(Bloomberg) — The Federal Reserve’s most well-liked measure of underlying US inflation most likely remained uncomfortably excessive in February, displaying why central bankers are cautious about reducing rate of interest too quickly.

Most Learn from Bloomberg

The core private consumption expenditures worth index, which excludes meals and power prices, is seen rising 0.3% on the heels of its greatest month-to-month improve in a 12 months. The general measure is forecast to climb 0.4%, probably the most since September.

That would depart annualized core worth progress over the previous three months working on the quickest tempo since Could. On a six-month annualized foundation, the core PCE worth index would additionally present an acceleration. What’s extra, some economists anticipate the January figures to be revised larger following latest authorities reviews on client and producer costs.

That stands in distinction to the tip of 2023, when inflationary pressures had been displaying indicators of settling again to the Fed’s 2% objective.

Fed Chair Jerome Powell, after he and his colleagues saved rates of interest unchanged for a fifth assembly, emphasised the broader story of a gradual but bumpy path for getting inflation again to focus on. Worth information to this point this 12 months has neither added to policymakers’ confidence nor undercut it, he indicated.

Learn extra: Fed Stays on Observe for Fee Cuts With One Eye on Bumpy Inflation

The PCE report, due when US inventory and bond markets are closed for observance of Good Friday, can be projected to point out stronger client spending progress in February in addition to one other stable acquire in private revenue.

Amongst different financial releases within the holiday-shortened week, the federal government will situation information Monday on new-home gross sales for February, adopted by sturdy items orders on Tuesday. On Thursday, the third estimate of fourth-quarter gross home product will embody authorities figures on revenue and company earnings.

What Bloomberg Economics Says:

“The sturdy jobs report and retail-sales rebound in February recommend the month’s private revenue and outlays report must be sizzling too. Hiring, wage progress and a rise in hours labored will enhance private revenue. Private spending doubtless grew on the again of auto gross sales, although spending in different classes seems tepid. Headline PCE inflation will doubtless speed up, even because the core moderates..”

—Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou, economists. For full evaluation, click on right here

Elsewhere, doable clues on Swedish price cuts, in addition to inflation readings from Australia to France, might transfer the needle with key currencies. Nigeria’s central financial institution might ship a big price hike.

Click on right here for what occurred final week and beneath is our wrap of what’s developing within the world financial system.

Asia

A lot of inflation updates are due within the coming week. In Australia, the most recent worth report might assist the case for the central financial institution to stay in data-dependent mode for a bit longer earlier than it pivots to an easing cycle amid slowing progress.

Wednesday’s report there are anticipated to point out inflation sped up a tick in February, to three.5%.

Worth numbers for the Tokyo space, a number one indicator for the nationwide gauge, will doubtless level to inflation sticking at or above the Financial institution of Japan’s goal for a twenty fourth month in March.

Such a outcome would hold a second-half price hike throughout the realm of prospects after officers took the historic step on Tuesday of exiting damaging borrowing prices, the ultimate central financial institution on the planet to finish that coverage experiment.

Client inflation is forecast to average a tad in Singapore and Malaysia when these reviews are launched on Monday.

Apart from consumer-price numbers, China will get an opportunity to see how its producers are faring with industrial revenue information for the primary two months of the 12 months.

Australia’s retail gross sales progress is predicted to sluggish to 0.5% in February, and the nation additionally will get client confidence information for March.

Thailand’s export progress might have slowed final month, whereas Hong Kong additionally will get commerce stats.

Europe, Center East, Africa

Following financial fireworks all over the world previously week, together with the Swiss Nationwide Financial institution’s shock determination to chop charges, it’s Sweden’s activate Wednesday.

