A bull market is right here, however not each inventory is benefiting. Some gamers stay within the doldrums. It is as much as traders to resolve whether or not these left behind are prone to stay there or make prime shopping for alternatives as we speak that might ship nice rewards down the highway.

Wall Avenue is especially passionate about two beaten-down biotech shares that soared within the earlier days of the pandemic. These two developed coronavirus vaccine candidates, and traders have been betting they might finally commercialize the merchandise and win large. One reached commercialization however gross sales dissatisfied, whereas the opposite hasn’t but reached the vaccine end line.

Learn beneath to find whether or not Wall Avenue’s exuberance about these two struggling shares was justified.

Novavax

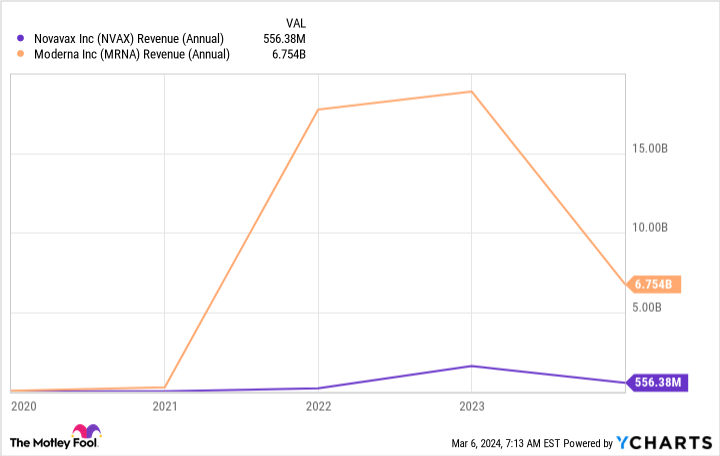

Novavax (NASDAQ: NVAX) inventory soared greater than 2,700% again in 2020 as traders guess on the corporate’s vaccine candidate. The product did enter the market, however late, so Novavax missed out on the most important income alternative. Whereas rival Moderna‘s vaccine income peaked at round $18 billion, Novavax’s peak income got here in significantly decrease.

As vaccine demand declined in later pandemic phases, Novavax even questioned its potential to proceed enterprise — and the biotech launched a cost-cutting plan. Although Novavax is not out of the woods but, constructive components have emerged. The corporate settled a dispute with one in every of its prospects, eradicating one main uncertainty, and has made important progress alongside the path to price financial savings.

For instance, the corporate has lowered its workforce by 30% over the previous yr and goals to chop analysis and improvement and administrative bills to as little as $700 million this yr, in comparison with the extent of $1.7 billion in 2022.

What can we anticipate from Novavax within the months and years forward if it meets its cost-cutting targets? The corporate goals to progressively carve out market share by the autumn by launching its vaccine early within the season and specializing in retail pharmacies, the place most vaccination is finished. And the corporate hopes to launch a mixed COVID/flu vaccine in 2026.

In the meantime, Wall Avenue expects Novavax shares to leap greater than 170% throughout the coming 12 months. I believe that is overly optimistic, but when the corporate continues to make cost-savings progress and experiences constructive information from its vaccine program, the inventory might advance considerably from as we speak’s stage. Nonetheless, this inventory is for aggressive traders, because it carries a good quantity of danger and has fluctuated vastly prior to now.

Ocugen

Earlier within the pandemic, Ocugen (NASDAQ: OCGN) surged greater than 700% in a matter of days as the corporate acquired the rights to promote Bharat Biotech’s Covaxin, a coronavirus vaccine, in the USA. However the product by no means gained authorization within the U.S., and Ocugen’s shares progressively declined. At this time, they commerce for lower than $1.

This biotech firm hasn’t given up on coronavirus vaccines, although. At this time it is creating inhaled vaccine candidates for flu and coronavirus, and people initiatives are in preclinical research.

Ocugen’s closer-to-market candidates embrace a candidate acquired by its reverse merger with Histogenics again in 2019 and one of many firm’s personal candidates in its specialty space of eye illness remedies. This former Histogenics candidate is Neocart, a cell remedy to rebuild broken knee cartilage. Ocugen plans on starting a part 3 trial within the second half of this yr.

The opposite superior candidate is OCU-400, which treats Retinitis Pigmentosa, a genetic illness that leads to imaginative and prescient loss as cells within the retina break down. The corporate goals to launch a part 3 trial early this yr. Ocugen has different earlier-stage eye illness candidates in its pipeline, too.

The corporate does not but have merchandise available on the market and is not producing income. But when all goes easily with Neocart and OCU-400, this might change over the subsequent few years.

Wall Avenue may be very bullish on Ocugen, with the typical 12-month share-price forecast calling for a achieve of greater than 630%. I believe that is overly optimistic. If Ocugen is profitable with one or each of its closest-to-market candidates, the shares might climb this a lot or extra over time, however I would not anticipate the potential launches of late-stage trials to spur that a lot of a rise.

It is nonetheless too early to put a long-term guess on this firm. Ocugen began out specializing in eye illness however has branched out into different areas. That is high quality, however earlier than investing, I might like to realize extra visibility on what the corporate could appear to be a number of years down the highway.

Do you have to make investments $1,000 in Novavax proper now?

Before you purchase inventory in Novavax, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Novavax wasn’t one in every of them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 26, 2024

Adria Cimino has no place in any of the shares talked about. The Motley Idiot recommends Moderna. The Motley Idiot has a disclosure coverage.

Two Crushed-Down Shares That Might Soar 170% and 630%, Respectively, In accordance with Wall Avenue was initially printed by The Motley Idiot