Authored by Michael Lebowitz by way of RealInvestmentAdvice.com,

Over the past 4 quarters, Tesla generated complete income and earnings of $96 billion and $15 billion, respectively. Toyota’s income and earnings are roughly thrice bigger at $299 billion and $44 billion. But Tesla’s market cap is greater than double that of Toyota.

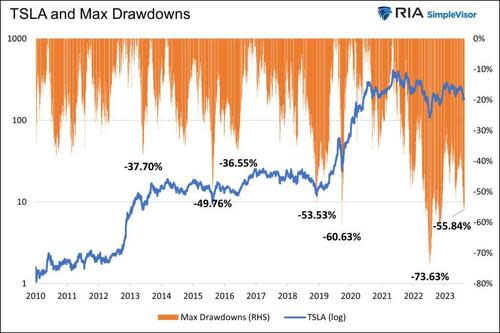

Tesla shares have soared since going public, whereas Toyota and different main auto producers’ shares have meandered alongside. Since going public in 2010 at $1.59 (cut up adjusted), Tesla shares are up practically 12,000%. That determine is extra gorgeous, contemplating it’s down 50% since late 2021. The graph beneath, charting the 2 shares since 2018, highlights Tesla’s outperformance versus Toyota and the acute volatility of its returns. As proven within the second graph, 40-50+% drawdowns are usually not unusual for Tesla.

Tesla shares have outperformed Toyota’s and the market due to the numerous development of EVs, a sturdy outlook for EV market penetration, and forecasts that Tesla will preserve its lead position in manufacturing EVs. Tesla’s market cap depends on all three coming to fruition.

What if a number of of these don’t happen? Would possibly hybrids be the popular know-how till a extra environment friendly battery evolves? Will EV competitors from established and new auto producers upend Tesla’s market share? Perhaps most important, may Toyota, not Tesla, be on the forefront of a big technological advance for vehicles?

With a price-to-earnings ratio of 9 for Toyota and 72 for Tesla, the solutions to our questions have vital implications for shareholders of each shares.

EVs VS ICE

Gross sales of EVs are multiplying. The newest information reveals that EVs will account for 9% of all home new automotive gross sales in 2024. That leaves loads of upside for EV producers if the U.S. follows the trail of different nations like Germany and China, during which EVs signify roughly a 3rd of all new automotive gross sales.

Whereas the transition from inner combustion engines (ICE) to electrical is certain to proceed, its tempo seems to be moderating. There are a number of drawbacks affecting the uptake of EVs.

EV Drawbacks

Think about the next:

-

Fewer EV vehicles are eligible for Federal tax credit.

-

Kelley Blue Guide claims the five-year value to personal EVs versus ICE autos is 15% increased.

-

The time to “replenish” an EV is for much longer than an ICE automotive, and the EV recharging infrastructure is insufficient in lots of locations. Consequently, “vary anxiousness,” or the worry of operating out of energy on the flawed time or location, is a priority.

-

Per the Nationwide Car Sellers Affiliation (NADA)- The ultimate value of the automobile is its depreciation at resell, the distinction between what the patron paid for it and its price after 5 years of possession. EVs lose a mean of $43,515 in worth; ICE autos depreciate by $27,883.

-

EV batteries are much less environment friendly in extreme temperatures.

-

EVs have increased insurance coverage and financing prices.

-

Lithium-ion batteries can catch fireplace in an accident and on uncommon events when they don’t seem to be in use.

The plain profit for EV house owners is gasoline prices. NADA estimates an EV proprietor will save roughly $5,000 in gasoline and some hundred {dollars} in upkeep prices over 5 years versus an ICE proprietor.

The marketplace for EVs amongst early adapters and wealthier, environmentally involved customers is beginning to get saturated. Extra automotive patrons will seemingly shift from ICE to EV, however that transition shall be slower than it has been for the extra keen first adapters.

Tesla Doesn’t Have a Monopoly Anymore

At one level, Tesla’s market cap was nearly equal to that of all the auto trade. Not solely have been Tesla buyers projecting that Tesla could be the most important automaker, but additionally that a few of their different ventures, like vitality era and robo-taxis would do fabulously properly. Lots has modified since then.

