billion in income from information heart GPUs this yr, because it prepares to launch the brand new MI300 chip for AI workloads. Meta Platforms, ChatGPT proprietor OpenAI, and Microsoft are already in line to make use of the brand new chips this yr.

However AMD can also be experiencing a powerful restoration in its CPU enterprise. AMD’s EPYC server chips grew income greater than 50% quarter over quarter in 2023’s Q3, whereas its Ryzen 7000 sequence CPUs for shopper PCs additionally posted sturdy progress of 46% sequentially.

The inventory is costlier than Nvidia, buying and selling at a ahead price-to-earnings (P/E) ratio of 47. However the mixture of a recovering CPU market and progress prospects in AI GPUs are nice causes to contemplate shopping for shares for the lengthy haul.

Nvidia

There are good the reason why Nvidia’s inventory value continues to be surging to new highs and stands out as the higher purchase. It is estimated to manage round 90% share of the AI chip market, and the inventory is cheaper than AMD, buying and selling at a ahead P/E ratio of simply 31 based mostly on this yr’s earnings estimate.

Nvidia has been forward of the sport for a few years. Nvidia has lengthy been a favourite model for PC avid gamers, and CEO Jensen Huang was early to identify the chance in information facilities. Over the previous couple of many years, the corporate has invested over $37 billion in analysis and improvement, and that has received Nvidia the highest spot within the GPU market.

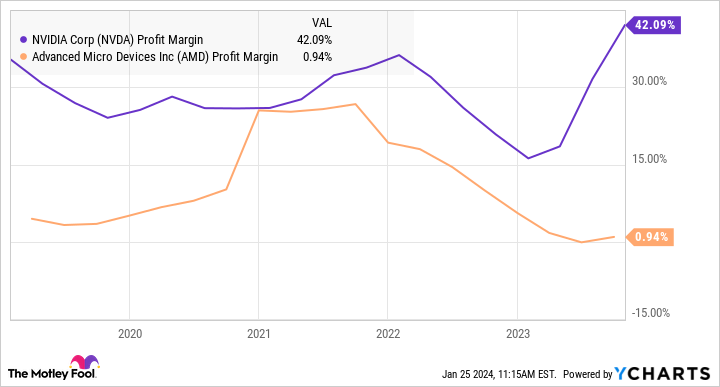

Aside from a less expensive valuation, one more reason to love Nvidia is the corporate’s profitability. Along with chip {hardware}, Nvidia additionally provides networking tools, software program libraries, and improvement software kits to assist prospects remedy industry-specific issues. This is a vital aggressive benefit and explains why Nvidia can earn a powerful software-like revenue margin of 42%, in comparison with AMD’s historical past of producing decrease margins.

It’ll take time for the world’s information facilities to improve their tools for AI processing. In a latest Instagram put up, Meta CEO Mark Zuckerberg famous the social media large can be utilizing 350,000 of Nvidia’s H100 GPUs to construct extra compute infrastructure to help its future roadmap.

To place that in perspective, a single H100 prices hundreds of {dollars}. The surging demand for these chips pushed Nvidia’s information heart income to $14.5 billion within the October-ending quarter, up from $3.8 billion within the year-ago quarter.

Search for Nvidia’s superior profitability and progress to carry the inventory to new highs over the following few years, if not by means of the tip of this yr.

Must you make investments $1,000 in Superior Micro Gadgets proper now?

Before you purchase inventory in Superior Micro Gadgets, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Superior Micro Gadgets wasn’t one among them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of January 22, 2024

Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Ballard has positions in Superior Micro Gadgets and Nvidia. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2023 $57.50 calls on Intel, lengthy January 2025 $45 calls on Intel, and quick February 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.

These AI Shares Are Crushing the S&P 500 in 2024 was initially revealed by The Motley Idiot