Many buyers have an interest within the “Magnificent Seven” shares for good causes apart from excellent returns over the past 12 months. This elite group of tech firms has robust manufacturers and a rising buyer base, and they’re very worthwhile companies — all the things an investor appears for in a stable funding.

Over the past 12 months, the Roundhill Magnificent Seven ETF has returned 51%, beating the Nasdaq Composite‘s 32% and the S&P 500‘s 23% return. There’s some debate about how lengthy this group will proceed to outperform within the close to time period. On a price-to-earnings (P/E) foundation, most of those shares commerce at large premiums to the typical inventory within the main indexes.

The most costly of the seven is Nvidia (NASDAQ: NVDA), which presently has a trailing P/E of 77. Regardless of its excessive valuation, the corporate’s superior progress and future alternative may justify extra new highs for years to come back. This is why the inventory stays a core holding in my portfolio.

Nvidia’s progress runway

Nvidia is benefiting as information facilities change from central processing items (CPUs) to the much more highly effective graphics processing items (GPUs) for synthetic intelligence (AI) workloads. Traditionally, information facilities spent about $250 billion per 12 months on infrastructure, however this quantity has elevated for the primary time in a few years, which could possibly be only the start of a serious spending increase.

The marketplace for Nvidia’s merchandise is proving to be a lot larger than initially thought a number of years in the past. Income surged 265% 12 months over 12 months to $22 billion within the fiscal fourth quarter, considerably outpacing the expansion for the opposite Magnificent Seven firms.

Nvidia is simply scratching the floor of this chance. Firm executives have talked about $1 trillion value of knowledge middle infrastructure that’s beginning to undertake accelerated computing, which is using a number of GPUs operating collectively to deal with massive information workloads.

Nevertheless, the chance could possibly be a lot larger. AI is permitting firms to make use of information in ways in which was not potential earlier than, as Nvidia chief monetary officer Colette Kress mentioned on the latest Morgan Stanley expertise convention.

Because of this there are new sorts of information facilities rising referred to as GPU-specialized cloud service suppliers. It is one cause Nvidia executives consider the precise information middle infrastructure market could possibly be value nearer to $2 trillion.

Why purchase the inventory?

AI is totally turning conventional computing on its head, which is mirrored within the accelerating demand for Nvidia’s H100 GPU. It is nearly turn out to be a bragging proper for firms to speak about what number of H100s they’ve bought. Magnificent Seven member Meta Platforms has mentioned it plans to have 350,000 H100s up and operating by the tip of the 12 months.

Demand is already outstripping provide for Nvidia’s H200 GPU, which is on observe to begin transport within the fiscal second quarter. Firm steering requires income to be up 234% 12 months over 12 months within the fiscal first quarter.

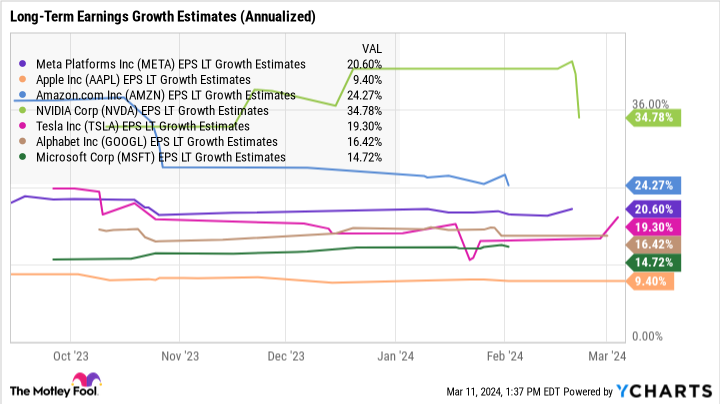

Over the long run, analysts count on Nvidia to develop earnings at 35% per 12 months, which can be increased than the opposite Magnificent Seven.

Nvidia’s main share within the GPU market ought to translate to extra progress as information facilities proceed to improve parts for AI. As this chance unfolds, this GPU inventory affords long-term upside that might outperform the opposite Magnificent Seven over the following decade. Relative to anticipated earnings this 12 months, Nvidia is not all that costly, buying and selling at a ahead P/E of 37.

Nvidia has been the king of GPUs for a few years, so it is principally obtained the fitting product on the proper time to learn from the AI increase. However what in the end seals the deal for me is how a lot money the enterprise is producing.

Its trailing free money move totaled $27 billion, up 10-fold over the past 5 years. This provides the corporate large assets to remain forward in GPU innovation and generate shareholder returns for years to come back.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of March 11, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. John Ballard has positions in Nvidia and Tesla. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

This is My High “Magnificent Seven” Inventory to Purchase and Maintain for the Subsequent 10 Years was initially revealed by The Motley Idiot