What’s essentially the most unique membership on Wall Avenue? I might argue it is the trillion-dollar membership, a bunch of six shares, every boasting a valuation above $1 trillion: Microsoft, Apple, Nvidia, Alphabet, Amazon, and Meta Platforms.

By 2035, the membership will seemingly increase considerably, with corporations throughout a broad vary of sectors topping the $1 trillion mark. So, let’s look at one which will have the potential to hit a valuation of $1 trillion by 2035: Palantir Applied sciences (NYSE: PLTR).

How Palantir stacks up at the moment

Let’s begin with how massive it’s now to determine how a lot Palantir’s valuation might go. As of this writing, Palantir has a market cap of $51.6 billion. The corporate ranks because the 350-largest American firm.

For sure, Palantir has a protracted strategy to go if it needs to crack the $1 trillion membership. The corporate would want to develop practically 2,000% or 20x by 2035. That works out to a Compound Annual Progress Price (CAGR) of about 32%. Curiously, Palantir has generated a CAGR of 31% since debuting through an Preliminary Public Providing (IPO) in 2020.

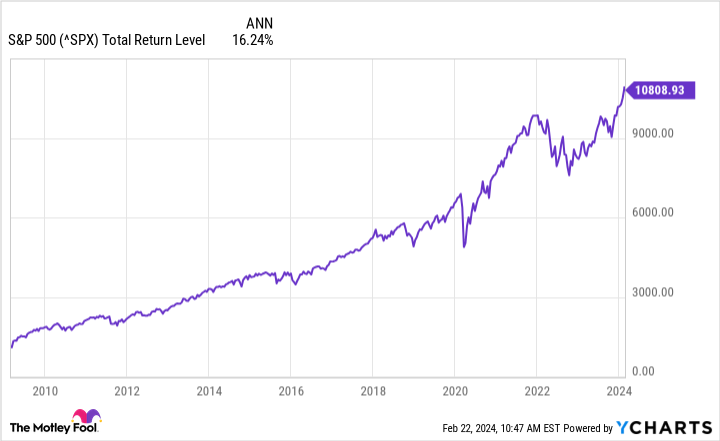

Such a development stage may appear unachievable for an extended time span. In any case, in case you have a look at a benchmark index, just like the S&P 500, its lifetime complete return CAGR, which stretches again over 70 years, is simply 10%. Even in case you select shorter, extra bullish durations, the S&P 500’s CAGR improves however nonetheless falls nicely in need of 30%.

For instance, between March 2009 and at the moment — total, a really bullish interval within the inventory market — the S&P 500’s CAGR is simply 16%.

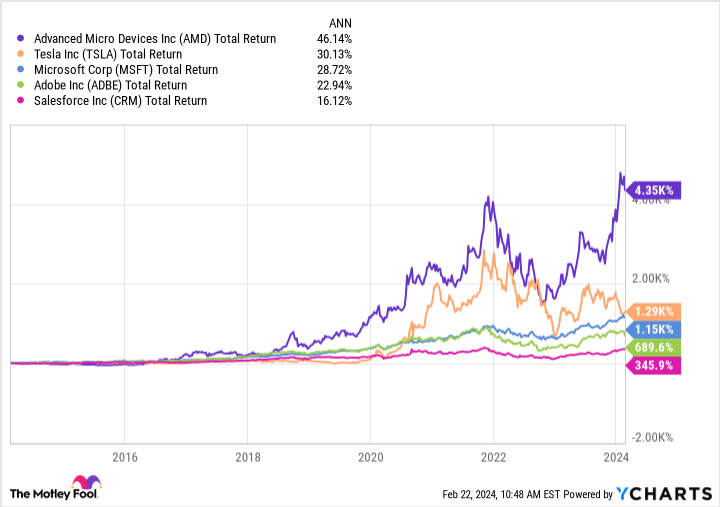

Nevertheless, the S&P 500, like all inventory market indexes, has much less volatility than particular person shares. If we look at shares one after the other, it turns into clear that hitting and sustaining a 30% CAGR is feasible.

As you may see within the chart beneath, Superior Micro Gadgets, Microsoft, and Tesla all achieved a CAGR equal to or higher than 28% during the last decade. AMD, for one, has a 10-year CAGR of 46%. Many of those high-growth charges stem from the ever-growing demand for synthetic intelligence (AI). Nevertheless, Adobe and Salesforce (corporations that extra carefully resemble Palantir resulting from their software-focused enterprise fashions) have notched decrease CAGRs of 23% and 16%, respectively. Whereas that does not imply Palantir cannot get to $1 trillion by 2035, it’s price noting {that a} 30% CAGR is difficult to realize and preserve — even for well-performing corporations.

Might Palantir’s enterprise assist a $1 trillion valuation?

First issues first: What does Palantir do?

In brief, the corporate builds software program platforms that assist its prospects grapple with their very own knowledge and understand sensible efficiencies. Extra organizations than ever want this sort of service, given how a lot knowledge they generate each day.

Take the Nationwide Well being Service (NHS) of the UK, for instance. It is a large system that serves over 56 million folks total, with near 1.6 million affected person interactions day-after-day. Every of these interactions ends in new knowledge that should be recorded — making on-the-spot evaluation tough. Directors as a substitute depend on top-down, after-the-fact evaluation, which is expensive and sometimes yields few real-time enhancements.

But, by using Palantir’s software program, the NHS has realized spectacular outcomes. For instance, the inpatient ready listing at two London-based hospitals decreased by 28% after adopting Palantir’s software program. As well as, working room utilization elevated by 5.7%.

Now, as Palantir leverages AI to strengthen its software program packages, there’s extra alternative for its buyer base to develop. Nevertheless, solely time will inform precisely how that development will take form over the following decade.

Will Palantir hit $1 trillion by 2035?

Regardless of its stable enterprise mannequin and well-liked software program, it will not be simple for Palantir to crack the $1 trillion mark by 2035.

The corporate should proceed to develop its income and buyer base. As of its most up-to-date quarter (the three months ending Dec. 31, 2023), Palantir grew its business income by 32% year-over-year. Equally, its business buyer depend jumped 55% from a 12 months earlier. These features in its business enterprise, reasonably than its government-focused phase, the place development is slower, might assist a 30% CAGR for the corporate. Furthermore, as demand for AI-powered instruments and massive knowledge analytics continues to ramp up, it is attainable Palantir’s development charges might speed up.

Nevertheless, I am not optimistic that the corporate will obtain a $1 trillion valuation in lower than 11 years. Whereas I nonetheless assume Palantir is a superb firm and a stable funding, I do not assume it has what it takes to cross the very excessive hurdle of $1 trillion by 2035. It will require constant ranges of explosive development, which might be unrealistic for many corporations.

At any price, for long-term buy-and-hold traders, Palantir stays a inventory price contemplating.

Do you have to make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 finest shares for traders to purchase now… and Palantir Applied sciences wasn’t considered one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 20, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Jake Lerch has positions in Adobe, Alphabet, Amazon, Nvidia, and Tesla. The Motley Idiot has positions in and recommends Adobe, Superior Micro Gadgets, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Palantir Applied sciences, Salesforce, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Will Palantir Applied sciences Be a Trillion-Greenback Inventory by 2035? was initially printed by The Motley Idiot