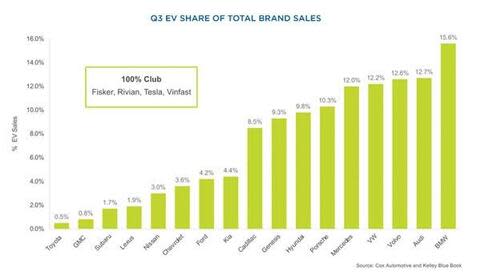

Tesla now not has a monopoly on EVs. Virtually each auto producer, and some new ones like Rivian and Fisker, now manufactures EV vehicles, as proven within the graph beneath, courtesy of Cox Automotive.

Additional, take into account the next paragraph from Cox Automotive:

EV transaction costs in Q3 have been down considerably from 2022. In an try to extend gross sales quantity, Tesla slashed costs, which at the moment are down roughly 25% yr over yr. The worth cuts have helped, as Tesla’s Q3 gross sales grew by 19.5% yr over yr, surpassing the trade’s total development price of 16.3%. Nevertheless, Tesla’s share of the EV phase continues to plunge, hitting 50% in Q3, the bottom stage on report and down from 62% in Q1.

Backside line: Tesla is dropping its aggressive benefit. They’re relinquishing EV market share and reducing costs, ergo earnings, to remain aggressive.

Hybrid- The Bridge Expertise

This dialogue of hybrid vehicles doesn’t consult with fashions with gasoline engines and battery packs that may be plugged into an influence supply.

As proven within the graph above, Toyota lags each different automaker, with solely 0.5% of gross sales coming from EVs. Nevertheless, Toyota has a distinct technique concerning producing environmentally pleasant autos. They’re the most important vendor of hybrid vehicles. The hybrid Prius was launched to the U.S. market in 2000. Toyota’s first mover expertise offers them a singular benefit in profitably manufacturing hybrid autos.

Hybrid vehicles can get 35 to 50+ miles per gallon. The know-how permits a battery to seize a cost by means of its braking mechanism. This electrical energy then dietary supplements its inner combustion engine. Shopper Stories estimates hybrids present a 40% enchancment in gasoline mileage versus non-hybrids.

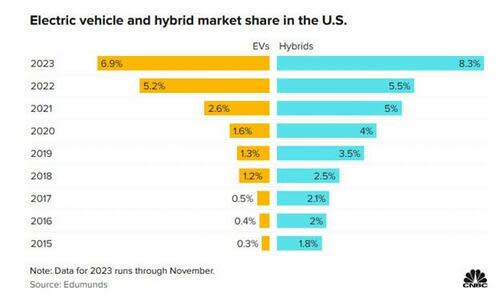

The graphic beneath, courtesy of CNBC, reveals that U.S. gross sales of hybrids have simply saved up with EV gross sales since 2015.

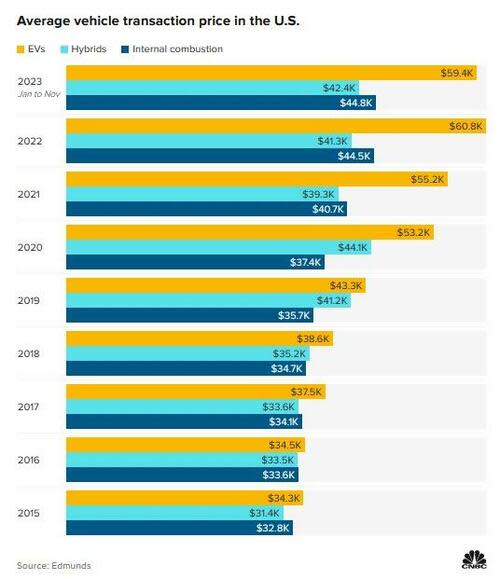

Automotive house owners favor higher gasoline mileage, and we presume many wish to do their half to assist the setting. That mentioned, most auto customers are usually not prepared to totally decide to EVs. We listed some causes for the hesitation, however seemingly a very powerful is the value. The CNBC graphic beneath reveals hybrids and ICE autos are related in worth, whereas EVs are costlier.

