Retail is among the finest markets for long-term funding, recognized for its constant progress. The business ranges from grocery to e-commerce, client tech, and way more, permitting stockholders to learn from the tailwinds of dozens of sugments. In reality, the worldwide retail market hit a valuation of $27 trillion in 2022 and is projected to rise to $30 trillion this yr.

Costco (NASDAQ: COST) has loved immense success within the business, with its shares up 248% since 2019. The corporate’s wholesale enterprise mannequin has received over shoppers in additional than a dozen nations and has an thrilling outlook because it continues to increase.

Nonetheless, it is onerous to contemplate Costco’s inventory when Amazon (NASDAQ: AMZN) additionally exists. The corporate is the world’s second-biggest retailer (solely after Walmart) and is the No. 1 title in e-commerce. Moreover, Amazon’s various enterprise mannequin has seen it achieve a strong place in tech, with a number one 31% market share within the $626 billion cloud market.

This chart exhibits Amazon’s inventory considerably outperforming Costco’s over the past yr. In the meantime, varied progress catalysts in retail and tech will doubtless hold the corporate on its present trajectory.

So overlook Costco. This progress inventory might be poised for a bull run.

Amazon has confirmed resilient when confronted with macroeconomic headwinds

An financial downturn in 2022 prompted a market-wide sell-off that noticed the Nasdaq Composite plunge 33% in the course of the yr. Retail firms had been hit significantly onerous as inflation spikes compelled shoppers to chop discretionary spending. Consequently, shares in Amazon fell 50% in 2022 alongside steep revenue declines in its e-commerce segments.

Nonetheless, the corporate has made a formidable restoration since then, proving its reliability and resilience. In fiscal 2023, Amazon’s income rose 12% yr over yr to $575 billion, whereas working revenue tripled to $37 billion.

A spread of cost-cutting measures and easing inflation bolstered the corporate’s e-commerce enterprise and has seen its free money circulate skyrocket 904% to $32 billion within the final 12 months.

Amazon’s efficiency over the past yr highlights the significance of investing with a long-term mindset. Traders who bought the corporate’s inventory in 2022 is not going to have benefited from its vital progress since then.

The retail big has proven it may possibly efficiently navigate macroeconomic headwinds, making its shares a pretty long-term purchase. In the meantime, its appreciable money reserves point out it has the monetary assets to proceed increasing and investing in high-growth industries like synthetic intelligence (AI).

Earnings per share estimates point out a large upside for Amazon’s inventory

In dozens of nations, Amazon dominates e-commerce, a market anticipated to hit $3.6 trillion in 2024 and increase at a compound annual progress price (CAGR) of 10% via 2028. The tech agency will doubtless proceed making the most of the sector’s tailwinds for years.

Nonetheless, Amazon’s greatest progress catalyst is definitely its cloud platform, Amazon Net Companies (AWS). In This autumn 2024, income from the platform rose 13% yr over yr to $24 billion. In the meantime, AWS was liable for 54% of the corporate’s working revenue, regardless of incomes the bottom portion of income between its three segments.

Furthermore, AWS provides Amazon a profitable function in AI, a market projected to increase at a CAGR of 37% via 2030. Because the world’s greatest cloud service, AWS has the potential to leverage its huge cloud information facilities and steer the generative AI market.

Amazon has entered the market by including a spread of AI instruments to AWS and unveiling a brand new AI procuring assistant known as Rufus on its retail website.

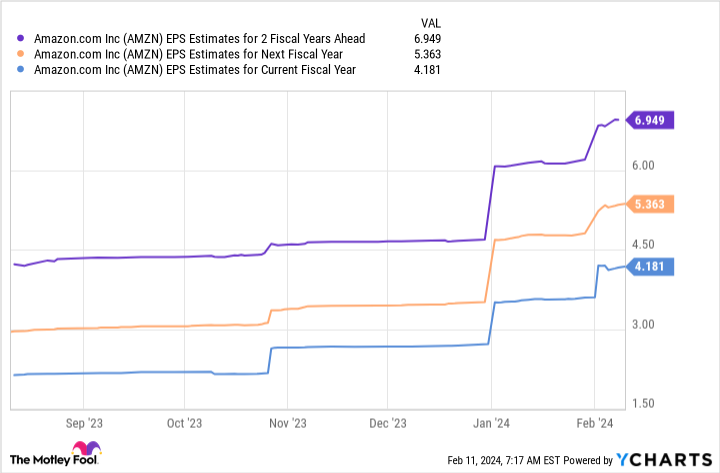

The tech big is on an thrilling progress path, and earnings per share (EPS) estimates mirror its vital potential.

This desk exhibits Amazon’s EPS might hit almost $7 per share over the following two fiscal years. When multiplying that determine by the corporate’s ahead price-to-earnings ratio of 42, you obtain a inventory value of $294. Contemplating its present place, these projections would see Amazon’s share value rise 69% by fiscal 2026.

Mixed with a dependable enterprise mannequin and stable positions in e-commerce and AI, Amazon is a greater choice than Costco and might be poised for a bull run.

Do you have to make investments $1,000 in Amazon proper now?

Before you purchase inventory in Amazon, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Amazon wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 12, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Dani Prepare dinner has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, Costco Wholesale, and Walmart. The Motley Idiot has a disclosure coverage.

Neglect Costco: This Development Inventory Is Poised for a Potential Bull Run was initially revealed by The Motley Idiot