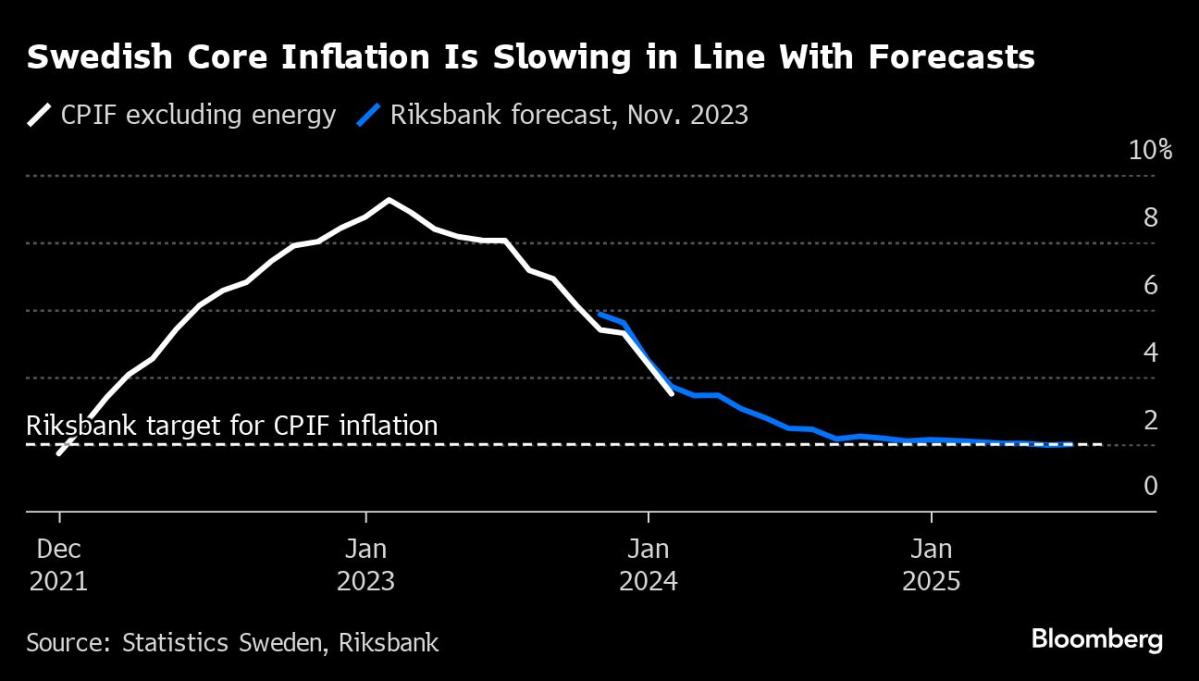

The Riksbank will lay out a plan on how to reply to subsiding inflation. The world’s oldest central financial institution has stated it might cut back borrowing prices within the first half of this 12 months, and its steerage ought to present whether or not it targets a transfer in Could, June or later.

Whereas latest inflation outcomes have been benign, policymakers warning that there are nonetheless dangers of renewed worth hikes. Most fastened revenue buyers polled by SEB this week imagine the Riksbank will depart its benchmark price at 4% not less than till June.

Hungary will maintain Europe’s different key financial determination on Tuesday. Officers are poised to decelerate their tempo of cuts to the European Union’s highest price after a dispute between the federal government and the central financial institution spooked buyers and hammered the forint.

Amongst different highlights within the euro zone, European Central Financial institution President Christine Lagarde will communicate on Monday.

Among the many information which will draw consideration, inflation reviews are scheduled for launch in Spain on Wednesday, then Italy and France on Friday. Collectively they could sign the doubtless route of the euro-zone quantity that’s due for publication the next week.

Within the UK, in the meantime, Financial institution of England policymaker Catherine Mann — one among two hawks who deserted votes for a price hike at Thursday’s assembly — will ship a speech on productiveness in Belfast on Monday.

A abstract of the Monetary Coverage Committee’s most up-to-date deliberations might be printed on Wednesday.

A number of central financial institution selections are scheduled throughout Africa:

-

Ghanaian policymakers on Monday are anticipated to maintain charges on maintain at 29% due to inflation dangers from a weaker cedi.

-

A day later, Nigeria’s financial authority is poised to elevate its benchmark gauge from 22.75% to rein in decades-high inflation and assist the naira.

-

Off the continent’s east coast, Seychelles is ready to go away its key price at a record-low of two% because it continues to battle deflation.

-

On Wednesday, South African officers are set to maintain borrowing prices on maintain for a fifth straight assembly, watching inflation dangers from rising utility payments and antagonistic climate circumstances.

-

Neighboring Mozambique’s policymakers might decide to chop charges once more as inflation continues to chill. Governor Rogerio Zandamela signaled after the January assembly that circumstances exist for the start of a cycle of gradual easing.

Latin America

In Mexico, February information will doubtless present that the nation’s commerce surplus with the US widened additional, to a contemporary document. It’s arduous to think about Donald Trump, the previous president and presumptive 2024 Republican candidate, leaving that alone. Additionally on faucet are February labor market readings and month-to-month lending.

Argentina follows up on information that confirmed output fell within the fourth quarter and for the complete 12 months with a January financial exercise replace. Most analysts see a deeper first-quarter contraction on the way in which.

Together with February unemployment, Chile reviews 5 different indicators together with retail gross sales and industrial manufacturing.

Banco Central do Brasil is slated to ship the minutes of its March assembly, the place it delivered a sixth straight half-point rate of interest lower, to 10.75%.

The minutes, together with the week’s posting of the quarterly inflation report — which can replace key financial forecasts — might shed some mild on how policymakers are sizing up a run of hotter-than-expected inflation readings.

Brazil watchers may even get some arduous information to think about: the nation’s broadest measure of inflation, the mid-month print of the benchmark IPCA inflation index, and February unemployment.

–With help from Robert Jameson, Zoe Schneeweiss, Niclas Rolander, Brian Fowler and Monique Vanek.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.