We expect hybrid autos will be the transitional know-how of alternative till a greater EV battery evolves. Many customers appear to agree!

Extra On Hybrids

The next is from a latest Wall Road Journal article entitled, Toyota Motor reviews rise in quarterly web revenue as gross sales grew.

Executives at Japanese automakers which can be sturdy in hybrids, together with Toyota and Honda, say they’re skeptical of rivals’ skill to catch up shortly. They observe that it took some twenty years for Japanese carmakers to carry their hybrids to profit-margin parity with purely gasoline-powered autos.

Hybrid gross sales grew final yr at a quicker clip than gross sales for pure electrical autos within the U.S. and another markets. Indicators have emerged that the EV push may need gotten forward of U.S. customers who’re anxious about charging issues and better costs. That has steered them towards cheaper hybrids, which will be crammed up with gasoline.

Automakers that had been speeding to pivot towards full EVs at the moment are reconsidering.

Basic Motors mentioned final week it could introduce some plug-in hybrid fashions in North America after dealing with strain from sellers.

Ford Motor mentioned final yr it could search to quadruple its hybrid gross sales within the subsequent 5 years.

Strong-State Batteries

We now take into account the subsequent potential recreation changer for the auto trade: solid-state batteries. Strong-state batteries promise to remove many issues related to present EV lithium-ion batteries.

Lithium-ion batteries are heavy, costly to fabricate, sluggish to cost, and have a mileage vary thought of too brief by many. Strong-state batteries vastly enhance on these issues. Nevertheless, whether or not the know-how will be mass-produced at cheap prices is unclear.

Many consultants imagine Toyota is the chief in solid-state battery growth. Per Forbes:

Toyota’s acknowledged aim is for his or her solid-state batteries to in the end have a variety of >1,200km, and to go from 10 – 80% cost in 10 minutes or much less. This compares to the Tesla Mannequin Y, which at present has a variety of 542 km, and fast-charges in 27 minutes.

Different automakers are investing in solid-state battery growth. Toyota believes they would be the first to provide vehicles with solid-state batteries. Manufacturing may come as early as 2027. The funding and manufacturing prices are monumental, and there aren’t any guarantees these batteries will make financial sense for customers or producers.

Tesla doesn’t imagine within the viability of solid-state know-how, and, so far as the market is aware of, it isn’t growing solid-state batteries.

Tesla 4680 Battery Cells

Elon Musk is an innovator. He is aware of that his present battery know-how will fall behind his rivals if it isn’t improved. Tesla is betting on 4680 batteries as a substitute of solid-state. The 4680 battery hopes to enhance value, weight, and vitality density.

Per evlithium.com, the potential advantages are battery weight, which can be about 10% lighter. Moreover, the price of the batteries might be 15% cheaper, and the driving distance on a cost may enhance by 10-15%.

Such could be an honest enchancment, nevertheless it pales in comparison with the promise of solid-state batteries.

Fundamentals and Valuations

So, with an appreciation for the position of hybrids, EVs, and solid-state batteries, let’s examine Toyota to Tesla and higher admire their comparative valuations and fundamentals.

Valuations

Earlier than wanting on the valuation comparisons beneath, take into account that Tesla is a high-growth firm whereas Toyota is mature. Toyota is the world’s largest auto producer, whereas Tesla is ranked fifteenth. Given its smaller dimension, it’s a lot simpler for Tesla to realize world market share. The potential for outsized development is mirrored within the valuations. Tesla trades at valuations 6-8 instances that of Toyota, implying 6-8x extra development for Tesla over the long term.

The PEG ratio, nonetheless, tells a distinct story. The PEG ratio divides every firm’s P/E ratio by its 3-5-year anticipated earnings development. The ratio helps normalize the P/E ratio for corporations with various development charges.

Based mostly on the P/E and the PEG ratio, the market implies earnings development of 19.05% for Toyota and 12.44% for Tesla.

Fundamentals

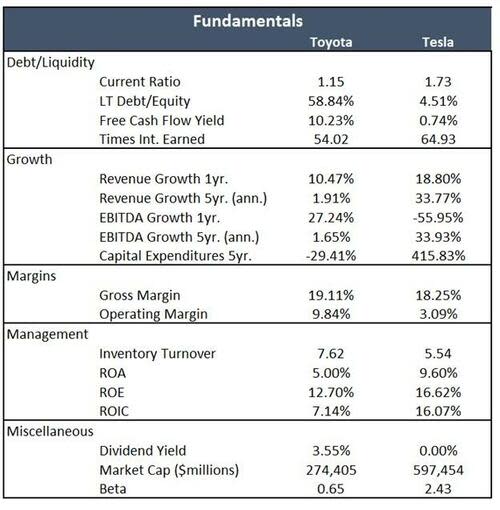

Along with rising extra quickly than Toyota, Tesla is extra operationally and financially environment friendly. EV vehicles have fewer components, making meeting faster and cheaper. Moreover, Tesla’s income and earnings profit from EV credit. Lastly, Tesla generates income from different sources. Whereas not at present sizable, they skew the info and forecasts.

Toyota’s income has been comparatively stagnant over the past 5 years, whereas Tesla has grown by 33% a yr on common. Tesla’s money circulation development is difficult to gauge as they’re closely reinvesting into manufacturing and R&D, as proven by the great development in its capital expenditures. One other indication that the businesses are in several lifecycle levels is Tesla’s lack of dividends in comparison with Toyota’s wholesome 3.55% yield.

Tesla has a lot much less long-term debt than Toyota. Nevertheless, if they’re to proceed rising quickly, debt will seemingly develop accordingly.

Betting On The Future

Investing in Tesla or Toyota is a wager on the way forward for vehicles.

Tesla shareholders hope the corporate will proceed bettering EV know-how, increasing its charging community, and acquire worthwhile market share. Importantly, it’s a wager that some model of the present lithium-ion battery know-how is the way forward for EVs. Tesla has different non-manufacturing ventures that will even be very worthwhile.

Toyota buyers will do properly if the corporate maintains its management in ICE autos and its hybrid fashions proceed to realize market share. Additional, if solid-state batteries are the popular EV battery, then Toyota could have an enormous leg up on Tesla and the trade.

Toyota has a price-to-earnings (P/E) ratio of 9, lower than half of the S&P 500 and properly beneath Tesla’s 72. It seems that Toyota presents a conservative funding within the state of the present auto trade with a doubtlessly worthwhile possibility for the longer term by way of its appreciable funding in solid-state batteries.

If solid-state batteries show to be the subsequent step in EVs, Toyota would be the subsequent Tesla. In such a case, Tesla could wrestle in the event that they don’t adapt to comparable know-how. Nevertheless, if solid-state know-how is simply too expensive, Tesla could proceed to realize market share and meet the lofty objectives of its shareholders.

It’s price disclaiming that different potential applied sciences, corresponding to hydrogen, exist. Whereas we don’t low cost them, we restrict this dialogue to what’s possible over the approaching 5 years.

Abstract

Toyota appreciates hybrid autos’ position in transitioning to extra energy-efficient transportation. Whereas dropping the EV battle, they make up for it in hybrid gross sales. Extra importantly, they could have a greater EV battery inside a number of years. If Toyota can proceed to dominate the hybrid area and make important inroads into EVs later this decade by way of a solid-state battery, its inventory is reasonable.

Tesla is a wager on Elon Musk and his confirmed skill to innovate. Not solely did he begin the EV revolution, however he’s on the forefront of different thrilling applied sciences. How these fold into Tesla is unknown.

Whereas Musk has confirmed to be a fantastic horse to wager on, Tesla’s worth could be very excessive. At a P/E of 72 and a PEG ratio greater than 10x its rivals, Tesla buyers are hoping for continued great development. Importantly, they’re betting that Tesla will take important market share from well-established automakers.

Given all he has completed, it’s laborious to wager towards Elon Musk. Nevertheless, we expect Toyota would be the safer funding and the inventory with extra upside.

By Zerohedge.com

Extra High Reads From Oilprice.com: